Table of Contents

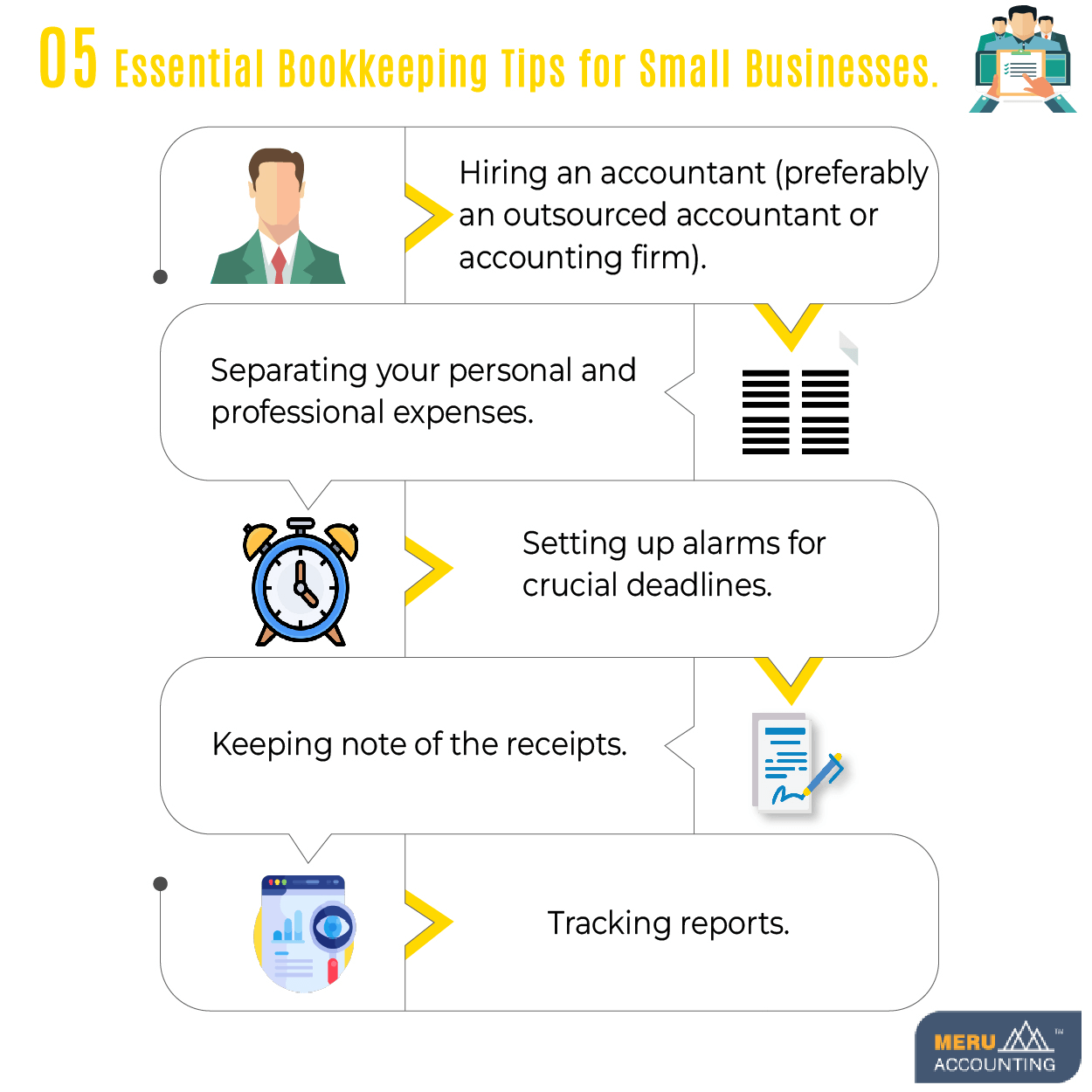

05 Essential Bookkeeping Tips for Small Businesses.

It can feel like you are doing everything yourself when you run a small business, and some crucial jobs may go unnoticed. But bookkeeping ideas for small businesses is one thing that should never be overlooked.

Maintaining your finances in order need not be as difficult as it sounds, despite being scary. Here are our bookkeeping tips for small businesses to keep your finances organized and maintain your peace of mind.

5 small business bookkeeping tips you just can’t miss

- Consult your bookkeeping service provider

- Separate your personal and professional finances.

- Observe receipts

- Retain Reports

-

-

One of the safest and most effective small business bookkeeping tips to handle your finances is to hire an accountant if you want to keep things as easy as possible and ensure that you never break the law. An accountant can help you manage your finances, save money on taxes, and provide advice on how to streamline various aspects of your company. One of the best bookkeeping tips for small business owners is to proceed with it is by hiring an outsourced accountant or a company based on the size of the company and budget.

- Separating personal and business banking is essential for small business owners to simplify bookkeeping and avoid potential errors. By keeping personal and business accounts separate, you can save countless hours spent on identifying deductions and expenses is one of the best bookkeeping tips for small business owners . It eliminates confusion about which account covers what expenses and ensures accurate financial reports. Take control of your finances and avoid potential bookkeeping nightmares by making the change to separate accounts.

-

-

Set up alerts for crucial deadlines.

- It's now simple to set up reminders using an online calendar for all those significant tax and other deadline dates so you'll know when things are getting urgent. One of the best bookkeeping tips for small businesses is to keep your alerts on for your crucial deadlines so that you do not put yourself in a quicksand position. Proactively managing your deadlines through online calendar reminders ensures timely action, prevents unnecessary stress, and maintains a smooth bookkeeping process for your small business's financial health.

- To create a reliable audit trail, make sure to save all receipts. It's crucial to obtain an invoice whenever you make a payment to a supplier and store it. Keep all of your receipts for purchases and company expenses. You never know when you might be subject to an audit and need to back up all of your claims. Keeping track of every business transaction is one of the best small business bookkeeping tips.

- Simplify your reports with these small business bookkeeping tips. Create a monthly one-page document listing income and expenses, and ask your accountant to provide a concise monthly report comparing actual versus planned figures. Keep important financial reports organized to monitor your business's development. To alleviate the burden of bookkeeping, consider outsourcing to Meru Accounting, a trusted agency specializing in bookkeeping ideas for small business. Their expertise will ensure accurate and efficient handling of your financial records, giving you peace of mind and allowing you to focus on growing your business.