Table of Contents

- 1 What are Accounts Payable Outsourcing Services?

- 2 Key Benefits of Accounts Payable Outsourcing

- 3 Accounts Payable Processing Services: How It Works

- 4 Why Businesses Choose Accounts Payable Outsourcing Services

- 5 Why Choose Accounts Junction for Accounts Payable Outsourcing Services?

- 5.1 Conclusion

- 5.2 FAQs

Accounts Payable Outsourcing Services and Processing Services

What are Accounts Payable Outsourcing Services?

Accounts payable outsourcing services involve handing the management of a company’s accounts payable (AP) process to a third-party provider. This allows businesses to streamline financial operations, enhance accuracy, and improve cash flow management. By accounts payable outsourcing, companies can reduce overhead costs and ensure compliance with industry standards while focusing on core business activities.

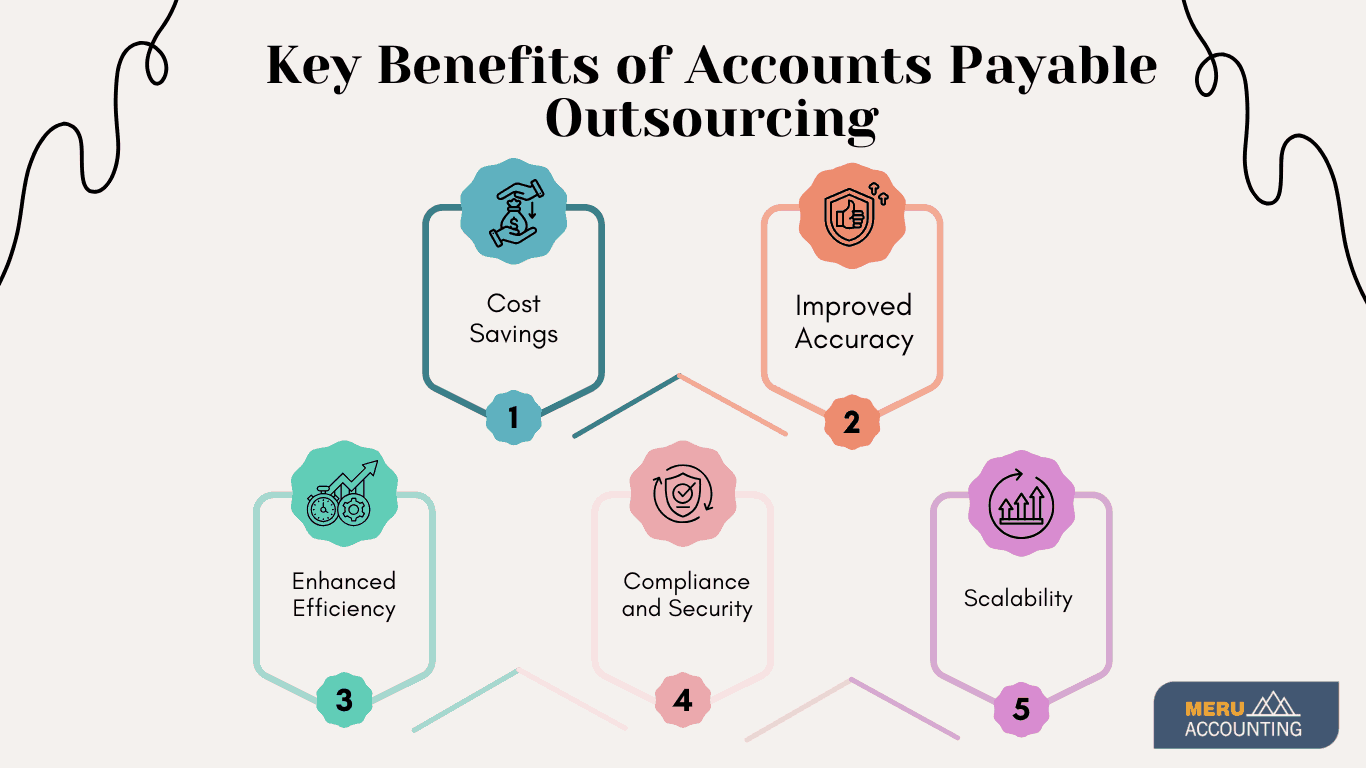

Key Benefits of Accounts Payable Outsourcing

Outsourcing accounts payable (AP) services provide a strategic advantage for businesses looking to optimize their financial operations.

- Cost Savings: Reduces operational expenses by eliminating the need for an in-house AP team, and cutting down payroll, infrastructure, and software costs. It also helps businesses allocate resources more efficiently.

- Improved Accuracy: Minimizes errors in invoice processing and payment approvals, reducing the risk of duplicate payments, miscalculations, and compliance issues. Professional AP service providers use advanced tools to ensure precision.

- Enhanced Efficiency: Speeds up the AP workflow with automated solutions, reducing processing time, avoiding late payment penalties, and improving vendor relationships with timely payments.

- Compliance and Security: Ensures adherence to regulatory requirements and enhances fraud prevention through strict internal controls, secure payment systems, and real-time tracking. This helps businesses avoid financial and legal risks.

- Scalability: Adapts to business growth without additional resource allocation, allowing companies to handle an increasing volume of transactions effortlessly. AP outsourcing solutions are flexible and can be tailored to evolving business needs.

Accounts Payable Processing Services: How It Works

Accounts payable processing involves multiple steps to ensure smooth payment operations and maintain financial accuracy. The process typically includes:

- Invoice Capture and Validation: Receiving invoices through different channels (email, paper, or digital) and verifying details such as invoice number, vendor information, and due dates. This step ensures that only valid invoices enter the system, reducing discrepancies.

- Data Entry and Matching: Extracting data and matching invoices with purchase orders and receipts to confirm accuracy and prevent overpayments. Automated matching helps detect mismatches and flag potential errors early.

- Approval Workflow: Sending invoices to designated approvers for authorization based on predefined rules and company policies. This step enhances accountability and ensures timely processing.

- Payment Processing: Scheduling and executing payments via bank transfers, checks, or electronic payment methods while ensuring timely vendor payments to maintain strong business relationships. Secure payment methods also help prevent fraud and unauthorized transactions.

- Reporting and Reconciliation: Generating reports for better financial control and auditing, allowing businesses to track expenses, identify trends, and ensure accurate financial records. Regular reconciliation helps maintain transparency and compliance.

Why Businesses Choose Accounts Payable Outsourcing Services

Many businesses choose accounts payable (AP) outsourcing services to enhance efficiency, reduce costs, and improve financial accuracy. By outsourcing AP functions, companies can focus on core business activities while ensuring seamless payment operations.

- Expertise and Technology: Access to industry professionals and advanced AP automation tools, ensuring compliance with best practices and regulatory requirements. This leads to a more streamlined and error-free AP process.

- Time-Saving: Eliminates manual work and accelerates invoice processing times, allowing businesses to improve cash flow management and reduce late payment penalties.

- Error Reduction: Reduces discrepancies and enhances data accuracy by implementing automated validation and matching systems. This minimizes risks associated with duplicate invoices, incorrect payments, and fraud.

- Better Vendor Relationships: Ensures timely payments, improving supplier trust and collaboration, which can lead to better payment terms and discounts. A smooth AP process strengthens long-term business partnerships.

Why Choose Accounts Junction for Accounts Payable Outsourcing Services?

Managing accounts payable (AP) efficiently is important for maintaining healthy cash flow and avoiding financial risks. At Accounts Junction, we provide comprehensive AP outsourcing solutions tailored to your business needs.

- Automated and AI-Driven AP Processing: We utilize automation and AI-powered solutions to process invoices, approvals, and payments, significantly reducing errors and improving operational efficiency.

- Transparent and Secure AP Management: With robust security protocols and real-time tracking, we ensure every transaction is processed with complete accuracy, mitigating financial risks.

- Compliance with Global Accounting Standards: Our team ensures your accounts payable processes comply with international tax laws and accounting regulations, minimizing compliance risks.

- 24/7 Expert Support: Our dedicated AP specialists provide round-the-clock assistance to address queries and ensure uninterrupted operations.

- Invoice Processing & Management: We handle end-to-end invoice processing, from invoice capturing, validation, and approval to timely payments, ensuring smooth operations.

- Vendor Management & Payment Processing: Our team ensures on-time vendor payments, helping maintain healthy vendor relationships and avoiding penalties due to late payments.

- Reconciliation & Reporting: We conduct regular bank reconciliations and generate detailed reports, giving you a clear financial overview and improving decision-making.

- Duplicate Payment & Fraud Detection: Our fraud detection mechanisms help identify duplicate invoices and suspicious transactions, safeguarding your business from financial risks.

- Cash Flow Optimization: We help optimize cash flow by strategically managing payment cycles and negotiating better payment terms with vendors.

- Customizable AP Solutions: Every business has unique needs. We offer customized AP solutions that align with your company's financial workflows and business goals.

Conclusion

Accounts payable outsourcing services provide businesses with a cost-effective and secure way to manage financial transactions while ensuring accuracy and compliance. Accounts Junction simplifies AP processes through automation, expert support, and advanced security, helping businesses reduce financial risks and improve vendor relationships. With efficient invoice processing and payment reconciliation, companies can minimize errors and enhance cash flow management.

Additionally, Accounts Junction offers real-time insights and customized reporting, enabling businesses to make informed financial decisions. By ensuring regulatory compliance and reducing audit risks, outsourcing AP functions allows companies to focus on core operations while maintaining strong supplier trust and financial stability.

FAQs

1. What industries benefit from accounts payable outsourcing?

Ans: Industries such as retail, healthcare, manufacturing, and technology benefit from accounts payable outsourcing services by reducing costs and improving payment accuracy.

2. Is accounts payable outsourcing secure?

Ans: Yes, reputable accounts payable outsourcing providers use secure technologies, encryption, and compliance measures to protect sensitive financial data.

3. Can accounts payable processing be customized?

Ans: Accounts payable processing can be tailored to meet your company’s specific workflow and reporting requirements.

4. How do accounts payable outsourcing reduce errors?

Ans: Through automation and expert supervision, accounts payable outsourcing services minimize manual errors, ensuring accurate invoice processing and payment reconciliation.

5. What are the cost savings of outsourcing accounts payable?

Ans: Companies can save up to 40% on AP management costs by outsourcing, as it eliminates the need for in-house staffing and infrastructure investment.