Table of Contents

End to End Process of Accounts Payable

Accounts Payable (AP) is a critical function within the accounting department of any business. It is the process of managing and tracking payments to suppliers or vendors for goods and services purchased on credit. It is an essential component of a company's financial operations that affects its cash flow, profitability, and reputation. The End to End Process of Accounts Payable includes several steps that must be executed in a timely and accurate manner to ensure that suppliers are paid on time and the company's financial records are accurate.

Maintaining strong vendor relationships, avoiding late payment fines, and preventing fraud all require effective management of the accounts payable process. This article will provide a detailed overview of the end-to-end process of accounts payable, highlighting the critical steps involved in managing vendor payments effectively.

Now let’s discuss the End to End Process of Accounts Payable:

Step 1: Purchase Order (PO) Creation:-

The first step in the End to End Accounts Payable Process is the creation of a purchase order. This is a document that outlines the details of the goods or services being purchased, including the quantity, price, and delivery date. The purchase order is created by the purchasing department and is sent to the supplier for confirmation.

Step 2: Goods Receipt:-

Once the supplier has confirmed the purchase order, the goods are delivered to the company. The receiving department checks the goods against the purchase order to ensure that everything has been received in good condition and in the correct quantities.

Step 3: Invoice Verification:-

The supplier will then send an invoice to the accounts payable department. The invoice should match the purchase order and the goods receipt. End to End Accounts Payable will verify the invoice details, including the amount owed, the payment terms, and any applicable taxes.

Step 4:- Invoice Processing :-

Once the invoice has been verified, it is entered into the company's accounting system. This step involves entering the invoice details, such as the invoice number, supplier name, and amount due, into the system. The invoice is then matched against the purchase order and the goods receipt to ensure that everything is correct.

Step 5:- Payment Approval:-

After the invoice has been processed, the accounts payable department will seek approval for payment. This step involves checking that the payment is within budget and that there are no issues with the invoice. The payment may also require approval from other departments or managers, depending on the company's payment approval process.

Step 6: Payment Processing:-

Once the payment has been approved, the End to End Accounts Payable Process department will process the payment. This may involve issuing a check or initiating an electronic transfer of funds to the supplier's account. The payment will be recorded in the company's accounting system as an accounts payable transaction.

Step 7: Reconciliation:-

Finally, the accounts payable department will reconcile the payments made to the supplier with the company's financial records. This step involves ensuring that all payments have been made in full and on time, and that there are no discrepancies between the supplier's records and the company's records.

Conclusion:-

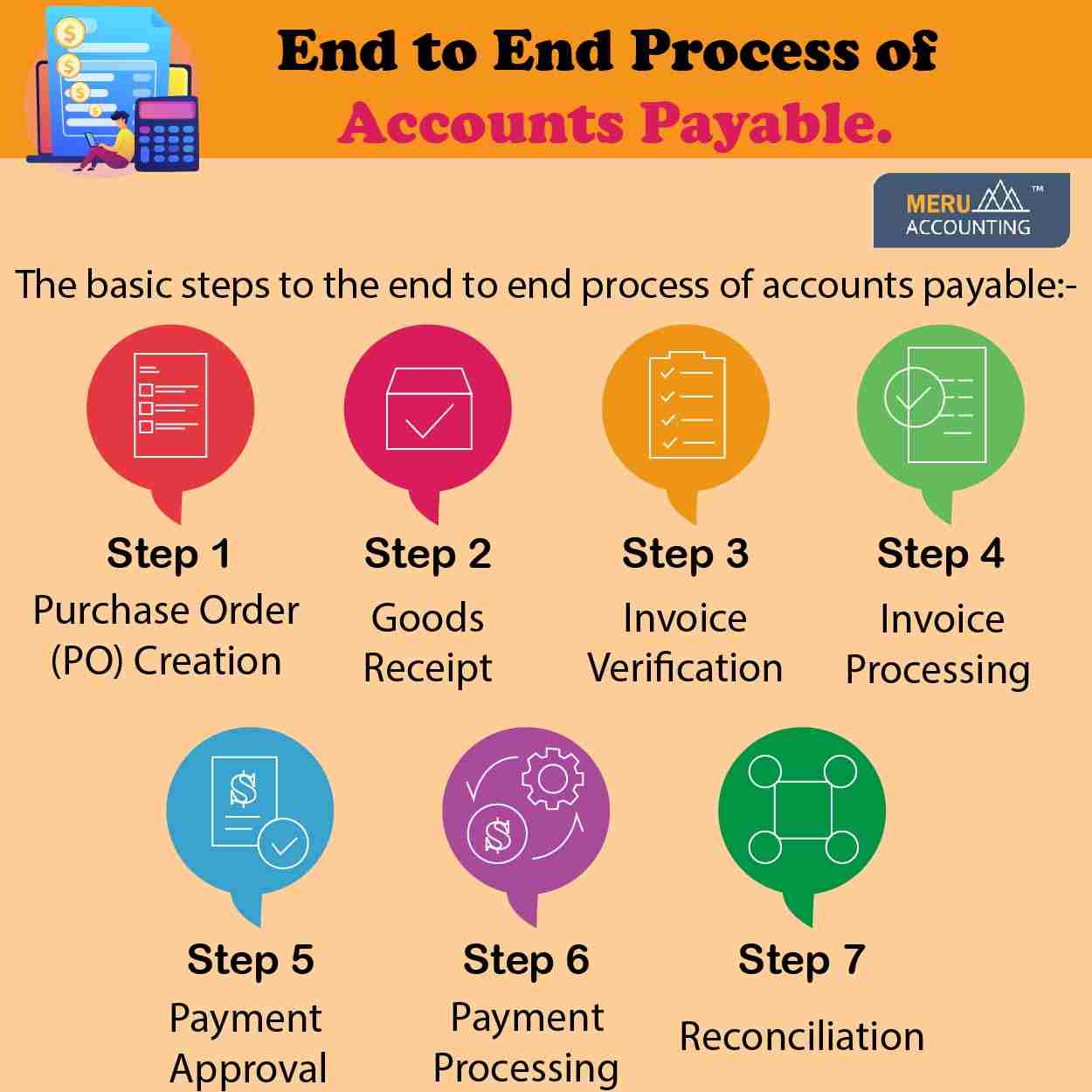

The basic steps to the End to End Process of Accounts Payable:-

Step 1: Purchase Order (PO) Creation

Step 2: Goods Receipt

Step 3: Invoice Verification

Step 4:- Invoice Processing

Step 5:- Payment Approval

Step 6: Payment Processing

Step 7: Reconciliation