Table of Contents

- 1 Introduction to Australia’s Foreign Income Tax System

- 2 Who Needs to Pay Australia Foreign Income Tax?

- 3 ATO Tax Return: Reporting Foreign Income Accurately

- 4 Common Deductions and Exemptions for Foreign Income Tax

- 5 How to Calculate Your Tax Return Estimate for Foreign Earnings

- 6 Why Choose Accounts Junction for Australian Tax Return Services?

- 6.1 Conclusion

- 6.2 FAQs

Australia Tax on Foreign Income

Introduction to Australia’s Foreign Income Tax System

Australia has a comprehensive tax system that requires residents to declare their worldwide income, including earnings from foreign sources. The Australian Taxation Office (ATO) oversees the taxation process, ensuring taxpayers accurately report their overseas income. Australia's foreign income tax regulations apply to individuals, businesses, and self-employed professionals earning income from overseas investments, pensions, rental properties, and employment. Understanding the rules of the Australian foreign income tax system helps taxpayers stay compliant and maximize their tax benefits.

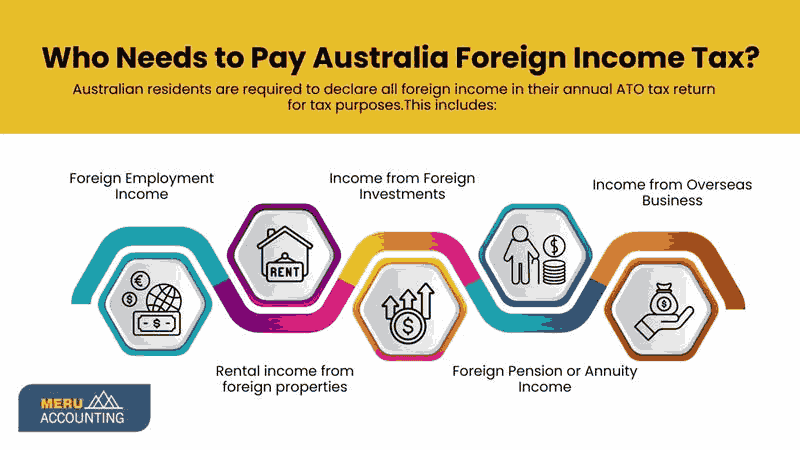

Who Needs to Pay Australia Foreign Income Tax?

Australian residents are required to declare all foreign income in their annual ATO tax return for tax purposes. This includes:

- Foreign Employment Income: If you earn income from a foreign employer or international contracts, you must report it. This includes salaries and wages from overseas jobs, which should be included in your Australian tax return.

- Rental income from foreign properties: If you own property overseas and earn rental income, you need to declare it. Deductions such as property management fees, mortgage interest, and maintenance costs may be applicable.

- Income from Foreign Investments: Dividends, interest, and other earnings from foreign stocks, bonds, and bank accounts must be declared. You may be eligible for foreign income tax offsets if you have already paid tax on these earnings abroad.

- Foreign Pension or Annuity Income: If you receive a pension or annuity from another country, you must report it. Some tax treaties may provide exemptions or reduced tax rates.

- Income from Overseas Business: If you run a business outside Australia, you must report any profits earned. Depending on your business structure, additional tax obligations may apply.

Determining your residency status for tax purposes is crucial in understanding your tax liabilities. If you are unsure about your status, consulting a tax expert can help clarify your obligations.

ATO Tax Return: Reporting Foreign Income Accurately

Accurately reporting foreign income on your Australian tax return is essential to avoid penalties and audits. The ATO requires all foreign income to be converted into Australian dollars using approved exchange rates. You must report:

- Gross income before deductions: Report your total foreign earnings before accounting for any expenses or deductions.

- Any foreign tax paid: If you have paid tax on your foreign income in another country, you may get a tax offset in Australia. This helps prevent double taxation.

- Income types separated: Different types of income should be reported separately. Salary, rental income, dividends, and business profits may have different tax rules.

Failing to declare foreign income can result in penalties, interest charges, or legal consequences. Keep detailed records like bank statements, payslips, and tax assessments from foreign countries. These documents help support your declarations.

Common Deductions and Exemptions for Foreign Income Tax

Taxpayers can claim deductions and exemptions to reduce their taxable income when filing an ATO tax return. Common deductions include:

- Work-related expenses for overseas employment

This includes expenses for uniforms, protective clothing, and work-related travel. It also covers training courses and professional memberships needed for your job.

- Deductions for Managing Foreign Investments

You may claim deductions for financial advisor fees, brokerage fees, and management costs related to foreign investments.

- Interest Deduction on Overseas Rental Property Loans

Interest on loans for overseas investment properties may be deductible if the property generates assessable income.

- Business Travel Expenses

You can claim deductions for airfare, accommodation, meals, and other business-related travel expenses for overseas trips.

- Depreciation of Foreign Rental Property Assets

Depreciation on assets like furniture, appliances, and building structures in foreign rental properties can be deducted over time.

- Self-Education Expenses

You may be able to deduct tuition fees, textbooks, and study materials. This applies if they are related to your overseas employment or business.

- Professional fees

Expenses for hiring tax advisors, accountants, or legal professionals to manage foreign tax affairs can be deducted.

- Foreign currency exchange losses

If you incur losses due to exchange rate fluctuations when bringing income to Australia, they may be deductible. This applies under certain conditions.

In some cases, foreign income may be exempt from Australian taxation. This applies if it meets specific criteria under tax treaties or special exemptions. Consulting a tax professional can help determine applicable deductions and exemptions, ensuring a correct tax return estimate.

How to Calculate Your Tax Return Estimate for Foreign Earnings

Calculating your tax return estimate for foreign income involves several factors:

- Convert Foreign Earnings to AUD: Report all foreign income in Australian dollars. Use the exchange rate that applies at the time you receive the income.

- Deduct Allowable Expenses and Exemptions: You can claim deductions for expenses related to earning foreign income. This includes costs like travel and property maintenance.

- Apply Correct Tax Rates: Use the ATO's tax brackets to find your tax rate. This is based on your total taxable income, including foreign earnings.

- Claim Foreign Income Tax Offsets: If you've paid tax overseas, you can claim a foreign income tax offset. This helps you avoid double taxation.

- Use Tax Calculators or Professional Services: Use online tools or consult professionals for an accurate tax return. They can help you include all deductions and offsets.

Online tax calculators and professional tax services can help estimate your Australian tax return.

Why Choose Accounts Junction for Australian Tax Return Services?

Choose Accounts Junction for perfect Australian tax return services. Our experts ensure accurate tax reporting, maximize deductions, and assist with foreign tax offsets. We stay updated on ATO regulations to reduce audit risks and offer personalized tax solutions for individuals and businesses. With precise exchange rate conversions, we help you optimize tax benefits and stay compliant.

Conclusion

Navigating Australia's foreign income tax system can be complex, but with the right guidance, you can ensure compliance and optimize your tax benefits. Understanding the rules regarding foreign income, accurately reporting earnings, and claiming allowable deductions and offsets are crucial steps in the process. By seeking expert advice and utilizing reliable tax services like Accounts Junction, you can simplify your Australian tax return, avoid penalties, and potentially reduce your overall tax burden.

FAQs

1. What is considered foreign income in Australia?

Ans: Foreign income includes wages, pensions, business earnings, rental income, and investment returns from overseas sources.

2. Do I have to pay tax on foreign income if I am an Australian resident?

Ans: Yes, Australian tax residents must declare all worldwide income in their tax return.

3. Can I claim a tax offset for tax paid overseas?

Ans: Yes, the ATO allows foreign income tax offsets to prevent double taxation.

4. What happens if I don’t report my foreign income?

Ans: Failure to report foreign income may lead to penalties, interest charges, or legal consequences.

5. How can I estimate my Australian tax return on foreign income?

Ans: You can use online tax calculators or seek professional assistance to determine your tax obligations and deductions accurately.