Table of Contents

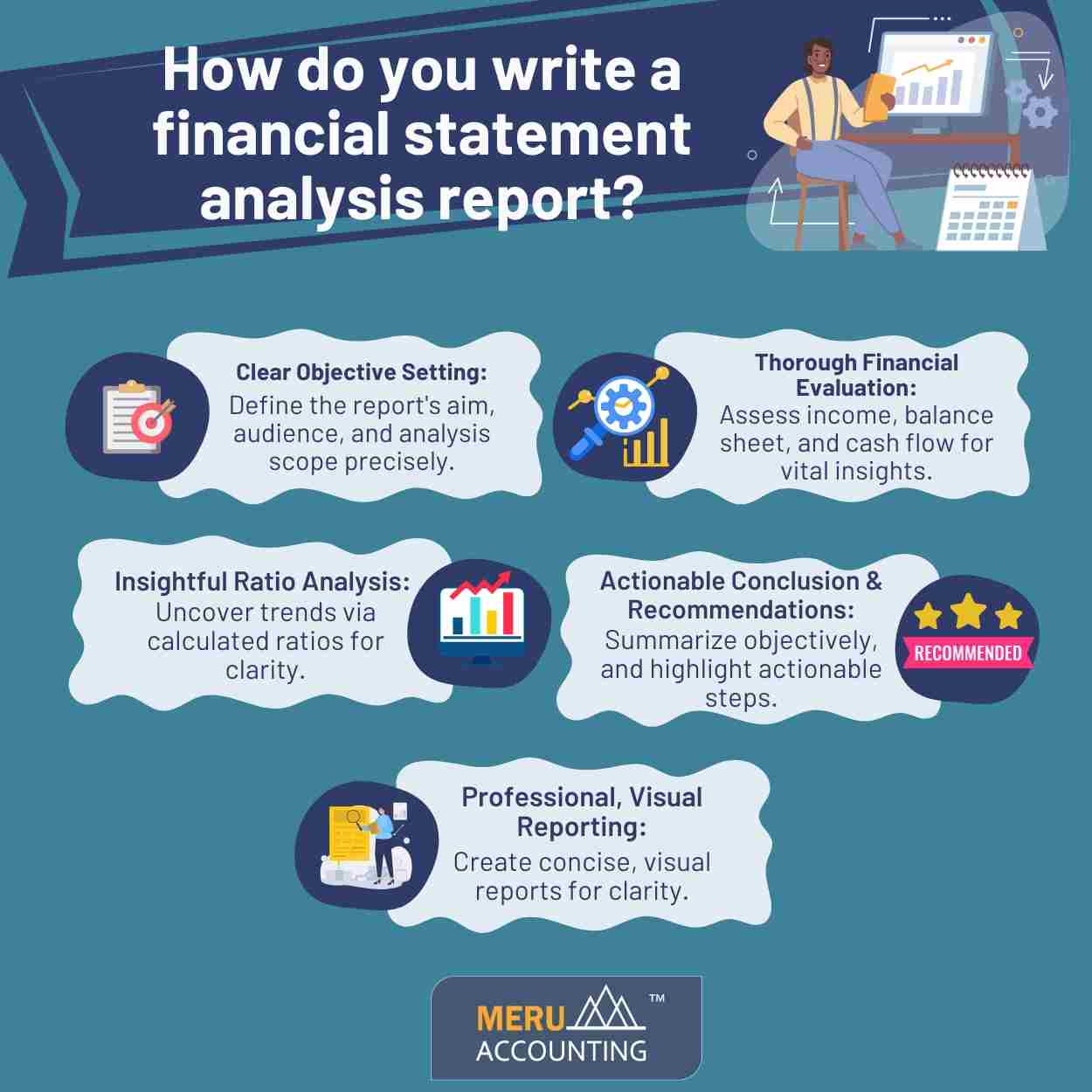

How do you write a financial statement analysis report?

The financial analysis report is a critical tool in the business world, providing a comprehensive understanding of a company’s financial health. A financial statement analysis report dives deep into a company’s financial statements, offering insights into its performance, profitability, and cash flow. Writing a compelling financial statement analysis report requires both technical skill and the ability to weave a captivating narrative.

This guide will equip you with the tools and steps to craft a report that informs, persuades, and empowers stakeholders, whether you're an investor seeking opportunities, a business owner strategizing for growth, or a creditor evaluating risk.

Understanding how to write financial analysis report

Purpose and Scope

Begin by outlining the purpose and target audience of your report. Are you evaluating a potential investment, presenting your company's financial health to lenders, or analyzing internal performance? This objective will dictate the depth and focus of your analysis. Next, define the scope. Will you be analyzing multiple years or focusing on a specific period? Establishing these parameters ensures your report is relevant and impactful.

Examining the Core Statements

The heart of your report lies in dissecting the key financial statements. The income statement reveals the company's profitability and scrutinizes revenue growth, expense trends, and profit margins. The balance sheet paints a picture of financial stability, with a focus on liquidity ratios, debt levels, and asset composition. Finally, the statement of cash flows sheds light on how the company generates and uses cash, a crucial indicator of operational efficiency.

Ratios and Comparisons

Financial statements alone are like raw ingredients; they hold potential but need transformation to reveal their true story. This is where ratio analysis comes in. Calculate relevant ratios like the current ratio, debt-to-equity ratio, and return on equity, and track their trends over time. This unlocks hidden patterns and allows you to compare the company's performance to industry benchmarks or its own historical data. Visual aids like charts and graphs can further enhance the impact of your findings.

Conclusions and Recommendations

Articulate the company's financial strengths and weaknesses, highlighting key trends and their potential implications. Objectivity is key; be mindful of potential biases and ensure your conclusions are well-supported by the data. Finally, consider offering actionable recommendations based on your analysis. Should the company invest in a new venture? Does it need to adjust its financial strategy? Providing valuable insights sets your financial statement analysis report apart as a true decision-making tool.

The financial statement analysis report should be clear, concise, and easy to understand. It should also be objective, presenting the facts without bias. Remember to use professional language and maintain a formal tone throughout the report.

How can Accounts Junction help?

Navigating financial statements can be complex. At Accounts Junction, we understand the value of a well-crafted financial analysis report. Our team of financial experts possesses the experience and expertise to analyze your data with meticulous detail, providing you with comprehensive and insightful reports that illuminate your path forward. Whether you're a novice seeking guidance or a seasoned professional looking for a second opinion, Accounts Junction stands ready to be your trusted partner in demystifying the financial landscape.