Table of Contents

- 1 Tax Planning Services: A Complete Guide to Optimizing Your Taxes

- 1.1 What are Tax Planning Services?

- 2 Importance of Tax Planning for Individuals and Businesses

- 2.1 1. Minimizing Tax Liabilities

- 2.2 2. Enhancing Financial Stability

- 2.3 3. Ensuring Compliance with Tax Laws

- 2.4 4. Facilitating Business Growth

- 2.5 5. Optimizing Investments

- 2.6 6. Retirement Planning

- 3 Key Benefits of Effective Tax Planning

- 3.1 1. Increased Savings

- 3.2 2. Better Cash Flow Management

- 3.3 3. Reduced Risk of Audits

- 3.4 4. Improved Investment Decisions

- 3.5 5. Peace of Mind

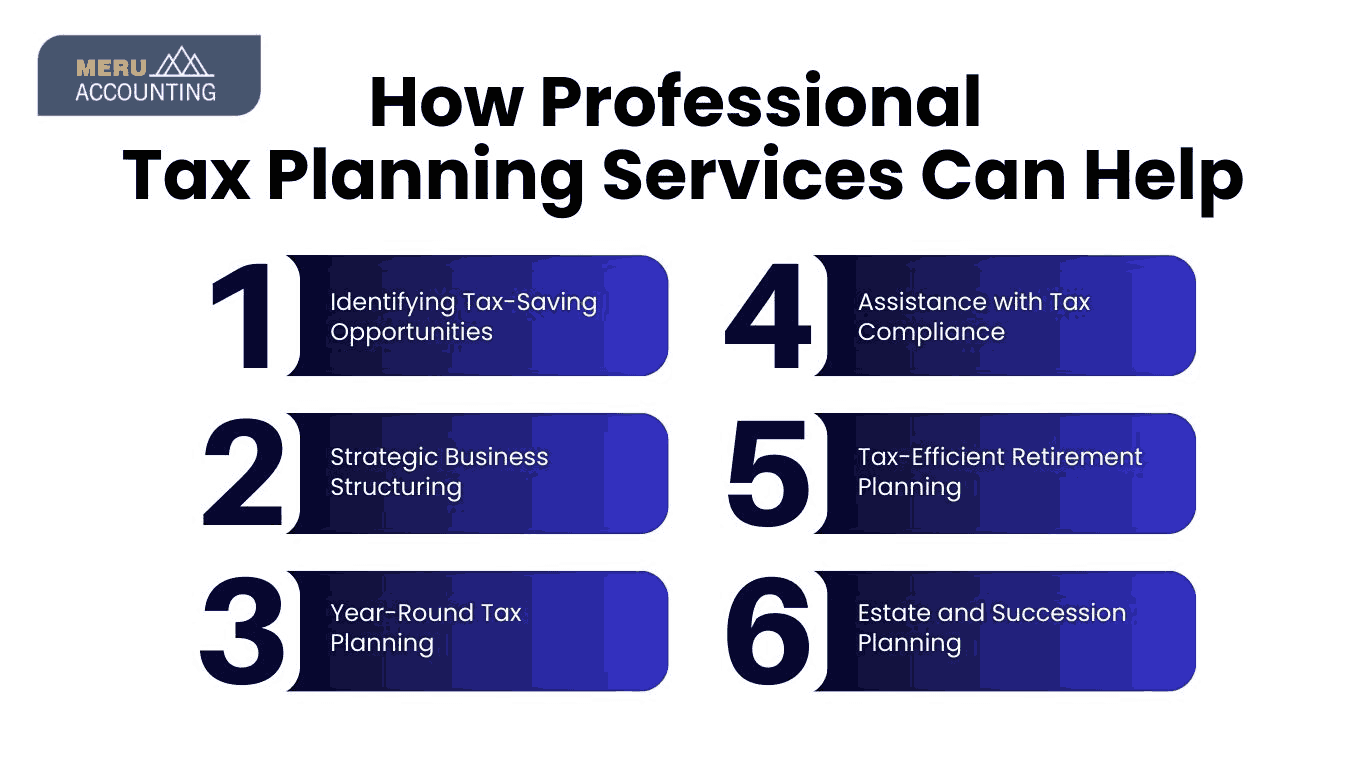

- 4 How Professional Tax Planning Services Can Help

- 4.1 1. Identifying Tax-Saving Opportunities

- 4.2 2. Strategic Business Structuring

- 4.3 3. Year-Round Tax Planning

- 4.4 4. Assistance with Tax Compliance

- 4.5 5. Tax-Efficient Retirement Planning

- 4.6 6. Estate and Succession Planning

- 5 Why Choose Accounts Junction for Expert Tax Planning Services?

- 5.1 1. Expertise in Tax Regulations

- 5.2 2. Customized Tax Strategies

- 5.3 3. Advanced Tax Planning Tools

- 5.4 4. Proactive Tax Planning

- 5.5 5. Transparent and Reliable Services

- 5.6 6. Hassle-Free Tax Filing

- 5.6.1 Conclusion

- 5.6.2 FAQs

How Can Tax Planning Services Shape Your Financial Future?

Tax Planning Services: A Complete Guide to Optimizing Your Taxes

What are Tax Planning Services?

Tax Planning Services involve strategic financial planning to minimize tax liabilities while ensuring compliance with tax laws and regulations. These services help individuals and businesses structure their financial activities efficiently, taking advantage of available tax deductions, credits, exemptions, and legal loopholes. Taxpayers want to avoid overpaying; effective tax planning allows them to reinvest their savings.

Tax planning services analyze income and expenses; they then create the best tax-efficient approach. Tax planners review financial situations; they then offer advice on managing assets and deductions. The service covers income tax and capital gains planning; it also includes retirement and estate tax strategies.

Businesses need to follow corporate tax laws; tax planning services help them reduce burdens through legal deductions. Businesses need to optimize tax efficiency; tailored tax advice helps them increase profitability and growth plans. Individuals and businesses need to avoid penalties; expert guidance helps them stay ahead of tax deadlines.

Importance of Tax Planning for Individuals and Businesses

Individuals and businesses need financial security; proper tax planning provides this and ensures legal compliance. Here’s why tax planning is important:

1. Minimizing Tax Liabilities

Tax planning strategies offer deductions and exemptions, and individuals and businesses can use them to reduce their tax burden.

2. Enhancing Financial Stability

Effective tax planning enables better financial management by forecasting tax obligations and avoiding unexpected liabilities.

3. Ensuring Compliance with Tax Laws

Staying compliant with ever-changing tax regulations is crucial to avoid penalties and legal issues.

4. Facilitating Business Growth

For businesses, tax planning helps in reinvesting savings into operations, expansion, or workforce development.

5. Optimizing Investments

Tax-efficient investment planning helps individuals maximize returns while minimizing tax implications.

6. Retirement Planning

Individuals can utilize tax planning services to optimize contributions to retirement accounts, ensuring long-term financial security.

Key Benefits of Effective Tax Planning

An effective tax planning strategy offers several advantages:

1. Increased Savings

By strategically managing income and deductions, individuals and businesses can save significant amounts in taxes.

2. Better Cash Flow Management

Tax planning ensures businesses and individuals allocate resources effectively to meet tax obligations without financial strain.

3. Reduced Risk of Audits

Accurate tax planning and compliance reduce the chances of errors that may trigger audits from tax authorities.

4. Improved Investment Decisions

Tax-efficient investment strategies help individuals and businesses make informed decisions that align with financial goals.

5. Peace of Mind

With a well-planned tax strategy, taxpayers can avoid last-minute tax filing stress and potential penalties.

How Professional Tax Planning Services Can Help

Engaging professional tax planning services provides expert tax advice tailored to individual or business needs. Here’s how professional tax advisors can help:

1. Identifying Tax-Saving Opportunities

Tax professionals analyze financial situations to identify potential deductions, exemptions, and credits that reduce tax liability.

2. Strategic Business Structuring

For businesses, tax planning services help determine the most tax-efficient legal structure (LLC, S-corp, C-corp, etc.).

3. Year-Round Tax Planning

Unlike last-minute tax filing, ongoing tax planning ensures financial decisions are tax-efficient throughout the year.

4. Assistance with Tax Compliance

Tax professionals ensure compliance with local, state, and federal tax regulations, minimizing legal risks.

5. Tax-Efficient Retirement Planning

Advisors help individuals plan retirement contributions in a way that maximizes tax benefits and long-term financial growth.

6. Estate and Succession Planning

Professional tax planning services assist in structuring estates and business successions to minimize tax liabilities.

Why Choose Accounts Junction for Expert Tax Planning Services?

When it comes to tax planning, choosing the right professionals is key. Accounts Junction offers comprehensive tax planning services with personalized tax advice to meet individual and business needs. Here’s why you should choose us:

1. Expertise in Tax Regulations

Our team stays updated with the latest tax laws to ensure compliance and maximize tax-saving opportunities.

2. Customized Tax Strategies

We develop tailored tax planning strategies based on your unique financial situation and goals.

3. Advanced Tax Planning Tools

We utilize modern tools and software to streamline tax calculations and reporting.

4. Proactive Tax Planning

Unlike reactive tax filing, we provide year-round tax planning services to optimize financial decisions.

5. Transparent and Reliable Services

We ensure transparency in tax planning, providing clear insights into tax obligations and savings.

6. Hassle-Free Tax Filing

With Accounts Junction, tax filing becomes stress-free as we handle all aspects of tax preparation and submission.

Conclusion

Individuals and businesses need financial stability; effective tax planning services play a crucial role in achieving this. By strategically managing income, expenses, and investments, tax planning helps minimize tax liabilities while ensuring full compliance with ever-changing tax regulations. You want to maximize deductions and optimize tax credits; professional tax advice helps you achieve significant savings.

For individuals, tax planning services ensure better wealth management, retirement planning, and estate preservation. Businesses want to reduce their tax burden; they can also improve cash flow and reinvest savings. The complexity of tax laws makes expert guidance essential to navigate tax strategies effectively, avoid penalties, and take full advantage of tax-saving opportunities.

By partnering with experienced professionals, taxpayers can benefit from customized tax planning solutions tailored to their financial goals. Personal finance optimization is important for individuals; tax efficiency is crucial for businesses, and expert tax advice provides significant long-term benefits in both cases. Taking proactive steps today with professional tax planning services will help secure a financially stable and tax-efficient future.

FAQs

1. What is the difference between tax preparation and tax planning?

Tax planning minimizes tax liabilities through financial strategies; tax preparation files returns based on records.

2. Who needs tax planning services?

Both individuals and businesses benefit from tax planning services to ensure compliance and optimize tax savings.

3. In what frequency should I review my tax plan?

It’s advisable to review your tax plan at least annually or whenever there are significant financial changes.

4. Can tax planning help reduce business expenses?

Yes, tax planning identifies deductible business expenses, reducing overall taxable income.

5. How can I start with Accounts Junction’s tax planning services?

You can contact us for a consultation, and our experts will guide you through personalized tax planning strategies.