Can I access my financial data from anywhere with digital bookkeeping services?

Introduction to Digital Bookkeeping Services

Digital bookkeeping services use online tools and software. They help manage your business's financial records, transactions, and reports. These services replace paper-based methods with secure digital processes. They ensure you have accurate and up-to-date financial data at your fingertips. Digital bookkeeping simplifies tasks like invoicing, bank reconciliations, payroll processing, and financial reporting.

Why Businesses Are Shifting to Online Accounting

The growing need for efficiency, accuracy, and convenience in financial management drives the shift toward online accounting. Businesses of all sizes are adopting online bookkeeping services because they streamline accounting processes and improve decision-making.

- Efficiency: Online accounting automates processes like invoicing, expense tracking, and bank reconciliation, reducing manual effort.

- Cost-Effective: Digital bookkeeping services reduce costs associated with paper, printing, and manual processes.

- Real-Time Data: Provides immediate access to financial data, allowing businesses to make faster decisions.

- Cloud Integration: Cloud-based systems ensure businesses don’t have to worry about data storage or system crashes.

- Remote Collaboration: Online accounting platforms allow multiple users, including accountants, to access and collaborate on financial data simultaneously.

- Security: Cloud accounting platforms are generally more secure than traditional systems. They use encrypted data and secure login protocols.

- Scalability: Businesses can scale their accounting solutions easily as they grow by adding features or increasing data storage.

- Compliance: Online accounting systems are updated regularly to ensure compliance with local regulations and tax laws.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

How Digital Bookkeeping Services Enable Remote Access

Digital bookkeeping services allow access to financial data anytime, anywhere.

- Cloud-Based Software: Digital bookkeeping services use cloud technology. This allows access from anywhere with an internet connection.

- Mobile Accessibility: Many online bookkeeping services offer mobile apps, allowing users to access their financial data on the go.

- Multiple Devices: Users can access financial data from various devices, such as laptops, tablets, and smartphones, ensuring flexibility.

- Secure Login: Secure login credentials and two-factor authentication ensure that only authorized users can access the financial data.

- Data Backup: Cloud-based systems automatically back up financial data. This reduces the risk of data loss from system failures.

- Collaborative Features: Teams can work together on financial reports. Each user can track changes in real-time.

- Access Control: Business owners can set access levels for different team members, limiting access to sensitive financial data.

- Time Zone Flexibility: Digital bookkeeping services enable businesses to operate across different time zones, enhancing international operations.

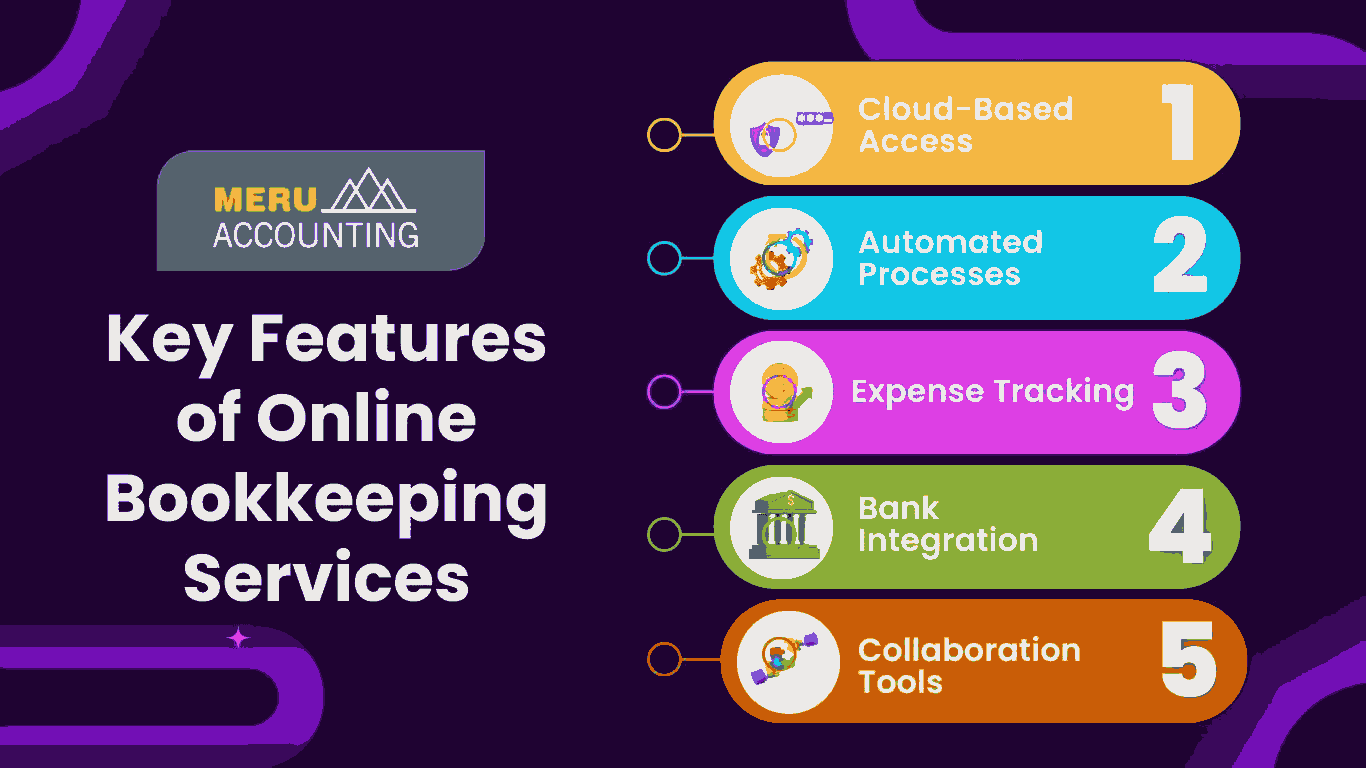

Key Features of Online Bookkeeping Services

Online bookkeeping services come with a wide range of features that help businesses manage their finances effectively. Some of the key features include:

- Cloud-Based Access: You can access your financial data from any device with an internet connection. This ensures real-time visibility into your accounts.

- Automated Processes: Tasks like invoicing, payroll, and reconciliations are automated, reducing the chances of human error and saving time.

- Expense Tracking: Easily track business expenses and categorize them for tax reporting and budgeting.

- Bank Integration: Link your bank accounts and credit cards for automatic transaction imports and reconciliation.

- Collaboration Tools: Share financial data securely with accountants and team members, improving teamwork and communication.

How Accounts Junction Can Help You with Digital Bookkeeping Services

At Accounts Junction we offer comprehensive digital bookkeeping services customized to your business needs. Our team of experts uses the latest online accounting tools. We ensure accurate, timely, and secure financial management for businesses of all sizes. By partnering with us, you’ll benefit from:

- Remote Access: We are providing you with full control over your financial data from anywhere, anytime. With cloud-based technology, you can access your accounts securely on the go.

- Customizable Solutions: We are providing bookkeeping services that align with your business’s specific needs and goals. Whether you're a small business or a large corporation, our services offer scalable solutions to help you thrive.

- Expert Assistance: We are managing complex accounting tasks with our team of qualified professionals. This ensures you stay on top of your finances, make informed decisions, and remain compliant with all financial regulations.

- Cost-Effective Services: Our services offer affordable digital bookkeeping, helping you save on operational costs. By automating tasks, we reduce the need for manual effort, lowering overhead expenses.

- Real-Time Financial Insights: Our online accounting services give you instant access to your financial data. This helps you make timely and informed decisions for your business.

- Tax Readiness: Our digital bookkeeping services ensure that your financial records are always tax-ready. We are providing accurate reports to make tax filing easier and ensure compliance with ever-changing tax laws.

Conclusion

Digital bookkeeping services are transforming the way businesses manage their finances. By adopting digital bookkeeping, companies can automate manual processes, access real-time financial information, collaborate remotely, and ensure compliance with ever-evolving tax regulations.

At Accounts Junction, we offer customized online bookkeeping services customized to your business’s needs. This ensures accurate, timely, and secure financial oversight. Our expert team is dedicated to supporting your financial success. Whether you're a small business or a large corporation, we provide the service you need.

FAQs

Q1: Can I access my financial data anywhere with digital bookkeeping services?

Ans: Yes, digital bookkeeping services are cloud-based. This allows you to access your financial data from any device with an internet connection.

Q2: Are online accounting services secure?

Ans: Yes, online accounting services use encryption to protect your financial data. They also have secure login systems to prevent unauthorized access.

Q3: How can I get started with online bookkeeping services?

Ans: You can start by choosing a digital bookkeeping service provider like Accounts Junction. They will help set up and manage your financial records digitally.

Q4: Are digital bookkeeping services suitable for small businesses?

Ans: Yes, digital bookkeeping services are highly suitable for small businesses. They offer affordable, scalable solutions for small business owners. These solutions help manage finances without complex accounting systems.

Q5: Will digital bookkeeping services help with tax preparation?

Ans: Yes, digital bookkeeping services keep your financial records organized and up-to-date. This makes it easier to prepare for tax filing. They provide accurate reports that help ensure compliance with tax regulations and reduce the stress of tax season.

Q6: How do online bookkeeping services save time for businesses?

Ans: Online bookkeeping services automate many time-consuming tasks such as invoicing, bank reconciliation, and payroll processing. This reduces manual efforts, minimizes errors, and allows business owners and accountants to focus on more strategic activities.