Table of Contents

- 1 The Anatomy of Cash Flow in Project Management:

- 2 Managing cash flow is paramount for several reasons:

- 2.1 Project Viability and Sustainability:

- 2.2 Enhanced Project Delivery:

- 2.3 Improved Stakeholder Satisfaction:

- 2.4 Risk Mitigation and Financial Resilience:

- 2.5 Strategic Decision-Making:

- 3 The Role of Accounts Junction in Managing Cash Flow in Project Management

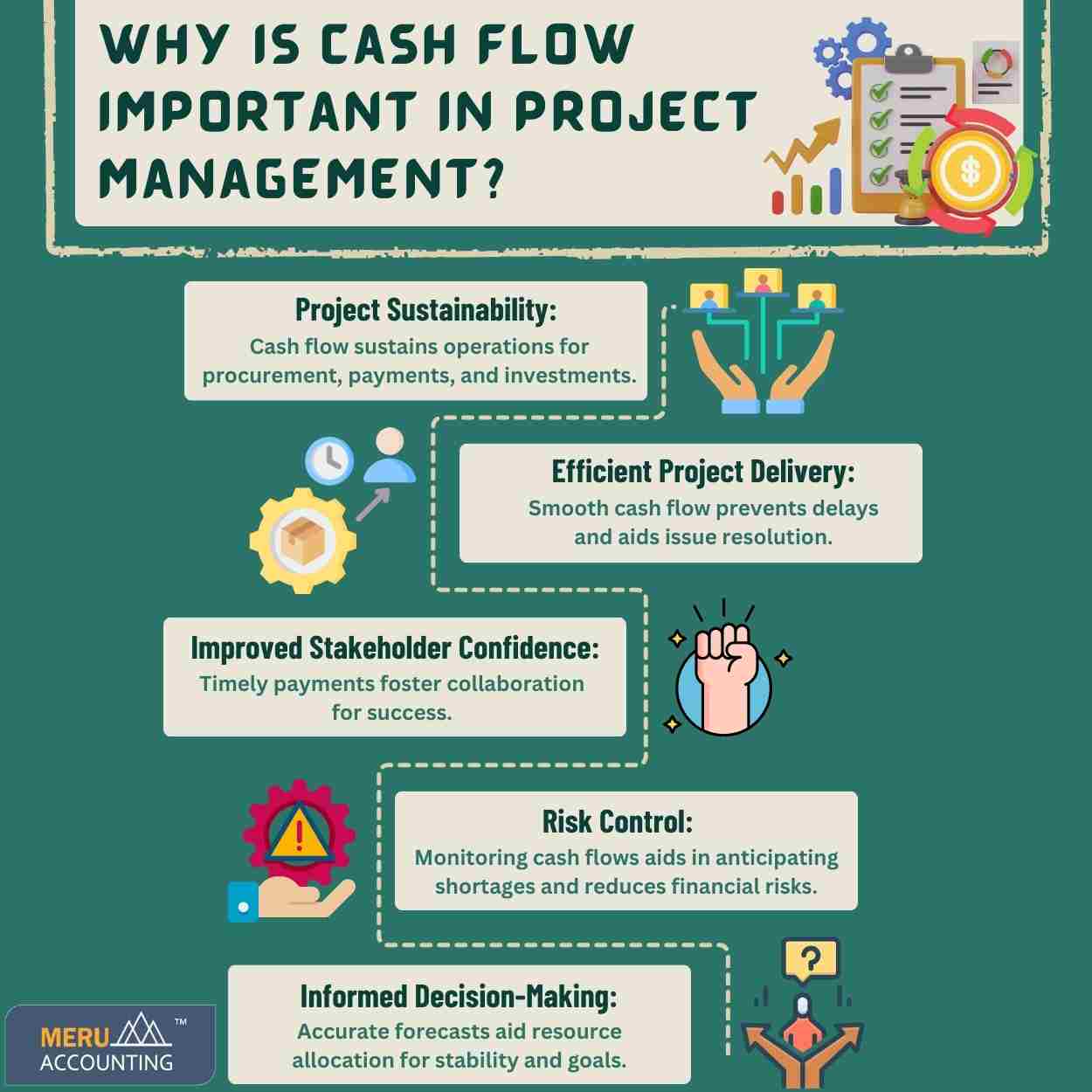

Why is cash flow important in project management?

Regarding project management, the ability to handle and predict cash flow is paramount. Managing cash flow within a project is not just a financial aspect but a strategic necessity that impacts every facet of the endeavor.

It involves the meticulous tracking and monitoring of funds moving in and out of a project, ensuring that there’s enough liquidity to cover expenses, investments, and unforeseen circumstances. Cash flow in project management serves as the lifeblood, determining the project’s health and sustainability in totality.

The Anatomy of Cash Flow in Project Management:

Cash flow in project management is the linchpin that keeps operations running smoothly. It enables project managers to forecast, plan, and mitigate potential risks. Managing cash flow ensures timely payments to suppliers, staff, and contractors, preventing delays that could jeopardize project timelines. Moreover, it provides a clear picture of available resources, allowing for informed decision-making regarding investments, expansions, or adjustments in project scope.

Managing cash flow is paramount for several reasons:

Project Viability and Sustainability:

Positive cash flow is the lifeblood of a project, enabling it to move forward without financial constraints. By maintaining a positive cash flow, projects can continue to procure materials, pay suppliers and employees, and invest in necessary resources. This financial stability ensures that projects can achieve their objectives and deliver value to stakeholders.

Enhanced Project Delivery:

Smooth cash flow contributes to a seamless project execution process. Timely payments to suppliers and contractors ensure the availability of materials and labor, preventing project delays and disruptions. Moreover, adequate cash flow allows for proactive problem-solving and enables project managers to address potential issues before they escalate.

Improved Stakeholder Satisfaction:

Timely payments and financial transparency foster positive relationships with project stakeholders, including clients, suppliers, and investors. When stakeholders are confident in the project’s financial health, they are more likely to collaborate effectively and contribute to project success.

Risk Mitigation and Financial Resilience:

Effective cash flow management helps in identifying and mitigating potential financial risks. By closely monitoring cash flows, project managers can anticipate cash shortfalls, negotiate better payment terms, and implement cost-saving measures to maintain financial stability. This proactive approach reduces the likelihood of financial distress and project failure.

Strategic Decision-Making:

Accurate cash flow forecasting provides valuable insights for making informed financial decisions. Project managers can make strategic choices about resource allocation, contract negotiations, and financing options, ensuring that the project remains on track financially and achieves its objectives.

In essence, managing cash flow is not just about managing money; it is about managing the very heartbeat of a project. By mastering the art of cash flow management, project managers can transform their projects into financial success stories.

The Role of Accounts Junction in Managing Cash Flow in Project Management

Accounts Junction, a leading financial management solution, offers robust tools and expertise to streamline cash flow in project management. At Accounts Junction, we provide real-time insights into cash inflows and outflows, allowing for better decision-making. With Accounts Junction’s comprehensive reporting features, project managers can track expenses, identify potential bottlenecks, and take proactive measures to ensure a healthy cash flow throughout the project lifecycle. Together, we can transform project management into a symphony of financial harmony.