Bookkeeping and Accounting for Artists, Painters, and Musicians

Nobody becomes an artist because they secretly want to be their own accountant. However, if you begin your creative profession, you will undoubtedly have to deal with your own finances.

You must manage your budget, create and sign contracts with studio spaces or freelancers, save money, then make it all legible to the IRS come tax season.

It's a lot of effort for anyone. However, it can be extremely burdensome for artists who are handling the creative side of their work, several day jobs, and the financial precarity of a creative existence.

Importance of Accounting and Bookkeeping for Artists

Freelancers, artists, and creatives frequently reach a point where their hustle becomes their main hustle. When this happens, accounting for artists, bookkeeping for artists, bookkeeping for painters or accountant for musicians become more vital than ever. There are also certain factors unique to the artist and freelance industry:

- Consider an LLC or S-corporation for your freelance business, and grasp the tax ramifications of both.

- Invoicing and income collection: Identifying options for invoicing your clients, accepting payments using platforms such as Venmo and Zelle, and ensuring all of your money is appropriately reported.

- Expense monitoring is determining the most effective method for recording deductible expenses and ensuring that you are functioning in the most tax-efficient manner feasible.

Tax Planning and Preparation Services for Artists:

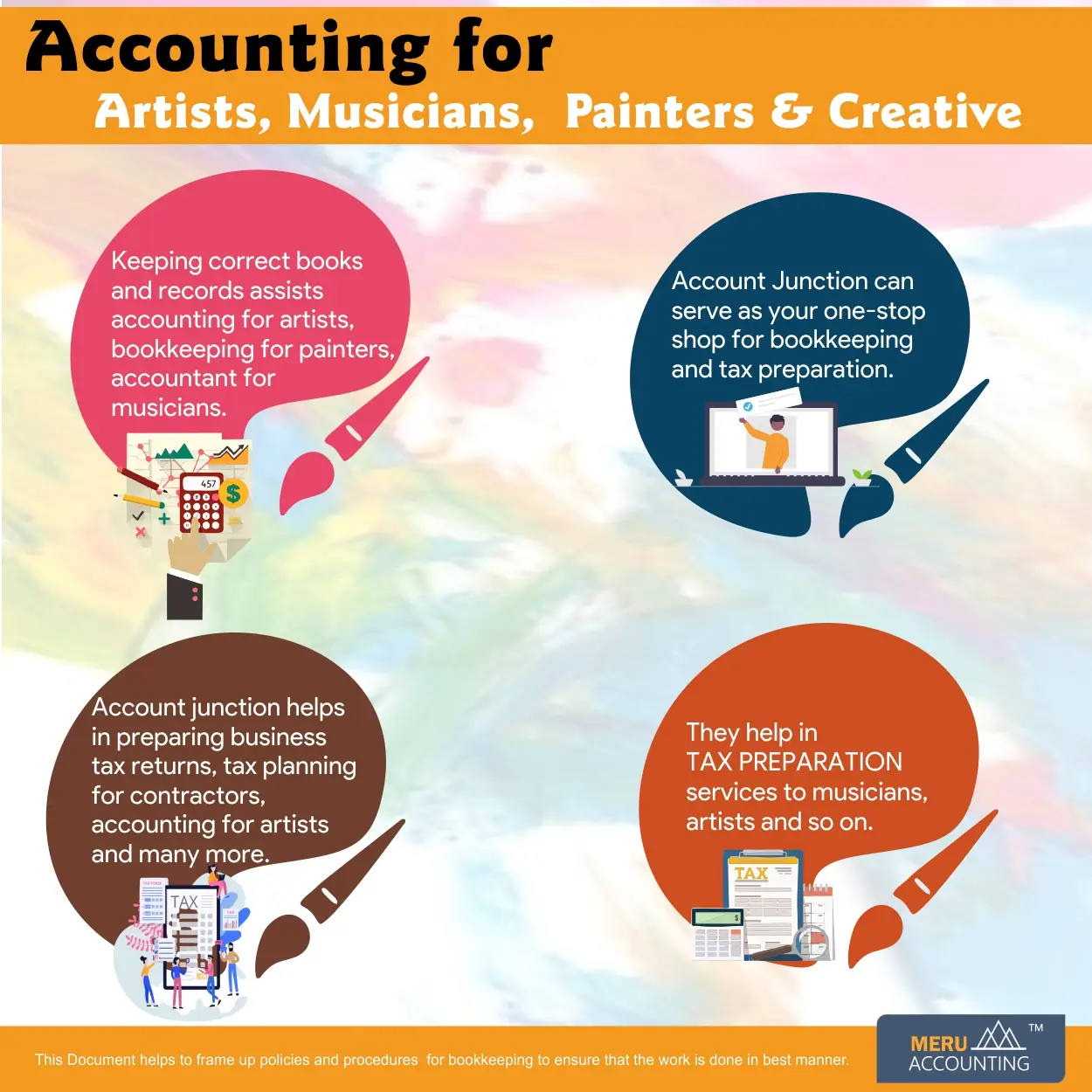

Keeping correct records assists accounting for artists, bookkeeping for artists, bookkeeping for painters, accountant for musician freelancers and artists to be tax prepared.

Account Junction can serve as your one-stop shop for bookkeeping and tax preparation.

TAX PLANNING FOR CONTRACTORS:-

Many freelancers and artists earn money from sources other than their freelance work. Account Junction may produce tax estimates throughout the year to ensure that you are never caught off guard when it comes to tax time. We can also walk you through ideas for lowering your tax liability before it's too late.

PREPARING BUSINESS TAX RETURNS:-

Account Junction caters to freelancers that have incorporated as LLCs or S-corporations. Industry-specific difficulties for freelancers include the qualifying business income deduction for certain service businesses, responsible programs for cost reimbursements, and reasonable wage estimates for S-corporation owners. Allow us to use our wealth of expertise and experience to ease the burden of business tax preparation off your shoulders.

SOLE PROPRIETORSHIP TAX PREPARATION:-

Many artists and creatives operate as sole proprietors for tax reasons, self-employment taxes are a major consideration. Account Junction can calculate and even schedule your projected payments for you to ensure you stay on track throughout the year.

Return to What Matters Most with Account Junction and Accounting:

We understand the bookkeeping and tax challenges that come with working as a freelancer or creative. They may include:

- Accounting process innovation and technology utilization

- Clear, consistent communication and availability to answer your questions

- Changes in tax law that have a direct impact on your business are communicated

For comprehensive outsourced bookkeeping and accounting solutions, small and medium-sized enterprises in the US, UK, Australia, New Zealand, Hong Kong, Canada, and Europe can turn to Accounts Junction, a CPA firm. It contains Account Junction, provides accounting and bookkeeping services to artists, musicians, painters, and creative freelancers. We can save you money while keeping you tax compliant.

Basics of Bookkeeping and Accounting for Artists and Painters:

1. Bookkeeping:

Keeping track of income and expenses to create a record of financial transactions, including invoices, receipts, and payment records.

2. Accounting

Analysing bookkeeping records to gain insights into the financial health of your artistic practice, involving tasks such as reconciling bank statements, preparing financial statements, and calculating taxes owed.

3. Tools and Software:

Utilize accounting software tailored for artists and painters to automate bookkeeping tasks and generate customized reports for better financial management.

4. Key Terms:

Familiarize yourself with important bookkeeping terms such as revenue (income), expenses (costs), assets (owned items), and liabilities (debts or obligations) to understand financial discussions.

5. Benefits:

Accurate record-keeping enables you to assess your business's profitability, identify areas for cost reduction or revenue growth, and make informed decisions about pricing and investments.

6. Time for Art:

Embracing bookkeeping and accounting basics empowers you to confidently take control of your finances, freeing up more time for your true passion – creating beautiful art.

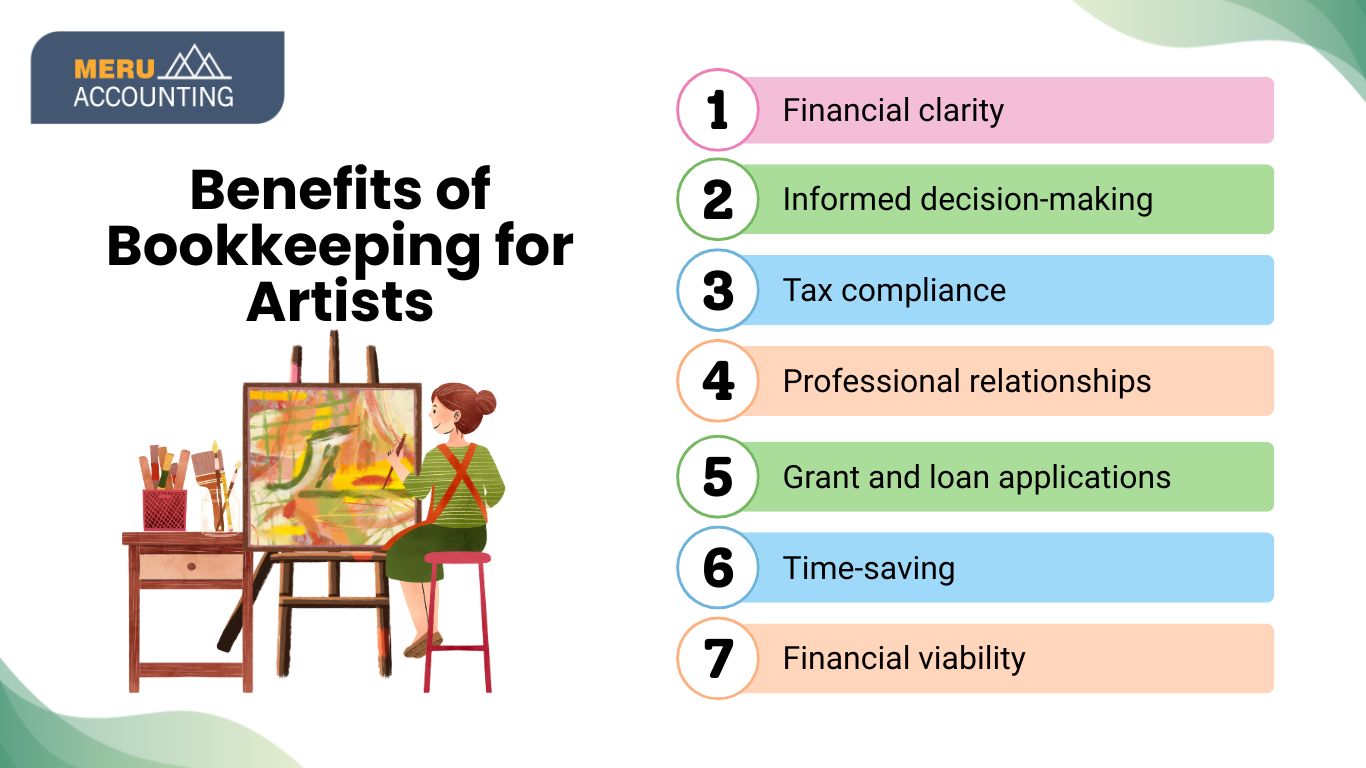

Benefits of Bookkeeping for Artists:

1. Financial clarity:

Bookkeeping provides artists with a clear picture of their financial situation, including income and expenses.

2. Informed decision-making:

Understanding your finances allows you to make informed decisions about pricing, budgeting, and investing in your artistic career.

3. Tax compliance:

Proper bookkeeping ensures accurate reporting of income and identifies deductible expenses, reducing tax liabilities and helping artists stay on top of tax obligations.

4. Professional relationships:

Keeping track of receipts and invoices through bookkeeping enables prompt and accurate invoicing, maintaining professional relationships with clients and galleries.

5. Grant and loan applications:

Well-maintained financial records facilitate the application process for grants or loans, as funding organizations often require detailed financial statements.

6. Time-saving:

Outsourcing or offshore bookkeeping services free up artists' time, allowing them to focus on creating art and pursuing new opportunities.

7. Financial viability:

Good bookkeeping practices demonstrate the financial viability and professionalism of an artist's endeavors, increasing credibility and opportunities for growth.

Bookkeeping is an essential aspect of managing the financial side of an artistic career, and artists can benefit from working with an accounting firm like Accounts Junction. We specialize in providing comprehensive financial services tailored to the unique needs of artists, painters, and musicians. With our expertise in artist-specific financial management, Accounts Junction can offer valuable insights and guidance. We can handle bookkeeping tasks, ensuring accurate record-keeping and compliance with accounting standards. Moreover, we can provide tax planning and optimization services, helping artists navigate the complexities of tax regulations and identify deductions and credits specific to their artistic careers. Additionally, Accounts Junction can offer financial guidance and planning, assisting artists in developing budgets, setting financial goals, and analyzing their financial performance. By partnering with Accounts Junction, artists can focus more on their creative work while ensuring the long-term financial success of their careers.

What expenses can be deducted for Artists

As an artist, it's important to understand what expenses you can deduct to maximize your financial benefits. While every artist's situation may vary, here are some common expenses that artists can often deduct:

1. Art Supplies:

The materials you use for creating your art, such as paintbrushes, canvases, and paints, can typically be deducted as business expenses.

2. Studio or Workspace Costs:

If you have a dedicated space where you create your artwork, the rent or mortgage payments for that space may be deductible. Additionally, any utilities or maintenance costs associated with your studio could also potentially qualify.

3. Marketing and Promotion Expenses:

Artists often need to invest in marketing their work through website development, advertising costs (both online and offline), and printing promotional materials like postcards or brochures - these expenses are usually deductible.

4. Professional Development:

Attending workshops, classes, or conferences related to improving your artistic skills are considered professional development activities and may be tax-deductible.

5. Travel Expenses:

If you travel for art shows or exhibitions outside of your local area, transportation costs (such as airfare or gas mileage) and lodging fees can generally be deducted.

6. Insurance Premiums:

Insuring valuable pieces of artwork is crucial for artists; fortunately premiums paid towards insurance like liability insurance might also be deductible.

How Accounts Junction specializes in maximizing tax benefits for artists

Accounts Junction specializes in maximizing tax benefits for artists through its comprehensive accounting services. Here are some ways they can help artists in this regard:

1. Expertise in Artist Taxation:

Accounts Junction has in-depth knowledge and experience in dealing with the unique tax situations faced by artists. We understand the specific deductions and credits available to artists and can help identify and maximize these tax benefits. By staying up-to-date with the latest tax laws and regulations, we ensure that artists take advantage of all eligible tax deductions.

2. Strategic Tax Planning:

Accounts Junction works closely with artists to develop proactive tax strategies. We analyze the artist's financial situation, income sources, and expenses to create a customized tax plan. This may include optimizing the timing of income and expenses, structuring the artist's business entity for tax efficiency, and identifying opportunities for retirement contributions or other tax-deferral strategies.

3. Record-Keeping and Documentation:

Proper record-keeping is essential for maximizing tax benefits. Accounts Junction assists artists in maintaining accurate and organized financial records, ensuring that all eligible expenses are documented and substantiated. This helps artists provide the necessary evidence during tax audits or inquiries, reducing the risk of deductions being disallowed.

4. Sales Tax Compliance:

For artists involved in selling artwork, understanding and complying with sales tax regulations is crucial. Accounts Junction can help artists navigate the complex landscape of sales tax, ensuring compliance with local, state, and even international sales tax requirements. We can guide on collecting and remitting sales tax, as well as advice on exemptions or special rules that may apply to art sales.

5. Monitoring Tax Law Changes:

Tax laws are subject to frequent changes and updates. Accounts Junction stays informed about these changes and how they impact artists' tax obligations. We help artists navigate any new tax legislation or regulations, ensuring ongoing compliance and capturing any new tax benefits that may arise.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1010 | : Cash on Hand | Assets: Curent Assets |

| 2 | 1020 | : Cash in Bank (Operating Account) | Assets: Curent Assets |

| 3 | 1030 | : Accounts Receivable (Customer Invoices for art sales or commissions) | Assets: Curent Assets |

| 4 | 1040 | : Inventory (Art Supplies, Finished Artworks, Framing) | Assets: Curent Assets |

| 5 | 1050 | : Prepaid Expenses (E.g., insurance, studio rent paid in advance) | Assets: Curent Assets |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services