Table of Contents

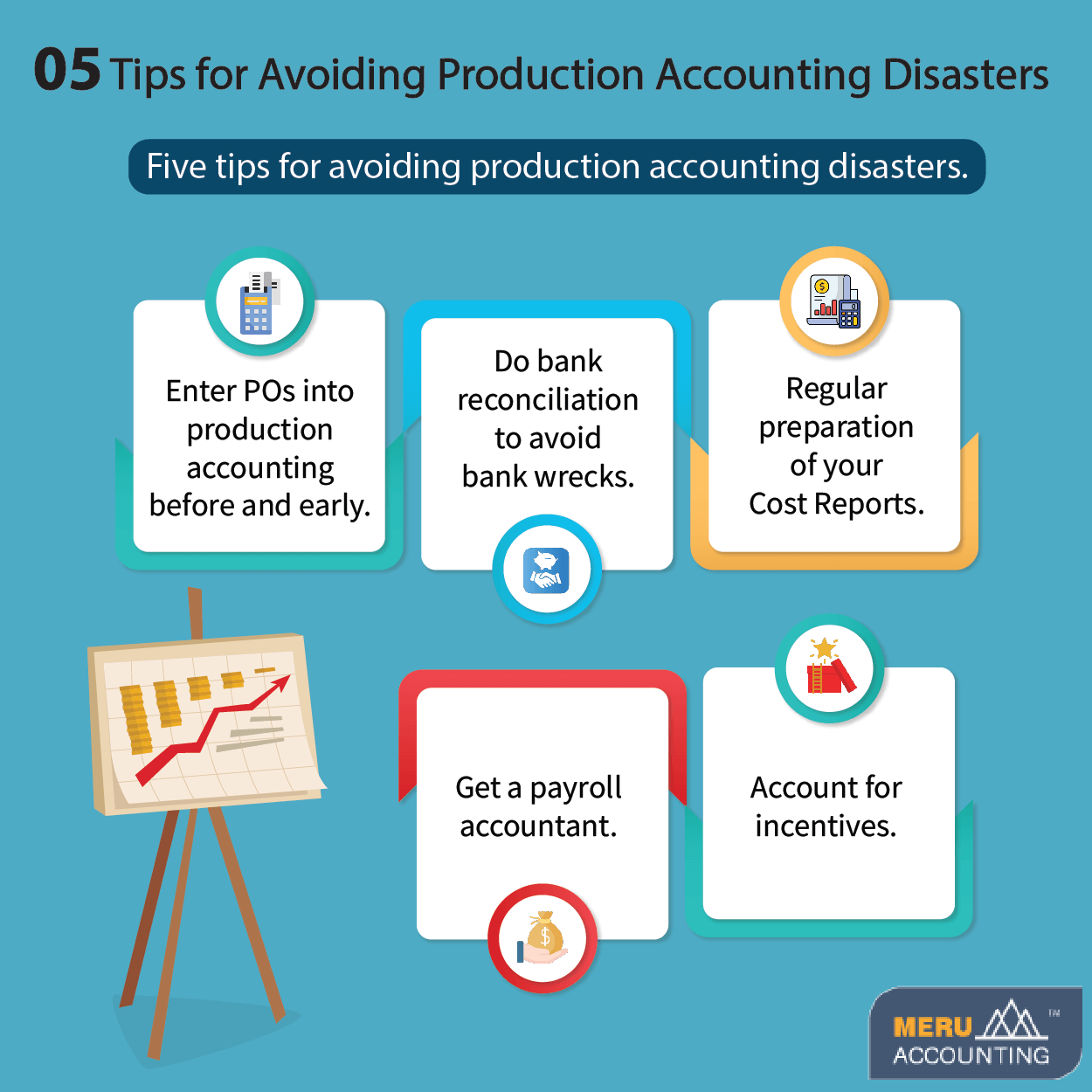

5 Tips for Avoiding Production Accounting Disasters

If you are in charge of accounting for film production, then this article will surely serve your purpose. There is a chance of production accounting mistakes, especially when production is close to wrapping.

Do get yourself and the producer into panic mode, and try out these accounting tips for film production to ensure seamless shoots and posts.

1. Enter POs into production accounting before and early

Purchase orders may create hassles for departmental heads, but they are crucial for efficient accounting for film production, and avoiding mistakes and missed opportunities.

A purchase order should be created before invoicing. A production accountant must be proactive in this regard. The submission of POs at the end of the production creates havoc and a nightmare for you.

As a production accountant, you are responsible for the reconciliation of actual expenses with the budget. What makes matters worse is that the number of POs who are missing may be higher than expected. You must avoid such production accounting mistakes, and enter the POs as they occur.

2. Do bank reconciliation to avoid bank wrecks

We all have the belief and perception that banks don’t make mistakes. A flaw could come from either your banker or the vendor banker of the film.

They may encash more checks than you intended to pay for. In order to avoid this bank reconciliation, there is a simple yet effective way of ensuring an accurate cash balance on the trial balance.

3. Regular preparation of your Cost Reports

Cost reports are indispensable for accounting for film production. As a production accountant, you should regularly prepare weekly or biweekly cost reports.

You cannot afford not to track the movement of money and variances from the original budget. A regular cost report provides a snapshot of the spending of all departments to track their expenses.

4. Get a payroll accountant

For efficient production accounting, you need a dedicated payroll accountant. A professional and dedicated payroll accountant takes care of minimum wage and hour laws for production.

There must be strict time frames in which employees get payments. The correct work location on timecards must be indicated for accurate payroll processing.

Now, you maintain regular cost reports, if employees are unintentionally underpaid, you may have the illusion of available extra funds in payroll and end up spending elsewhere. And when the production wraps, funds will be short to settle the shorted pay/contribution.

5. Account for incentives

The production accountant should consider various factors such as a refundable, grant, transferable, qualified spend, travel cost, etc. that work best for your production.

While shooting in a different location, a production accountant must understand the incentives in a particular region and its accounting requirements.

Many productions are unaware of the incentives because they are unsure of how and what expenses to track. They lack knowledge of the reporting requirements. They must take care of requirements for top incentive states and verify the accounting system to document the qualifying expenditure.

Next time when you get started keep these accounting tips for film production handy.