Table of Contents

05 key benefits of Bookkeeping Services for Real Estate

What Are Bookkeeping Services for Real Estate?

Bookkeeping services for real estate involve recording, tracking, and managing financial transactions related to property investments, sales, and management. These services include:

- Recording income from property sales, rental income, and commission

- Tracking expenses such as maintenance, property taxes, and mortgage payments

- Bank and credit card reconciliation

- Creating detailed financial reports, such as profit and loss statements, to provide insights into business performance

- Preparing for tax filings and ensuring compliance with regulations

- Managing payroll for real estate agents and staff

With professional bookkeeping for real estate, businesses can streamline their financial processes, minimize errors, and focus on growing their property portfolio.

Why Bookkeeping is Important for Real Estate Businesses

Bookkeeping for real estate is essential as it ensures accurate financial records, compliance with tax regulations, and better decision-making. With multiple transactions, including property sales, rentals, and management costs, maintaining organized financial data is vital. Proper bookkeeping for real estate helps businesses track income, manage expenses, and plan for future investments effectively.

Errors in financial records can lead to tax penalties and cash flow issues. Bookkeeping services for real estate ensure that every transaction is accurately recorded, categorized, and reconciled. This helps businesses maintain financial stability and prepare for audits and financial planning.

Key Advantages of Bookkeeping Services for Real Estate

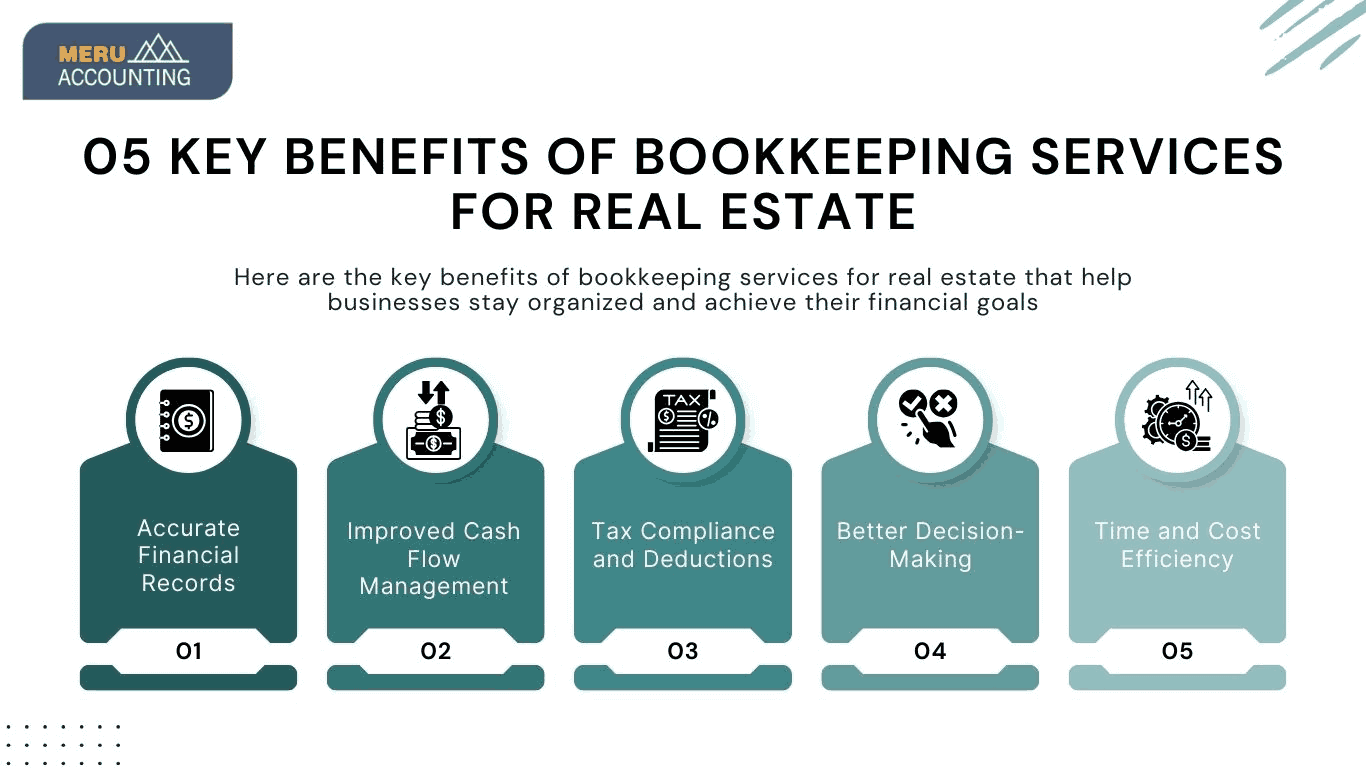

Effective bookkeeping for real estate ensures financial stability and smooth operations for businesses. Here are the key benefits of bookkeeping services for real estate that help businesses stay organized and achieve their financial goals.

- Accurate Financial Records

Bookkeeping services for real estate help maintain precise financial records, reducing errors and discrepancies. Accurate records make it easier to track income and expenses, ensuring the business remains financially stable. Real estate businesses can use these records to prepare for audits and make informed financial decisions.

- Improved Cash Flow Management

Managing cash flow is crucial for real estate businesses, as delays in payments and expenses can impact operations. Bookkeeping for real estate provides a clear picture of incoming and outgoing cash, helping businesses plan for expenses and avoid financial shortfalls.

- Tax Compliance and Deductions

Real estate businesses deal with complex tax regulations, and improper bookkeeping can lead to penalties. Bookkeeping services for real estate ensure accurate tax preparation, allowing businesses to claim deductions for expenses like property depreciation, repairs, and mortgage interest.

- Better Decision-Making

Real estate businesses need financial insights to make strategic investment decisions. Bookkeeping for real estate provides detailed reports, enabling businesses to analyze profitability, evaluate expenses, and identify growth opportunities.

- Time and Cost Efficiency

Handling bookkeeping in-house can be time-consuming and prone to errors. Outsourcing bookkeeping for real estate allows businesses to save time, reduce operational costs, and focus on core activities like property sales and management.

How to Choose the Right Bookkeeping Services for Real Estate?

Selecting the right bookkeeping services for real estate involves considering factors like experience, technology, and service offerings. Here are key points to evaluate:

- Industry Expertise: Choose a provider with experience in bookkeeping for real estate to ensure they understand industry-specific financial requirements.

- Technology and Software: Opt for bookkeeping services for real estate that utilize cloud-based accounting software for efficient data management.

- Customization: Ensure the services are tailored to your business needs, covering aspects like rental income tracking, expense management, and tax preparation.

- Compliance and Accuracy: The bookkeeping provider should ensure compliance with tax laws and maintain error-free financial records.

- Scalability: As your real estate business grows, bookkeeping for real estate should be able to scale accordingly to handle increased transactions and financial complexities.

Why Choose Our Real Estate Bookkeeping Services?

Our bookkeeping services for real estate offer customized solutions to help businesses maintain accurate financial records and achieve financial stability. Here’s why you should choose us:

- Experienced Professionals: Our team specializes in bookkeeping for real estate and understands industry-specific financial challenges, ensuring that businesses have access to knowledgeable professionals who can handle complex financial transactions with precision and efficiency.

- Advanced Accounting Software: We use the latest accounting tools to provide real-time financial insights and data security, ensuring businesses can access up-to-date reports that support informed decision-making and financial planning.

- Comprehensive Services: From income tracking to tax preparation, our bookkeeping services for real estate cover all aspects of financial management, allowing businesses to streamline operations and maintain compliance with financial regulations.

- Cost-Effective Solutions: We offer affordable pricing without compromising quality, ensuring your business benefits from professional bookkeeping for real estate that improves financial efficiency and reduces operational expenses.

- Dedicated Support: Our expert bookkeepers are always available to address queries, provide financial guidance, and assist businesses in optimizing their financial processes to achieve long-term growth and profitability.

With our bookkeeping services for real estate, you can ensure financial accuracy, compliance, and business growth.

Conclusion

Bookkeeping services for real estate play a crucial role in maintaining financial accuracy, ensuring tax compliance, and supporting business growth. With professional bookkeeping for real estate, businesses can manage cash flow, reduce financial risks, and make informed decisions. Choosing the right bookkeeping service provider is essential for seamless financial operations and long-term success. Accounts Junction offers reliable bookkeeping services for real estate, ensuring financial stability and efficiency. Real estate businesses can keep their finances in order while focusing on portfolio expansion by utilizing expert bookkeeping solutions.

FAQs

- Why do real estate businesses need bookkeeping services?

Real estate businesses need bookkeeping for real estate to maintain accurate financial records, manage cash flow, and ensure tax compliance.

- What expenses can real estate businesses track with bookkeeping services?

Bookkeeping services for real estate track expenses such as property maintenance, mortgage payments, property taxes, and commissions.

- How do bookkeeping services for real estate help with tax preparation?

They ensure all income and expenses are accurately recorded, making it easier to file taxes and claim deductions.

- Can bookkeeping for real estate help businesses with financial planning?

Yes, it provides financial reports and insights that help businesses make informed investment decisions.

- Is bookkeeping for real estate cost-effective?

Yes, outsourcing bookkeeping can save time and reduce errors, leading to better financial management and cost savings.