Table of Contents

- 1 Why Businesses Are Outsourcing Accounting to India

- 2 Key Benefits of Outsourcing Accounting to India

- 2.1 1. Cost Savings

- 2.2 2. Access to Skilled Professionals

- 2.3 3. Scalability and Flexibility

- 2.4 4. Time-Zone Advantage

- 2.5 5. Compliance and Expertise

- 3 What Factors Influence the Cost of Outsourcing Accounting to India?

- 3.1 1. Type of Service Required

- 3.2 2. Complexity of Accounting Needs

- 3.3 3. Technology and Software Used

- 3.4 4. Engagement Model

- 3.5 5. Experience and Reputation of the Provider

- 4 Breakdown of Costs for Outsourcing Accounting Services to India

- 5 How to Choose the Best Outsourcing Accounting Provider in India?

- 6 Why Choose Accounts Junction for Outsourcing Accounting Services to India?

- 6.1 Conclusion

- 6.2 FAQs

How much Do Accounting Outsourcing Services To India Cost?

Why Businesses Are Outsourcing Accounting to India

Outsourcing accounting services to India has become a strategic move for businesses worldwide. Companies are looking for cost-effective, high-quality financial management solutions, and India provides skilled professionals who can handle accounting, bookkeeping, and tax preparation efficiently. With advanced technology and compliance expertise, outsourcing accounting to India helps businesses streamline operations and reduce overhead costs.

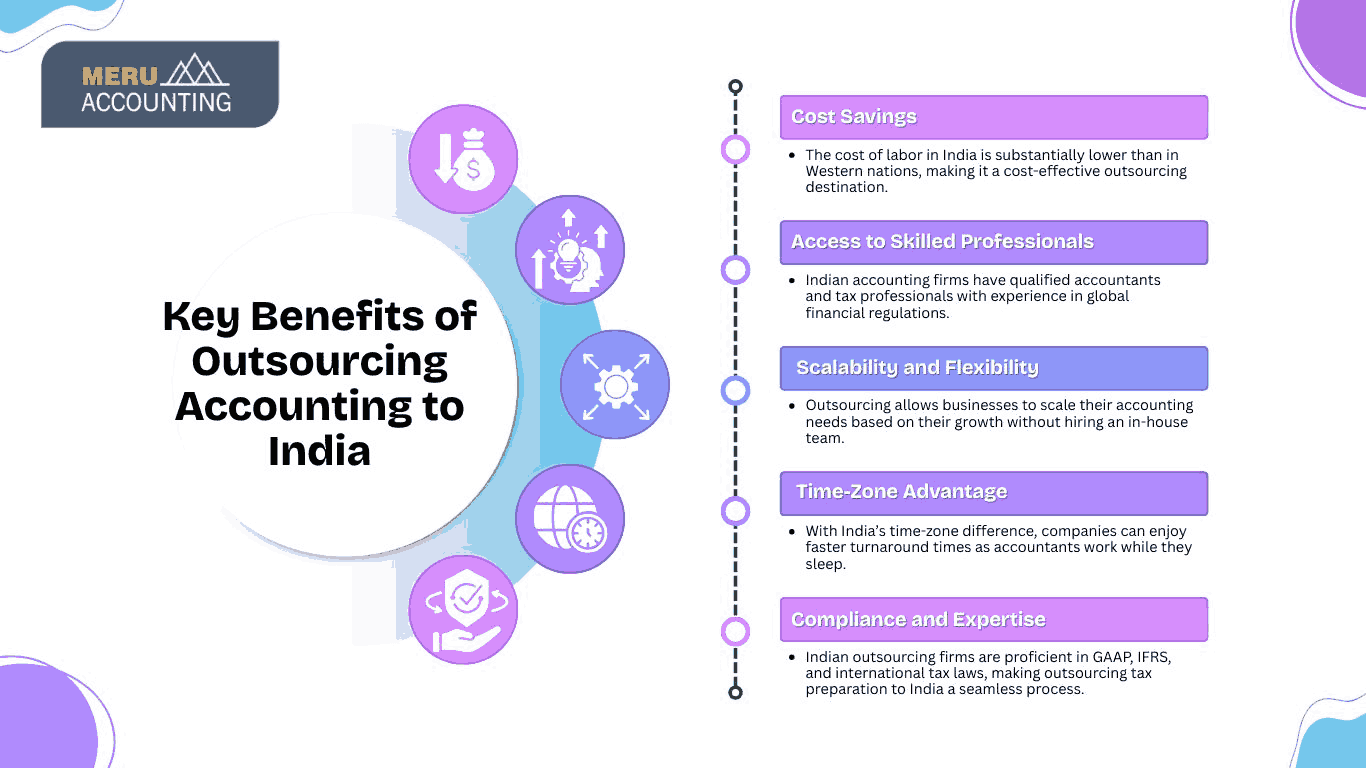

Key Benefits of Outsourcing Accounting to India

Businesses across various industries have recognized the multiple advantages of outsourcing accounting to India. Some of the key benefits include:

1. Cost Savings

- The cost of labor in India is substantially lower than in Western nations, making it a cost-effective outsourcing destination.

- Businesses save up to 50%-70% on accounting expenses.

2. Access to Skilled Professionals

- Indian accounting firms have qualified accountants and tax professionals with experience in global financial regulations.

3. Scalability and Flexibility

- Outsourcing allows businesses to scale their accounting needs based on their growth without hiring an in-house team.

4. Time-Zone Advantage

- With India’s time-zone difference, companies can enjoy faster turnaround times as accountants work while they sleep.

5. Compliance and Expertise

- Indian outsourcing firms are proficient in GAAP, IFRS, and international tax laws, making outsourcing tax preparation to India a seamless process.

What Factors Influence the Cost of Outsourcing Accounting to India?

While outsourcing accounting services to India is cost-effective, several factors impact the overall pricing. These include:

1. Type of Service Required

- Basic bookkeeping is cheaper than full-fledged financial planning and reporting.

- Services like payroll processing and tax preparation may have different pricing structures.

2. Complexity of Accounting Needs

- Large corporations with multiple subsidiaries will pay more than small businesses.

- Specialized financial reports or audits may cost extra.

3. Technology and Software Used

- If businesses require the use of specific accounting software like QuickBooks, Xero, or SAP, the cost may vary.

4. Engagement Model

- Hourly Model: Businesses pay per hour for services.

- Fixed Monthly Model: A predetermined fee is charged monthly.

- Project-Based Model: Cost is determined based on specific tasks.

5. Experience and Reputation of the Provider

- Established firms with a strong global presence may charge slightly higher fees than new outsourcing providers.

Breakdown of Costs for Outsourcing Accounting Services to India

Outsourcing accounting services to India involves various cost components depending on the nature and scope of the services required.

1. Labor Costs: The cost varies based on the experience and qualifications of the accounting professionals. Junior accountants cost less, while mid-level and senior accountants, including CPAs and CAs, charge higher rates. Businesses can also opt for dedicated accounting teams for full-time support.

2. Software and Technology Costs: Accounting firms use cloud-based accounting software such as Xero, QuickBooks, Zoho Books, Sage, or NetSuite. Costs may include software subscriptions, enterprise resource planning (ERP) systems, and cloud storage services. The pricing varies based on the number of users and the complexity of the software.

3. Service-Based Costs

The cost of outsourcing depends on the type of accounting services needed:

-

Bookkeeping: Covers daily financial transactions, bank reconciliations, and ledger management.

-

Payroll Processing: Charges are based on the number of employees and pay cycle frequency.

-

Tax Preparation and Compliance: Includes tax return filing, compliance management, and advisory services. Costs vary depending on business size and tax complexity.

-

Financial Reporting and Analysis: Includes budget forecasting, profit & loss analysis, and financial statements preparation.

-

Accounts Payable/Receivable Management: Charges depend on transaction volumes and invoicing frequency.

4. Infrastructure Costs: Outsourcing firms invest in high-speed internet, cloud hosting, cybersecurity measures, and communication tools like Zoom, Slack, or Microsoft Teams. These costs are often included in service pricing or may be charged separately.

5. Hidden Costs & Additional Charges

-

One-Time Setup Fees: Includes initial onboarding, account setup, and system integration.

-

Data Migration: If transitioning from another system, there may be costs for data transfer and validation.

-

Customization & Integration: For businesses requiring tailored financial reporting, ERP integration, or workflow automation, additional customization charges may apply.

How to Choose the Best Outsourcing Accounting Provider in India?

When choosing an outsourcing partner, it is essential to consider the following factors.

- Industry Experience: Choose a provider with expertise in your sector to ensure compliance with industry-specific regulations and financial best practices.

- Technology and Security: Ensure the firm follows strict data protection policies and uses secure accounting software to safeguard sensitive financial data.

- Reputation and Reviews: Check client testimonials and ratings on third-party platforms to assess the provider’s credibility and service quality.

- Pricing Transparency: Avoid hidden costs by ensuring a clear pricing structure and well-defined service agreement before committing.

- Scalability and Support: The provider should offer flexible solutions that can adapt and scale with your business growth over time.

Why Choose Accounts Junction for Outsourcing Accounting Services to India?

Accounts Junction is a trusted name in outsourcing accounting services to India, offering comprehensive solutions to businesses across the globe. Here’s why businesses choose us:

- Cost-Effective Solutions: We provide affordable accounting services with transparent pricing. There are no additional costs or unexpected fees.

- Experienced Accounting Professionals: Our team is experienced in US, UK, Canadian, and Australian accounting. We guarantee precision and adherence to local regulations.

- Advanced Technology: We use top accounting software like QuickBooks, Xero, Sage, and Zoho Books. This ensures smooth financial management and reporting.

- Compliance and Security: We follow international financial regulations and data security standards. We keep your financial information secure and confidential.

- Custom Solutions for Every Business: We customize solutions for bookkeeping, payroll, and tax preparation. Our services fit businesses of all sizes and industries.

Conclusion

Outsourcing accounting to India is a smart choice for businesses looking to reduce costs, access skilled professionals, and enhance financial efficiency. With flexible engagement models, advanced technology, and strict compliance standards, Indian firms offer reliable and secure accounting solutions. Outsourcing tax preparation to India has proven to be beneficial for businesses and accounting firms worldwide. Accounts Junction excels by providing cost-effective, customized services with a strong focus on accuracy and data security, making it a trusted partner for global businesses.

FAQs

1. How much can I save by outsourcing accounting to India?

Ans: Businesses save between 50%-70% on accounting costs by outsourcing to India.

2. Is outsourcing tax preparation to India reliable?

Ans: Yes, Indian firms follow international tax laws and use secure systems to handle tax compliance effectively.

3. Can I outsource only specific accounting tasks?

Ans: Absolutely. You can choose only bookkeeping, payroll, tax preparation, or a combination of services.

4. What accounting software do Indian firms use?

Ans: Most firms use QuickBooks, Xero, Sage, Zoho Books, and NetSuite, among others.

5. Why is Accounts Junction a preferred choice for outsourcing accounting?

Ans: Accounts Junction offers cost-effective solutions, experienced professionals, advanced technology, compliance, and customized services.

6. Does Accounts Junction support businesses in multiple countries?

Ans: Yes, Accounts Junction specializes in US, UK, Canadian, and Australian accounting regulations and compliance.

7. What accounting software does Accounts Junction use?

Ans: Accounts Junction utilizes QuickBooks, Xero, Sage, and Zoho Books for seamless financial management and reporting.