Table of Contents

Why outsource accounting is the growth engine for CPA firms?

Many CPA firms struggle with one common challenge; to ensure their financials are handled and managed in the same way as their clients. As a CPA firm, they know accurate and efficient accounting is essential for sound financial health. But often while meeting their client expectation and requirements, they land up in the following two situations.

- Firstly, they lose track of their firm’s accounting and bookkeeping.

- Second, they don’t get enough time to focus on the growth of the business.

Further, these situations lead to missing business development opportunities which ultimately affect the business. Negligence of accounting harms the financial health of the business.

If you are a CPA firm stuck in the above-mentioned situation, there are two ways to handle these challenges:

- Hire an in-house accounting team to manage your accounting and bookkeeping.

- Outsource bookkeeping services to reliable and reputed accounting service providers.

CPA outsourcing services are the new norm for getting your accounts done. As a CPA firm, you must be aware of the various benefits of outsourced bookkeeping services for CPAs. Many SMB and individual accountants are collaborating with external service providers to enjoy multiple benefits of outsourcing. Even medium and large-scale companies are availing services of an accounting firm like Meru Accounting to boost their growth. Companies view outsourcing as a strategy to get their work done cost-effectively.

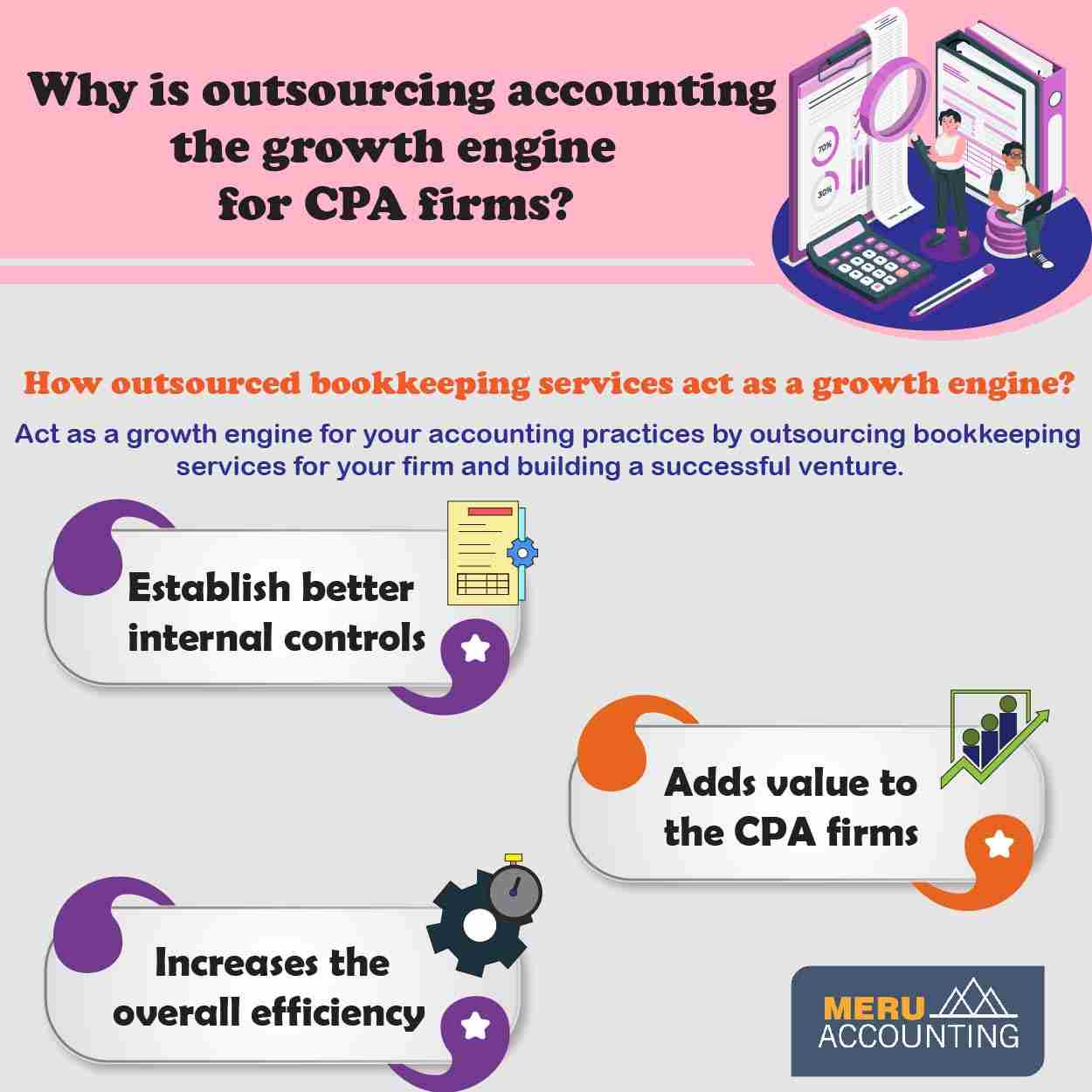

How outsourced bookkeeping services act as the growth engine for CPA Firms?

Better Internal Controls:

When you outsource your accounting to an external professional expert, it spares your time, so the company can divert the in-house accountants to its client projects. It also ensures quality work with multiple CPAs onboard. CPA outsourcing services help to strengthen internal controls through proper and accurate balance preparation by a professional expert. It protects your firm from any costly consequences such as fraud and also has an additional team to look for red flags in the accounting process of the company.

Bring value to CPA Firm:

From budding startup accounting firms to thriving CPS firms, more and more accounting service providers are opting for outsourced bookkeeping services to manage their day-to-day accounting; as they are busy as outsourcing partners for their clients. Outsourced bookkeeping services for CPA firms easily manage some of the tedious and burdensome tasks efficiently, sparing more time to focus on growth. Businesses look for a CPA firm beyond the accounting service, you can offer additional services to such clients such as financial reporting, financial planning, tax planning, and consulting services to expand your customer base.

Enhances efficiency:

If you are an individual CPA or startup firm and unable to access the latest technology and infrastructure due to budget constraints; then CPA outsourcing services help to improve efficiency in accounting functions. You can outsource some tasks of your accounting work and keep your availability for important business functions. This helps to improve efficiency and productivity and gives competition to the other players in the market.

Outsourced bookkeeping services for CPAs:

Outsourcing bookkeeping services for CPA firms is beneficial for accounting practices and their clients, especially at times of heavy workflow and stipulated time deadlines. Outsourcing provides an additional professional team for the smooth functioning of the business.

Fuel your business growth with professional bookkeeping and accounting services with Accounts Junction. Our accounting and bookkeeping outsourcing services take care of all your accounting back office workload.