Table of Contents

- 1 How can CPA for musicians optimize their income and tax strategies?

- 1.1 Business structure selection

- 1.2 Making proper tax planning

- 1.3 Bookkeeping and accounting

- 1.4 Income optimization

- 1.5 Expense management

- 1.6 Touring and travel deductions

- 1.7 Dealing with international taxation

- 1.8 Royalty Income

- 1.9 Record keeping and compliance

- 1.10 Long-Term Financial Planning

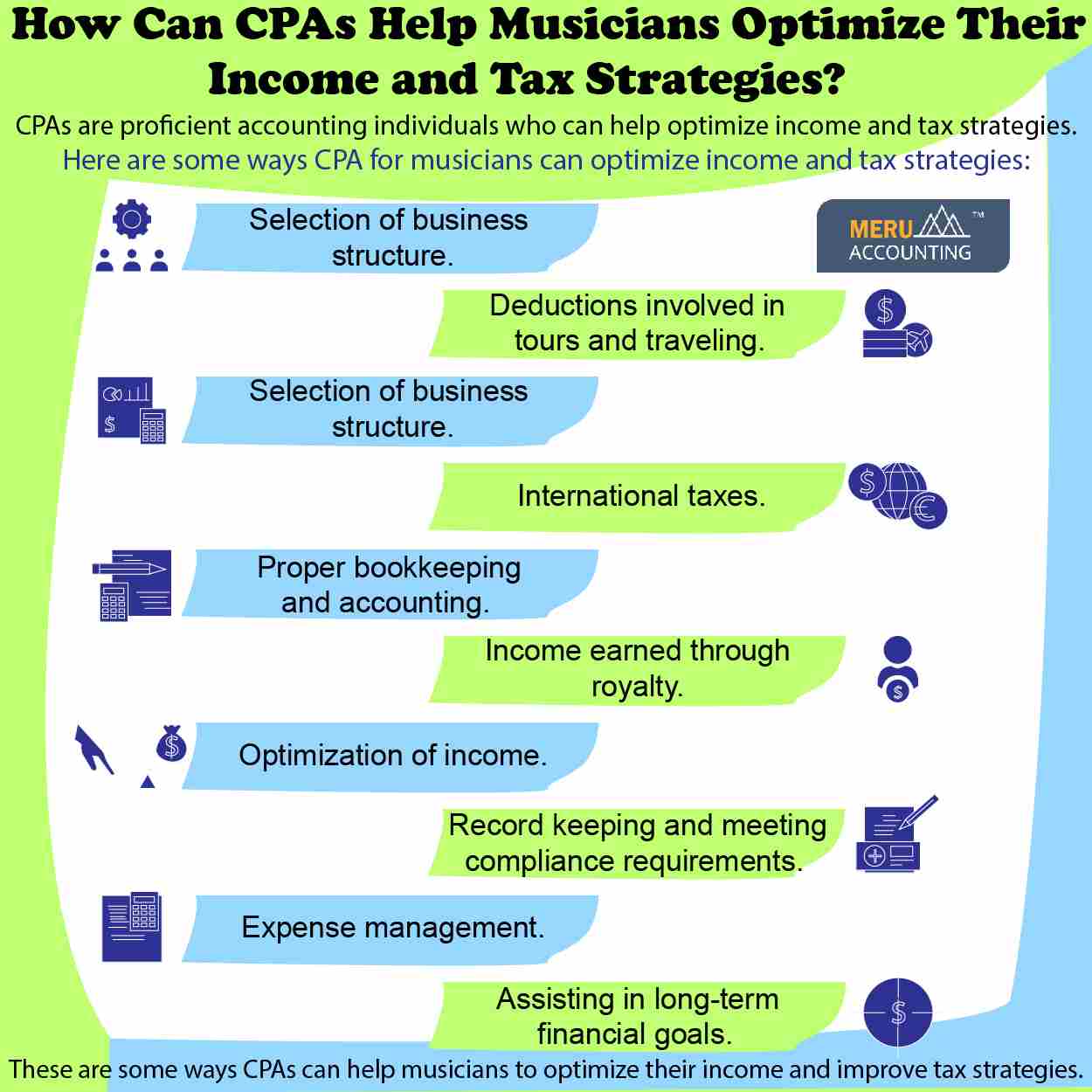

How Can CPAs Help Musicians Optimize Their Income and Tax Strategies?

While you are a self-employed musician, you will always want to be more creative in your profession. Despite this, accounting for musicians is important to improve income and make a better tax strategy. Many musicians till now had been ignoring the importance of accounting and other financial aspects of business.

There are many aspects and complexities in the finance, accounting, and tax-related aspects that can be done proficiently by Certified Public Accountants (CPAs) only. To make your task simpler, CPA for musicians can be a better option to deal with the finance, accounting, and tax-related aspects. They can get all the accounting work right and other tax-related aspects.

How can CPA for musicians optimize their income and tax strategies?

Here are ways CPA can help in accounting for musicians to improve their income and tax strategies:

Business structure selection

CPAs can help musicians choose the most appropriate business structure, such as a sole proprietorship, LLC, S-Corporation, or C-Corporation, based on their specific financial situation and long-term goals. The chosen structure can impact tax liability, legal protection, and ease of administration.

Making proper tax planning

CPAs can develop tax strategies to minimize a musician's tax liability, such as taking advantage of deductions, credits, and exemptions available to self-employed individuals. They can also help with estimated tax payments to avoid underpayment penalties.

Bookkeeping and accounting

Maintaining accurate financial records is crucial. CPAs can help musicians set up an efficient bookkeeping system and provide guidance on tracking income and expenses to ensure that they claim all eligible deductions.

Income optimization

CPAs can advise musicians on diversifying their income sources, which might include performance fees, royalties, merchandise sales, and licensing. They can also help with contract negotiation to maximize earnings.

Expense management

CPAs can assist musicians in identifying legitimate business expenses and structuring their financial transactions. It will minimize tax obligations while staying within the bounds of tax law.

Touring and travel deductions

Musicians often travel for performances. CPAs can guide them on how to properly document and deduct expenses related to touring and travel, including meals, accommodations, and transportation.

Dealing with international taxation

For musicians with international income or cross-border activities, CPAs with expertise in international taxation. This can help navigate complex tax issues, such as withholding taxes and tax treaties.

Royalty Income

CPAs can assist musicians in managing and reporting royalty income, which can come from songwriting, music publishing, and other creative endeavors.

Record keeping and compliance

CPAs can help musicians stay compliant with tax regulations and filing requirements. They can also advise on record-keeping practices to facilitate easier tax preparation.

Long-Term Financial Planning

CPAs can work with musicians to develop a comprehensive financial plan that considers short-term and long-term goals. This can involve saving for major expenses.

These are some ways CPA’s can help musicians to optimize their income and tax strategies. You need to outsource this task to the expert CPA who could assist you in achieving these goals.

Accounts Junction provides outsourced work for accounting for musicians. They have a team of experts to handle CPA for musicians which can optimize their income and tax strategies. The CPA here is well-qualified and can advise you to improve your financials. Accounts Junction is a well-known accounting services provider for musicians.