Table of Contents

- 1 What Is Law Firm Bookkeeping?

- 2 Why Accurate Bookkeeping for Law Firms Is Essential

- 3 Common Challenges in Law Firm Bookkeeping

- 4 How Law Firm Bookkeeping Services Improve Financial Transparency

- 4.1 1. Clear and Accurate Financial Reports

- 4.2 2. Organized Records

- 4.3 3. Transparency in Client Trust Funds

- 4.4 4. Account Reconciliation

- 5 Why invest in professional law firm bookkeeping services with Accounts Junction?

- 5.1 Conclusion

- 5.2 FAQs

How Law Firm Bookkeeping Services Enhance Financial Transparency and Compliance?

What Is Law Firm Bookkeeping?

Law firm bookkeeping means recording, tracking, and managing all financial transactions within a law firm. This includes maintaining accurate records of income, expenses, accounts payable, accounts receivable, client trust accounts, and payroll. Law firm bookkeeping ensures the firm follows financial reporting standards and legal requirements. It also provides insights into the business's financial health.

Why Accurate Bookkeeping for Law Firms Is Essential

Proper bookkeeping is essential for law firms' long-term success. Here’s why:

- Tax Compliance: Law firms must adhere to various tax laws and regulations. Accurate bookkeeping ensures the firm complies with tax obligations. This includes income taxes, sales taxes, and payroll taxes.

- Client Trust Account Management: Law firms often hold client funds in trust accounts, which must be tracked Carefully. Bookkeeping for law firms ensures proper handling of these funds, preventing errors and mismanagement.

- Financial Reporting: Accurate financial records allow law firms to produce timely financial statements, making it easier to assess profitability, growth, and overall financial performance.

- Cost Management: Proper bookkeeping helps law firms track operating costs, case-related expenses, and overheads. This makes it easier to manage budgets and allocate resources effectively.

- Regulatory Compliance: Law firms are subject to various regulatory bodies and industry standards. Accurate bookkeeping ensures compliance with these regulations, reducing the risk of legal issues.

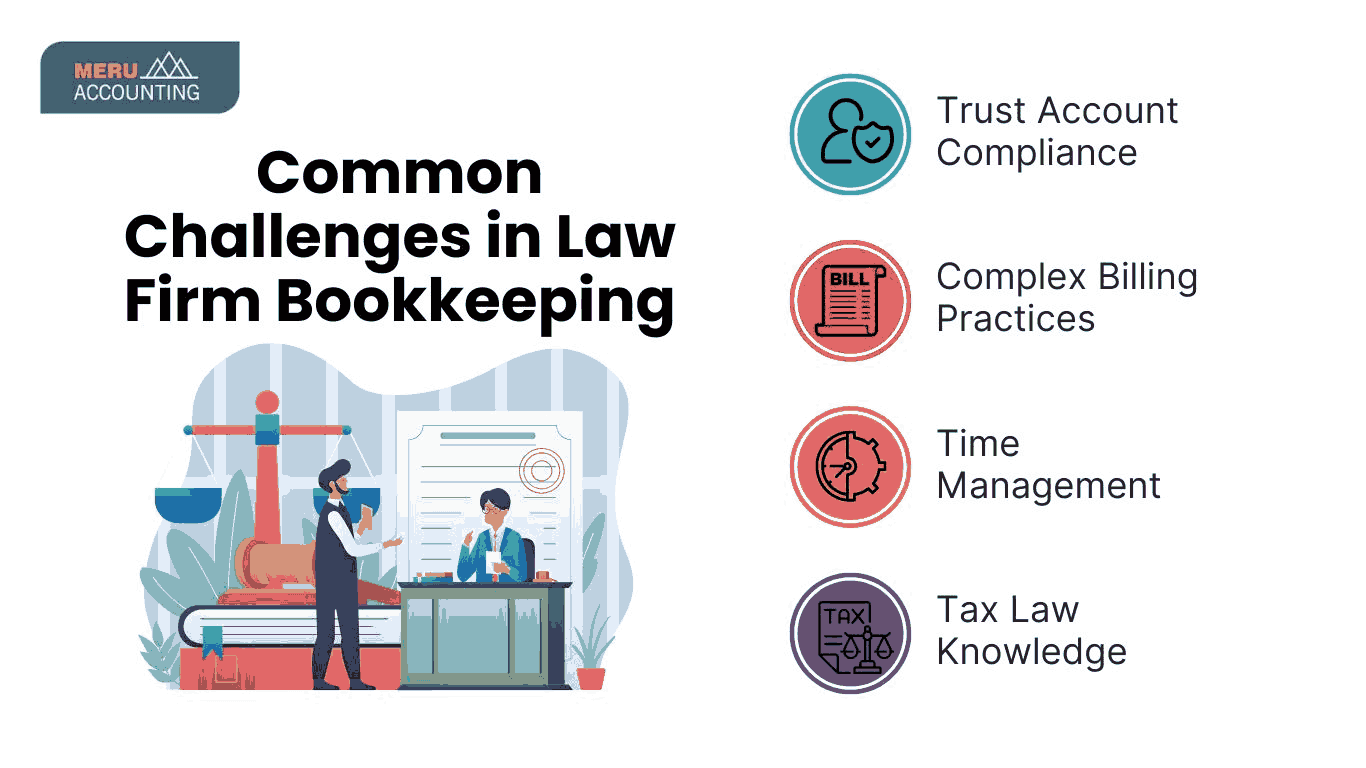

Common Challenges in Law Firm Bookkeeping

Challenges in law firm bookkeeping can affect the firm’s financial health. They can also make it harder to maintain compliance with legal and ethical obligations. Here are the key challenges:

- Trust Account Compliance: One of the biggest challenges for law firms is the management of client trust funds. Trust accounts hold money for clients for specific purposes, like retainer fees or settlements. They must be carefully tracked to keep client and firm funds separate. This not only ensures ethical handling of client money but also prevents legal penalties.

- Complex Billing Practices: Law firms typically have diverse and intricate billing practices that differ from standard business models. Law firms manage complex financial records and navigate intricate tax laws. These tasks require careful attention to detail. Managing different billing structures requires accuracy to invoice clients correctly. It also ensures retainers are handled properly and contingency payments are recorded after the case ends.

- Time Management: Lawyers and legal staff are often overwhelmed with their daily tasks. This leaves them with little time for careful bookkeeping. Legal professionals focus on serving clients, managing cases, and achieving legal outcomes. As a result, administrative tasks like bookkeeping can be overlooked. Some firms try to manage their finances on their own, but this can cause inefficiencies or missed deadlines. They may fail to track payments and receipts or delay financial reporting.

- Tax Law Knowledge: Law firms manage complex financial records and navigate intricate tax laws. These tasks require careful attention to detail. Understanding the nuances of tax laws specific to the legal industry can be overwhelming. For example, law firms need to know which legal expenses are deductible. They also must understand the tax impact of client settlements and manage payroll taxes for employees.

How Law Firm Bookkeeping Services Improve Financial Transparency

Professional law firm bookkeeping services can significantly improve financial transparency in several ways:

1. Clear and Accurate Financial Reports

Outsourcing bookkeeping to experts guarantees that your financial reports are not only detailed but also easy to understand. Real-time financial reporting allows for up-to-date insights into income, expenses, and cash flow. This clarity in financial reporting helps law firms make informed decisions and improves overall business planning.

2. Organized Records

One of the key advantages of professional bookkeeping is the systematic organization of financial records. This organization makes it simpler to trace financial transactions, review account balances, and verify details of past activities. Law firms must keep organized records to meet legal requirements. This helps reduce the risk of errors.

3. Transparency in Client Trust Funds

A law firm's handling of client trust funds is one of its most critical financial responsibilities. Professional bookkeeping services ensure that client trust funds are tracked with the utmost accuracy. Bookkeepers handle deposits, withdrawals, and balances in a way that allows easy monitoring of each transaction.

4. Account Reconciliation

Regular account reconciliation is important for accuracy. It makes sure a firm’s financial statements match the actual transactions. This process minimizes the chances of errors, discrepancies, or fraudulent activities going unnoticed. Bookkeeping services can catch and resolve discrepancies quickly through routine reconciliations. This prevents the buildup of financial inconsistencies.

Why invest in professional law firm bookkeeping services with Accounts Junction?

Investing in Accounts Junction’s professional law firm bookkeeping services offers numerous advantages:

1. Expertise in Legal Accounting: Accounts Junction specializes in law firm bookkeeping. We manage client trust accounts, follow regulatory requirements, and prepare accurate financial statements.

2. Time-saving: Outsourcing bookkeeping tasks allows law firm staff to focus on core legal work. This improves productivity by reducing time spent on administrative tasks.

3. Compliance Assurance: Our bookkeeping services help law firms stay compliant with tax laws and regulations. This helps them avoid penalties and legal issues.

4. Cost-Effective: Hiring an in-house bookkeeper can be expensive. Outsourcing bookkeeping services is a more affordable and scalable option for law firms of all sizes.

5. Customized Solutions: Accounts Junction provides customized bookkeeping solutions for law firms of all sizes. We offer personalized support to meet each firm's unique needs.

Conclusion

In law firms, bookkeeping is crucial for maintaining financial transparency. It also ensures compliance with the strict regulations that govern legal practices. Accurate and efficient bookkeeping makes tax preparation and financial reporting easier. It also helps prevent errors and penalties that could damage a firm’s reputation and legal standing. At Accounts Junction, we offer expert bookkeeping services to improve the financial health of law firms. Our customized solutions help save time, reduce costs, and enhance efficiency.

FAQs

1. What is the difference between law firm bookkeeping and general business bookkeeping?

Ans: Law firm bookkeeping follows specific legal requirements, such as managing client trust accounts. It also ensures compliance with ethical obligations, which are not common in regular business bookkeeping.

2. How do professional bookkeeping services ensure trust account compliance?

Ans: Professional bookkeeping services like Accounts Junction understand the rules of trust account management. They ensure client funds are handled separately and accurately.

3. Can outsourcing bookkeeping services help reduce operational costs?

Ans: Yes, outsourcing bookkeeping helps law firms save on hiring costs. It also ensures accurate and compliant financial management.

4. Is it possible to integrate law firm bookkeeping with other financial software?

Yes, many law firm bookkeeping services integrate with accounting software like QuickBooks or Xero. This helps streamline the financial management process.