How do Outsourced Xero Bookkeeping and Accounting Services work?

Xero accounting software is a cloud-based accounting software designed to help businesses manage their finances easily. It gives business owners real-time access to financial data. They can monitor cash flow, create reports, and work with accountants from anywhere. Xero is popular due to its user-friendly interface, automation features, and seamless integration with third-party applications. If you don’t want to manage your books using Xero yourself, outsourced Xero bookkeeping services makes invoicing, bank reconciliations, payroll, and tax calculations easier. This helps small and medium-sized businesses manage their finances better.

The Growing Trend of Outsourced Xero Bookkeeping Services

Many businesses are moving to outsourced Xero bookkeeping services. This change is due to the growing need for affordable and efficient financial management. Outsourcing bookkeeping tasks allows businesses to focus on core operations while experienced professionals handle financial records. This trend is growing as businesses see the benefits of using expert bookkeeping services. They can avoid the cost of hiring in-house accountants.

What Are Outsourced Xero Bookkeeping Services?

Outsourced Xero bookkeeping involves delegating bookkeeping tasks to a third-party service provider specializing in Xero accounting. These services include bank reconciliations, financial reporting, payroll processing, tax preparation, and accounts payable/receivable management. By utilizing outsourced Xero bookkeeping, businesses can streamline their financial processes, reduce errors, and ensure compliance with accounting standards.

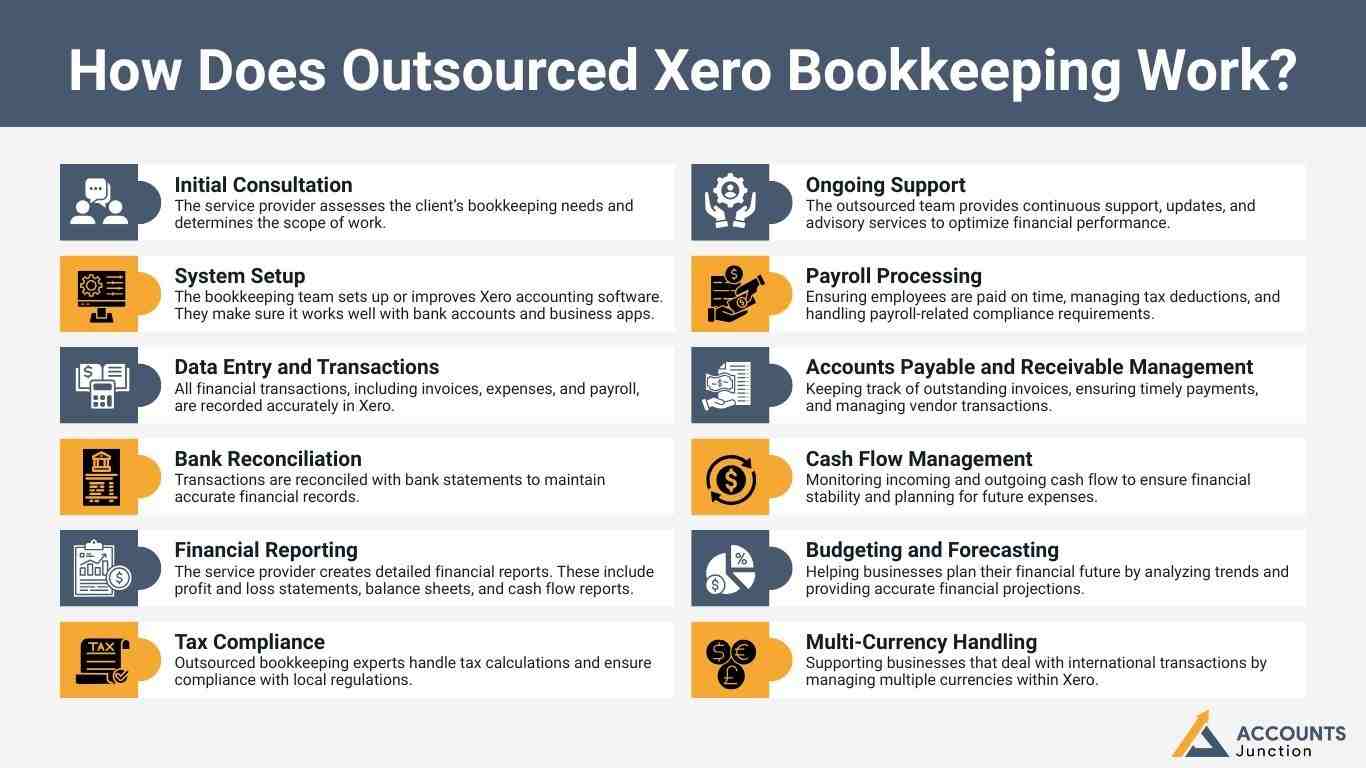

How Does Outsourced Xero Bookkeeping Work?

Outsourcing Xero bookkeeping allows businesses to efficiently manage their finances without needing in-house bookkeeping staff. It follows a structured process:

- Initial Consultation: The service provider assesses the client’s bookkeeping needs and determines the scope of work.

- System Setup: The bookkeeping team sets up or improves Xero accounting software. They make sure it works well with bank accounts and business apps.

- Data Entry and Transactions: All financial transactions, including invoices, expenses, and payroll, are recorded accurately in Xero.

- Bank Reconciliation: Transactions are reconciled with bank statements to maintain accurate financial records.

- Financial Reporting: The service provider creates detailed financial reports. These include profit and loss statements, balance sheets, and cash flow reports.

- Tax Compliance: Outsourced bookkeeping experts handle tax calculations and ensure compliance with local regulations.

- Ongoing Support: The outsourced team provides continuous support, updates, and advisory services to optimize financial performance.

- Payroll Processing: Ensuring employees are paid on time, managing tax deductions, and handling payroll-related compliance requirements.

- Accounts Payable and Receivable Management: Keeping track of outstanding invoices, ensuring timely payments, and managing vendor transactions.

- Cash Flow Management: Monitoring incoming and outgoing cash flow to ensure financial stability and planning for future expenses.

- Budgeting and Forecasting: Helping businesses plan their financial future by analyzing trends and providing accurate financial projections.

- Multi-Currency Handling: Supporting businesses that deal with international transactions by managing multiple currencies within Xero.

Key Benefits of Outsourced Xero Bookkeeping Services

Outsourcing Xero bookkeeping offers businesses a range of advantages, from cost savings to improved financial accuracy. By using expert bookkeeping services, companies can enhance efficiency and focus on their core operations. Below are some key benefits of outsourcing Xero bookkeeping:

1. Cost Savings

- Outsourcing Xero bookkeeping services means you don't need to hire full-time employees. This cuts down on payroll costs, office space expenses, and training costs.

2. Expertise and Accuracy

- Professional bookkeepers have extensive experience with Xero accounting, ensuring accurate and error-free financial records. Their expertise minimizes compliance risks and improves financial decision-making.

3. Time Efficiency

- By outsourcing bookkeeping tasks, businesses save valuable time, allowing them to focus on growth and strategic planning.

4. Scalability

- Outsourced Xero bookkeeping services can be scaled based on business needs, accommodating fluctuations in workload without additional hiring costs.

5. Real-Time Financial Insights

- With cloud access, business owners and stakeholders can check financial health anytime. This helps them make informed decisions using current reports.

6. Security and Compliance

- Reputable outsourced service providers ensure data security and compliance with financial regulations, reducing the risk of fraud and penalties.

Common Pitfalls While Using Xero on Your Own

Not Every Click Goes Right

- Many start using Xero with excitement. But then, small slips begin to appear. A skipped entry here, a wrong tag there, and before long, reports stop making sense.

Mistakes That Often Sneak In

- No Bank Reconciliation: It may seem fine to delay, but mismatched numbers pile up.

- Missed Receipts: A few ignored invoices can distort your true cash picture.

- Wrong Categorization: Classifying wrongly may twist expense reports.

- Ignoring Add-Ons: Some skip Xero’s connected apps that could save hours.

A Gentle Fix That Helps

Letting experts manage your Xero can turn that mess into order. They know the clicks that save time and the steps that prevent errors. With them, your focus may return to what builds your business, not what balances your books.

How Accounts Junction’s Xero Bookkeeping Services Improve Business Performance

Account Junction specializes in providing advanced outsourced Xero bookkeeping services tailored to businesses of all sizes. Here’s how our expertise enhances business performance:

1. Customized Bookkeeping Solutions

- Account Junction offers personalized bookkeeping services that align with business goals, ensuring tailored financial management solutions.

2. Compliance and Accuracy

- Account Junction has a team of skilled accountants. We make sure financial records are accurate and follow tax rules. This helps lower financial risks.

3. Advanced Reporting and Analytics

- Our Xero bookkeeping services provide in-depth financial insights, enabling businesses to track profitability, expenses, and financial trends effectively.

4. Dedicated Support Team

- Clients receive continuous support from experienced professionals, ensuring smooth bookkeeping operations and prompt assistance when needed.

5. Streamlined Financial Processes

- By automating bookkeeping tasks and reducing manual errors, Account Junction helps businesses operate more efficiently and productively.

6. Business Growth Focus

- Outsourcing bookkeeping tasks to Account Junction allows businesses to allocate more resources to expansion and revenue-generating activities.

Outsourced Xero bookkeeping simplifies financial management, offering businesses cost savings, accuracy, and scalability. By eliminating the need for in-house accountants, companies reduce expenses while ensuring compliance and error-free records. Real-time financial insights and automation further enhance efficiency, allowing businesses to focus on growth.

Accounts Junction specializes in providing expert Xero bookkeeping services, helping businesses streamline financial processes, generate accurate reports, and maintain tax compliance. With secure data handling and tailored solutions, they ensure businesses achieve financial stability and efficiency.

FAQs

1. What does outsourced Xero bookkeeping really mean?

- It simply means your daily accounting work gets handled by someone outside your office using Xero. They may manage your bills, receipts, and reports while you stay focused on business.

2. Can Xero bookkeeping be done from anywhere?

- Yes, it can. Since Xero works on the cloud, your data may be viewed or updated from any device with the internet.

3. Why do so many businesses outsource their Xero bookkeeping?

- Most do it to save time and money. Some also want better accuracy and fewer errors in their financial data.

4. Does outsourcing mean I lose control of my books?

- Not at all. You still own your Xero account. The team may only handle the work under your view.

5. How do outsourced bookkeepers connect to my Xero?

- They can log in through secure access that you provide. All actions are recorded and visible to you anytime.

6. Is it safe to share my Xero access with an outside service?

- Yes, when done with trusted providers. Xero uses encrypted connections, and most firms follow strict privacy rules.

7. What kind of work does an outsourced Xero bookkeeper handle?

- They may process invoices, manage payroll, reconcile banks, and prepare tax-ready reports.

8. Can outsourcing help small business owners too?

- Yes, small firms may benefit the most since it saves them from hiring full-time staff.

9. How soon can I see results after outsourcing?

- You may see cleaner records and faster reports within the first month itself.

10. Do outsourced bookkeepers also handle taxes in Xero?

- Many do. They can prepare tax data and ensure filings match local rules.

11. Can my accountant and outsourced bookkeeper work together?

- Yes, both can log in to Xero at once. They may even share live data while discussing reports.

12. What happens if I stop using the service later?

- Your books stay with you. You can keep full access to your Xero files even after the service ends.

13. How can outsourcing improve my financial reports?

- Experts may know how to set clear categories and track data properly, which leads to better, simpler reports.

14. Does outsourcing reduce manual errors?

- It often does. Automation inside Xero plus expert review may catch mistakes early.

15. Can outsourced Xero teams manage multi-currency accounts?

- Yes, Xero supports multiple currencies. They can handle exchange rates and global transactions smoothly.

16. Will my data be backed up automatically in Xero?

- Yes, it usually is. Cloud systems store your data safely so you can recover it anytime.

17. How can I tell if my business needs outsourced Xero bookkeeping?

- If bookkeeping feels like a daily struggle or takes too much time, outsourcing may be the relief you need.

18. Can outsourced Xero services grow as my business grows?

- They can. Most providers adjust the plan as your needs change.

19. What makes Xero different from other accounting tools?

- Xero may feel lighter and easier to use. It connects with many apps and shows live data in a few clicks.

20. How do I choose the right Xero bookkeeping partner?

- Look for experience, good reviews, clear pricing, and a team that understands your business type.