What Does a Film Production Accountant Do to Manage Accounting in a Better Way?

A film production accountant plays a very important role in every film project. This person looks after all the money matters during the making of a movie or a show. They keep records, manage the budget, track spending, and make sure everything stays under financial control. The film production industry is a very dynamic industry that works on a slightly different model than other industries. This is also reflected in the film industry's accounting. Although there are many similarities in the accounting of the film industry, there are a few different aspects. A film production accountant has to work on a different pattern here.

It is not possible for any of the inexperienced and general accountants to handle the accounting activities of the film industry. A proper, knowledgeable, and experienced accountant who has worked for a film production company can do it. The film production accounting professionals can handle all the activities in a very efficient way.

How does the production accountant work on accounting activities?

The production accountant tracks all the costs involved in the TV and movie shows. They monitor the expenditures made and ensure that all the costs of production are under budget. They have to coordinate with different departments of film production, like production managers, heads of departments, assistant directors, and others. The size of the film production accountant staff will depend on the size of the production.

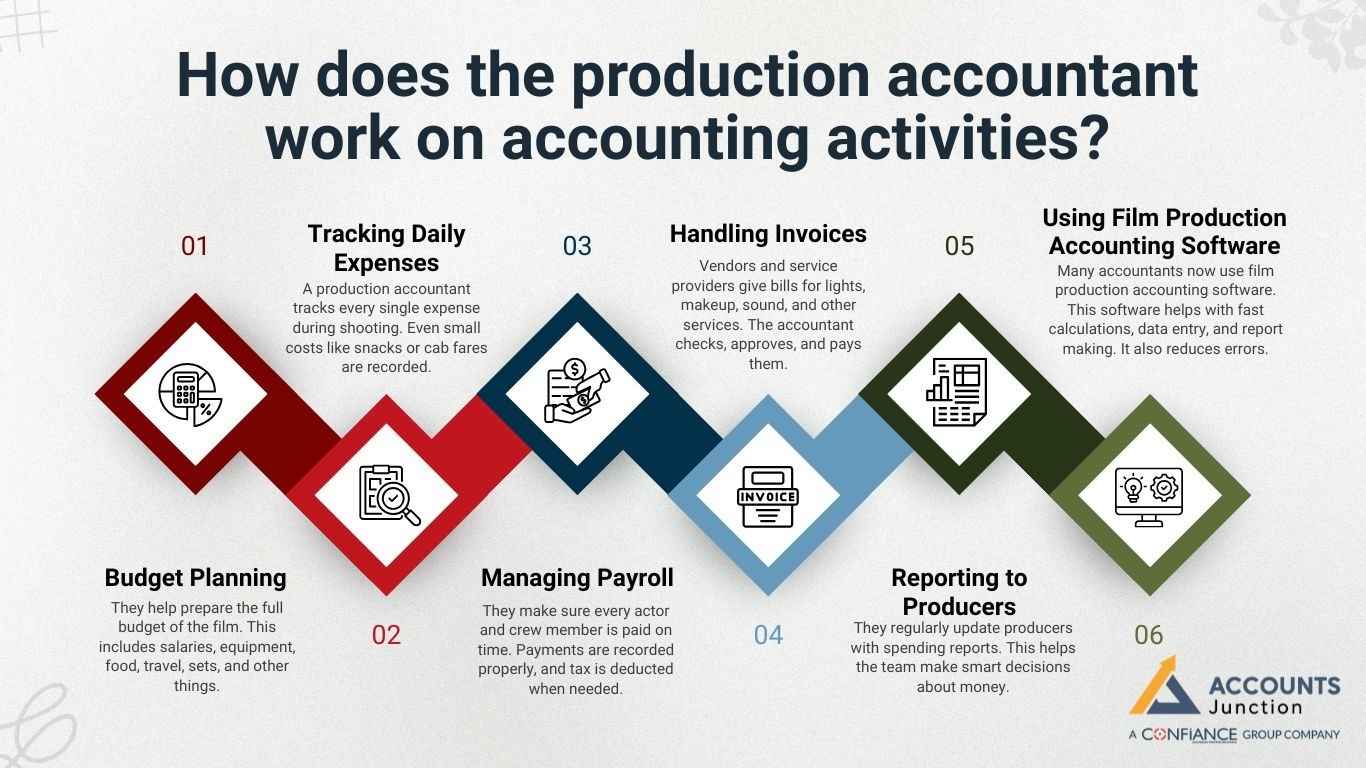

Here are the main tasks of a film production accountant:

1. Budget Planning

- They help prepare the full budget of the film. This includes salaries, equipment, food, travel, sets, and other things.

2. Tracking Daily Expenses

- A production accountant tracks every single expense during shooting. Even small costs like snacks or cab fares are recorded.

3. Managing Payroll

- They make sure every actor and crew member is paid on time. Payments are recorded properly, and tax is deducted when needed.

4. Handling Invoices

- Vendors and service providers give bills for lights, makeup, sound, and other services. The accountant checks, approves, and pays them.

5. Reporting to Producers

- They regularly update producers with spending reports. This helps the team make smart decisions about money.

6. Using Film Production Accounting Software

- Many accountants now use film production accounting software. This software helps with fast calculations, data entry, and report making. It also reduces errors.

What are the similarities and differences between accounting in film production and other industries?

There are certainly many similarities in the accounting of film production and other industries. Some of these similarities include adjustments of projections, tracking the budget, proper noting of financial entries in accounting books, etc.

Some of the important differences between film production accounting and other industries are:

Accounting activities

In other industries, similar activities are continuously happening, while in film production, the accounting for particular TV series and movies will continue until their show is continued.

Budget tracking

It is important for every organization to go as per the budget decided. The budgeting for other types of businesses has a similar pattern that can be followed accordingly. It is also made mostly during the financial year. The budgeting of the film production company will depend on the period during which the TV series or movies will start and end. For film production, there are multiple expenses handled in the budget simultaneously.

Accounting entries in different positions

The accounting entries in other types of businesses are generally in a similar pattern. In film production, the accounting entries are made with different patterns where the cost needs to be properly entered depending on the project type. This will help to determine the cost, revenue, and profit of a particular TV series or movie.

Reporting

The reporting for the general types of industries is mostly similar, which gives insights into the financial aspects of a financial year. Whereas, the reporting in the film production must be done in a different way.

These are some of the main differences in accounting for the general industry and the film industry. Only proper film production accounting professionals can handle the accounting activities properly.

It becomes difficult to find a particular niche accounting expert who can handle these activities. So, outsourcing the accounting to experts can be a better way.

Why a Film Production Accountant Is Important

A film production accountant is as important as the director or producer. Without them:

- The budget can go out of control.

- Payments may be delayed.

- Records can be lost.

- Legal problems may arise due to tax issues.

They ensure the project stays financially healthy.

How Film Production Accounting Software Helps

Managing a film budget by hand is very difficult. That’s why most production accountants now use special tools designed for the film industry. These tools simplify and speed up the financial process.

Here’s how film production accounting software helps:

- Speeds up calculations and saves valuable time.

- Stores and organizes all financial data in a single, easily accessible location.

- Minimizes errors in payments, taxes, and overall bookkeeping.

- Allows real-time tracking of expenses and income.

- Simplifies the process of creating detailed financial reports.

- Provides secure storage and automatic data backup.

- Offers better control over spending and helps avoid budget overruns.

Some advanced software solutions also link directly with payroll systems and tax platforms. This added feature reduces manual work and improves the workflow for any film production accountant.

How to Make Accounting Better During Production

Here are some simple ways to improve accounting in film production:

1. Start with a Clear Budget

- Plan every detail of the budget before shooting starts.

2. Use Good Software

- Using film production accounting software makes the job easier and faster.

3. Keep Receipts

- Every small and big bill should be saved and recorded.

4. Check Reports Weekly

- Look at weekly reports to see if the project is on track.

5. Communicate with the Team

- Regular meetings with the crew help avoid surprises in costs.

Common Challenges Faced by Film Production Accountants

Film production accountants often face unique challenges that may not appear in other industries. Some of these difficulties can include:

- Last-Minute Changes

Scenes may get reshot, or locations may change suddenly, which can push costs up unexpectedly. - Complex Vendor Payments

Multiple vendors need payment at different times, and invoices may arrive late or be incomplete. - Tight Deadlines

Financial reports are often needed quickly so producers can make decisions. - Tax Complications

Film productions may work across states or countries, and tax rules can be tricky. - Communication Gaps

Coordinating with departments like production, casting, and post-production requires constant updates.

Even a skilled accountant can find these situations stressful, but proper systems and software can help manage them efficiently.

Skills That Make a Film Production Accountant Successful

Not every accountant can handle film production. Some skills may help a person succeed in this field:

- Attention to Detail

Small mistakes in expenses or payroll can lead to major problems. - Organizational Skills

Keeping track of budgets, invoices, and receipts requires structured methods. - Technical Knowledge

Knowing how to use film production accounting software is crucial. - Communication Skills

Explaining budget issues to directors or producers clearly can prevent misunderstandings. - Adaptability

Film shoots often change, so accountants must adjust their calculations and reports quickly. - Understanding Film Processes

Knowing how shoots, schedules, and post-production work can make accounting more accurate.

These skills help accountants not just manage numbers but also contribute to smoother film production overall.

Outsourcing Film Production Accounting

Outsourcing accounting tasks has become a common practice in the film industry. It may:

- Reduce Costs

Hiring external accountants may cost less than maintaining a full-time in-house team. - Provide Expert Knowledge

Experienced outsourced accountants may already know common challenges and industry practices. - Save Time

Producers and directors can focus on creative work while accountants handle finances. - Ensure Compliance

External accountants can ensure all tax and legal requirements are met correctly.

By outsourcing to trusted firms, a film production team can maintain financial control and reduce the risk of costly errors.

Real-Life Examples of Accounting Mistakes

Many film projects have failed due to bad accounting. Some examples:

- A film went over budget because the team didn’t track extra shoot days.

- A show had to stop midway because the crew wasn’t paid on time.

- A studio faced fines for not filing taxes properly.

These problems show why a skilled production accountant is needed.

Accounts Junction provides professional remote film production accounting services, allowing you to outsource all your accounting tasks efficiently. We have certified experts in film production accounting who can manage and streamline your financial activities with precision. Our team is fully equipped with advanced accounting software to handle every task accurately. Partner with us for seamless and reliable film production accounting solutions.

FAQs

1. What does a film production accountant do?

- A film production accountant manages all financial aspects of a film, including budgeting, cost tracking, payroll, and reporting for producers and production teams.

2. Why is a film production accountant important for a shoot?

- They ensure the production stays on budget, prevent financial errors, and maintain transparency in spending.

3. What kind of projects do film production accountants handle?

- They work on movies, TV shows, commercials, web series, and other media productions, often managing short-term project budgets.

4. Can a film production accountant work remotely?

- Yes, many productions hire remote accountants who track expenses, prepare reports, and manage payroll without being on set.

5. How does a film production accountant manage budgets?

- They create detailed budgets before filming, track daily expenses, compare actual costs with planned costs, and flag any overruns.

6. What types of expenses does a film production accountant track?

- Salaries, crew travel, equipment rentals, catering, set construction, visual effects, and miscellaneous production costs.

7. Does a film production accountant handle payroll?

- Yes, they calculate crew payments, manage deductions, and ensure everyone is paid accurately and on time.

8. How often do film production accountants provide financial reports?

- Typically weekly, but they may prepare daily reports for large productions or urgent financial decisions.

9. Can a small film production operate without a film production accountant?

- Small productions can manage without one, but risks like overspending, delayed payments, and tax errors increase.

10. What software do film production accountants use?

- Popular tools include Movie Magic Budgeting, Showbiz Budgeting, QuickBooks, and custom production management software.

11. How does a film production accountant handle taxes?

- They calculate payroll taxes, handle vendor tax compliance, and ensure the production follows local tax laws.

12. What’s the difference between a film production accountant and a regular accountant?

- Film accountants manage short-term, project-based budgets with fluctuating costs, unlike regular accountants who handle ongoing business finances.

13. Do film production accountants attend shooting locations?

- Yes, for large or complex productions, they may visit sets to track expenses and resolve financial issues in real time.

14. How can a film production accountant prevent budget overruns?

- By monitoring daily spending, updating reports, and alerting producers to potential financial risks before they escalate.

15. Can film production accountants manage multiple projects simultaneously?

- Yes, they use separate ledgers, software tools, and careful scheduling to handle multiple shoots efficiently.

16. Are outsourced film production accountants effective?

- Yes, outsourcing provides expert financial management while reducing the workload of in-house production staff.

17. What skills are essential for a film production accountant?

- Strong accounting knowledge, familiarity with film budgeting software, attention to detail, and communication with production teams.

18. How does a film production accountant handle unexpected costs?

- They track all expenditures carefully, adjust the budget, and advise producers on cost-saving measures or reallocations.

19. What are common mistakes in film production accounting?

- Missing invoices, not tracking small expenses, delayed reporting, and failing to reconcile accounts regularly.

20. How can someone become a film production accountant?

- Gain accounting experience, learn production-specific software, understand film budgets, and gain hands-on experience in the entertainment industry.