Blockchain and its impact on accounting

Blockchain is a fancy word for many of us. The majority still associate it with the crypto-currency Bitcoin. Blockchain is the underlying technology that makes Bitcoin work. Blockchain does not work because of Bitcoin.

What is Blockchain?

Blockchain is what we call a Distributed Ledger Technology(DLT). Information in DLT is stored in a distributed or a shared ledger, which is protected by public and private keys. The information in DLT can be made available to the concerned parties in a secured manner. It can be made accessible to clients, auditors, regulators, etc.

The biggest advantage of Blockchain is that it is incorruptible. The data is encrypted and is time-stamped. So, if anyone makes changes to the data, it will be known to the owners of the data. Such data is stored in a series of blocks which form a chain, hence the name Blockchain.

What is its impact on Accounting?

Blockchain was basically made for supporting the architecture of Bitcoins. But it has applications in various other industries. Banks around the world are trying to make use of Blockchain to make their transactions more secure. Though the technology has not been adopted on a large scale in any industry, it is being tested at various junctures.

Accounting is done to record a series of transactions between two entities and record its impact on the balance sheet, profit and loss account. Accounting stores a user’s data and displays it in a systematic form. Blockchain can be used to do the same, albeit, with two advantages, one is that the transactions can be recorded in a secure environment which is difficult to manipulate. The second is that it is secure, access can be limited only to a few authorized persons, and it is transparent. Every recorded transaction will be easy to track. It will also make the process of auditing the books of accounts hassle free. Reconciliation of accounts will be easier with improved efficiency and less occurrence of frauds.

If Blockchain accounting is used on a large scale, there are fears that it will take the jobs of existing accountants. It is far from true. Only the nature of those jobs will change. New jobs will be created. There will be still persons required to record the same transactions and also the same experts will analyse the financial statements.

The implications of Blockchain the accounting industry can be huge. The fact is we are still uncertain if they are going to be as huge as predicted. No proven scalable system has been created till now. An exciting future in the industry looms for us. We can only embrace the disruption if it ever comes at all. Executives will have to learn new skills. But hey, we already know how to do that because the accounting faculty is dynamic and ever changing.

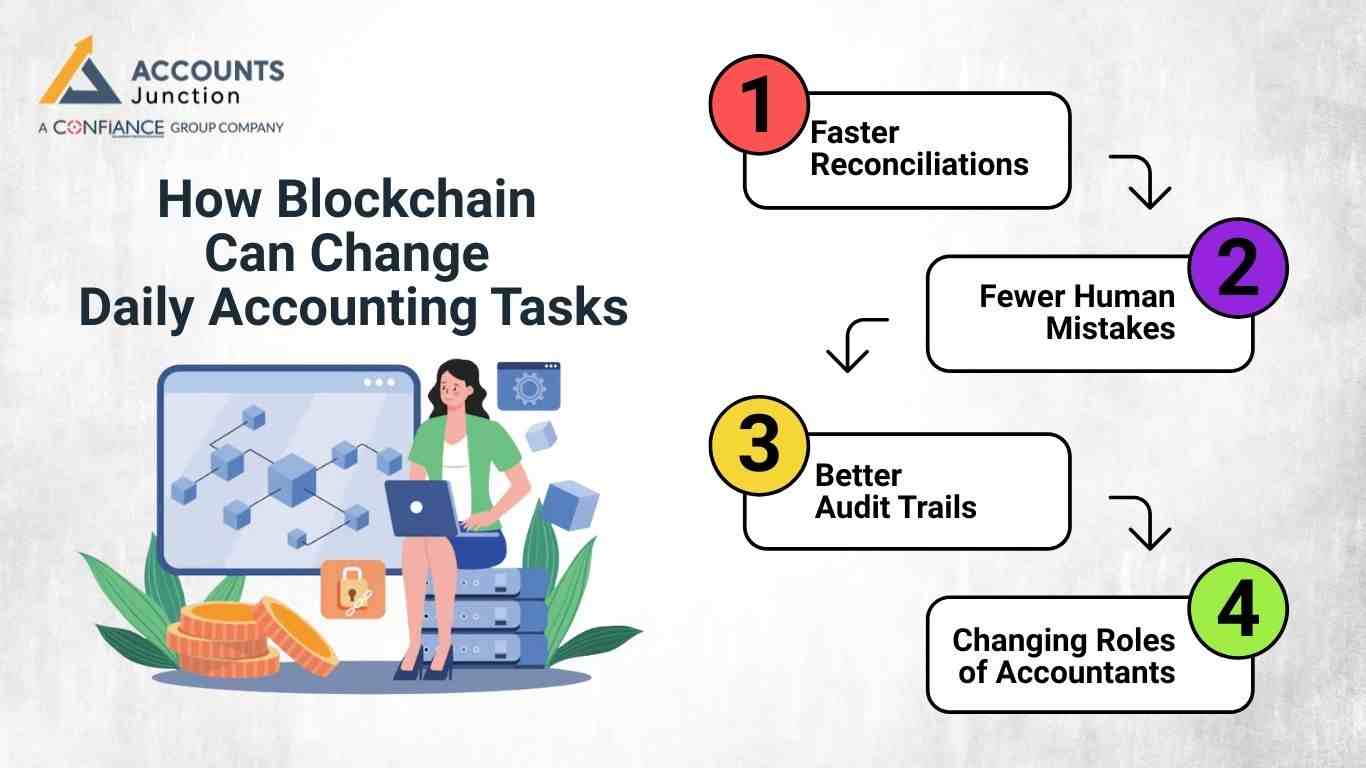

How Blockchain Can Change Daily Accounting Tasks

Daily accounting may look very different in the future, showing Blockchain and Its Impact on Accounting. Today, accountants use journals, ledgers, and manual checks. Blockchain may change all of that.

Faster Reconciliations

- One of the advantages of Blockchain in Accounting is that transactions may be recorded instantly, speeding up bank checks.

- Matching invoices and statements by hand may become rare.

- Closing accounts at month-end may take less time.

Fewer Human Mistakes

- Humans can make mistakes while typing numbers, but the Advantages of Blockchain in Accounting help reduce such errors automatically.

- Blockchain may record many entries automatically.

- Books may stay more accurate and need fewer fixes.

Better Audit Trails

- Blockchain and Its Impact on Accounting ensures every transaction is stored with a date and cannot be erased.

- Auditors may check changes without looking at paper records.

- This may make managers and partners trust the numbers more.

Changing Roles of Accountants

- Accountants may spend more time studying numbers than typing them.

- They may help make smart decisions with better insights.

Blockchain and Financial Reporting

Reports help businesses make decisions, and Blockchain and Its Impact on Accounting can make them more accurate and reliable.

Accurate and Reliable Reports

- Data cannot be changed easily, so reports may stay true.

- Errors or tampering may drop a lot.

Real-Time Access

- Firms may see their financial data anytime.

- Managers can check cash, expenses, and earnings at once.

- Quick decisions may be easier when numbers are current.

More Trust for Stakeholders

- Investors, regulators, and partners may see data that is verified.

- Transparency may make people trust the company more.

Integration Issues

- Old software may need updates to work with Blockchain.

- Staff may need training to use the new system.

Challenges in Using Blockchain in Accounting

Blockchain is strong, but it has some challenges.

Cost to Start

- Setting up Blockchain may be costly, especially for small firms.

- Hardware, software, and upkeep add to expenses.

Need for Skills

- Firms need trained people to run Blockchain systems.

- Without skills, adoption may be slow.

Rules and Laws

- Laws about Blockchain may differ in each country.

- Firms may need to update systems to follow new rules.

Handling Many Transactions

- Many transactions may slow the system if not set up well.

- Proper design is needed to keep things smooth.

Change in Workplace

- Employees may not like new technology at first.

- Training and gradual changes may help staff adapt.

Future Trends in Blockchain Accounting

Blockchain and Its Impact on Accounting may slowly change how firms handle their books and reports.

Working with AI

- AI may look at Blockchain data to predict trends, showing how Blockchain and Its Impact on Accounting can combine with technology for insights.

- Real-time insights may help firms make better choices.

Smart Contracts

- Payments or invoices may happen automatically when rules are met.

- Less manual work may be needed.

Global Use

- Banks and big firms may use Blockchain around the world.

- Cross-border payments may be faster and safer.

New Roles for Accountants

- Accountants may focus on reading data and giving advice.

- New jobs like Blockchain auditors or data analysts may appear.

Slow Growth

- Blockchain may grow slowly due to cost and tech needs.

- Firms may test it before using it fully.

How Blockchain May Reduce Fraud

The advantages of Blockchain in Accounting are clear in how it helps reduce fraud and secure records.

Safe Records

- Each deal is kept and locked in a chain.

- Changing a record without being seen may be very hard.

Clear Transactions

- Only allowed users can see all activity at once.

- Suspicious moves may be found fast.

Less Paperwork

- Records are digital and safe, so fewer papers are needed.

- This may lower the chance of lost or wrong files.

Build Trust

- Partners, clients, and banks may trust the data more.

- Conflicts may be solved quickly with safe records.

Blockchain and Its Impact on Accounting is seen in how it makes data safe, clear, and true. It stores transactions in a way that cannot be changed easily, which cuts errors and fraud. Tasks like checking banks, matching bills, and closing accounts can be done faster. Reports stay correct and are ready at any time, so firms can make quick and smart choices.

At Accounts Junction, we offer accounting and bookkeeping services with modern tools for speed and accuracy. Our certified experts keep your records, check statements, and ensure trust for partners, clients, and regulators. We deliver reliable financial services that let your business run smoothly. Partner with us for strong accounting support.

FAQs

1. What is Blockchain in simple terms?

- Blockchain is a safe digital record where data is kept in linked blocks. This setup makes it hard to change old records.

2. How is Blockchain different from regular databases?

- It keeps data safe and lets many people see the same information. Normal databases are run by one group, while Blockchain is shared.

3. Can Blockchain replace accountants?

- Not fully. It may shift their work to analysis rather than data entry. Accountants still study data, make choices, and check rules.

4. How secure is Blockchain?

- Blockchain is very safe because each record is coded and time-stamped. It is spread over many computers, so no single failure can break it.

5. Does Blockchain work only for Bitcoin?

- No. It started with Bitcoin but works in banks, accounting, and more. Any field that needs safe, clear records can use it.

6. Can small businesses use Blockchain?

- Yes, but cost and skill can be a barrier at first. Some cloud-based Blockchain tools can help small firms try it out.

7. Will Blockchain make audits easier?

- Yes, it gives a clear, unchangeable record of all transactions. Auditors can check data fast without piles of paper.

8. How does Blockchain help in reconciliation?

- It makes reconciliation faster and more accurate. Mistakes and mismatches are easy to spot right away.

9. Are there risks in using Blockchain for accounting?

- Yes. It can be costly, tricky, and the rules are unclear. Companies need trained staff and clear policies before using it.

10. What is a distributed ledger?

- It is a record shared across many computers. All users can see every change, so it is very clear.

11. Can auditors access Blockchain records?

- Yes, if allowed. They can see records in real time. They can check data without changing the original entries.

12. Does Blockchain reduce fraud?

- Yes, it is hard to change data without being seen. Everyone can see changes, so wrong actions are noticed fast.

13. How does Blockchain affect financial reporting?

- Reports are more clear, correct, and ready right away. Managers can make quick and smart decisions.

14. Can Blockchain work with existing accounting software?

- Yes, but some tech work may be needed. Tools like APIs can link Blockchain with old systems.

15. Will Blockchain eliminate paperwork?

- It can cut a lot of paper but not all. Some papers are still needed.

- Storing contracts and invoices digitally saves time and space.

16. What are smart contracts in accounting?

- They are agreements that act automatically when rules are met. For example, payments can go out once invoices are checked.

17. Can Blockchain handle large transaction volumes?

- It can struggle without the right setup. Strong networks and good software are needed for big firms.

18. Do all companies need Blockchain now?

- Not always. It suits firms that need top security and clear records. Other firms may do better with regular accounting tools.

19. How long before Blockchain becomes mainstream in accounting?

- It may take years, depending on rules and tech adoption. Early users may gain faster checks and fewer errors.

20. Will Blockchain create new accounting jobs?

- New roles may appear due to the advantages of Blockchain in Accounting, including jobs in audits, system checks, and data analysis.