Table of Contents

- 1 Introduction to Accounts Outsourcing

- 2 Why Businesses in Singapore Prefer Outsourcing Accounting Services to India

- 3 Benefits of Outsourcing Accounting Services to India

- 4 How to Choose the Best Outsourced Accounting Services in India

- 5 Challenges and Solutions in Accounts Outsourcing

- 6 Why Choose Accounts Junction for Outsourcing Accounting Services?

- 6.1 Conclusion

- 6.2 FAQs

Growth of Accounts outsourcing from Singapore to India

Introduction to Accounts Outsourcing

Accounting outsourcing means giving accounting and bookkeeping work to outside service providers. These providers are often in countries with expert skills and lower costs. Many businesses in Singapore are outsourcing accounting services to India. This is because of skilled professionals, lower costs, and advanced technology support. Globalization has increased the need for businesses to focus on their core tasks. As a result, the demand for outsourcing bookkeeping and accounting services has grown.

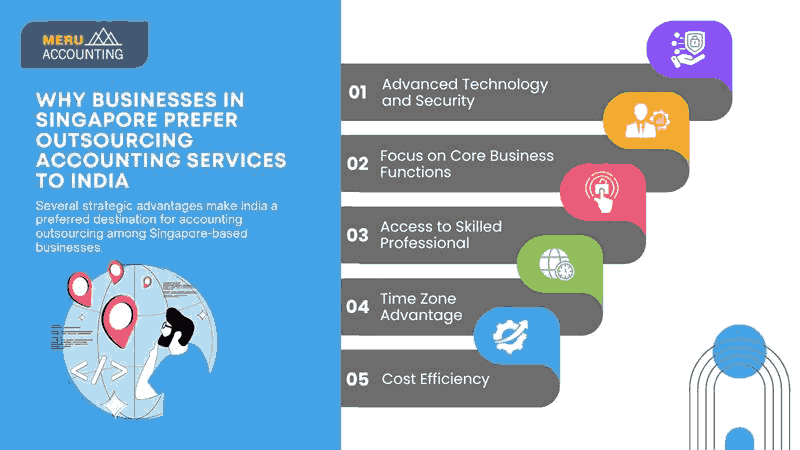

Why Businesses in Singapore Prefer Outsourcing Accounting Services to India

Several factors drive Singapore-based businesses to consider accounts outsourcing to India.

- Cost Efficiency: Outsourcing accounting services to India helps businesses reduce costs associated with hiring full-time employees, training, and infrastructure. The affordable pricing in India does not compromise on quality, making it a cost-effective option.

- Access to Skilled Professionals: India has skilled accountants, Chartered Accountants (CAs), and financial professionals with expertise in international accounting standards, ensuring high-quality financial services for businesses.

- Time Zone Advantage: The time zone difference between Singapore and India allows work to continue after Singapore office hours. This leads to faster turnaround and better efficiency.

- Focus on Core Business Functions: Outsourcing bookkeeping and accounting services helps businesses save time. This allows them to focus on growth, client management, and important decisions.

- Advanced Technology and Security: Indian accounting firms use advanced software like QuickBooks, Xero, and Zoho. They also follow strong data security protocols to ensure accurate and safe financial reporting.

Benefits of Outsourcing Accounting Services to India

Singapore-based companies gain numerous advantages from outsourcing accounting services to India:

- Cost Savings: The most evident benefit is significant cost reduction. Outsourcing eliminates expenses related to recruitment, salaries, employee benefits, and office infrastructure.

- High-Quality Services: The best outsourced accounting services in India adhere to international financial reporting standards, delivering precise, timely, and professional services.

- Scalability: Outsourcing partners in India offer scalable solutions. They help with bookkeeping, payroll, tax preparation, and financial analysis. Services can be adjusted as the business grows.

- Reduced Compliance Risk: Outsourcing accounting services to India helps businesses follow tax laws and financial rules. Experts in India understand international compliance requirements.

- Improved Decision-Making: Reliable financial reports and analysis provided by outsourced partners help business owners make better, data-driven decisions.

- Data Confidentiality and Security: Reputed Indian outsourcing companies have stringent data security policies and use secure servers to protect client data.

How to Choose the Best Outsourced Accounting Services in India

Finding the right partner is crucial for successful accounts outsourcing. Here’s how Singapore businesses can select the best outsourced accounting services in India:

- Check the Company’s Experience: Look for firms with experience in providing outsourcing accounting services to international clients, particularly those in Singapore.

- Evaluate Credentials and Certifications: Verify the qualifications of the team members. Working with firms that have Chartered Accountants and certified professionals ensures better service delivery.

- Technology and Tools: Make sure the outsourcing partner uses the latest accounting software and secure platforms. They should also have tools that match your business needs.

- Customization: Choose a firm that can offer tailored services instead of a one-size-fits-all approach. Every business has unique needs, and the outsourcing firm should adapt to them.

- Reviews and References: Check client testimonials and online reviews. Also, ask for references to make sure the firm has a good track record.

- Transparent Pricing: Make sure the outsourcing partner has clear and transparent pricing structures with no hidden charges.

- Communication and Support: The firm should have a dedicated contact person. They should also provide quick and responsive support for smooth communication.

Challenges and Solutions in Accounts Outsourcing

1. Data Security Concerns: One of the major concerns is the safety of financial data.

Solution: Choose outsourcing firms with strict confidentiality agreements, secure servers, and regular audits to maintain data integrity.

2. Communication Gaps: Different time zones and work cultures can lead to communication delays.

Solution: Set up regular meetings, use collaborative tools, and work with firms experienced in working with international clients.

3. Quality Control: Ensuring consistent quality in outsourced work can be a challenge.

Solution: Choose firms that follow stringent quality checks and provide detailed reports and error-free work.

4. Hidden Costs: Some companies face unexpected charges when outsourcing.

Solution: Always sign contracts with clearly defined pricing and scope of work.

5. Lack of Domain Knowledge: Some service providers may not understand specific industry requirements.

Solution: Partner with firms that specialize in your industry and have domain expertise.

Why Choose Accounts Junction for Outsourcing Accounting Services?

Accounts Junction specializes in outsourcing accounting services from Singapore to India, providing industry-specific expertise and tailored solutions. Our experienced accountants and Chartered Accountants ensure accurate financial reporting using advanced software like Xero, QuickBooks, and MYOB. We offer cost-effective bookkeeping, payroll, tax preparation, and financial consulting while maintaining strict data security. With a dedicated support team, we ensure seamless communication and reliable assistance for Singapore businesses.

Conclusion

Outsourcing accounting services from Singapore to India is a smart move for businesses seeking cost savings, expertise, and efficiency. With advanced technology, skilled professionals, and reliable support, Indian outsourcing firms continue to help businesses focus on growth while managing their finances accurately.

At Accounts Junction, we offer many accounting services. These include outsourced bookkeeping, payroll, tax preparation, and financial analysis. Our team of experts uses the latest accounting tools. We provide secure and customized solutions for your business.

FAQs

Q1. What services can I outsource to India from Singapore?

Ans: You can outsource bookkeeping, payroll processing, tax preparation, accounts payable/receivable management, financial reporting, and compliance services.

Q2. Is it safe to outsource bookkeeping to India?

Ans: Yes, it’s safe to outsource bookkeeping to trusted firms. Make sure they have strong data security policies and confidentiality agreements.

Q3. How do I select the best outsourced accounting services in India?

Ans: Check the firm’s experience, certifications, technology use, client reviews, and pricing structures. Transparent communication and data security should also be priorities.

Q4. How does outsourcing help my business grow?

Ans: Outsourcing accounting services saves time and reduces costs. It also provides expert support, better compliance, and clear financial insights for smart decisions.

Q5. What is the future of accounts outsourcing from Singapore to India?

Ans: The future is bright with growing demand. This is driven by advanced technology, cost savings, skilled talent, and the need for scalable accounting solutions.