Table of Contents

- 1 Introduction to Accounts Receivable Management / AR Management

- 2 Key Features of an Accounts Receivable Management System

- 2.1 1. Automated Invoicing

- 2.2 2. Payment Tracking & Reminders

- 2.3 3. Integration with Accounting Software

- 2.4 4. Credit Risk Assessment

- 2.5 5. Real-Time Reporting & Analytics

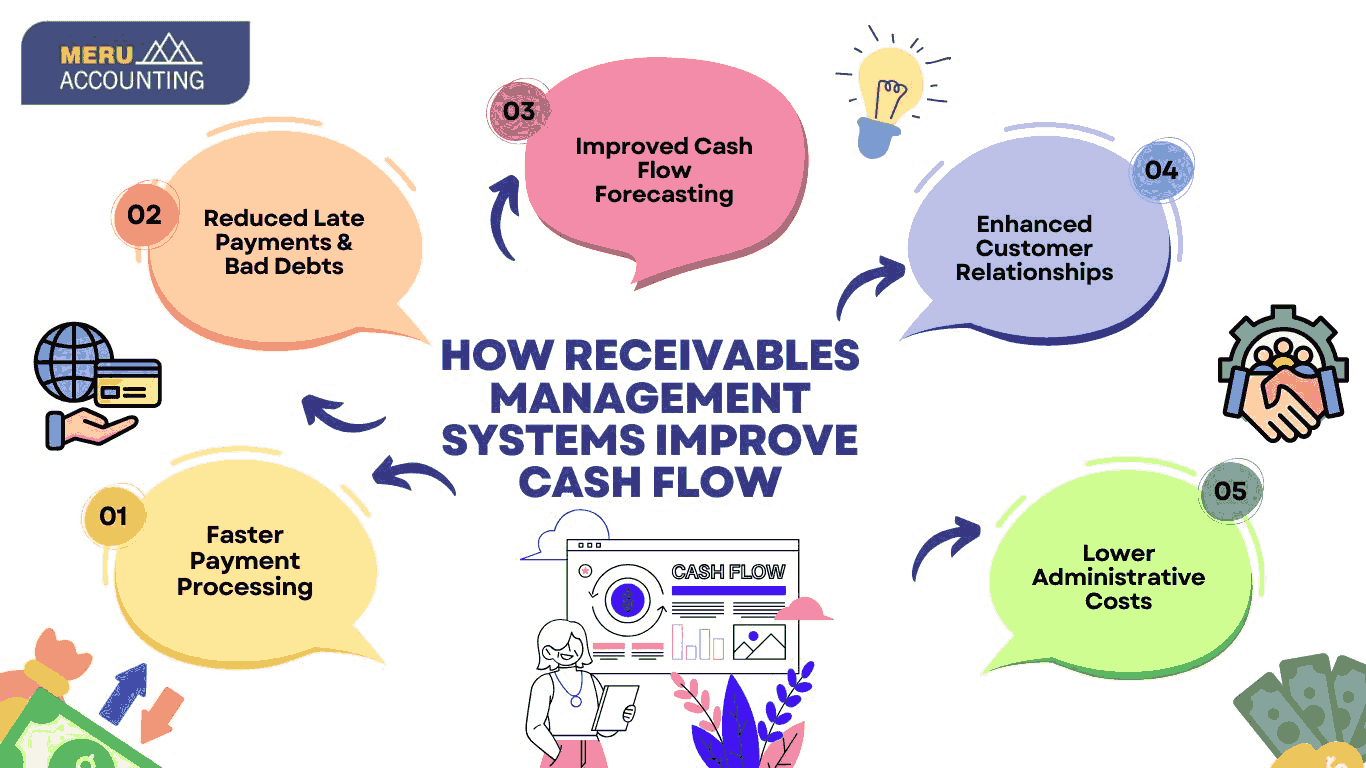

- 3 How Receivables Management Systems Improve Cash Flow

- 3.1 1. Faster Payment Processing

- 3.2 2. Reduced Late Payments & Bad Debts

- 3.3 3. Improved Cash Flow Forecasting

- 3.4 4. Enhanced Customer Relationships

- 3.5 5. Lower Administrative Costs

- 4 The Role of AR Management in Accounting Efficiency

- 4.1 1. Streamlined Financial Recordkeeping

- 4.2 2. Better Compliance & Audit Readiness

- 4.3 3. Real-Time Financial Insights

- 4.4 4. Reduced Discrepancies & Disputes

- 4.5 5. Integration with Business Operations

- 5 Why Choose Accounts Junction for AR Management Services?

- 5.1 1. Industry Expertise

- 5.2 2. Advanced Technology & Tools

- 5.3 3. Dedicated Support & Consultation

- 5.4 4. Cost-Effective & Scalable Solutions

- 5.5 5. Proven Track Record of Success

- 5.5.1 Conclusion

- 5.5.2 FAQs

How Accounts Receivable Management System is beneficial in Accounting?

Introduction to Accounts Receivable Management / AR Management

Effective AR management is crucial for businesses to maintain a healthy cash flow and ensure financial stability. Accounts receivable management systems help businesses track outstanding invoices, reduce overdue payments, and improve overall financial efficiency. Without a structured receivables management system, businesses risk delayed payments, increased bad debts, and cash flow disruptions.

An efficient AR management strategy involves streamlining invoicing, automating payment reminders, and integrating with accounting systems. This approach helps businesses enhance customer relationships while ensuring timely collections. We will discuss accounts receivable management systems. We'll cover key features, cash flow impact, and why Accounts Junction is the best choice.

Key Features of an Accounts Receivable Management System

A well-designed accounts receivable management system provides businesses with essential tools to streamline and automate receivables processes. Here are some key features of an effective receivables management system:

1. Automated Invoicing

- Generates and sends invoices automatically.

- Reduces manual errors and processing time.

- Ensures consistency in billing cycles.

2. Payment Tracking & Reminders

- Tracks outstanding payments and due dates.

- Sends automated reminders for overdue invoices.

- Enhances collection efficiency and reduces payment delays.

3. Integration with Accounting Software

- Syncs with accounting systems like Xero, QuickBooks, and NetSuite.

- Provides real-time financial data for better decision-making.

- Reduces the risk of duplicate entries and manual errors.

4. Credit Risk Assessment

- Evaluates customer creditworthiness before extending credit.

- Helps in reducing bad debts and improving cash flow.

5. Real-Time Reporting & Analytics

- Provides detailed reports on receivables and cash flow trends.

- Identifies slow-paying customers for proactive collection strategies.

- Enhances financial planning and forecasting.

By utilizing these features, businesses can ensure an efficient AR management process, minimizing the risk of unpaid invoices and improving overall financial stability.

How Receivables Management Systems Improve Cash Flow

One of the primary goals of AR management is to enhance cash flow by ensuring timely payments from customers. A robust accounts receivable management system plays a critical role in achieving this by implementing the following strategies:

1. Faster Payment Processing

- Online payment options and automated invoicing speed up the collection process.

- Reduces delays caused by manual invoicing and check payments.

2. Reduced Late Payments & Bad Debts

- Automated reminders encourage timely payments.

- Credit risk assessments help in identifying high-risk customers.

3. Improved Cash Flow Forecasting

- Real-time data from receivables management systems enables better cash flow predictions.

- Businesses can plan expenses and investments with greater accuracy.

4. Enhanced Customer Relationships

- Streamlined billing and payment processes reduce customer disputes.

- Transparency in invoicing fosters trust and long-term business relationships.

5. Lower Administrative Costs

- Automation reduces the need for manual follow-ups and administrative work.

- Businesses save time and resources, allowing focus on growth and expansion.

An effective AR system helps businesses. They can reduce payment delays, lower financial risks, and keep a steady cash flow.

The Role of AR Management in Accounting Efficiency

A well-structured accounts receivable management system contributes to overall accounting efficiency by optimizing cash flow, reducing errors, and improving financial reporting. Here’s how AR management enhances accounting processes:

1. Streamlined Financial Recordkeeping

- Automated data entry minimizes errors in accounts.

- Guarantees precise recording and reconciliation of every transaction.

2. Better Compliance & Audit Readiness

- Proper documentation and recordkeeping improve compliance with financial regulations.

- Easier access to records simplifies the auditing process.

3. Real-Time Financial Insights

- Receivables management systems provide up-to-date financial reports.

- Businesses can monitor their receivables and adjust credit policies accordingly.

4. Reduced Discrepancies & Disputes

- Automated invoicing and tracking reduce billing errors.

- Prompt dispute resolution minimizes financial losses.

5. Integration with Business Operations

- Aligns receivables with overall business financial goals.

- Provides a holistic view of financial health and operational performance.

An efficient AR management strategy not only improves collections but also streamlines accounting operations, ensuring accuracy and compliance.

Why Choose Accounts Junction for AR Management Services?

Choosing the right partner for AR management is crucial for optimizing cash flow and improving financial stability. Accounts Junction offers expert accounts receivable management system solutions tailored to your business needs. Here’s why you should choose us:

1. Industry Expertise

- Experienced professionals with in-depth knowledge of receivables management systems.

- Customized solutions for businesses of all sizes.

2. Advanced Technology & Tools

- Innovative accounts receivable management system software for automation and efficiency.

- Seamless integration with leading accounting platforms.

3. Dedicated Support & Consultation

- Personalized assistance for optimizing your AR management process.

- Regular financial analysis and strategy recommendations.

4. Cost-Effective & Scalable Solutions

- Affordable services tailored to different business needs.

- Scalable solutions that grow with your business.

5. Proven Track Record of Success

- High client satisfaction with improved cash flow and reduced overdue payments.

- Trusted by businesses across various industries.

By partnering with Accounts Junction, businesses can efficiently manage their receivables, enhance financial stability, and focus on growth.

Conclusion

An efficient AR management strategy is vital for maintaining cash flow and ensuring financial stability. By implementing an advanced accounts receivable management system, businesses can automate invoicing, reduce late payments, and enhance financial reporting. Receivables management systems play a crucial role in improving accounting efficiency, reducing administrative burdens, and optimizing cash flow.

Partnering with Accounts Junction ensures expert AR management services customized to your business needs. Our solutions work for all businesses. We help you manage receivables, reduce risks, and achieve financial success.

FAQs

1. What is AR management?

AR management is about tracking and collecting invoices. It ensures timely payments and healthy cash flow.

2. How does an accounts receivable management system improve business efficiency?

An accounts receivable management system automates invoicing, tracks payments, and sends reminders, reducing manual work and improving cash flow.

3. What are the benefits of using receivables management systems?

Receivables management systems offer automation, real-time reporting, reduced errors, and improved cash flow management, making collections more efficient.

4. How can Accounts Junction help with AR management?

Accounts Junction provides expert AR management services, utilizing advanced technology and industry expertise to optimize cash flow and minimize overdue payments.

5. Is an accounts receivable management system suitable for small businesses?

Yes, a good AR system helps small businesses. It streamlines collections, reduces late payments, and improves finances.