Table of Contents

Accounting 101: Essential Tips for Small Business Owners.

Now you are the small business owner, all set to take your company to take at a better level. Although you are an expert in your area of business, it is not always that all business owners are experts in accounting.

If you want to improve the finances of your business, it is essential that you know some basic aspects of bookkeeping and accounting. Knowing Bookkeeping 101 and Accounting 101 can help you to know some basic aspects of it.

If you are a small business owner, it is essential that you know some level of bookkeeping and accounting. Bookkeeping 101 and Accounting 101 are simply the basic understanding of fundamental concepts of bookkeeping and accounting respectively. Understanding these aspects is very important for any business owner.

What are some small business accounting 101 that need to be understood?

As a small business owner, you need to understand some of the basic aspects of accounting.

Here is an accounting 101 cheat sheet that will give you an understanding on some basic concepts about it:

- Introduction to Accounting

An overview of the purpose, importance, and role of accounting in business.

- Basic Accounting Principles

Understanding the fundamental principles that guide accounting, such as consistency, materiality, and conservatism.

- Financial Statements

An examination of the three primary financial statements is crucial for any business owner. These financial statements are balance sheets, income statements, and statements of cash flows are very important.

- Recording Transactions

The process of recording financial transactions using the double-entry bookkeeping system. This involves understanding debits and credits, journal entries, and the general ledger.

- Adjusting Entries

Learning how to make adjusting entries to ensure that revenues and expenses are properly recognized in the appropriate accounting period.

- Internal Controls

Understanding the importance of internal controls in safeguarding assets, preventing fraud, and ensuring accurate financial reporting.

- Cash Payables and Receivables

Accounting for cash transactions is very important to have a financial check. You can achieve this by getting better on cash payables and cash receivables.

- Depreciation

Learning how to account for the systematic allocation of the cost of long-term assets over a period is essential for the business.

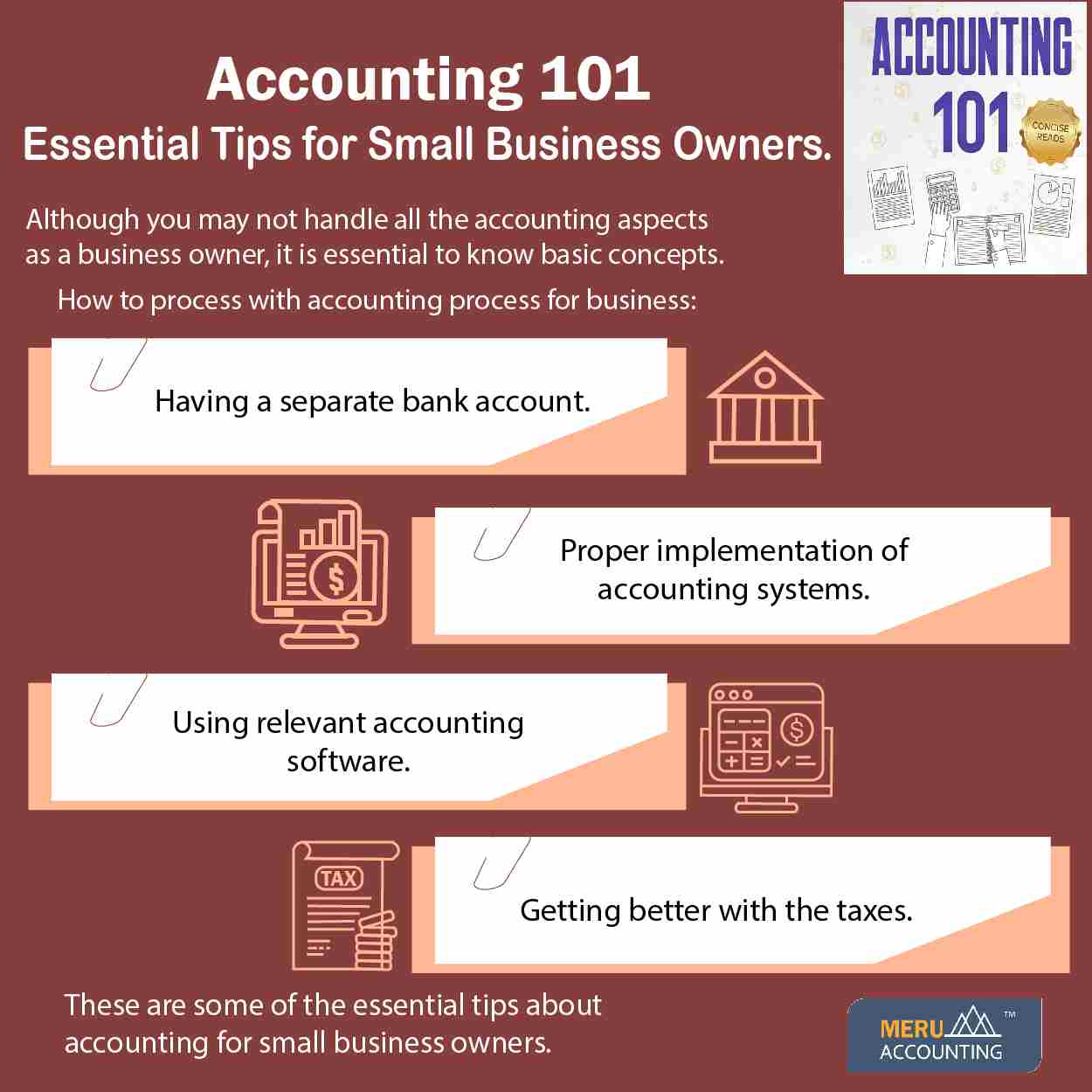

How to proceed with the accounting process?

As you understand the basic terms in accounting, here is the accounting process to help you proceed on it:

- Having a separate bank account

You must have a separate bank account different from your personal account. It will help you to keep track of your finances and assist you in getting business loans.

- Implementing a proper accounting system

Businesses follow two different types of accounting systems and you must follow either of them. The accrual method and cash method are two types of accounting systems.

- Using proper accounting software

Accounting software is now used by most businesses that have an easy accounting process and brings efficiency to it. You can choose any of the accounting software depending on your requirements, features, pricing, and other factors you may consider.

- Get better with taxes

Although filing taxes is very confusing and complicated, it is one of the essential aspects of every business. You must get your taxes properly with the help of experts.

These are some of the aspects of the Accounting 101 cheat sheet that business owners must understand. Although it is not possible to get expertise in accounting, you can outsource to accounting experts.

Meru Accounting provides outsourced accounting work to businesses from different countries like USA, UK, Canada, and many more. Their expertise has in-depth knowledge of small business accounting 101 required.

They have all the technical support to handle accounting activities. Meru Accounting is a well-known accounting service-providing agency across the globe.