Table of Contents

Financial Analytics: What It Is, How It's Used, and 6 Basic Types

What is Financial Analytics?

Financial Analytics is analyzing financial data to gain insights that help in decision-making, strategy development, and performance tracking. Businesses use financial data analytics to assess profitability, reduce risks, and forecast future trends. By utilizing financial analytics software, companies can efficiently process large amounts of data and make data-driven financial decisions.

How Financial Analytics is Used in Business Decision-Making

Financial analytics plays an important role in shaping business strategies by providing a clear picture of an organization's financial health. Here’s how businesses utilize it:

- Improved Budgeting and Forecasting: Companies analyze past financial data to create accurate budget plans and financial forecasts, ensuring efficient resource allocation.

- Risk Management: Identifies potential risks by analyzing financial trends, helping businesses prepare for uncertainties and mitigate financial threats.

- Profitability Analysis: Determines which products or services generate the most revenue and where improvements are needed to enhance profitability.

- Cash Flow Optimization: Helps businesses track cash inflows and outflows to ensure financial stability and avoid liquidity issues.

- Investment Decisions: Enables companies to evaluate investment opportunities based on data-driven insights, minimizing financial risks.

- Regulatory Compliance: Ensures businesses meet financial regulations by analyzing financial data patterns and preventing legal penalties.

- Operational Efficiency: Identifies cost-saving opportunities and areas where operational processes can be improved for better financial performance.

- Strategic Growth Planning: Assists businesses in making long-term growth decisions by analyzing financial trends and market conditions.

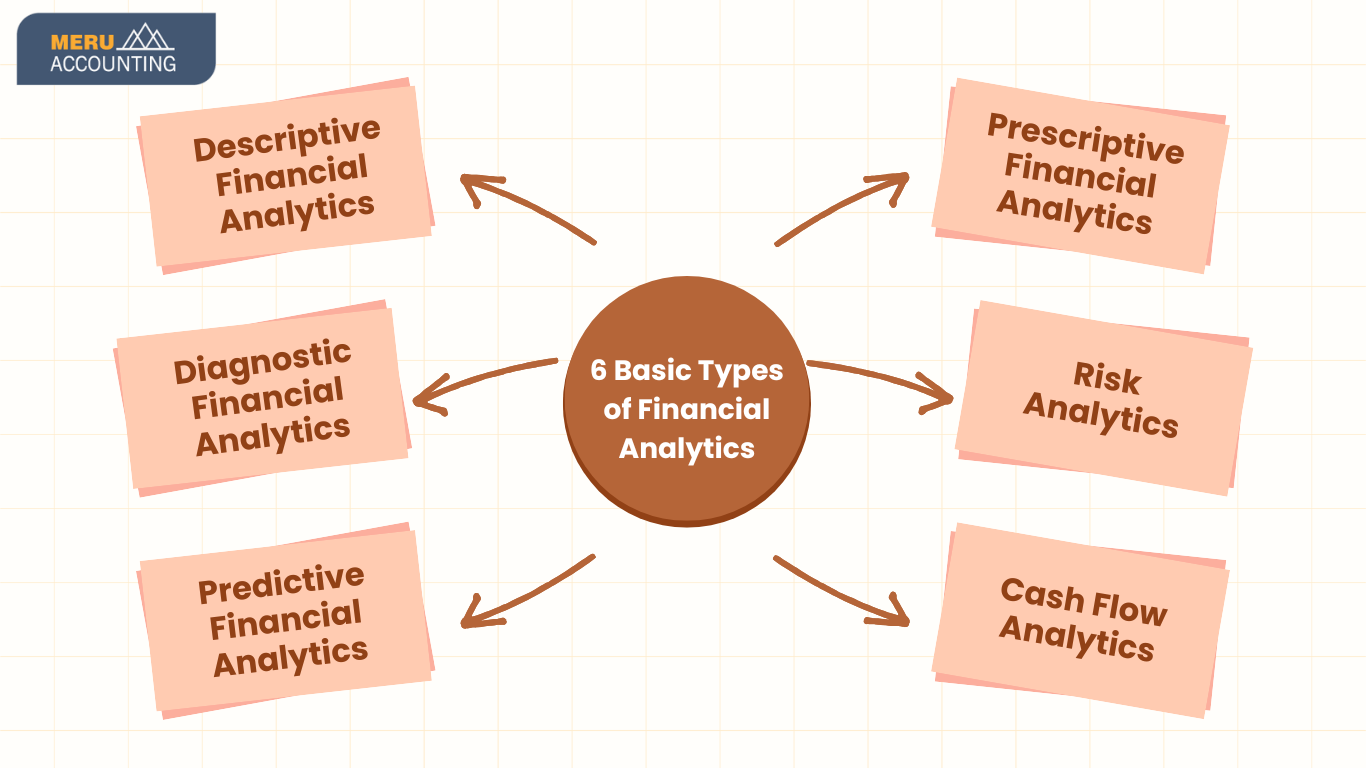

6 Basic Types of Financial Analytics

1. Descriptive Financial Analytics: This type of financial analytics examines past financial data to understand trends and business performance. It answers the question, "What happened?"

2. Diagnostic Financial Analytics: By analyzing financial data in-depth, this method explains why certain financial events occurred. It identifies factors affecting financial performance.

3. Predictive Financial Analytics: Predictive analytics uses historical financial data analytics to forecast future financial outcomes. Businesses use this for risk assessment and strategic planning.

4. Prescriptive Financial Analytics: This approach provides actionable insights based on predictive models. It helps businesses make informed financial decisions by recommending the best course of action.

5. Risk Analytics: Financial risk analytics focuses on identifying and mitigating risks, such as market risks, credit risks, and operational risks. It helps businesses prepare for uncertainties.

6. Cash Flow Analytics: Cash flow analytics ensures that businesses have sufficient cash to meet their obligations. It helps in managing liquidity and maintaining financial stability.

Top Financial Analytics Software

Financial analytics software helps businesses automate data processing and generate accurate reports. Some of the best financial analytics tools include:

- Tableau: A powerful visualization tool for analyzing financial data, enabling businesses to create interactive and dynamic dashboards.

- Microsoft Power BI: Provides business intelligence insights with real-time financial reporting, helping organizations track key financial metrics.

- SAP Analytics Cloud: A comprehensive solution for predictive and prescriptive financial analytics, integrating AI and machine learning for deeper insights.

- IBM Cognos Analytics: Helps businesses analyze financial data and improve decision-making by offering advanced reporting and visualization capabilities.

- Oracle Hyperion: Used for financial planning, budgeting, and forecasting, ensuring accurate financial consolidation and reporting.

- Qlik Sense: Enables businesses to perform self-service financial analytics, uncover hidden patterns, and enhance decision-making.

- Zoho Analytics: A cost-effective analytics tool that provides automated financial reporting and insights for small and medium-sized businesses.

Why Choose Our Financial Analytics Solutions?

Our financial analytics solutions are designed to provide businesses with the insights they need to make informed decisions. Here’s why you should choose us:

- Advanced Financial Data Analytics: We use innovative financial analytics software and AI-driven tools to deliver accurate insights. Our solutions help identify trends, detect anomalies, and optimize financial strategies.

- Customized Solutions: Our services are tailored to meet the specific needs of businesses across various industries. We ensure industry-specific financial insights that align with your unique business model.

- Expert Team: Our team of experienced financial analysts specializes in forecasting, budgeting, and risk analysis. We bring deep industry expertise to enhance financial decision-making.

- Real-Time Reporting: We provide instant access to financial reports and dashboards for timely decision-making. Monitor key financial metrics and detect potential risks before they escalate.

- Cost-Effective: Our solutions are designed to be affordable while delivering high-value financial insights. We provide flexible pricing plans designed to accommodate businesses of all sizes.

- Predictive Analytics & Risk Mitigation: We use predictive analytics to forecast trends and proactively mitigate financial risks. This helps businesses optimize investments and enhance financial stability.

- Seamless Integration with Existing Systems: Our solutions integrate smoothly with QuickBooks, Xero, NetSuite, and Odoo. This ensures easy adoption without disrupting your existing financial systems.

Conclusion

Financial analytics is a powerful tool that enables businesses to make data-driven decisions, enhance profitability, and mitigate financial risks. By utilizing advanced financial analytics software and AI-driven insights, companies can improve budgeting, optimize cash flow, and drive strategic growth. Our financial analytics solutions provide customized, real-time reporting, predictive analytics, and seamless integration with existing systems, ensuring businesses stay ahead in a competitive market. Whether you need to enhance forecasting, manage risks, or improve financial performance, our expert team is here to help you unlock the full potential of financial analytics.

FAQs

1. What industries benefit the most from financial analytics?

Ans: Financial analytics is useful for all industries, including banking, healthcare, retail, manufacturing, and technology. Any business that relies on financial data for decision-making can benefit from it.

2. How does financial analytics improve profitability?

Ans: By analyzing financial data, businesses can identify cost-saving opportunities, optimize pricing strategies, and enhance revenue generation, leading to increased profitability.

3. Can small businesses use financial analytics?

Ans: Yes, Small businesses can use financial analytics software to track expenses, manage cash flow, and make strategic financial decisions.

4. What is the difference between financial analytics and business analytics?

Ans: Financial analytics focuses on financial data, such as revenue, expenses, and cash flow. Business analytics covers a broader range, including marketing, operations, and customer data.

5. How do I choose the right financial analytics software?

Ans: Consider factors such as ease of use, integration with existing systems, reporting capabilities, and cost when selecting financial analytics software.

6. How does Accounts Junction assist with financial analytics?

Ans: Accounts Junction provides data-driven insights, budgeting support, and risk analysis using advanced financial analytics tools.

7. Can Accounts Junction tailor financial analytics solutions for my industry?

Ans: Yes, we customize financial analytics services to meet the unique needs of various industries, ensuring relevant and actionable insights.