Table of Contents

CIS Returns Online

All about the UK- CIS tax return

Often subcontractors due to annual tax rebates. Such a situation occurs as too much tax deducted from their payments. The tax deduction increase over the years leads to tax overpayments. The tax overpayments are reclaimed through CIS tax return.

What is CIS monthly return?

CIS stands for the construction Industry scheme is a special tax scheme introduced by the HMRC. The CIS tax aims to regulate the payment made by the construction contractors to any sub-contractors.

According to CIS rules, a contractor must deduct CIS tax while paying to the sub-contractors from their invoices and pay to HMRC. The sub-contractors can claim the CIS deduction back upon the filing of a tax return.

Who registers for CIS?

Any contractor using the subcontractors for any construction work must register with HRMC for CIS scheme.

An individual subcontractor or subcontracting company carrying out a construction Company for a contractor should also register for CIS. It is advisable to register as high deduction form their payments if not registered with HMRC.

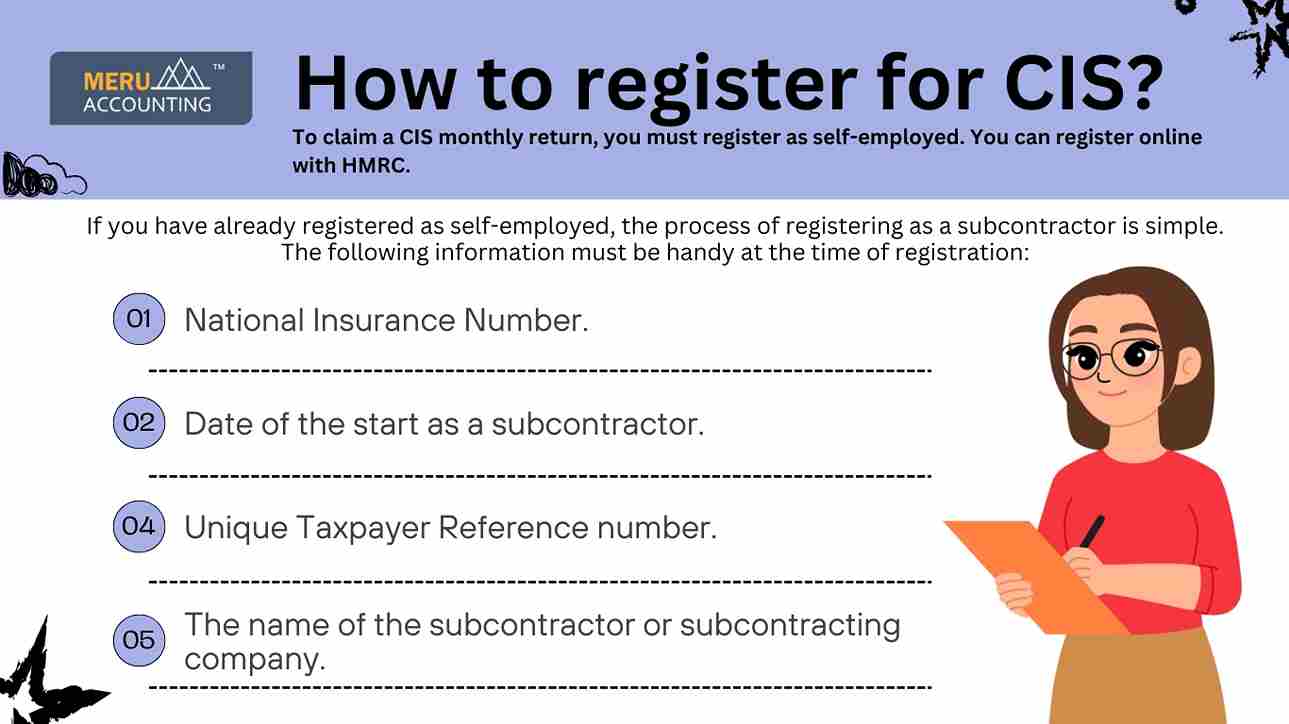

How to register for CIS?

To claim a CIS monthly return, you must register as self-employed. You can register online with HMRC. Alternatively can contact HMRC by calling 0300 200 3210.

If you have already registered as self-employed, the process of registering as a subcontractor is simple. The following information must be handy at the time of registration:

1. National Insurance Number.

2. Unique Taxpayer Reference number.

3. Date of the start as a subcontractor.

4. The name of the subcontractor or subcontracting company.

What is the deduction rate for CIS?

1. CIS deduction form payments made under the CIS scheme consist of three applicable rates:

2. The most common payments for small-sized sub-contractors registered under the CIS scheme at a rate of 20 %

3. 30% rate applies to subcontractors not registered with HMRC or if no previous record is found.

4. 0% tax deduction. For register for this CIS scheme, several checks are done by the HMRC.

What expense can a subcontractor claim as CIS tax refund?

- Clothing cost.

- Tools and equipment.

- Traveling costs.

- Administrative cost.

- Advertising expense

- Capital allowances for commercial vehicles etc. and many more.

While claiming for CIS tax refund, we help you better if you share all the information concerning subcontracting. It allows you to get the maximum possible rebate for you.

Monthly CIS return:

The contractors have to report their CIS activities to the HMRC through Monthly CIS returns. The contractor must hold the information for a minimum period like any other financial records. He must submit a CIS return to HRMC each month. If no CIS occurs within a month, then intimation to HMRC about no CIS return is due is done.

The monthly CIS return includes details about the deduction and payments made in the previous month. It can either submitted online to HMRC through its website or CIS software.

The tax month starts from 6th of one month to the 5th of the following month.

The contractor issues CIS statement to the subcontractor for the payment made.

How can I (Subcontractors) with CIS tax return?

First, you need to put together as much as information we get on board. The more information about your construction the better we can help you to maximize your claim. Documents and records that you must have:

1. Copies of CIS tax statements (also refer as CIS vouchers or payslips)

2. Details of the location of the site where you worked.

3. Copies of MOT certificates showing your mileage.

4. Copy invoices or receipts for your expenses.

5. Invoice or receipt for tools and equipment.

The more information we get, the better CIS tax refund, we at Accounts Junction take cares of all your CIS tax hassles. We have qualified tax professionals to help to run through everything right from CIS registration to claiming CIS tax refund.