Bookkeeping and Accounting Services for Contractors

Independent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have systematic bookkeeping and accounting systems. Improper bookkeeping and accounting is most commonly observed among small and middle level contractors. Inappropriate accounting for contractors causes a lot of financial irregularities in the organization.

They always experience financial crunch due to improper bookkeepking and accounting. So, a proper contractor accounting is very important to ensure that the cash flow is good in the organization which can help to grow the business. This will give better insights about the financial aspects of the contractors that give better information about the cost, revenue, profits, cash-inflow, cash outflow, etc. If you are looking for proficient accounting and bookkeeping for contractors then Accounts Junction is a better choice for you. They have good experience of working for accounting and bookkeeping for independent contractors. Outsourcing the bookkeeping and accounting tasks to Accounts Junction can be very beneficial for the independent contractors in many ways.

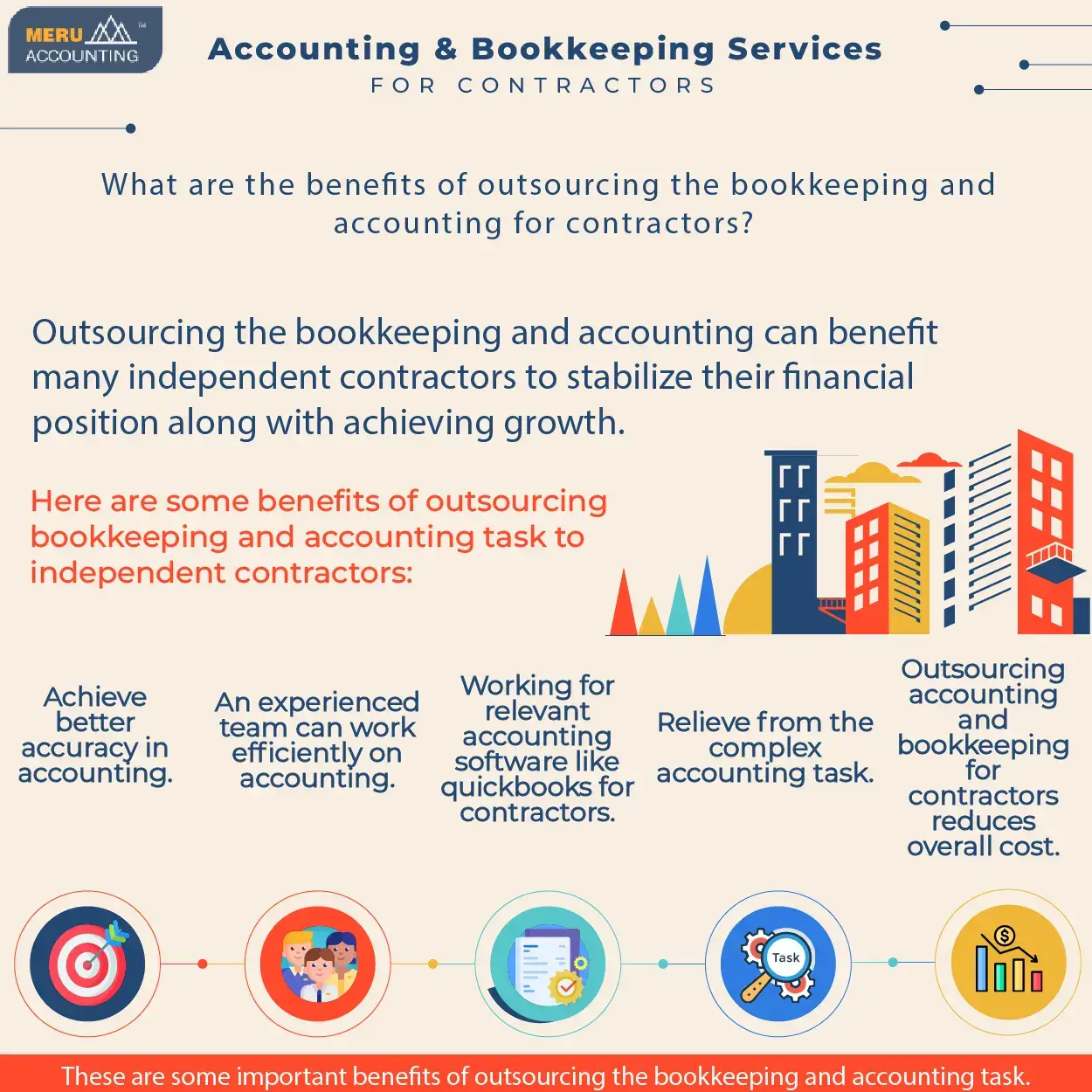

Benefits of Outsourcing Bookkeeping & Accounting for Contractors

Outsourcing bookkeeping and accounting tasks here can be beneficial in many ways.

Here are some benefits of outsourcing booking and accounting for contractors to Accounts Junction:

1. Accuracy in accounting

Mistakes and errors are bound to happen in the accounting task. However, if there are more mistakes, it can hamper the financials of the business. And for independent contractors, it is very important that they avoid any errors in accounting. Else, it can cause difficulty to deal with their clients and many financial problems in the organization. Accounts Junction are proficient in the service they provide which can bring the desired accuracy in the accounting.

2. Experience working with contractors

Accounts Junction has worked with multiple clients from all around the world. Their team has individuals who have worked for independent contractor accounting. This can help you to get better organized accounting for independent contractors.

3. Work on relevant accounting software

Now, most accounting activities are done on some accounting software which has really speed-up and reduced the accounting cost. By outsourcing to Accounts Junction, you do not need to purchase any independent accounting software or get training to work on it. They have relevant accounting software to do bookkeeping and accounting activities.

4. Relieve from complex accounting task

There are many independent contractors who have inefficient accounting or they themselves get involved in the accounting. This affects their focus on the core business adversely. Outsourcing to Accounts Junction can relieve the contractors from accounting activities and focus more on their core business activities. They will use the accounting software of QuickBooks for contractors to work on accounting.

5. Reduce the accounting cost

More cost is involved in the in-house accounting activities like recruitment, training, and allocating resources. However, outsourcing to Accounts Junction will reduce all these costs as they charge comparatively lesser for accounting activities.

These are some of the benefits you get after outsourcing bookkeeping and accounting to a proficient agency. Accounts Junction is a popular accounting service providing the agency with clients all over the world.

The Importance of Outsourcing Bookkeeping and Accounting for Contractors to Accounts Junction:

Here are some benefits of outsourcing bookkeeping and accounting for contractors to Accounts Junction:

1. Streamlined Cash Flow Management:

- Outsourcing bookkeeping and accounting ensures accurate and timely invoicing, payment tracking, and cash flow monitoring.

- Contractors can have a clear view of their receivables, payables, and overall cash flow position, helping them make informed financial decisions.

2. Reduction of Administrative Burden:

- By outsourcing accounting tasks, contractors can offload time-consuming administrative responsibilities.

- This allows contractors to focus on their core competencies, such as project management and client satisfaction.

3. Access to Industry Insights and Best Practices:

- Outsourced accounting professionals often have industry-specific knowledge and experience.

- Contractors can benefit from their insights, guidance, and best practices to optimize financial operations and stay ahead of industry trends.

4. Improved Financial Forecasting:

- Professional bookkeeping and accounting services provide accurate and up-to-date financial data for effective forecasting.

- Contractors can better anticipate future financial needs, plan for contingencies, and make strategic business decisions.

5. Risk Mitigation:

- Expert accounting services help contractors identify and mitigate financial risks associated with their operations.

- This includes monitoring financial ratios, ensuring compliance with regulatory requirements, and implementing internal controls.

6. Enhanced Vendor and Subcontractor Management:

- Outsourcing accounting tasks can streamline vendor and subcontractor management processes.

- Accounting professionals can handle payment processing, expense tracking, and maintaining accurate records, strengthening relationships with vendors and subcontractors.

7. Improved Project Costing and Profitability:

- Accurate job costing provided by outsourced accounting services helps contractors track project expenses and measure profitability.

- Contractors can make data-driven decisions, optimize resource allocation, and ensure projects remain within budget.

8. Increased Financial Transparency:

- Outsourcing bookkeeping and accounting promotes financial transparency, providing stakeholders, including clients and investors, with a clear view of the contractor's financial health and performance.

The Services Provided by contractor bookkeepers:

Here are the services provided by contractor bookkeepers:

1. Recording financial transactions:

Contractor bookkeepers accurately record income and expenses, ensuring that all financial data is properly entered into the books.

2. Bank and credit card statement reconciliation:

They compare the records in the books with bank and credit card statements to identify any discrepancies or errors, ensuring accurate financial records.

3. Financial report preparation:

Contractor bookkeepers prepare essential financial reports like balance sheets, profit and loss statements, and cash flow statements. These reports provide insights into the business's performance and help with decision-making.

4. Tax preparation:

They gather relevant financial information and ensure compliance with tax regulations. Contractor bookkeepers help organize receipts, categorize expenses correctly, and assist in filing taxes accurately and on time.

5. Payroll management:

Some contractor bookkeepers offer payroll management services, ensuring accurate calculation and distribution of employee wages.

6. Invoicing support:

Contractor bookkeepers may assist with generating invoices and managing the invoicing process, ensuring timely and accurate billing for clients.

Hiring a contractor bookkeeper can relieve contractors from financial management tasks, allowing them to focus on their core business operations and achieve greater efficiency.

Steps to set up a Bookkeeping and Accounting system for your Contracting Business:

Here are the steps to set up a bookkeeping and accounting system for your contracting business:

1. Choose the accounting method:

Decide whether cash or accrual accounting suits your business best.

2. Establish a chart of accounts:

Create categories for income, expenses, assets, liabilities, and equity to organize your financial records.

3. Select accounting software:

Choose a user-friendly software like QuickBooks Online or Xero that aligns with your needs and budget.

4. Set up the software:

Input relevant information such as bank account details and vendor information. Customize invoice templates to match your branding.

5. Reconcile bank statements:

Regularly compare your bank statements with the entries in your software to ensure accuracy and identify any discrepancies.

6. Review financial reports:

Schedule regular reviews of profit/loss statements and balance sheets to monitor the overall health of your business and make informed decisions.

How does Accounts Junction help in Contractor Accounting

By outsourcing their bookkeeping tasks to a professional contractor bookkeeper from Accounts Junction, contractors can benefit in several ways. These include:

1. Expert financial management:

Accounts Junction provides expert bookkeepers who specialize in contractor bookkeeping. They have the knowledge and experience to handle the specific financial requirements of contractors, ensuring accurate record-keeping and financial reporting.

2. Time-saving:

By entrusting their bookkeeping tasks to Accounts Junction, contractors can save valuable time that can be redirected towards delivering quality work to their clients and growing their businesses.

3. Compliance with tax regulations:

Contractor bookkeepers from Accounts Junction are well-versed in tax regulations and can assist contractors in maintaining compliance. They help organize receipts, categorize expenses correctly, and ensure accurate and timely tax preparation.

4. Financial insights:

Accounts Junction offers valuable insights into the financial health of contractors' businesses. They provide regular financial reports, including balance sheets, profit, and loss statements, and cash flow statements. These reports help contractors make informed decisions about their business operations and future investments.

5. Customized services:

Accounts Junction tailors their services to meet the specific needs of each contractor. Whether it's general ledger maintenance, payroll processing, accounts payable/receivable management, or bank statement reconciliation, they provide a comprehensive range of services to support contractors' financial management requirements.

In today's fast-paced business world, contractors play a vital role in various industries. However, managing the financial aspects of their businesses can be challenging and time-consuming. That's where contractor bookkeeping services, such as the ones provided by firms like Accounts Junction, come into play.

Accounts Junction is an accounting firm specializing in contractor bookkeeping services. They understand the unique needs and challenges faced by contractors and offer tailored financial management solutions to address those needs effectively.

When considering outsourcing bookkeeping tasks, contractors can explore options like Accounts Junction to find a reliable and trusted partner. This specialized accounting firm understands the contractor industry and has the expertise to handle the financial complexities contractors face.

By utilizing contractor bookkeeping services from Accounts Junction, contractors can streamline their finances, ensure accuracy in their financial records, and gain valuable insights to drive business growth. It's a smart investment that allows contractors to focus on their core business while leaving the financial management in the hands of professionals.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1000 | Bank & Cash Accounts: | Bank |

| 2 | 1001 | Operating Bank Account | Bank |

| 3 | 1002 | Petty Cash: Bank | Bank |

| 4 | 1200 | Accounts Receivables: | Accounts Receivable |

| 5 | 1201 | Client Receivables | Accounts Receivable |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services