Can I use QuickBooks to manage my chiropractic clinic's inventory?

QuickBooks offers effective bookkeeping for chiropractors with integrated inventory management features. These tools help simplify and automate inventory tracking, making it easier to maintain accurate records of products and supplies. Effective inventory management is crucial for successful business operations. Whether you're new to QuickBooks for chiropractors or looking to enhance your current setup, understanding how to use these features is essential. Bookkeeping for chiropractors is essential for managing the financial health of a chiropractic practice, ensuring all transactions, like patient payments, insurance reimbursements, and expenses, are accurately tracked. Utilizing QuickBooks for chiropractors simplifies this process by providing tailored features such as invoicing, expense tracking, and financial reporting, helping chiropractors stay organized and compliant.

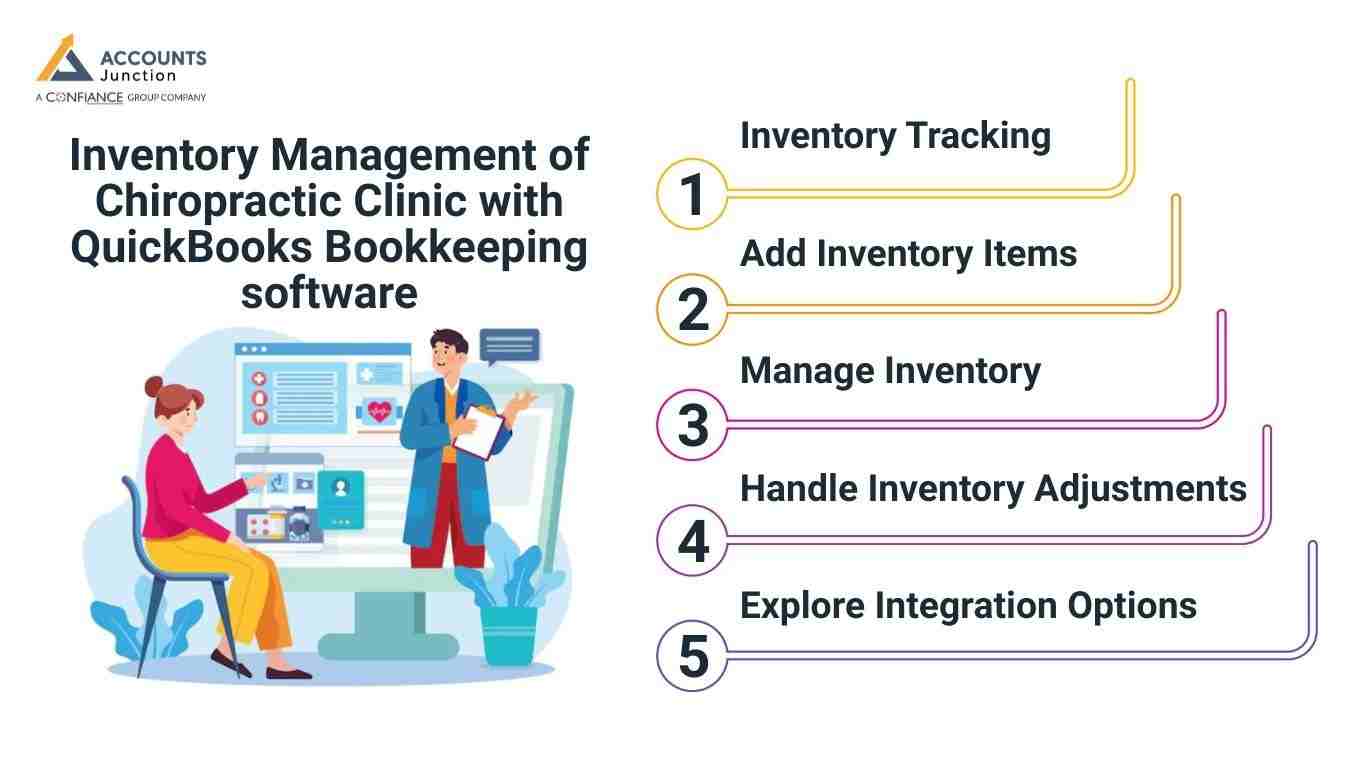

Inventory Management of Chiropractic Clinic with QuickBooks Bookkeeping software

Inventory Tracking

QuickBooks Online offers basic inventory tracking features, allowing you to track the quantity, cost, and stock status of items such as:

- Supplements

- Braces and orthotics

- Retail products such as vitamins, pillows, and massagers

You can easily monitor when stock levels are low and reorder supplies to avoid shortages. QuickBooks also helps you categorize your inventory, which is useful for organizing different types of products or separating retail inventory from medical supplies.

Add Inventory Items

- Once inventory tracking is enabled, you can add your products to QuickBooks.

- Navigate to the Invoicing tab, then select Products and Services.

- Click on the New button to add your inventory items. You will need to enter details such as the item name, description, SKU, and cost. This information is crucial for accurate tracking and bookkeeping for chiropractors.

Manage Inventory

- QuickBooks Online automatically updates your inventory levels as you create invoices, sales receipts, or purchase orders.

- You can view your inventory levels at any time by going back to the Products and Services section.

- QuickBooks for chiropractors provides detailed reports that help you track your inventory levels, monitor sales performance, and understand the costs associated with your inventory.

Handle Inventory Adjustments

- Occasionally, you may need to adjust your inventory due to discrepancies, returns, or damaged goods.

- To adjust your inventory, go to the Products and Services list, select the item you want to adjust, and choose Adjust Quantity.

- Enter the necessary adjustments to ensure your inventory levels are accurate.

Explore Integration Options

- If you use other business management software, like practice management tools such as ChiroTouch, you may need to manually input data into QuickBooks or explore available integration options.

- Integrating your inventory management with other software can streamline your operations, reduce manual data entry, and reduce the risk of errors.

Benefits of QuickBooks for Chiropractic Inventory

-

Saves time by tracking stock automatically for all clinic items. QuickBooks for chiropractors also stops errors from manual data entry.

-

Helps control costs by showing slow or high-cost products. Bookkeeping for chiropractors can benefit from this feature to plan orders and avoid waste easily.

-

Gives clear reports on stock levels and product sales. Reports also show which items bring the most profit.

-

Supports better choices for buying and pricing clinic products. Helps make sure the clinic meets patient needs.

-

Makes inventory work easier for staff and management daily. Keeps daily work smooth and stops last-minute problems.

Setting Up Reorder Alerts

-

QuickBooks lets you set a minimum stock for each product. Alerts warn staff before items run fully out.

-

Alerts notify staff when stock runs low for reordering. QuickBooks for chiropractors keeps all products available for patients each day.

-

Helps avoid running out of braces, vitamins, or supplies. It also lowers stress for clinic staff greatly.

-

Alerts can adjust for each item based on usage. You can change levels if demand grows or drops.

-

Reduces emergency orders, saving time and extra costs. Planning is simpler and inventory stays neat and clear.

Categorizing Inventory for Clarity

-

Group products as medical supplies, retail items, or equipment. This helps make reports simple and easy to read.

-

Categories help track profits for each type of product. You can also see which products sell best over time.

-

Makes reports easier to read and use for decisions. It helps managers spot trends and gaps in stock.

-

Helps separate items for taxes and financial reporting clearly. Each category can show cost and profit for items.

-

Reduces waste by showing slow-moving or extra inventory. It also helps plan discounts or special offers well.

Managing Vendor Information

-

Track vendor names, contacts, and payment terms for efficiency. This helps make sure orders are placed right and fast.

-

Keep order history to check reliability and past orders. You can compare vendors to find the most steady suppliers.

-

Compare prices to find the best deals for products. This saves money while keeping the stock filled properly.

-

Supports timely orders and keeps supplier relationships strong. Vendors respond better when the clinic keeps clear records.

-

Helps avoid delays and ensures the clinic has the needed items. Planning purchases ahead prevents shortages or last-minute problems.

Using Reports to Optimize Inventory

-

The Inventory Valuation Summary shows total stock value clearly. QuickBooks for chiropractors helps track clinic items and know the true costs.

-

Sales by Product report shows which items sell fastest. Bookkeeping for chiropractors can use this to plan restocking and track high-demand items well.

-

The Stock Status report shows low or overstocked inventory items. It prevents shortages and lowers excess products in storage.

-

Reviews help plan purchases and control cash flow well. Regular checks keep money steady and daily work smooth.

-

Reports simplify decisions and reduce mistakes in inventory work. They also show trends to improve future planning clearly.

QuickBooks bookkeeping for chiropractors offers inventory management features that provide a straightforward yet powerful way to keep track of your products and supplies. By following these steps, you can ensure that your inventory is accurately recorded and managed, allowing you to focus on other essential aspects of your business.

For businesses seeking more comprehensive support, Account Junction offers expert bookkeeping and accounting solutions, including inventory management, to help you increase the benefits of QuickBooks Online and simplify your financial processes. With QuickBooks for chiropractors, practitioners can focus more on patient care while maintaining a clear view of their financial performance, ensuring their practice remains profitable and efficient. Effective bookkeeping for chiropractors is key to long-term success.

FAQs

1. Can QuickBooks for chiropractors track all my clinic stock items?

- Yes, QuickBooks lets you track stock for supplements, braces, and retail goods. You can see how much stock you have, know when to reorder, and avoid running out of key items.

2. How do I add new products to my QuickBooks list?

- You can add items under the Products and Services tab. You type in the name, code, cost, and other details. This helps you keep clear, up-to-date stock records.

3. Does QuickBooks update stock when I make a sale?

- Yes, when you create an invoice or receipt, QuickBooks lowers the stock count for that item. This helps you avoid manual updates and saves time.

4. How can I fix a wrong stock count in QuickBooks?

- Go to Products and Services. Pick the item and hit Adjust Qty. Type in the right count to match your real stock.

5. Can QuickBooks work with my clinic software?

- Some apps sync with QuickBooks. Others need you to type data by hand. A link saves time and cuts input errors.

6. Do I still need bookkeeping for chiropractors if I use QuickBooks?

- QuickBooks tracks stock and sales fast. A bookkeeper still helps with taxes, money plans, and reports that tools can’t do well.

7. Will QuickBooks give me reports on stock and sales trends?

- Yes, you can pull reports on what items sell most, how much stock you have, and what products cost. These reports help you plan purchases and improve profit.

8. Can QuickBooks track expiration dates for my products?

- QuickBooks may allow you to track expiry dates. This helps prevent selling outdated supplements or braces.

9. Does QuickBooks help me calculate reorder points?

- Yes, you can set minimum stock levels. QuickBooks may notify you when items need reordering.

10. Can I track inventory by location in QuickBooks?

- QuickBooks may allow multiple locations tracking. This is useful if you run more than one clinic or storage room.

11. Will QuickBooks alert me to overstock items?

- Yes, you can review reports to spot slow-moving items. This can prevent unnecessary cash tied up in inventory.

12. Can I attach supplier information to inventory items?

- Yes, you can include supplier names and contact details. This makes reordering easier and faster.

13. Is it possible to track retail and medical inventory separately?

- Yes, you can create categories to separate retail and clinical supplies. This keeps financial tracking accurate.

14. Does QuickBooks let me see inventory costs per item?

- Yes, you can track cost per product. This helps with pricing and profit calculations.

15. Can I run inventory reports for a specific period?

- Yes, reports can be filtered by dates. You may analyze trends monthly, quarterly, or annually.

16. Does QuickBooks help reduce manual inventory errors?

- Yes, automatic stock updates reduce mistakes. Manual corrections are still possible if needed.

17. Can I track damaged or returned products in QuickBooks?

- Yes, you can adjust quantities for returns or damages. This keeps your stock accurate.

18. Is it possible to generate profit reports based on inventory?

- Yes, QuickBooks can link inventory to sales. This shows profits for each product.

19. Does QuickBooks allow bulk importing of inventory items?

- Yes, you can import multiple products at once using spreadsheets. This saves time during setup.

20. Can I access my inventory on mobile with QuickBooks?

- Yes, QuickBooks Online may let you view and adjust stock on the go. This adds convenience for busy clinics.