How cloud accounting is different from traditional accounting

Accounting processes are central to managing business finances effectively. They influence accuracy, speed, and overall operational efficiency. Traditional accounting has relied on local tools for decades. Cloud accounting provides an online, automated approach to financial management.

Each method tracks money differently and affects work procedures uniquely. Choosing the right method may impact cost, team efficiency, and reporting. Businesses must weigh team size, workflow needs, and long-term goals. Understanding these differences allows firms to adopt optimal accounting systems.

What is Traditional Accounting?

- Local Work

Traditional accounting mostly works on local office computers.

Some firms still use paper books and desktop software. - Manual Entry

Most data is typed or written manually by staff.

Repetitive tasks may cause mistakes and slow work. - Limited Access

Data is usually only available in the office.

Remote teams may have trouble checking or changing records. - Time Needed

Reconciliation and reports may take many hours daily.

Slow reporting can delay business decisions or actions. - Physical Security

Files and ledgers must be stored safely in the office.

Extra effort is needed for backup and theft prevention. - Software Updates

Updates are done by IT or staff manually.

Delays may make it harder to follow new rules.

What is Cloud Accounting?

- Online Access

Cloud accounting lets staff check accounts online anytime.

Users can log in from different devices at once. - Automation

Tasks like invoices and reports can run automatically.

Staff save time and reduce errors with automated work. - Real-Time Updates

Data changes instantly for all users in the system.

Reports always show the latest numbers without delays. - Strong Security

Data is coded and backed up online safely.

Permissions can limit who sees or edits records. - Integration

Cloud accounting can link to payroll and tax tools.

It helps all parts of the business work together. - Scalable

Cloud systems can grow with the company’s size.

New teams or sites can be added easily anytime.

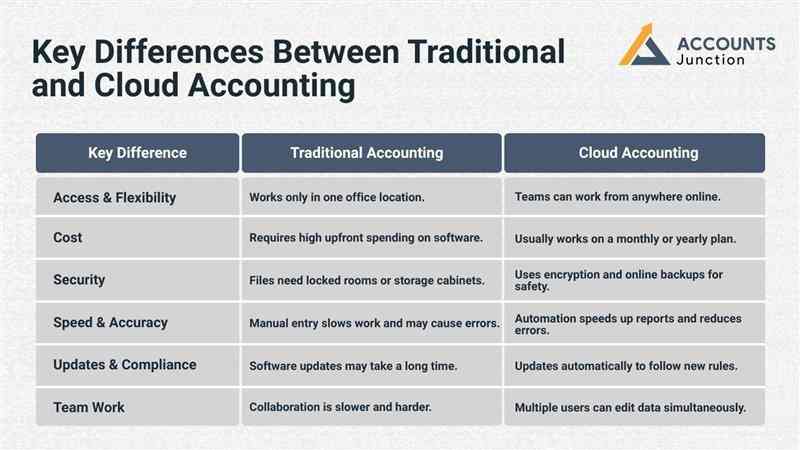

Key Differences Between Traditional and Cloud Accounting

|

Key Difference |

Traditional Accounting |

Cloud Accounting |

|

Access & Flexibility |

Works only in one office location. |

Teams can work from anywhere online. |

|

Cost |

Requires high upfront spending on software. |

Usually works on a monthly or yearly plan. |

|

Security |

Files need locked rooms or storage cabinets. |

Uses encryption and online backups for safety. |

|

Speed & Accuracy |

Manual entry slows work and may cause errors. |

Automation speeds up reports and reduces errors. |

|

Updates & Compliance |

Software updates may take a long time. |

Updates automatically to follow new rules. |

|

Team Work |

Collaboration is slower and harder. |

Multiple users can edit data simultaneously. |

Advantages of Cloud Accounting

Work from Anywhere

- Staff can work from home or any place easily.

- Team can view or change accounts at any time.

Automatic Tasks

- Bills, reports, and checks run on their own.

- Saves time and keeps all data right and true.

Works with Other Tools

- Links easily with payroll, bank, and other apps.

- Keeps all business systems running well together always.

Instant Data

- Reports show current numbers fast for managers’ use.

- Managers can make quick choices with the correct numbers.

Grows with Business

- Cloud systems can add users or locations fast.

- Works well for small teams or large groups.

Fewer Mistakes

- Automatic updates cut errors in accounts and reports.

- Numbers are updated fast, giving more trust in the data.

Save Money

- Cloud service cuts hardware and IT costs clearly.

- Monthly fees are simple to plan for budgets.

Challenges of Cloud Accounting

Internet Needed

- A stable internet is needed to check accounts fast.

- Poor connections can slow down work or access data.

Recurring Fees

- Subscriptions cost money every month or each year.

- Businesses must plan spending for months or years ahead.

Learning

- Staff may need help to use the new software.

- Training shows how to use tools and reports well.

Cyber Risk

- Data may still face online hacks or theft risk.

- Strong passwords and backups help reduce these risks.

Why Traditional Accounting May Still Work

Small Business Fit

- Small firms with simple accounts may use old methods.

- They may not need online tools or fast automation.

Weak Internet

- Some areas have poor internet, limiting cloud use fast.

- Offline systems may stay more stablquicklyr small firms.

Familiarity

- Staff may like paper or known tools for ease.

- Learning new systems can take extra time and cost.

Low Integration Needs

- Some firms do not need links to payroll or tax.

- Old methods may be enough for simple workflows now.

Choosing Between Cloud and Traditional Accounting

- Size

Big firms may gain from cloud tools.

Small firms may not need online tools or extra automation. - Team Location

Teams that work far apart may need cloud access.

Traditional methods can slow down work between offices. - Work Complexity

Complex accounts may benefit from fast, real-time data.

Cloud tools make reporting and tracking easier for large firms. - Growth Plans

Growing firms may need flexible cloud systems.

Old software may limit growth and fast reporting. - Budget

Traditional software may cost a lot upfront.

Cloud subscriptions are small, fixed, and easy to manage.

Cloud Accounting and Tax Rules

Cloud accounting helps businesses follow tax rules. It tracks tax rates and deadlines in real time, making it easier than old methods.

Some tools make tax reports ready, calculate GST or VAT, and connect to government portals. Traditional accounting can do this too, but it needs more manual work and checking.

Benefits for Tax Work

- Faster Tax Preparation: Reports are ready quickly.

- Fewer Mistakes: Automatic math reduces errors.

- Easy Filing: Data can be sent straight to tax portals.

Industry Examples

- Retail

Cloud accounting links sales, stock, and money reports.

This helps managers spot trends and plan stock fast. - Healthcare

Bills, insurance, and rules can be done automatically.

Cloud tools cut mistakes and speed up daily work. - Manufacturing

Costs and budgets update on their own.

Managers can make quick choices with clear data. - Finance

Reports in real time help with checks and rules.

Automation cuts errors and saves staff time. - Hospitality

Many locations can be run from one system.

Staff can see current accounts from any site.

Cloud accounting and traditional accounting differ in key ways. Cloud systems provide automation, online access, and real-time updates. Traditional accounting remains useful for small or offline-focused firms.

Accounts Junction offers expert accounting services for all business types. Our team helps with setup, migration, and day-to-day management. Our Certified experts ensure accurate, secure, and timely financial records. We help businesses streamline accounting and save valuable time. Partner with us for a reliable, scalable accounting solution.

FAQs

1. How does cloud accounting differ from traditional accounting?

- Cloud accounting stores data online and works automatically. Traditional accounting uses local software and manual data entry.

2. Can cloud accounting speed up reporting?

- Yes, reports update right away for all users. Traditional methods may take hours or even full days.

3. Is cloud accounting better for multiple locations?

- Yes, teams in different offices can share the data. Traditional accounting limits access to one office at a time.

4. How does cloud accounting reduce mistakes?

- Automation handles math, invoices, and reconciliations with ease. Traditional accounting relies on manual entry, which may cause errors.

5. Can cloud accounting work with other tools?

- Yes, it links with payroll, tax, and CRM software. Traditional accounting often needs manual steps to connect tools.

6. Which method costs less for small businesses?

- Cloud accounting can cut hardware and IT support costs. Traditional accounting requires high upfront costs and extra setup.

7. How does cloud accounting help decision-making?

- Data updates right away for managers and team members. Traditional accounting needs manual reports that may be slow.

8. Is cloud accounting good for growing businesses?

- Yes, new users or locations can be added easily. Traditional accounting may need new machines or software upgrades.

9. Does cloud accounting help teams work together?

- Multiple users can update accounts at the same time. Traditional accounting may only let one person work at once.

10. How safe is cloud accounting?

- Cloud data is coded and backed up online safely. Traditional accounting uses locks and local backups for protection.

11. Can cloud accounting make audits easier?

- Yes, reports and records are ready for review fast. Traditional accounting needs manual collection of files for audits.

12. Can cloud accounting work for different industries?

- Yes, retail, healthcare, and finance benefit from automation. Traditional accounting may work for small firms with simple needs.

13. How does cloud accounting help with rules and laws?

- Updates happen automatically, keeping systems within new rules. Traditional accounting may lag behind in following new laws.

14. Can cloud accounting reduce staff workload?

- Automation handles routine tasks, freeing staff for other work. Traditional accounting needs manual entry and reconciliation each day.

15. How easy is switching to cloud accounting?

- Experts and tools can make the move smooth and safe. Planning and training prevent data loss or entry mistakes.

16. Can cloud accounting show financial status clearly?

- Dashboards show real-time numbers for fast insight and control. Traditional accounting often needs manual reports for a clear view.

17. Does cloud accounting work on mobile devices?

- Yes, data can be accessed on phones or tablets. Traditional accounting is usually limited to office-based computers.

18. Can cloud accounting track cash flow better?

- Yes, updates happen in real time for clear cash insight. Traditional methods may delay showing how much cash is available.

19. How does cloud accounting handle backups?

- Data is backed up automatically on secure online servers. Traditional accounting needs manual backup to avoid losing files.