Federal Tax Return

Filing your federal tax return is not just a legal obligation. It’s a crucial part of running a compliant and financially healthy business in the United States. Several people in the US who run the business in different states have several questions. If you are not a financial expert, then you must do all the federal tax filing activity properly. Earlier, federal tax filing was comparatively very complicated and time-consuming. However, the online federal tax filing is easier and quicker now. Those people who have small businesses or are self-employed have to make sure that all the tax-related aspects are in proper order. Accurate tax filing can avoid complicated situations further.

Instead, approach an expert tax consultant who can guide you properly on federal tax filing accurately. Prior tax preparation is vital while filing federal taxes online.

What is a Federal Tax Return?

A federal tax return is a form sent to the IRS. It shows your income, deductions, and any tax credits. The IRS uses it to check if you owe money or get a refund.

Anyone in the U.S. who earns taxable income must file each year. This rule applies to both individuals and businesses. If you don’t file, you may face fines, interest, or legal trouble.

Filing on time and doing it right is very important. Online tools have made filing easier.

Still, expert help can be useful to stay on track.

How Much Federal Tax Should I Pay?

Your federal tax amount depends on different factors. Here's a simple breakdown:

1. Income Tax

- This is the primary section of your federal tax return. The rate changes based on your income and filing status. Credits and deductions reduce the income subject to taxation.

2. Self-Employment Tax

- If you're self-employed, you must pay both the employer and worker parts of Social Security and Medicare. This must be calculated correctly in your tax return.

3. Business Taxes

- Tax rules vary by business type. Sole owners, partnerships, and corporations all follow different rules and deadlines.

4. Payroll Taxes

- If you have employees, you must report and pay payroll taxes. These are part of your full federal tax amount.

5. Capital Gains Tax

- If you sell stocks or property and earn a profit, it may be taxed. The rate depends on how long you owned the asset.

6. Other Taxes

- Other taxes may apply based on your business or personal finances.

- You’ll need to include these in your federal tax return too.

Federal Tax Filing Online Tips

Filing taxes can be tricky, especially for businesses with many income sources or deductions. Use these tips to simplify the process:

1. Choose Reliable Online Platforms

- Compare tax software options based on cost, features, and ease of use.

2. Keep All Documents Ready

- Organize your income statements, receipts, and other supporting documents in advance.

3. File Early

- Avoid last-minute mistakes. Filing early also helps track your federal tax return status smoothly.

4. Use Direct Deposit

- This is the fastest way to receive your refund—usually within 12 to 15 days.

5. Double-Check Entries

- Even one mistake can delay your refund or cause issues with the tax authorities.

6. Consult a Tax Professional

- Tax consultants, like Accounts Junction, can ensure accurate filing and provide reliable support.

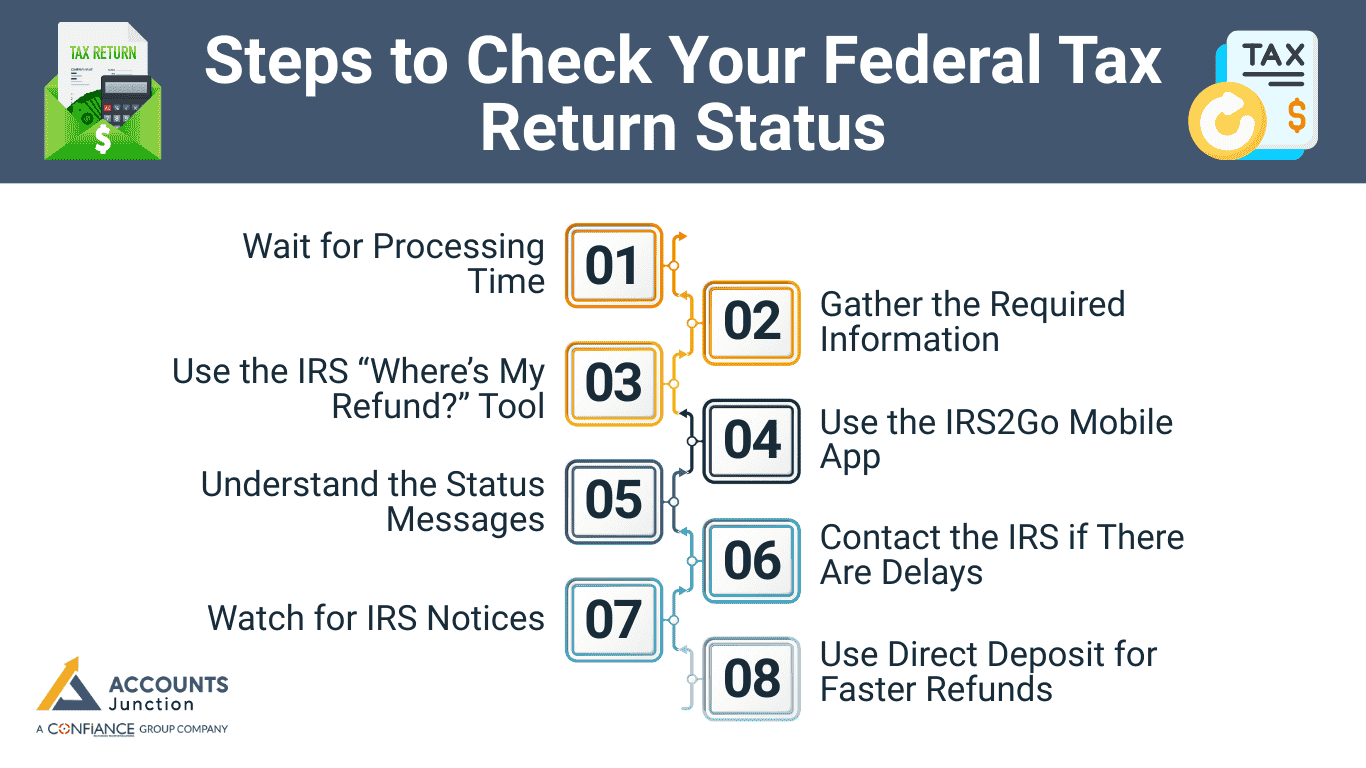

Steps to Check Your Federal Tax Return Status

Once you've filed, it's important to monitor your federal tax return status to confirm it's processed and to know when to expect a refund.

Here is a step-by-step process to check your tax return status:

Step 1: Wait for Processing Time

- E-filed returns: Wait at least 24 hours after electronic submission.

- Paper-filed returns: Wait about 4 weeks after mailing your return.

- The IRS needs this time to enter your return into its system.

Step 2: Gather the Required Information

Before you check your federal tax return status, gather these three important details:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Your filing status (such as Single, Married Filing Jointly, etc.)

- The exact refund amount you expect to receive

These details are required to use the IRS refund tracking tool.

Step 3: Use the IRS “Where’s My Refund?” Tool

- Visit the official IRS website at irs.gov

- Click on “Where’s My Refund?”

- Enter your SSN or ITIN, tax filing status, and the amount of your refund.

- Click “Submit” to check your federal tax return status

This tool is available 24/7 and updates once every 24 hours, typically overnight.

Step 4: Use the IRS2Go Mobile App

- Download the IRS2Go app from the Apple App Store or Google Play

- Use the same information to check your federal tax return status

- This is especially convenient if you prefer tracking your refund via a mobile device

Step 5: Understand the Status Messages

The IRS tool will show one of three messages:

- Return Received – Your return is in the system and being processed.

- Refund Approved – Your refund has been authorized and is being processed for deposit or mailing.

- Refund Sent – Your refund has been sent to your bank or mailed to your address.

Step 6: Contact the IRS if There Are Delays

If it’s been:

- 21 days since you e-filed, or

- Six weeks have passed since you sent your paper return. If you still don’t see any updates on your federal tax return status, you can:

- Call the IRS at 1-800-829-1040

- Be prepared for long wait times, especially during peak tax season

Step 7: Watch for IRS Notices

The IRS may mail you a notice if there’s a problem with your return.

This can slow down your refund, especially if they ask for more documents or corrections.

Step 8: Use Direct Deposit for Faster Refunds

Always choose direct deposit when you file.

It usually gets your refund to you in 12 to 15 days—much faster than waiting for a mailed check.

Common Mistakes to Avoid While Filing Federal Taxes

Filing federal taxes may seem simple, yet small mistakes can lead to big issues. People often overlook details that can delay their refund or trigger an IRS notice.

Frequent Errors to Watch For:

- Incorrect Social Security Numbers: Even a single wrong digit can cause problems.

- Math Errors: Miscalculating income, deductions, or credits may slow processing.

- Missing Forms: Forgetting W-2s, 1099s, or receipts can lead to penalties.

- Filing Status Errors: Choosing the wrong status can impact your refund amount.

- Overlooking Deductions: Some deductions like education expenses or health costs may be missed.

Avoiding these errors can make the filing process smoother and may reduce the risk of audits or delays. Keeping organized records and double-checking entries is key.

Benefits of E-Filing Federal Taxes

Electronic filing, or e-filing, has become more common for individuals and businesses alike. It may not guarantee perfection, but it can simplify many steps.

Why E-Filing May Be Beneficial:

- Speed: Returns are processed faster than paper submissions.

- Accuracy: Built-in software checks can reduce common mistakes.

- Convenience: File anytime from home without mailing forms.

- Direct Refunds: Payments can be deposited directly into your bank account.

- Environment-Friendly: Reduces paper waste and unnecessary mailing.

E-filing may also provide automatic confirmation that your return has been received, giving peace of mind and reducing anxiety.

How to Prepare for Next Year’s Federal Tax Filing

Federal tax filing does not end once your return is submitted. Proper preparation can make next year’s process much smoother.

Preparation Steps:

- Track Income Year-Round: Keep all pay stubs, 1099s, and business earnings in one place.

- Organize Expenses: Separate personal and business expenses to identify deductions more easily.

- Update Records Regularly: Any life changes, like marriage, moving, or new dependents, may impact your taxes.

- Review Previous Returns: Check past returns for missed deductions or errors.

- Consider Professional Services: Certified tax experts may make filing easier and reduce stress.

Consistent preparation may not only save time but also prevent errors and maximize potential refunds.

Accounts Junction provides comprehensive federal tax filing services. Our certified experts prepare accurate returns, monitor filing status, and ensure maximum refunds. Partner with us for reliable and efficient tax management.

FAQs

1. Who must file a federal tax return in the U.S.?

- Individuals and businesses with taxable income above IRS thresholds are required to file a federal tax return.

2. What is the deadline to file a federal tax return?

- For most taxpayers, the deadline is April 15. Extensions can be requested using Form 4868.

3. How can I file my federal tax return online?

- IRS-approved e-filing platforms allow taxpayers to submit their federal tax return securely and quickly.

4. What forms are used to file a federal tax return?

- The main form is Form 1040. Additional schedules may be needed for income, deductions, and credits.

5. What documents are required to file a federal tax return?

- W-2s, 1099s, records of income, receipts for deductions, and proof of tax credits are commonly required.

6. Do I need to file a federal tax return if I am self-employed?

- Yes, self-employed individuals must file a federal tax return and report income on Schedule C and SE.

7. Can I file a federal tax return for free?

- Eligible taxpayers can use IRS Free File software to e-file their federal tax return at no cost.

8. What happens if I file my federal tax return late?

- Late filing can lead to penalties, interest, and delayed refunds. Timely filing avoids these issues.

9. How can I correct mistakes on a filed federal tax return?

- You can file an amended return using Form 1040-X to fix errors or add information.

10. How do federal tax refunds work after filing a return?

- Refunds are issued if you overpaid taxes. E-filing with direct deposit usually speeds up the process.

11. What deductions can I claim on my federal tax return?

- Common deductions include business expenses, student loan interest, mortgage interest, and medical costs.

12. Are there penalties for underreporting income on a federal tax return?

- Yes, failing to report all taxable income can result in penalties, interest, or audits.

13. Can I file a joint federal tax return with my spouse?

- Yes, married couples can file jointly, which may increase deductions and credits.

14. How is self-employment tax handled on a federal tax return?

- Self-employment tax is reported on Schedule SE and covers Social Security and Medicare contributions.

15. Do I need to file a federal tax return if I had no income?

- Generally, you do not need to file if income is below the filing threshold, but filing may allow you to claim refundable credits.

16. Can I e-file my federal tax return using tax software?

- Yes, IRS-approved tax software can file your federal tax return electronically.

17. How long should I keep copies of my federal tax return?

- Keep returns and supporting documents for at least three years in case of IRS review or audit.

18. Can a tax professional prepare my federal tax return?

- Yes, certified tax professionals can prepare and file your federal tax return accurately.

19. What is the difference between federal and state tax returns?

- A federal tax return reports income to the IRS, while state returns follow different rules and filing requirements.

20. How do I know if I qualify for credits on my federal tax return?

- IRS instructions and tax software can help determine eligibility for credits like the Child Tax Credit or Earned Income Tax Credit.