Best Accounting Practices for Small Business Owners

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Managing Cash Flow Effectively

Cash flow management is one of the most vital aspects of accounting for small business owners. In the absence of proper cash flow, even profitable businesses can suffer financial difficulties. The best accounting practices for managing cash flow involve regularly tracking both incoming and outgoing funds. Small businesses should prioritize creating a detailed cash flow forecast, which helps anticipate periods when cash may be tight.

A good cash flow management system will also involve monitoring accounts receivable and payable to ensure timely payments. Invoices should be issued promptly, and follow-ups should be conducted regularly to ensure clients are paying on time. Additionally, businesses should have a solid plan for handling unexpected expenses or downturns in revenue. By regularly reviewing cash flow statements, small business owners can make informed decisions about spending and investment opportunities, helping ensure financial stability.

Effective cash flow management also includes budgeting, another key aspect of accounting for small business owners. Creating a budget allows business owners to plan for both short-term and long-term expenses. This helps you track income and expenses, set goals, and find areas to cut costs.

Tax Compliance and Financial Reporting

Tax compliance is a critical component of accounting for small business owners. Failing to comply with tax regulations can result in significant penalties and interest charges. A key accounting practice is keeping detailed records of all income, expenses, and tax documents year-round. This not only ensures that your business stays compliant but also makes it easier to prepare accurate financial reports.

Regular financial reporting is another important practice. Prepare financial statements regularly. This gives small business owners a clear view of their finances. These reports can be shared with stakeholders or used to secure funding from investors or lenders. Accurate financial statements help businesses plan for the future and make informed decisions based on their performance.

For tax purposes, properly categorizing expenses and tracking deductions can lower your overall tax burden. Many small businesses also take advantage of tax credits or incentives, which can further improve their bottom line. Consulting with a tax professional or accountant can help ensure you are following the best accounting practices for tax compliance and financial reporting

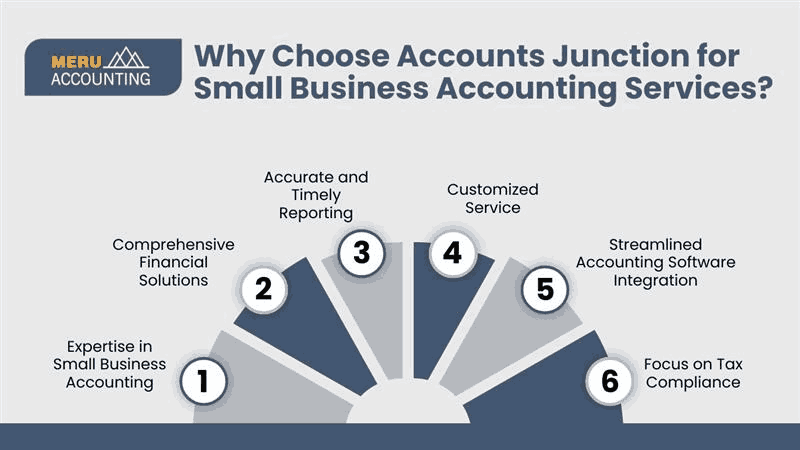

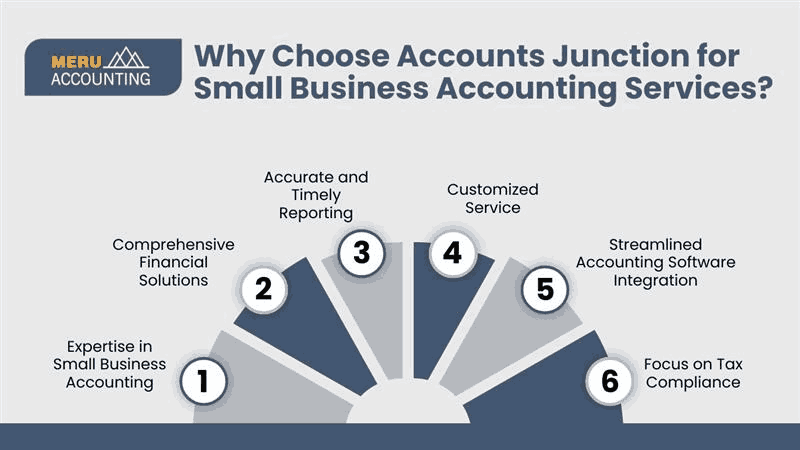

Why Choose Accounts Junction for Small Business Accounting Services?

Expertise in Small Business Accounting

- Accounts Junction specializes in providing tailored accounting services for small businesses. Their team has extensive experience in handling the unique financial needs and challenges of small business owners.

Comprehensive Financial Solutions

- Accounts Junction offers full accounting services. We handle bookkeeping, payroll, taxes, and financial reporting.

Accurate and Timely Reporting

- Accounts Junction ensures accurate and timely financial reports, including balance sheets, profit and loss statements, and cash flow reports, giving you reliable data for decision-making.

Customized Services

- They offer personalized accounting solutions based on your business's specific needs. Whether you're a startup or an established business, their services are flexible and designed to meet your exact requirements.

Streamlined Accounting Software Integration

- Accounts Junction uses the latest accounting software to automate your financial processes, improving efficiency and reducing errors.

Focus on Tax Compliance

- With their expertise in tax laws, Accounts Junction keeps your business compliant, helping you avoid penalties and maximize tax deductions.

Conclusion

Accounting is crucial for small business owners for the success and sustainability of a business. Following best accounting practices, small businesses can manage cash flow, stay tax-compliant, and learn about their finances. By understanding proper financial management, small business owners can make better decisions, lower financial risks, and build a foundation for growth. Remember, good accounting is not just about numbers; it's about creating a plan that helps your business grow. If you want help with accounting for small businesses, Accounts Junction is ready to serve the purpose.

FAQs

1. Why are accounting practices important for small business owners?

Accounting practices track financial health, ensure tax compliance, and support decision-making, helping small businesses grow and remain sustainable.

2. How can small business owners manage cash flow effectively?

Effective cash flow management means tracking income and expenses, forecasting cash flow, and ensuring timely invoicing and payments.

3. What tax benefits can small businesses claim?

Small businesses can claim deductions for business expenses, home office costs, and employee benefits, reducing their overall tax burden.

4. What accounting software should small businesses use?

Popular accounting software like QuickBooks, Xero, and FreshBooks helps small businesses streamline accounting processes, track expenses, and generate reports.

For small businesses, maintaining sound financial practices is essential to long-term success and growth. As a small business owner, good financial management impacts both daily operations and long-term success. One of the most important steps you can take is to adopt the best accounting practices. These practices ensure that your business remains compliant with regulations, optimizes cash flow, and facilitates better decision-making.

In the case of small business owners, bookkeeping goes beyond just keeping track of income and expenses. It means setting up a financial system to track your finances, plan, and spot growth opportunities or issues. Use the right tools and strategies. So, accounting for small business owners can benefit business in the long-term, whether you're starting or improving.

Essential Accounting Practices for Small Business Owners

1. Choose the Right Accounting Method

- Small businesses have many accounting choices. They can either use cash accounting or accrual accounting. Choosing the right method ensures accurate financial tracking.

2. Separate Business and Personal Finances

- Open a dedicated business bank account to distinguish between personal and business expenses. This reduces confusion during tax season and helps maintain organized financial records.

3. Maintain Accurate and Detailed Records

- Keep detailed records of all income, expenses, and financial transactions. This includes receipts, invoices, and bank statements. Consistently updating your records helps prevent errors and ensures accurate financial reporting.

4. Use Accounting Software

- Invest in reliable accounting software like QuickBooks, Xero, or FreshBooks to automate your bookkeeping processes. This minimizes the risk of human error and helps streamline accounting tasks such as invoicing, payroll, and generating reports.

5. Track Cash Flow Regularly

- Consistently monitor your cash flow to ensure that there is enough liquidity to cover daily expenses. Prepare regular cash flow statements to avoid cash shortages and identify trends in incoming and outgoing funds.

6. Set a Budget

- Develop a budget to plan for expected expenses and revenues. This helps in managing operational costs, setting financial goals, and making decisions based on forecasts rather than assumptions.

7. Implement Regular Financial Reporting

- Prepare financial reports such as balance sheets, profit and loss statements, and cash flow statements regularly. These reports offer insights into the financial health of the business, helping you make informed decisions.

8. Maintain Tax Compliance

- Keep track of tax deadlines, including sales tax, payroll tax, and income tax. Keeping accurate records of expenses and income helps ensure your tax filings are correct and lowers the risk of penalties.

9. Reconcile Bank Accounts Monthly

- Regularly reconcile your business bank accounts to ensure that your records match your bank statements. This helps identify discrepancies and ensures the accuracy of your financial data.

10.Plan for Business Growth

- Use your financial data to assess the feasibility of new investments, expansion opportunities, and potential risks. Having accurate financial records supports decision-making regarding business growth strategies.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Managing Cash Flow Effectively

Cash flow management is one of the most vital aspects of accounting for small business owners. In the absence of proper cash flow, even profitable businesses can suffer financial difficulties. The best accounting practices for managing cash flow involve regularly tracking both incoming and outgoing funds. Small businesses should prioritize creating a detailed cash flow forecast, which helps anticipate periods when cash may be tight.

A good cash flow management system will also involve monitoring accounts receivable and payable to ensure timely payments. Invoices should be issued promptly, and follow-ups should be conducted regularly to ensure clients are paying on time. Additionally, businesses should have a solid plan for handling unexpected expenses or downturns in revenue. By regularly reviewing cash flow statements, small business owners can make informed decisions about spending and investment opportunities, helping ensure financial stability.

Effective cash flow management also includes budgeting, another key aspect of accounting for small business owners. Creating a budget allows business owners to plan for both short-term and long-term expenses. This helps you track income and expenses, set goals, and find areas to cut costs.

Tax Compliance and Financial Reporting

Tax compliance is a critical component of accounting for small business owners. Failing to comply with tax regulations can result in significant penalties and interest charges. A key accounting practice is keeping detailed records of all income, expenses, and tax documents year-round. This not only ensures that your business stays compliant but also makes it easier to prepare accurate financial reports.

Regular financial reporting is another important practice. Prepare financial statements regularly. This gives small business owners a clear view of their finances. These reports can be shared with stakeholders or used to secure funding from investors or lenders. Accurate financial statements help businesses plan for the future and make informed decisions based on their performance.

For tax purposes, properly categorizing expenses and tracking deductions can lower your overall tax burden. Many small businesses also take advantage of tax credits or incentives, which can further improve their bottom line. Consulting with a tax professional or accountant can help ensure you are following the best accounting practices for tax compliance and financial reporting

Why Choose Accounts Junction for Small Business Accounting Services?

Expertise in Small Business Accounting

- Accounts Junction specializes in providing tailored accounting services for small businesses. Their team has extensive experience in handling the unique financial needs and challenges of small business owners.

Comprehensive Financial Solutions

- Accounts Junction offers full accounting services. We handle bookkeeping, payroll, taxes, and financial reporting.

Accurate and Timely Reporting

- Accounts Junction ensures accurate and timely financial reports, including balance sheets, profit and loss statements, and cash flow reports, giving you reliable data for decision-making.

Customized Services

- They offer personalized accounting solutions based on your business's specific needs. Whether you're a startup or an established business, their services are flexible and designed to meet your exact requirements.

Streamlined Accounting Software Integration

- Accounts Junction uses the latest accounting software to automate your financial processes, improving efficiency and reducing errors.

Focus on Tax Compliance

- With their expertise in tax laws, Accounts Junction keeps your business compliant, helping you avoid penalties and maximize tax deductions.

Conclusion

Accounting is crucial for small business owners for the success and sustainability of a business. Following best accounting practices, small businesses can manage cash flow, stay tax-compliant, and learn about their finances. By understanding proper financial management, small business owners can make better decisions, lower financial risks, and build a foundation for growth. Remember, good accounting is not just about numbers; it's about creating a plan that helps your business grow. If you want help with accounting for small businesses, Accounts Junction is ready to serve the purpose.

FAQs

1. Why are accounting practices important for small business owners?

Accounting practices track financial health, ensure tax compliance, and support decision-making, helping small businesses grow and remain sustainable.

2. How can small business owners manage cash flow effectively?

Effective cash flow management means tracking income and expenses, forecasting cash flow, and ensuring timely invoicing and payments.

3. What tax benefits can small businesses claim?

Small businesses can claim deductions for business expenses, home office costs, and employee benefits, reducing their overall tax burden.

4. What accounting software should small businesses use?

Popular accounting software like QuickBooks, Xero, and FreshBooks helps small businesses streamline accounting processes, track expenses, and generate reports.