Table of Contents

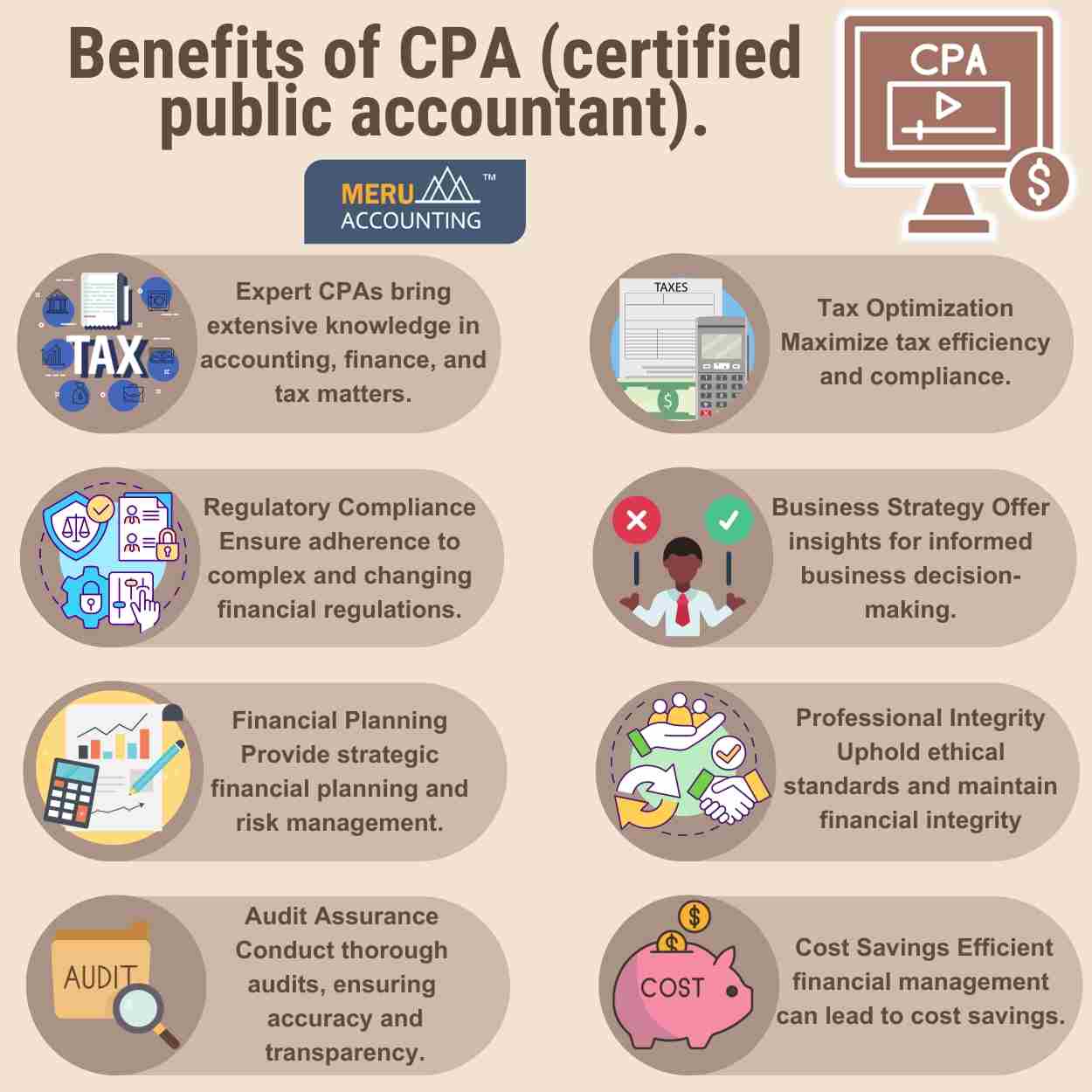

Benefits of CPA - Certified Public Accountant

In today's complex business landscape, financial management is crucial for success and sustainability. One key player that businesses often turn to for financial expertise is the Certified Public Accountant (CPA). These professionals bring a wealth of knowledge and skills that go beyond traditional accounting services. Let's delve into the myriad benefits of hiring a cpa certified public accountant for your business.

Expertise in Accounting and Finance

CPAs undergo rigorous education and training, equipping them with comprehensive knowledge of accounting principles, financial management, and taxation. Their expertise ensures accurate and compliant financial reporting, providing a solid foundation for strategic decision-making.

Navigating Regulatory Complexity

Financial regulations are constantly evolving, posing a challenge for businesses to stay compliant. CPAs are well-versed in these regulations, helping businesses navigate complex legal frameworks and avoid potential pitfalls. Their in-depth knowledge ensures adherence to tax laws, financial reporting standards, and other compliance requirements.

Strategic Financial Planning

Beyond routine accounting tasks, cpa certified public accountant will contribute to strategic financial planning. They assess the financial health of the business, identify areas for improvement, and develop plans for long-term success. This proactive approach is invaluable for achieving financial goals and mitigating risks.

Audit Assurance

CPAs play a critical role in conducting audits, providing an independent and objective assessment of a company's financial records. This not only ensures accuracy but also enhances transparency, instilling confidence in stakeholders such as investors, creditors, and regulatory bodies.

Tax Optimization

Tax laws are complex and subject to frequent modifications. CPAs are specialized in tax planning and optimization. They can help businesses in optimizing their tax positions legally. By identifying tax incentives, credits, and deductions, CPAs can significantly reduce a company's tax liability, contributing to improved cash flow and profitability.

Informed Business Decision-Making

CPAs bring financial insights that extend beyond numbers. They analyze financial data to offer valuable insights for informed decision-making. Whether it's evaluating investment opportunities, assessing the viability of expansion plans, or optimizing resource allocation, CPAs contribute to sound business strategies.

Professional Integrity

Maintaining ethical standards is paramount in the financial realm. CPAs adhere to a strict code of professional conduct, ensuring integrity, objectivity, and confidentiality. This commitment to ethical practices enhances the credibility of financial information and builds trust with stakeholders.

Cost Savings Through Efficiency

Effective financial management leads to cost savings. CPAs streamline financial processes, implement efficient accounting systems, and identify areas for cost reduction. This not only enhances operational efficiency but also contributes to the overall financial health of the business.

In conclusion, hiring a Certified Public Accountant from Accounts Junction is an investment in the financial success and longevity of your business. Their expertise extends far beyond basic accounting, encompassing strategic financial planning, regulatory compliance, and ethical financial practices. As businesses navigate an increasingly complex financial landscape, the role of CPAs becomes indispensable for unlocking growth, ensuring compliance, and making informed decisions that drive success.