Table of Contents

-

03 Aug 2002

Can I submit a VAT return online?

What Are VAT Returns?

A VAT return is a report submitted by businesses registered for Value Added Tax (VAT). It is usually filed every quarter with the tax authorities. The return summarizes the VAT collected on sales (output tax) and the VAT paid on purchases (input tax). If the VAT collected is higher than the VAT paid, the business must pay the difference to the government. If the VAT paid is higher, the business may be eligible for a refund. Filing accurate VAT returns is crucial to ensure compliance with tax laws and avoid penalties.

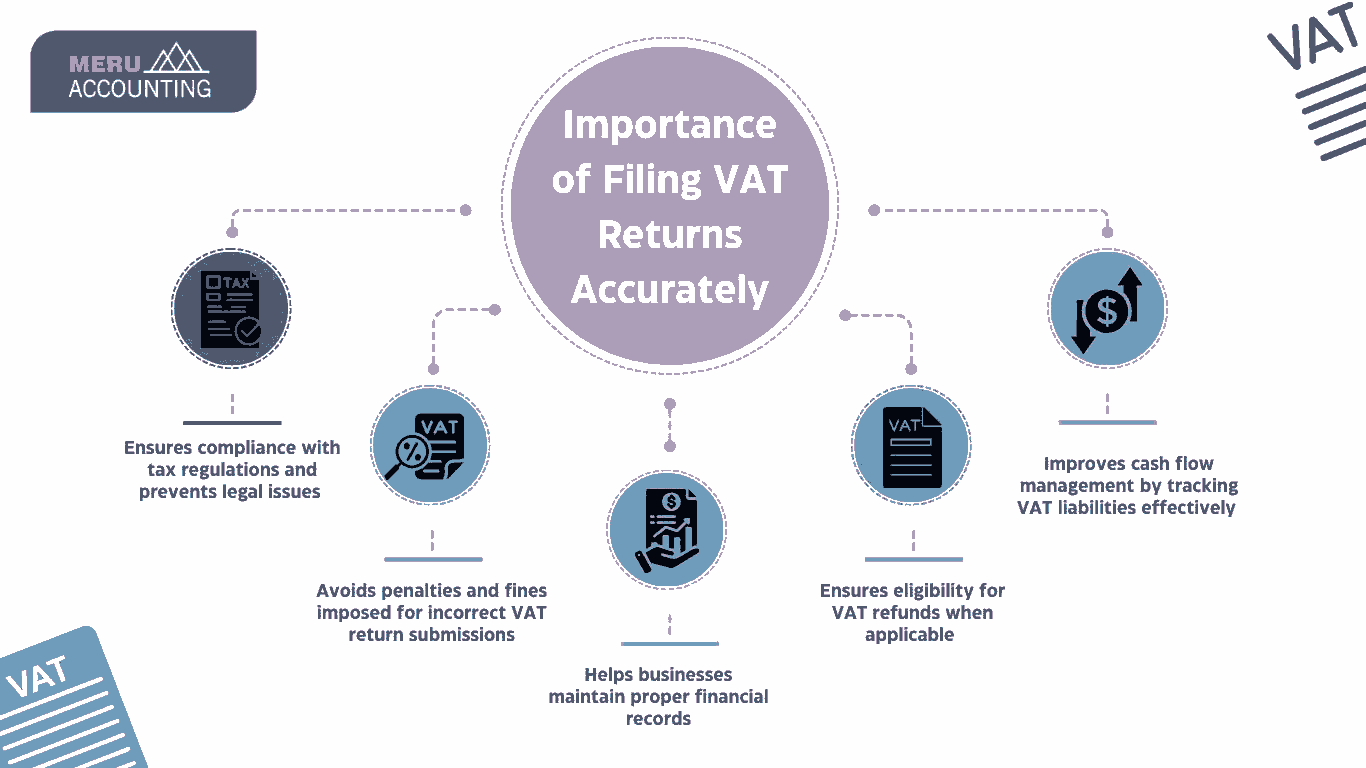

Importance of Filing VAT Returns Accurately

Filing VAT returns accurately is essential for several reasons:

- Ensures tax compliance and avoids legal complications

Submitting VAT returns online accurately helps businesses comply with tax laws, reducing the risk of audits and legal complications. - Avoids penalties and fines imposed for incorrect VAT return submissions

Errors in VAT return online submissions can lead to hefty penalties, making accuracy crucial for businesses. - Helps businesses maintain proper financial records

Keeping accurate VAT return records ensures that businesses can track input tax and output tax efficiently. - Ensures eligibility for VAT refunds when applicable

Businesses can reclaim overpaid VAT when they file their VAT returns correctly and on time. - Improves cash flow management by tracking VAT liabilities effectively

Submitting VAT returns online allows businesses to monitor their VAT liabilities, plan their finances better, and avoid unexpected tax burdens.

Can You Submit a VAT Return Online?

Yes, businesses can submit VAT returns online. Many tax authorities, including HMRC in the UK, require VAT-registered businesses to file their VAT returns online. They must use the Making Tax Digital (MTD) system for VAT return submissions. This ensures the process is digital, accurate, and compliant with tax regulations. Online VAT return submission simplifies the process, ensuring faster and more accurate reporting. Submitting a VAT return online eliminates paperwork, reduces errors, and helps businesses manage their tax obligations more efficiently. By using online VAT return services, businesses can streamline their financial operations, meet tax deadlines, and avoid penalties.

Step-by-Step Guide to Submit a VAT Return Online

Follow these steps to submit a VAT return online:

- Register for VAT Online Services: Make sure your business is VAT-registered. Ensure you have access to the tax authority’s online portal.

- Keep Accurate Records: Maintain detailed records of VAT-charged sales and VAT-paid purchases.

- Log Into Your Account: Access your online VAT account via the government tax portal.

- Use Compatible Accounting Software: Many tax authorities require businesses to use MTD-compatible software. Examples include Xero, QuickBooks, or Sage for submitting VAT returns online.

- Fill in the VAT Return Form: Enter the correct figures for output tax, input tax, and any VAT adjustments.

- Review and Submit: Double-check the VAT return details to ensure accuracy before submission.

- Make the Payment (If Required): If you owe VAT, arrange payment through the available methods.

- Keep a Copy for Records: Save a copy of the submitted VAT return for future reference.

Why Our VAT Filing Services Are the Right Choice for You

Our VAT filing services make it easy to submit VAT returns online with accuracy and efficiency. Here’s why businesses choose us:

- Expert Assistance: Our team of experienced tax professionals ensures error-free VAT return submissions. We guide you through every step of the VAT return online submission process. This helps reduce the risk of errors and penalties.

- MTD Compliance: We use government-approved, MTD-compliant software for VAT returns. This ensures a seamless online filing experience. With our services, businesses can submit VAT returns online effortlessly while meeting all compliance requirements.

- Timely Filing: Avoid penalties and interest charges by submitting VAT returns online before the deadline. Our proactive approach ensures your VAT return is prepared and submitted on time. This helps keep your business in good standing with tax authorities.

- Cost-Effective Solutions: We provide affordable VAT return filing services tailored to businesses of all sizes. Whether you run a small business or a large enterprise, we offer VAT filing solutions. Our services help you stay compliant without high costs.

- Customer Support: Our dedicated customer support team is available to assist you with any VAT-related queries. Whether you need guidance on how to submit a VAT return online or require help with VAT calculations, we are here to support you.

- Hassle-Free VAT Return Online Submission: We handle the complexities of VAT return filing. You can focus on growing your business. Our experts ensure that your VAT returns are accurate, compliant, and submitted on time.

Conclusion

Submitting VAT returns online doesn’t have to be complicated. With the right knowledge, tools, and expert support, businesses can ensure smooth and accurate VAT return submissions. Filing VAT returns on time helps maintain compliance with tax regulations, avoid penalties, and manage cash flow efficiently. It also enables businesses to claim VAT refunds when applicable.

At Accounts Junction, we understand the importance of filing VAT returns accurately and on time. You can submit a VAT return online or get expert help with VAT compliance. Our MTD-compliant VAT return services ensure seamless and error-free submissions. These services can help you stay fully compliant with tax regulations. We assist with online VAT return submissions and provide expert guidance on tax regulations.

FAQs

1. Who needs to submit a VAT return?

Ans: Any business registered for VAT must submit a VAT return, usually quarterly, to report VAT collected and paid.

2. Can I submit my VAT return online myself?

Ans: Yes, you can submit VAT returns online through the government tax portal or using MTD-compatible accounting software.

3. What happens if I file my VAT return late?

Ans: Late submission of VAT returns may result in penalties, interest charges, and potential audits.

4. How do I check if my VAT return was successfully submitted?

Ans: After submission, you will receive a confirmation email or reference number from the tax authority.

5. Can I amend a submitted VAT return?

Ans: If you discover an error after submission, you may be able to amend it through the tax portal or notify the tax authority, depending on the type of error.