Everything about Australian Tax Deductibles

If you think about taxes, the mind can wander into a fog. Rules, forms, numbers, and deadlines often feel endless. But there is a bright side hidden in all of this. Australian Tax Deductibles can act like a boon, reducing the money taken from your income. It also makes the process of tax easier to manage. They can reduce the money taken from your income and offer a way to soften the burden of paying tax. Understanding them can seem tricky, but with a little patience and guidance, it might not be as hard as it looks. Once you understand how they link to your Australian Tax Return, the whole picture may start to make much more sense.

Tax deductibles are not magic that can erase your tax completely. They are means that may help in pushing your taxable income down, saving money in ways you cannot imagine. In this blog, we will explore what Australian Tax deductibles are, its types, how to claim them, and tips for organizing records.

What are Australian Tax Deductibles?

In essence, Australian Tax Deductibles are expenses connected to earning your income that can lower the amount of money the tax office counts as taxable.

- They often come from spending that is directly linked to your work or income.

- Personal spending rarely fits unless a rule allows it.

- Receipts or proof can be crucial since the tax office may ask.

Keeping such proof also makes it easier when preparing your Australian Tax Return, as every valid record supports your claims. Think of them as a small window of relief in a room that can feel cluttered with numbers. They do not erase tax but can reduce the weight.

How Tax Deductibles Work

Suppose a person earns one hundred thousand dollars a year. Spending two thousand dollars on work related items can bring taxable income closer to ninety eight thousand. That difference, small as it looks, can change the tax owed noticeably.

Some costs are fully deductible, while others only partially. Splitting shared usage or claiming fractions can be confusing at first. But understanding what fits where may make the process smoother. It also means fewer errors when you finally prepare or file your Australian Tax Return, since you already know which expenses belong.

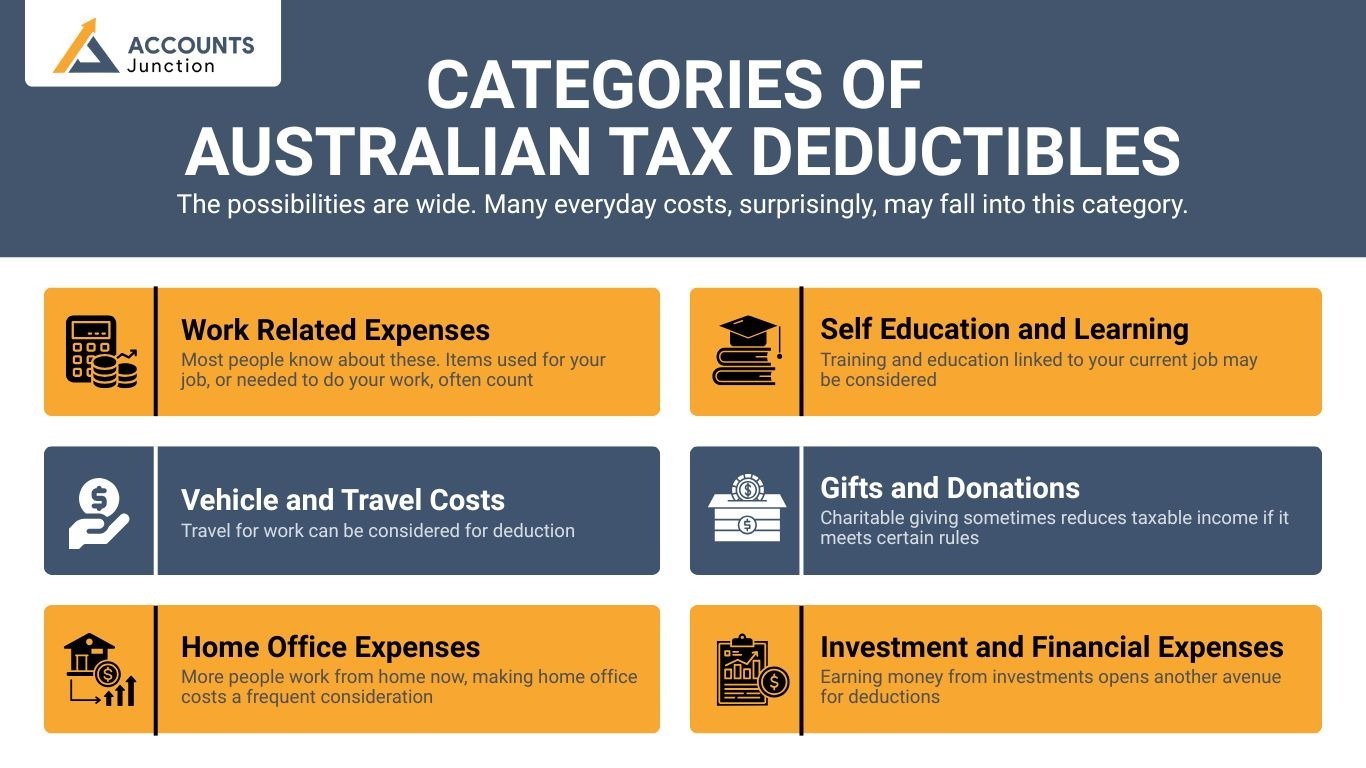

Categories of Australian Tax Deductibles

The possibilities are wide. Many everyday costs, surprisingly, may fall into this category.

Work Related Expenses

Most people know about these. Items used for your job, or needed to do your work, often count:

- Uniforms specific to your job

- Protective clothing for manual work

- Laptops, phones, or other equipment used mostly for work

- Subscriptions to professional magazines or journals

When personal use overlaps, only the work related portion can be counted. Records showing the split are often important.

Vehicle and Travel Costs

Travel for work can be considered for deduction:

- Car trips to meet clients

- Flights to attend work events

- Accommodation during work trips

Keeping a log or receipts may help. When travel mixes personal and work, the deductible part usually needs careful calculation.

Home Office Expenses

More people work from home now, making home office costs a frequent consideration:

- Electricity, heating, and cooling

- Internet and phone

- Furniture and office equipment

The key is showing that part of your home is used for work. Without this, claims may be questioned.

Self Education and Learning

Training and education linked to your current job may be considered:

- Course fees and seminar charges

- Books or online resources

- Travel for attending training

Learning can be both beneficial for skills and helpful for lowering taxable income. Records supporting that connection are usually needed.

Gifts and Donations

Charitable giving sometimes reduces taxable income if it meets certain rules:

- Donations of money to approved charities

- Donating property or other items

Receipts or acknowledgment letters are vital to support these claims. Without them, it can be difficult to justify the deduction.

Investment and Financial Expenses

Earning money from investments opens another avenue for deductions:

- Interest on investment loans

- Fees for financial advice

- Costs of managing rental properties

Careful tracking of these expenses can make the difference between a successful claim and one that is rejected.

Lesser Known Tax Deductibles

Some items are unexpected yet often valid:

- Membership fees to professional associations

- Union fees

- Protective gear for hobbies that earn income

Even subscriptions for work tools or software sometimes count, if mostly used for work purposes.

Keeping and Maintaining Records

The tax office can request proof at any time. Receipts, invoices, and statements form the backbone of all deductions. Without them, claims may not succeed.

Tips:

- Retain receipts for five years or more

- Separate personal and work expenses clearly

- Use logs, paper or digital, for clarity

- Record percentage of work versus personal use for shared items

Small efforts in organization can prevent bigger headaches later.

Common Mistakes to avoid while filing Australian Tax Return

Mistakes happen often. Common ones include:

- Claiming personal expenses as work related

- Forgetting to split shared costs

- Ignoring small receipts that are valid

- Not maintaining a travel log

Avoiding these reduces stress and strengthens the claim.

Apps and software are valuable tools. For filing Australian Tax Return, you can use them to:

- Scan and categorize receipts

- Track expenses in real time

- Summarize totals for tax purposes

Using tools reduces errors, saves time, and helps organize records for possible audits.

Even small deductions add up over the year. Keeping track and claiming everything eligible can have a meaningful impact. Organizing expenses well can lead to smoother tax filing and better outcomes.

Planning and Strategy

Deductions are not only about the current year. Planning purchases and expenses strategically can enhance benefits:

- Buy work equipment before financial year end

- Allocate home office and travel costs thoughtfully

- Combine smaller donations or fees in one year

Planning carefully can save money without bending rules.

Getting Professional Help

Some claims are tricky. Accountants or tax advisors can:

- Spot overlooked deductions

- Guide in organizing records

- Suggest strategies to reduce taxable income legally

At Accounts Junction, we have helped many Australian businesses claim benefits of tax deductibles. Our Australian tax services can significantly show a difference in your tax. Even a short consultation can make a noticeable difference in results.

Australian Tax Deductibles may include work related costs, travel, home office, learning, donations, and investment expenses. Careful record keeping, avoiding mistakes, and consulting professionals where needed can make the process simpler and more effective. This blog has helped you understand deductibles easily. If you wish to take the advantage of Australian tax deductibles for your business, contact Accounts Junction now!

FAQs

1. What are Australian Tax Deductibles?

- They are expenses you can subtract from your income before tax.

2. Can personal expenses be claimed?

- Usually not. Only work related costs may qualify.

3. Are home office expenses deductible?

- Yes, if a part of your home is used mainly for work.

4. How do vehicle expenses work?

- Car or travel costs for work trips can be claimed, not personal trips.

5. Can education costs be claimed?

- Courses and training linked to your job can be deductible.

6. Are donations deductible?

- Yes, if the charity is approved and receipts are kept.

7. What about tools for work?

- Work tools or equipment can be claimed fully or partially.

8. Do I need receipts?

- Yes, proof is needed to justify any claim.

9. Can software subscriptions be claimed?

- Yes, if used mostly for work.

10. Are union fees deductible?

- Yes, membership fees for unions or professional groups count.

11. Can I claim phone or internet bills?

- Only the work related portion qualifies.

12. How long should records be kept?

- At least five years in case the tax office requests them.

13. Are accountant fees deductible?

- Yes, if they relate to managing taxes or deductions.

14. Can small donations be combined?

- Yes, combining them in one year simplifies claiming.

15. Are clothing expenses deductible?

- Only uniforms or protective clothing specific to the job.

16. Can travel for conferences be claimed?

- Yes, if it is connected to work.

17. Are investment expenses deductible?

- Yes, costs like loan interest or advisory fees may qualify.

18. Can part-time work expenses be claimed?

- Yes, the work related portion can be included.

19. What if work and personal use are mixed?

- Only the work portion counts, with proper proof.

20. Can apps help with deductibles?

- Yes, they simplify tracking and record keeping.