Table of Contents

- 1 Introduction: Why Xero for Charities Is the Best Choice for Small Nonprofits

- 2 Key Features of Xero for Charities

- 2.1 Access Anywhere:

- 2.2 Bank feeds and Reconciliation:

- 2.3 Easy Report Generation:

- 2.4 Handling Different Currencies:

- 2.5 Works with Your Other Apps:

- 2.6 Plan Your Spending:

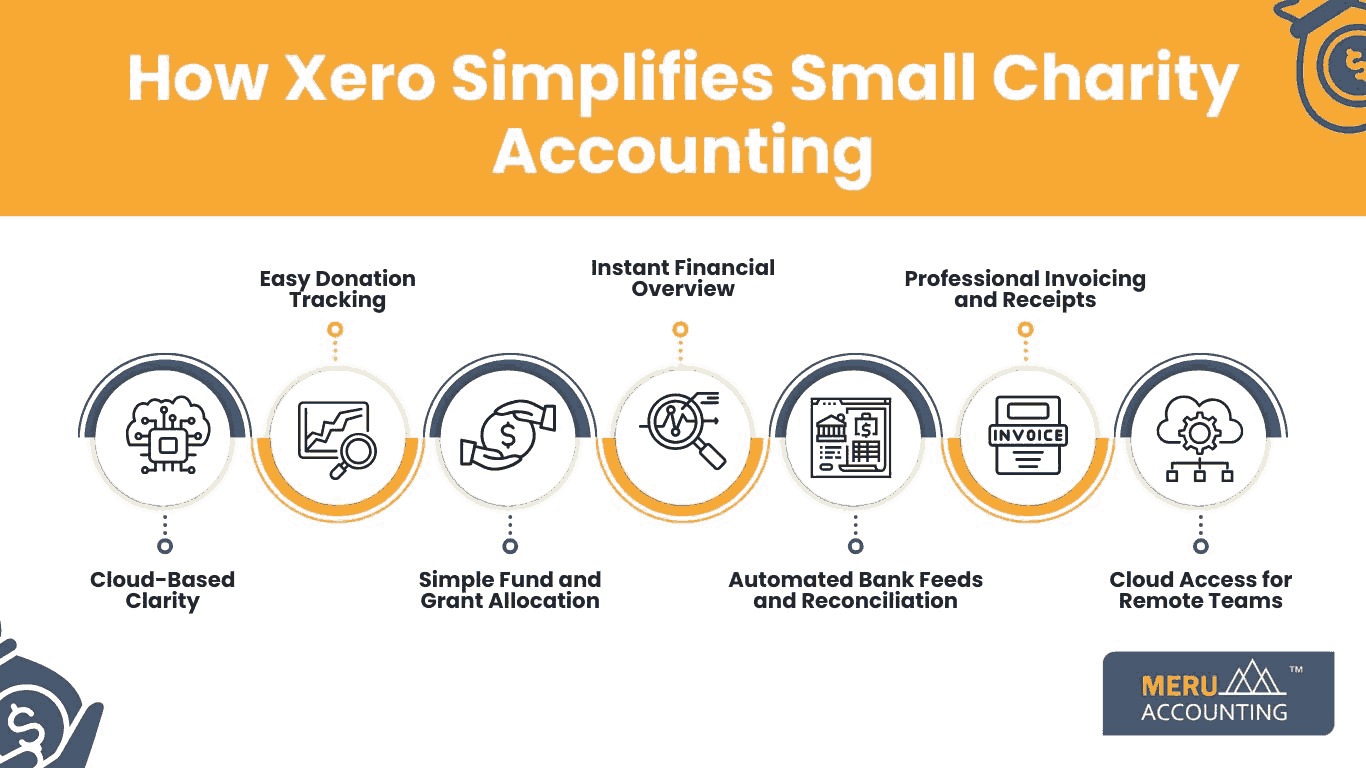

- 3 How Xero Simplifies Small Charity Accounting

- 3.1 1. Cloud-Based Clarity

- 3.2 2. Easy Donation Tracking

- 3.3 3. Simple Fund and Grant Allocation

- 3.4 4. Instant Financial Overview

- 3.5 5. Automated Bank Feeds and Reconciliation

- 3.6 6. Professional Invoicing and Receipts

- 3.7 7. Cloud Access for Remote Teams

- 4 The Benefits of Xero Accounting for Charities

- 4.1 Cost-Effective for Small Charities

- 4.2 Saves Time and Boosts Efficiency

- 4.3 Clear and Honest Financial Reporting

- 4.4 Smarter Money Management

- 4.5 Fewer Mistakes with Automation

- 4.6 Grows With Your Charity

- 4.7 Helps You Stay Compliant

- 5 Comparison: Xero vs. Other Charity Accounting Software

- 5.1 Conclusion

- 5.2 FAQs

7 Reasons why Xero is the best accounting software for a small charity?

Introduction: Why Xero for Charities Is the Best Choice for Small Nonprofits

Xero for charities is a helpful resource for small nonprofits who manage their finances without too much hassle. When you are busy doing social work, it is important to keep track of your donations and expenses with the right tool. For that, Xero software provides the best help to non profit organizations. It's too convenient to use, affordable, and fits the needs of charities. In this blog, we’ll have a look at why Xero is often called the best charity accounting software, and how it can help your small nonprofit save time, avoid mistakes, and stay focused on what matters most.

Key Features of Xero for Charities

Xero is a cloud-based accounting platform. It offers a strong suite of features particularly beneficial for charities.

Access Anywhere:

Users can view their financial information from any location on the internet. This makes it easier for your team, accountants and volunteers to work together.

Bank feeds and Reconciliation:

You can attach your bank accounts with Xero. Your bank records are auto-connected with Xero. It reduces your manual work, minimizes errors, and provides a real-time view of your cash flow.

Easy Report Generation:

Users can create reports like income statements, balance sheets and cash flow statements. Furthermore, This report tracks specific grants and projects which provide clear information to shareholders.

Handling Different Currencies:

If your nonprofit has an international reach or receives donations in various currencies, Xero takes care of the currency conversion process without you having to do it manually. This makes sure your financial records are accurate and simplifies transactions across borders.

Works with Your Other Apps:

Xero can merge with your existing apps, like your fundraising platform and CRM. That's why you don’t need to enter the same data twice. So you can do your work smoothly and peacefully.

Plan Your Spending:

You can map out your financial goals and then easily keep an eye on how your real spending compares. This gives you a clear picture of where your money's going, helping you stay in control and make smarter decisions about your resources. Xero offers small charities a modern, efficient, and affordable accounting solution for simplified financial management and transparency.

How Xero Simplifies Small Charity Accounting

Small charities often have limited resources and may not have committed accounting staff. Xero’s intuitive design and automation features significantly simplify the accounting process:

1. Cloud-Based Clarity

Xero frees you from dealing with messy spreadsheets and mountains of receipts. All your financial data is stored securely online, ensuring everything stays organized and easy to find.

2. Easy Donation Tracking

Xero for charities makes donation tracking straightforward. You can categorize each gift by its type, where it originated, or the specific campaign it supported, which is ideal for staying organized and providing clear reports to your donors.

3. Simple Fund and Grant Allocation

Delegating income and expenses to specific projects or grants is simple with Xero. This feature helps you stay compliant and gives a clear view of how each fund is being used.

4. Instant Financial Overview

Xero’s dashboard shows you up-to-the-minute information on your income, expenses, and cash flow. It’s a simple way to keep your board or team in the loop without any extra hassle.

5. Automated Bank Feeds and Reconciliation

Link your bank to Xero and your transactions are imported automatically. This saves time and makes reconciling your accounts fast and accurate.

6. Professional Invoicing and Receipts

Send branded invoices and donation receipts directly through Xero. This makes your charity look professional and ensures donors get timely acknowledgment.

7. Cloud Access for Remote Teams

The cloud-based nature of Xero means your team can operate it securely from any location. Whether it's your staff in their Ahmedabad offices, volunteers working from home, or your accountant, everyone sees the same financial data in real-time.

The Benefits of Xero Accounting for Charities

Using Xero as your accounting software for a charity comes with several key benefits:

Cost-Effective for Small Charities

Xero is affordable, even for small charities with tight budgets. You don’t need a big, expensive system to get great accounting tools. That’s why it’s often called the best charity accounting software—you get a lot without spending too much.

Saves Time and Boosts Efficiency

With Xero, many tasks are automatic. Bank transactions sync in, reports are generated quickly, and everything is simpler. Your team can dedicate more time to making an impact and spend less time on administrative tasks. Using a month-end checklist in Xero also helps you stay on track with your accounts.

Clear and Honest Financial Reporting

Donors and funders like to see where their money goes. Xero accounting for charities makes it easy to show clear, honest reports. It builds trust with supporters and shows you’re managing money responsibly.

Smarter Money Management

Xero shows you your charity’s money situation in real-time. You can track spending, set budgets, and plan ahead. Having these insights helps your team make better decisions every day.

Fewer Mistakes with Automation

Manual data entry can lead to errors. Xero’s automation features and built-in checks help avoid mistakes. This means your reports are more accurate and easier to trust.

Grows With Your Charity

As your charity gets bigger, your accounting needs grow too. Xero for charities can grow with you. Its flexible features and add-ons make it a great long-term solution for any accounting software for small nonprofit organizations.

Helps You Stay Compliant

Xero ensures compliance with all nonprofit accounting regulations. You can create the reports needed for audits and government filings. A monthly checklist template in Xero makes sure you don’t miss any important steps.

Comparison: Xero vs. Other Charity Accounting Software

|

Feature |

Xero for Charities |

Other General Accounting Software |

Basic/Free Accounting Software |

Nonprofit-Specific Software |

|

Charity Suitability |

Good for charities, customizable. Xero accounting for charities is adaptable. |

Needs customization for charities. May lack charity features. |

Lacks charity-specific features. Not ideal for small charity accounting. |

Built for nonprofits, may lack broader business features. |

|

Ease of Use |

User-friendly. Good for small charity accounting software. |

Varies in complexity, training might be needed. |

Basic, easy for simple tasks, lacks depth. |

Varies can be complex due to nonprofit needs. |

|

Key Charity Features |

Strong reporting, donation tracking (via integrations), and expense management. Supports efficient small charity accounting. |

Core accounting features may need add-ons for charity needs. |

Basic features, lacks donation/grant tracking. |

Fund accounting, donor management, grant tracking. |

|

Cost |

Suitable plans for different sizes. Cost-effective small charity accounting software. |

Tiered pricing can get expensive. |

Free/low-cost, limited features. |

Varies can be expensive. |

|

Cloud-Based Access |

Cloud-based, accessible anywhere. Good for Xero accounting for charities. |

Increasingly cloud-based. |

Often cloud-based, limited functionality. |

Maybe cloud or desktop-based. |

|

Integration |

Works seamlessly with charity-focused apps, expanding Xero’s functionality for nonprofits. |

Integrates with business apps, with fewer charity-specific options. |

Limited integration. |

May have specific nonprofit integrations and fewer business integrations. |

Conclusion

In short, Xero for small charity provides you with an easy, affordable and powerful way to manage your finances. Xero for charity is the best choice for you. It saves your time, stays organized and does everything clear for your team and donors. That is it is the best charity accounting software for a non profits organization. As Accounts Junction, We will guide you through every step, so each process runs smoothly and stress-free. So you can direct more toward your mission.

FAQs

1. Is Xero only for large charities?

No. Xero is perfect for small charities too. It’s designed to scale and adapt based on your needs.

2. Can Xero handle donor and grant tracking?

Yes. Xero allows you to tag income and expenses to specific donors, grants, or projects.

3. Is Xero easy to learn for non-accountants?

Absolutely. Xero is user-friendly and easy to learn, even if you’re not a finance expert.

4. How well protected is my charity’s data when using Xero?

Very secure. Xero utilizes industry-standard encryption and cloud backups.

5. Can Accounts Junction help with training on Xero?

Yes, Accounts Junction provides comprehensive training to ensure your team can effectively use Xero accounting for charities.