Table of Contents

- 1 What Is Cash Management?

- 2 Key Aspects of Cash Management

- 3 The Importance of Cash Flow Management for Business Success

- 3.1 Importance of Cash Flow Management

- 4 Key Strategies for Effective Cash Management

- 4.1 1. Forecasting Cash Flow

- 4.2 2. Managing Accounts Receivable & Payable

- 4.3 3. Maintaining a Cash Reserve

- 4.4 4. Reducing Unnecessary Expenses

- 4.5 5. Utilizing Digital Cash Management Solutions

- 5 Benefits of Advanced Cash Management Solutions for Businesses

- 6 Why Choose Accounts Junction’s Cash Management Solutions?

- 6.1 Our Key Offerings:

- 6.1.1 Conclusion

- 6.1.2 FAQs

What are the strategies in cash management?

What Is Cash Management?

Cash management is the process of handling a business’s cash inflows and outflows efficiently. It ensures liquidity, financial stability, and optimal use of working capital. It includes monitoring cash flow and managing accounts receivable and payable. It also involves maintaining cash reserves and making strategic investment and financing decisions.

Effective cash management solutions help businesses prevent cash shortages, reduce borrowing costs, improve profitability, and enhance decision-making. Strong cash flow management strategies help businesses run smoothly and meet financial obligations on time. They also create opportunities for sustainable growth.

Key Aspects of Cash Management

- Liquidity Planning: Ensuring enough cash is available to meet short-term obligations.

- Cash Flow Management: Tracking incoming and outgoing cash to maintain financial balance.

- Investment of Surplus Cash: Using excess funds for short-term investments to generate returns.

The Importance of Cash Flow Management for Business Success

Cash flow management plays a crucial role in sustaining business operations. Even profitable businesses can face financial challenges if cash flow is not properly managed.

Importance of Cash Flow Management

- Ensures Business Continuity: Proper cash flow management prevents liquidity crises, ensuring that businesses have enough funds to cover daily operational expenses and unforeseen costs.

- Optimizes Working Capital: By efficiently managing accounts receivable, accounts payable, and inventory, businesses can allocate funds wisely, reducing reliance on external financing.

- Improves Decision-Making: A clear understanding of cash flow patterns helps businesses decide when to invest, cut costs, or expand. This leads to more informed financial decisions.

- Enhances Creditworthiness: A strong and consistent cash flow builds credibility with lenders and investors. This makes it easier to secure loans and attract investment for future growth.

- Reduces Financial Risks: Effective cash management reduces the risk of late payments, overdrafts, and excessive debt. It helps protect the business from financial crises.

By implementing robust cash flow management solutions, businesses can maintain stability, improve profitability, and achieve long-term success.

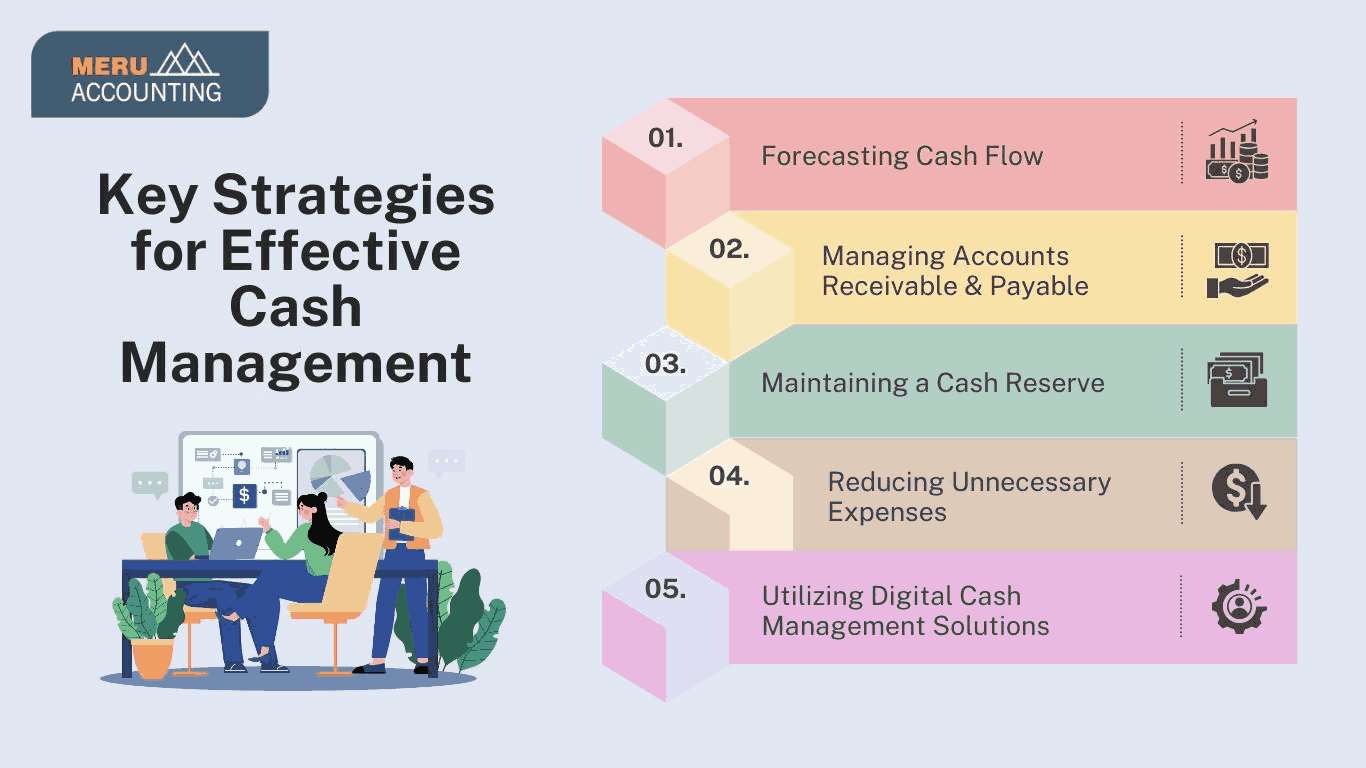

Key Strategies for Effective Cash Management

Implementing robust cash management solutions can help businesses manage finances efficiently. Here are some key strategies:

1. Forecasting Cash Flow

- Regularly monitor and project cash inflows and outflows to anticipate financial needs and prevent cash shortages.

- Use advanced financial tools and software to create accurate cash flow forecasts and make proactive financial decisions.

2. Managing Accounts Receivable & Payable

- Offer early payment discounts to customers to encourage quicker payments and improve cash inflows.

- Implement strict credit policies to reduce the risk of delayed or unpaid invoices.

- Negotiate extended payment terms with suppliers to manage outgoing cash better and optimize working capital.

3. Maintaining a Cash Reserve

- Build an emergency cash reserve to cover unexpected expenses, business downturns, or unforeseen financial challenges.

- Set aside a percentage of revenue to ensure financial stability during uncertain times.

4. Reducing Unnecessary Expenses

- Regularly review expenses to find and remove unnecessary costs.

- Optimize operational efficiency by adopting cost-saving measures such as renegotiating vendor contracts and reducing overhead expenses.

5. Utilizing Digital Cash Management Solutions

- Implement automated cash flow management tools to track financial activities in real time.

- Use cloud-based accounting software to streamline invoicing, expense tracking, and cash flow reporting.

Benefits of Advanced Cash Management Solutions for Businesses

For businesses looking to optimize their cash flow, advanced cash management solutions provide the following benefits:

- Automated Cash Flow Monitoring: AI-powered tools and software help businesses track and analyze cash movements. They also provide real-time forecasts. This enables proactive financial decision-making and prevents cash shortages.

- Integrated Banking Solutions: Digital banking platforms allow seamless fund transfers, automated payment processing, and centralized liquidity management, reducing manual efforts and improving cash accessibility.

- Smart Investment Strategies: Businesses can invest surplus funds in short-term, low-risk securities. These include treasury bills, money market funds, or high-interest savings accounts. This helps ensure capital growth while maintaining liquidity.liquidity.

- Fraud Prevention Measures: Advanced security protocols like multi-factor authentication and encrypted transactions protect against fraud. AI-driven fraud detection helps prevent unauthorized transactions and cyber threats.

- Efficient Accounts Receivable Management: Automated invoicing, digital payments, and follow-up reminders help businesses get paid on time. This reduces outstanding dues and improves cash flow.

- Strategic Accounts Payable Optimization: Businesses can negotiate better payment terms with suppliers and take advantage of early payment discounts. They can also automate payment schedules to improve cash flow and maintain good vendor relationships.

- Cash Reserve and Contingency Planning: Setting aside a portion of revenue as an emergency fund keeps businesses financially strong. It helps them handle economic downturns, unexpected expenses, or market changes.

- Advanced Cash Flow Forecasting: Predictive analytics and financial modeling tools help businesses anticipate future cash needs and plan investments. They also adjust financial strategies based on real-time data insights.

Why Choose Accounts Junction’s Cash Management Solutions?

At Accounts Junction, we specialize in providing customized cash flow management services to help businesses maintain liquidity, optimize working capital, and achieve financial stability. Our expert-driven solutions ensure smooth financial operations, reducing risks and maximizing profitability.

Our Key Offerings:

1. Real-Time Cash Flow Tracking: Get instant insights into cash inflows and outflows with AI-powered analytics. This helps you make proactive financial decisions.

2. Automated Invoicing and Payments: Streamline accounts receivable and payable processes with automated invoicing, payment reminders, and digital payment solutions to ensure timely transactions.

3. Cash Reserve Planning and Optimization: Plan a cash reserve strategically to build a financial cushion. This helps businesses handle unexpected expenses and economic changes.

4. Expense Management and Cost Control: Identify cost-saving opportunities, manage operational expenses effectively, and eliminate unnecessary spending to improve cash flow efficiency.

5. Integrated Banking and Payment Solutions: Connect business accounts with digital banking platforms for seamless fund transfers, automated reconciliation, and better liquidity management.

6. Fraud Prevention and Security Measures: Implement advanced security protocols, encrypted transactions, and fraud detection tools to safeguard financial assets and prevent unauthorized transactions.

Accounts Junction’s advanced cash management solutions help businesses streamline financial operations. They also enhance profitability and support long-term financial success.

Conclusion

Effective cash management is essential for business stability, profitability, and growth. By implementing advanced cash flow management strategies, businesses can optimize working capital, reduce financial risks, and make informed decisions. Utilizing forecasting tools, digital banking solutions, automated invoicing, and strategic investment planning ensures smooth financial operations and prevents cash shortages.

At Accounts Junction, we provide customized cash management solutions that enhance liquidity, improve financial control, and streamline business operations. With our expertise, businesses can achieve long-term success, strengthen financial security, and drive sustainable growth.

FAQs

1. What are the key components of cash management?

Ans: The key components include cash flow forecasting, liquidity planning, and managing accounts receivable and payable. They also cover expense control and investing surplus funds.

2. How does cash flow forecasting help businesses?

Ans: Cash flow forecasting helps businesses predict future cash needs and plan expenses wisely. It also prevents liquidity shortages that could disrupt operations.

3. What strategies can improve cash flow management?

Ans: Strategies include timely invoicing, reducing unnecessary expenses, negotiating better payment terms, automating payment processes, and maintaining an emergency cash reserve.

4. How can businesses prevent cash shortages?

Ans: Businesses can prevent cash shortages by monitoring cash flow regularly and optimizing working capital. They can also secure lines of credit and ensure timely customer payments.

5. Why should businesses invest surplus cash?

Ans: Investing surplus cash in short-term, low-risk assets helps businesses earn extra income. It also keeps the funds accessible for future needs.