What is the Accounts Payable Process Flow?

What keeps a business running isn’t just sales or big deals. It’s the small, unseen routine of paying vendors, matching invoices, and recording expenses. That cycle forms the Accounts Payable Process Flow — a system that may not give you profits, but keep your business alive.

This flow may look simple at first glance. But, going beyond it can shape how smoothly a business runs and how trusted it stays with its suppliers. In this blog, we will learn more about how this process flows step by step, what each stage may involve, and why keeping it clean can make a big difference.

Understanding the Meaning of Accounts Payable

When a business buys something but does not pay at that very moment, that pending amount becomes a payable. It’s like a promise—a short-term one—to pay later.

So, Accounts Payable, often called AP, refers to all those short-term debts or unpaid bills a company owes to vendors or suppliers. Managing them is not just about paying. It’s about tracking, verifying, approving, and recording each step with care.

And the route that these tasks follow from start to finish forms what we call the Accounts Payable Process Flow.

Why the Accounts Payable Process Flow Matters

Without a clear process, a business may pay late, pay wrong, or even lose track of who it owes. A smooth Accounts Payable Process Flow can help create order and confidence. It may also free the finance team from chaos.

Here’s why it can matter so much:

- Avoids late payments – Vendors stay happy when they get paid on time.

- Prevents duplicate entries – A clean system ensures no double payments.

- Keeps records audit-ready – Every detail stays documented and easy to trace.

- Improves cash planning – The business may see where money will go before it goes.

- Reduces errors – Steps, when followed properly, can catch small mistakes early.

The flow may look like a checklist, yet it becomes the heartbeat of the payable side of accounting.

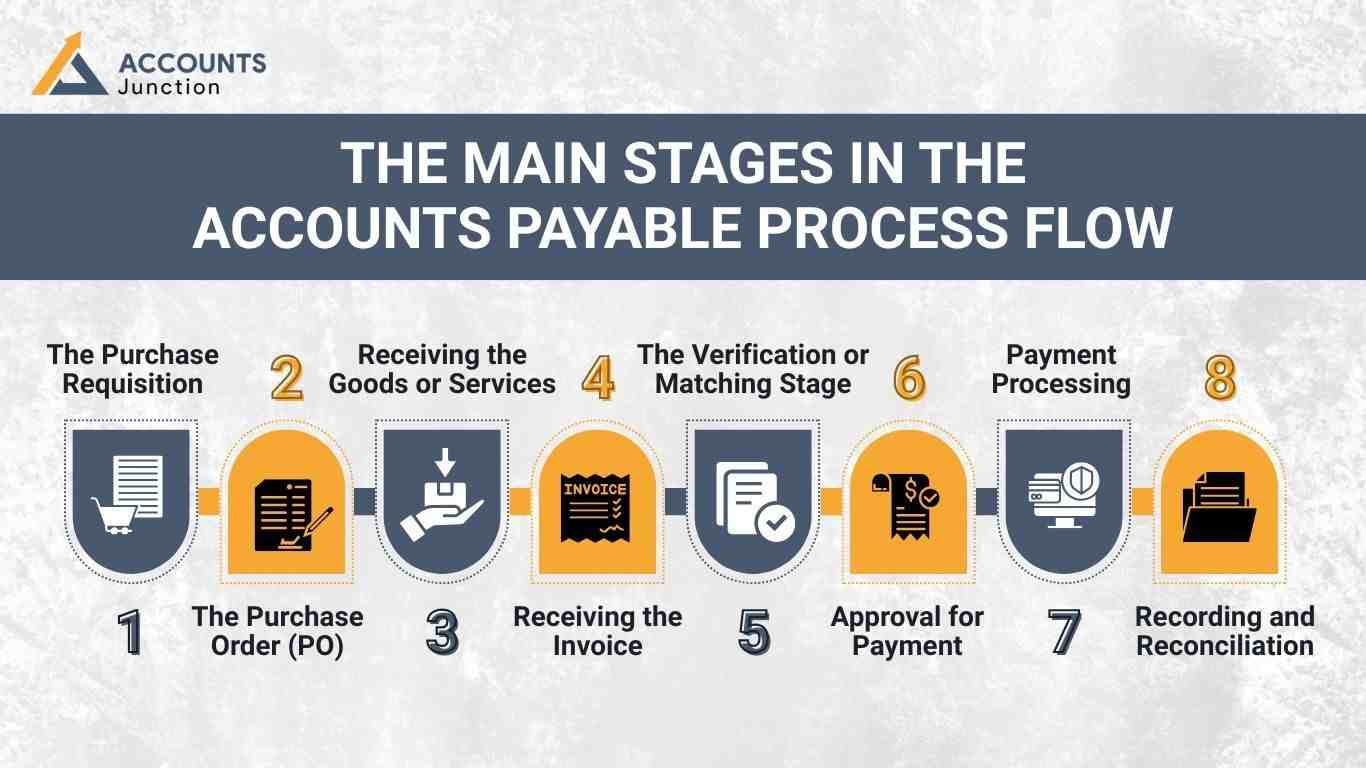

The Main Stages in the Accounts Payable Process Flow

Each invoice a business receives may walk through these common stages before it gets paid. Let’s look at each stage, one-by-one.

1. The Purchase Requisition

Every story begins with a need. A team may need new supplies, raw materials, or even a repair service.

They fill out a purchase requisition, asking permission to buy. This form tells what they want, why they need it, and how much it may cost.

Once it’s reviewed and approved, the buying process begins.

2. The Purchase Order (PO)

After approval, the company sends a purchase order to the supplier. This document lists the products, quantities, prices, and expected delivery date.

The PO works like a handshake—an official promise that the company will buy, and the supplier will deliver. It also becomes the first piece in the matching process that comes later.

3. Receiving the Goods or Services

Now comes the actual delivery. The supplier sends the goods or completes the service.

When the shipment arrives, someone checks the quality, quantity, and other details. If everything seems right, a receiving report is made. This note confirms that the order arrived as expected.

If the goods don’t match, a return or correction may follow before moving ahead.

4. Receiving the Invoice

Soon after delivery, the supplier sends an invoice. This is the request for payment.

It usually includes:

- Supplier’s name

- Invoice number and date

- List of items or services

- Total amount

- Payment terms and due date

Invoices can come by email, post, or through software. Once received, they enter the accounts payable system for processing.

5. The Verification or Matching Stage

Here lies the most crucial part of the Accounts Payable Process Flow—the verification step.

At this stage, the AP team performs three-way matching, comparing:

- The Purchase Order (what was ordered)

- The Receiving Report (what was received)

- The Invoice (what is billed)

If these three match, the invoice is ready for the next stage. If not, it may be sent back for clarification or correction.

This step may look slow, but it prevents overpayment, fraud, and confusion later.

6. Approval for Payment

After matching, the invoice moves to the approval phase. Someone with authority—often a department head or finance manager—reviews and confirms that the payment can proceed.

This step adds control. It ensures no one pays without proper verification. Many companies set approval limits so that small bills can be cleared faster while large ones get higher-level checks.

7. Payment Processing

Once approved, the invoice is ready to be paid. Payments may happen through:

- Cheques

- Bank transfers

- Online gateways

- Cards or digital wallets

The payment method may depend on vendor preference or company policy.

Each payment is recorded with the date, amount, and transaction ID for tracking. Some businesses also plan their payments by schedule—say every Friday or on the 10th and 25th of the month—to stay organized.

8. Recording and Reconciliation

After the payment leaves, the work doesn’t stop. The final step is recording and reconciliation.

The paid invoice is marked as complete. The accounting team updates the books, adjusting the payable account and posting the expense.

Later, during reconciliation, the recorded payments are matched with bank statements to confirm everything aligns. If any mismatch appears, it’s investigated right away.

A Simple Look at the Accounts Payable Process Flow

You may picture it like a small chain:

- Requisition raised

- Purchase order sent

- Goods received

- Invoice received

- Three-way match done

- Payment approved

- Payment made

- Books updated

The chain repeats as new invoices arrive. Over time, this cycle becomes the rhythm of every business purchase.

Common Issues That May Appear in the Process

No process stays perfect forever. The Accounts Payable Process Flow can face some challenges too.

Let’s see what may go wrong and what can help prevent it.

1. Late Invoice Approvals

If managers delay approvals, payments may miss due dates and harm vendor relations.

2. Data Entry Mistakes

Manual typing errors can cause wrong amounts or duplicate entries.

3. Missing Invoices

Sometimes invoices get lost in the pile, especially when handled on paper.

4. Confusion Between Departments

When the purchasing and finance teams don’t communicate, mismatched data may arise.

5. Lack of Document Control

Without proper filing, it may be hard to trace past payments or prove them during audits.

Catching these issues early and improving the workflow may keep things smooth.

Ways to Improve the Accounts Payable Process Flow

Fixing small things can make big changes over time. These steps may help any business build a stronger payable system.

1. Automate Repetitive Tasks

Automation tools can scan invoices, verify details, and send alerts when something doesn’t match.

2. Use Clear Approval Rules

Set who can approve what amount. This reduces waiting time and confusion.

3. Keep Vendor Data Updated

Check supplier details often to prevent wrong transfers or lost payments.

4. Create Payment Schedules

Batch similar payments together to manage cash outflow better.

5. Train the Team

When every team member knows the process, mistakes drop naturally.

6. Reconcile Regularly

Don’t wait for the month-end. Weekly checks may help find small issues before they grow.

These small actions, when repeated, may create a habit of accuracy and order.

How Technology Transforms the Accounts Payable Process

Modern software can do more than record bills. It may track, verify, alert, and analyze all at once.

Some tools use OCR (Optical Character Recognition) to read invoices automatically. Others integrate with bank systems for seamless payments.

Automation may bring:

- Quicker data entry

- Fewer duplicate entries

- Instant matching

- Clearer approval trails

- Easier reporting

With such tools, the Accounts Payable team may spend less time typing and more time managing strategy.

Manual vs Automated Process Flow

|

Aspect |

Manual Process |

Automated Process |

|

Speed |

Slow and prone to delay |

Fast with instant validation |

|

Accuracy |

Error-prone due to typing |

High accuracy through automation |

|

Storage |

Paper-based and messy |

Digital and easy to search |

|

Approval |

Manual routing |

Automatic workflow |

|

Cost |

Hidden cost of labor and delay |

Lower in long run |

|

Scalability |

Hard to handle growth |

Scales easily with volume |

An automated process doesn’t remove humans—it helps them focus where thinking is needed most.

Building a Scalable and Reliable AP System

As a business expands, invoices may flood in. A scalable Accounts Payable Process Flow can handle that growth without breaking pace.

To build it:

- Define each step clearly

- Set approval layers by amount

- Use a central database for all records

- Keep audit trails transparent

- Review the process often

Scalability comes not from fancy tools alone but from clarity and consistency.

The Role of Accounts Payable in Business Growth

Accounts Payable may seem like a back-office function. Yet it can shape how steady a business feels.

When managed well, it can:

- Build stronger vendor trust

- Help manage cash flow better

- Keep books audit-ready

- Reduce stress during closing periods

A clean process may also open the door to discounts, better terms, and smoother supplier relationships.

The future may hold smarter systems. Artificial intelligence may predict due dates, flag errors, or even draft approvals. With a proper system in place, you can get patterns and insights—like which suppliers delay or which months see high expense spikes. Want to improve your accounts payable process flow with the help of an expert? Contact Accounts Junction now! Our outsourced payables processing service will transform the way you deal with your payables forever. We will automate and make your entire accounts payable process flow easier and better to understand.

FAQs

1. What is meant by the Accounts Payable Process Flow?

- It is the series of steps a company follows to manage and pay supplier bills.

2. Why should a business care about Accounts Payable Process Flow?

- Because it helps control cash flow, avoid mistakes, and maintain vendor trust.

3. What starts the accounts payable process?

- It usually starts with a purchase requisition or a need for goods or services.

4. What is three-way matching?

- It compares the purchase order, goods receipt, and invoice to ensure accuracy.

5. Who approves invoices before payment?

- Managers or finance heads usually check and confirm the payment.

6. What happens if invoices are not matched?

- The payment may get delayed until all details align properly.

7. Can small businesses use a formal process flow?

- Yes, even simple spreadsheets or tools can make it organized.

8. What types of payments are used in AP?

- Payments may happen through bank transfers, cheques, or online gateways.

9. Why is reconciliation needed for AP?

- It ensures that what is recorded matches what the bank shows.

10. How often should AP be reconciled?

- Weekly or monthly checks keep records clean and accurate.

11. What tools are good for AP automation?

- Software like QuickBooks, Xero, or Zoho Books can manage payables easily.

12. How can a company stop duplicate payments?

- By using systems that flag repeated invoice numbers before approval.

13. What role does AP play in audits?

- It provides records and proofs for all supplier transactions.

14. What risks come with poor AP management?

- Late fees, lost trust, and wrong reporting may occur.

15. Can AP data help with budgeting?

- Yes, past payments can show spending trends for planning.

16. What does vendor communication have to do with AP?

- Good communication helps fix invoice issues faster.

17. Why should businesses store invoices safely?

- To keep evidence for audits and future references.

18. What is an approval hierarchy?

- It defines who can approve which payments based on value.

19. Can outsourcing AP be useful?

- Yes, it may bring expertise, faster processing, and fewer errors.