Table of Contents

- 1 What Is Wave Accounting?

- 2 Why Small Businesses Prefer Wave Bookkeeping

- 3 Key Features of Wave Accounting Software

- 3.1 1. Invoicing

- 3.2 2. Expense Tracking

- 3.3 3. Financial Reports

- 3.4 4. Payroll Management

- 3.5 5. Multi-Currency Support

- 3.6 6. Tax Preparation

- 4 How Wave Bookkeeping Simplifies Financial Management

- 5 Who Should Use Wave Accounting?

- 5.1 1. Freelancers and Self-Employed Individuals

- 5.2 2. Small Businesses

- 5.3 3. Startups

- 5.4 4. Consultants and Service Providers

- 5.5 5. Nonprofits and Community Organizations

- 5.6 6. Online Businesses and eCommerce Stores

- 6 Why choose Accounts Junction for Wave Accounting?

- 6.1 Conclusion

- 6.2 FAQs

All you need to know about wave accounting

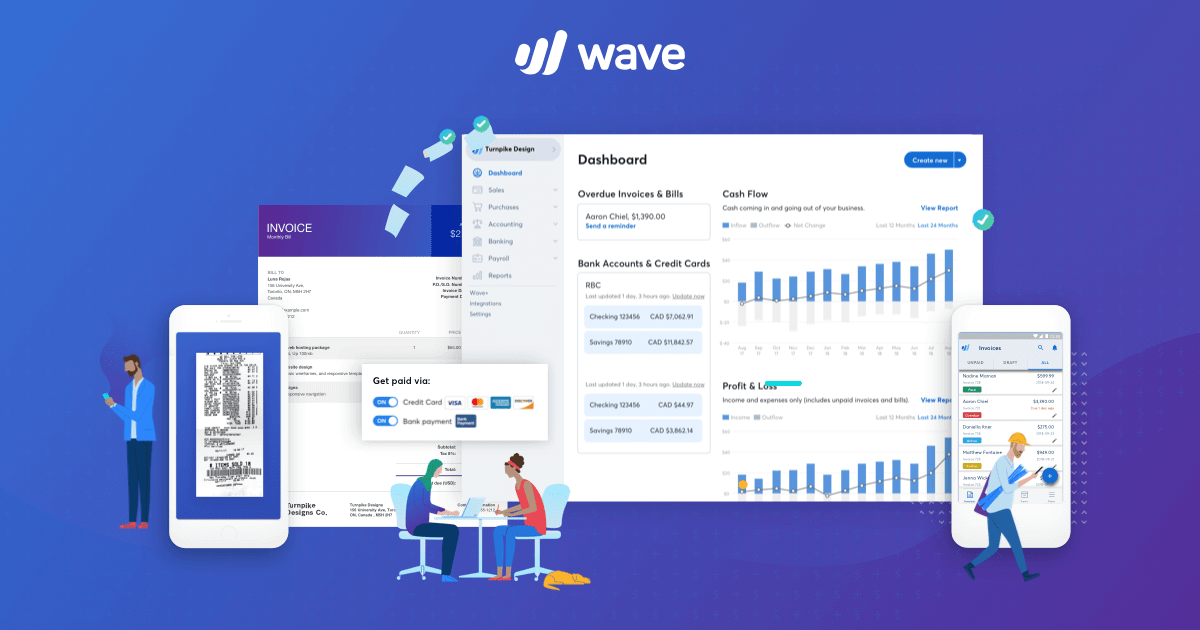

What Is Wave Accounting?

Wave Accounting is a cloud-based accounting software designed for small businesses, freelancers, and entrepreneurs. It offers a range of financial tools, including wave bookkeeping, invoicing, expense tracking, and financial reporting. Wave Accounting software is affordable and offers free accounting features. It also provides optional paid add-ons like payroll and payment processing.

Why Small Businesses Prefer Wave Bookkeeping

Small businesses choose Wave bookkeeping for its user-friendly interface and essential accounting tools. It offers these features without the high costs of traditional software. Some key reasons include:

- Free Accounting Features: Unlike other paid accounting solutions, Wave Accounting offers core bookkeeping functionalities at no cost.

- Automated Expense Tracking: Businesses can connect bank accounts and credit cards for real-time transaction tracking.

- Cloud-Based Access: Access financial data anytime, anywhere.

- Professional Invoicing: Create and send invoices easily with built-in templates.

- Secure Financial Management: Ensures data security with encryption and cloud backups.

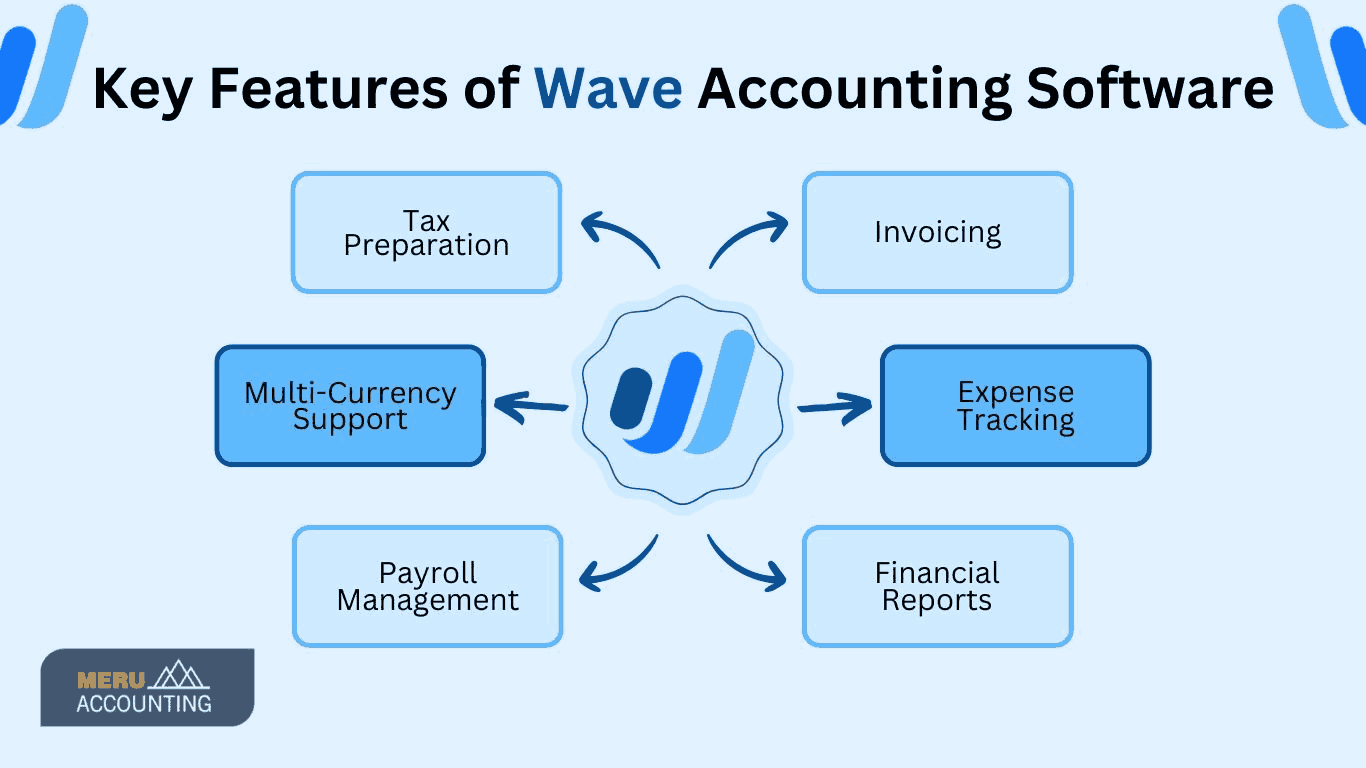

Key Features of Wave Accounting Software

1. Invoicing

Wave Accounting allows businesses to generate and customize professional invoices effortlessly. Users can:

- Create branded invoices with their company logo and colors.

- Set up automated reminders for overdue payments.

- Accept online payments directly through the invoice.

- Track invoice status in real time to monitor outstanding payments.

2. Expense Tracking

With Wave bookkeeping, tracking business expenses is simple and efficient. Users can:

- Link your bank accounts and credit cards to automatically sort and categorize expenses.

- Upload receipts and attach them to transactions for accurate record-keeping.

- View detailed spending reports to analyze where money is going.

- Separate personal and business expenses for better financial management.

3. Financial Reports

Wave Accounting software provides essential financial reports to help businesses understand their financial health. These reports include:

- Profit & Loss Statements: Evaluate business profitability over a specific period.

- Balance Sheets: Understand assets, liabilities, and equity in a structured manner.

- Tax Reports: Simplify tax preparation with categorized financial records.

- Cash Flow Statements: Track inflows and outflows to maintain a healthy cash balance.

4. Payroll Management

For businesses with employees, Wave Accounting software offers payroll management as a paid feature. It includes:

- Automatic tax deductions and payroll tax filing.

- Direct deposit for seamless employee payments.

- Employee self-service portal to access pay stubs and tax forms.

- Compliance with state and federal payroll regulations.

5. Multi-Currency Support

Businesses working with international clients benefit from multi-currency support. Key features include:

- Automatic currency conversion for transactions in different currencies.

- Ability to invoice clients and receive payments in multiple currencies.

- Financial reports are generated in both local and foreign currencies.

- Simplified reconciliation for international bank accounts.

6. Tax Preparation

Tax filing is easier with Wave bookkeeping, as the software organizes all financial data systematically. Users can:

- Generate tax reports with income and expense breakdowns.

- Export financial data for tax filing or share it with an accountant.

- Track deductible expenses to maximize tax savings.

- Ensure compliance with tax regulations through accurate record-keeping.

How Wave Bookkeeping Simplifies Financial Management

Using Wave bookkeeping, small businesses can streamline their financial management by:

- Eliminating manual data entry: Bank integrations automatically record and categorize transactions, saving time and reducing errors.

- Tracking business expenses efficiently: Connecting multiple bank accounts and credit cards enables real-time monitoring of financial transactions.

- Seamlessly generating invoices and accepting payments: This eliminates the need for third-party software and helps maintain cash flow.

- Providing real-time financial insights: Businesses can make informed decisions based on up-to-date financial data.

- Ensuring tax compliance: Accurate bookkeeping records make tax filing stress-free by keeping all relevant financial data organized.

- Improving cash flow management: Customizable reports help businesses forecast revenue and expenses effectively.

- Reducing administrative workload: Automation of invoice follow-ups, expense categorization, and payroll processing frees up time for other tasks.

Who Should Use Wave Accounting?

Wave Accounting software is best suited for:

1. Freelancers and Self-Employed Individuals

- Need a simple accounting system to track income, expenses, and invoices.

- Helps manage finances without the need to hire an accountant.

2. Small Businesses

- Looking for cost-effective accounting software with all essential bookkeeping features.

- Offers a solution without a hefty price tag.

3. Startups

- Require basic bookkeeping solutions.

- Ideal for businesses that don’t want to invest in expensive or complex accounting software.

4. Consultants and Service Providers

- Need to generate invoices, track payments, and efficiently monitor business finances.

- Provides an easy-to-use platform for managing financial tasks.

5. Nonprofits and Community Organizations

- Require a simple yet powerful financial tracking system.

- Perfect for organizations with limited accounting budgets.

6. Online Businesses and eCommerce Stores

- Need seamless integration with payment gateways.

- Benefits businesses that require automated invoicing for customers worldwide.

Why choose Accounts Junction for Wave Accounting?

At Accounts Junction we provide Wave bookkeeping services, offering expert assistance in managing financial data, ensuring accurate bookkeeping, and optimizing tax preparations.

- Get customized financial reports: Modified to their specific needs and business structure.

- Ensure accurate reconciliation of transactions: Preventing errors and maintaining clean financial records.

- Receive expert tax planning and compliance support: Minimize tax liabilities and ensure smooth tax filing.

- Optimize financial management with professional guidance: Helping businesses make informed financial decisions.

- Save time on accounting tasks: Allowing business owners to focus on growth and operations.

- Benefit from real-time financial insights: Ensuring better cash flow management and profitability.

- Access dedicated support: Ensuring any accounting queries or software-related issues are resolved quickly.

Conclusion

Wave Accounting is an excellent choice for small businesses and freelancers seeking free, easy-to-use accounting software. Whether you're a startup or an independent professional, Wave Accounting software has all the essential tools. It helps you manage finances effortlessly.

At Accounts Junction, we specialize in Wave bookkeeping services. We help businesses maximize their benefits through accurate financial tracking, tax compliance, and optimized financial planning. Our experts specialize in Wave Accounting and provide personalized assistance.

FAQs

1. Is Wave Accounting software free?

Ans: Yes, Wave Accounting provides free bookkeeping and invoicing features. However, additional services like payroll and payment processing come at a cost.

2. Can I use Wave Accounting for my small business?

Ans: Wave bookkeeping is perfect for small businesses, freelancers, and consultants. It offers a cost-effective accounting software solution.

3. Does Wave Accounting support multiple currencies?

Ans: Yes, Wave Accounting software offers multi-currency support, making it suitable for businesses dealing with international clients.

4. How secure is Wave Accounting?

Ans: Wave Accounting ensures high-level security with encryption, regular backups, and compliance with financial regulations.

5. Can I integrate Wave Accounting with my bank account?

Ans: Yes, Wave bookkeeping allows you to connect your bank accounts for automated expense tracking and reconciliation.