How to convert Myob to Xero

Switching your accounting software from Myob to Xero can help your business manage books better and faster. Both systems are good, but Xero is more flexible and easier to use. It allows smooth online access and real-time updates, which help in quick financial decisions.

Many small and medium businesses now choose Xero for its automation and cloud features. This guide will show you how to convert Myob to Xero step by step. You’ll learn how to prepare, move, and check your data safely while keeping everything simple and clear.

Why Move from Myob to Xero

Switching from Myob to Xero helps your business gain efficiency and better control. Below are key reasons to make the switch.

1. Cloud-Based Access

You can use Xero from anywhere and on any device.

It helps business owners and teams work remotely with ease.

2. Real-Time Updates

All transactions update automatically and instantly in Xero.

You get live financial data to make fast business choices.

3. Easy to Use

The interface of Xero is simple and clear to understand.

You don’t need deep accounting knowledge to manage it well.

4. Smart Reports

Generate clear reports that give accurate business insights.

These reports help plan budgets and track overall growth.

5. Strong Integrations

Xero connects with hundreds of business tools and apps.

It makes your daily accounting work faster and more flexible.

6. Better Automation

Xero reduces manual tasks with automation tools and feeds.

This helps save time and lowers the chances of human mistakes.

Before You Convert Myob to Xero

Proper preparation ensures smooth and error-free data migration. Before you move, follow these steps to clean and prepare your data.

1. Review Myob Data

Go through all accounts and ensure they are updated.

Remove errors, missing entries, and reconcile all transactions.

2. Take Data Backup

Always create a complete backup of your Myob files.

Keep a copy in a safe cloud or local drive for safety.

3. Clean Chart of Accounts

Check your chart of accounts for duplicates or extra names.

Simplify your list to make the transfer cleaner and faster.

4. Verify Invoices and Bills

Confirm all open invoices and bills before migration.

List all unpaid items to avoid confusion during import.

5. Choose Migration Date

Select a start date that aligns with your accounting period.

Most businesses pick the start of a month or fiscal year.

Methods to Move from Myob to Xero

There are three main methods to move your data safely. Choose the one that fits your time, skills, and data size.

1. Manual Migration

You can manually convert Myob to Xero if you prefer full control.

Export your reports, lists, and balances from Myob and enter them in Xero.

Pros:

- Full control of what data moves to Xero.

- Great for small files or few transactions.

Cons:

- Time-consuming and prone to manual errors.

- Needs more care and double-checking of entries.

2. Using Conversion Tools

Several tools help businesses move from Myob to Xero easily.

Tools like Jet Convert, Movemybooks, and MMC Convert automate the job.

Pros:

- Fast, accurate, and less manual work is needed.

- Saves time for medium and large-sized files.

Cons:

- Customization options are sometimes limited.

- Some tools charge extra for added features.

3. Hiring a Professional

Professional help ensures that you convert Myob to Xero without errors.

Experts handle data mapping, import, and testing for accuracy.

Pros:

- Safe, stress-free, and clean migration process.

- Full post-migration checks and support.

Cons:

- Slightly higher cost but ensures better accuracy.

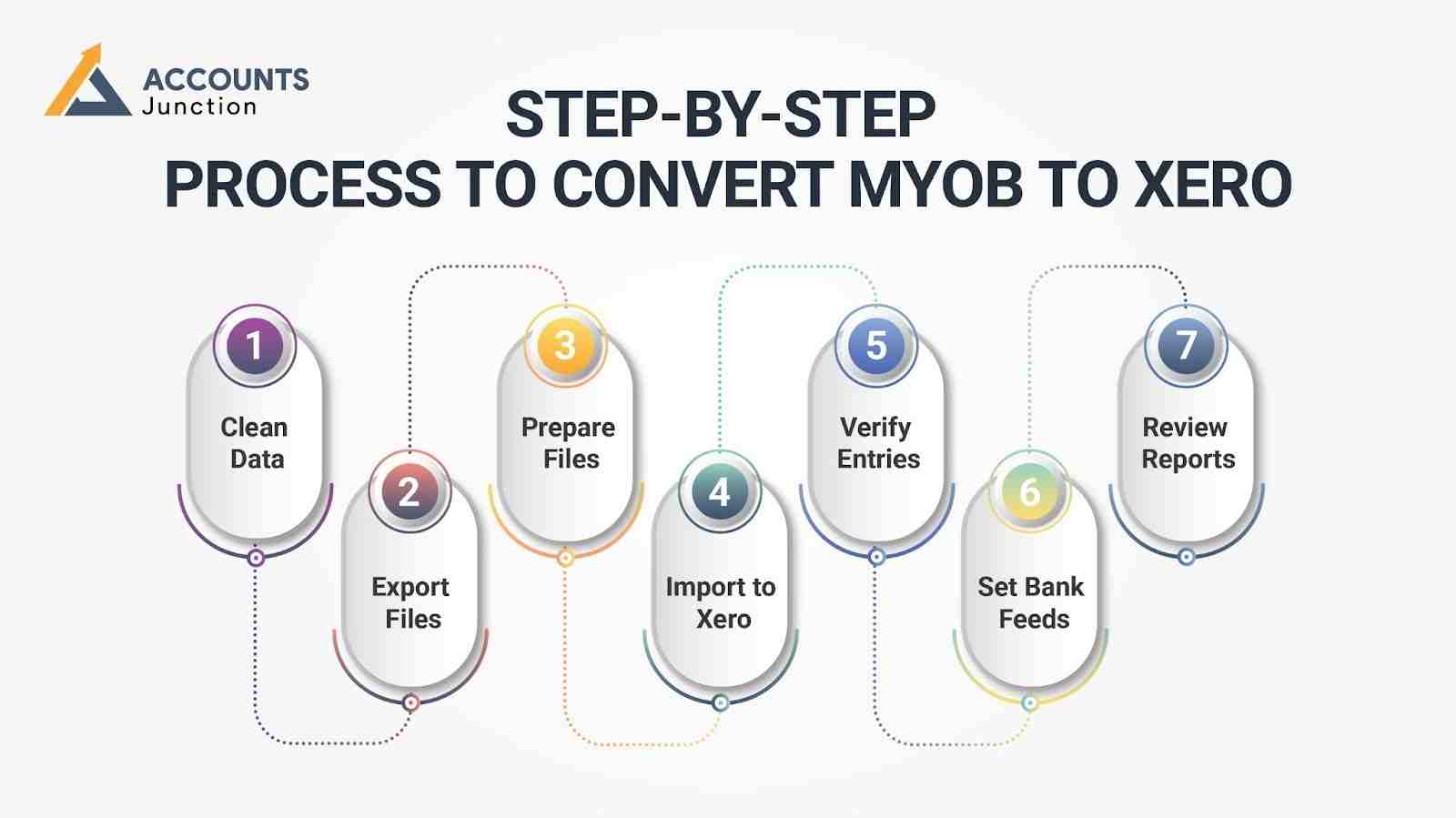

Step-by-Step Process to Convert Myob to Xero

Follow this clear process to move your data without confusion.

Step 1: Clean Data

Review your Myob file and remove old entries.

Fix duplicate names, wrong accounts, and missing data.

Step 2: Export Files

Export your data from Myob in CSV format.

Include accounts, invoices, suppliers, and customer details.

Step 3: Prepare Files

Edit exported files to match Xero import templates.

Fix date formats, currency, and column headers.

Step 4: Import to Xero

Go to Settings → Import in your Xero account.

Select data types and upload each prepared CSV file.

Step 5: Verify Entries

After the import, compare data from both systems.

Check if invoices, bills, and balances are correct.

Step 6: Set Bank Feeds

Connect bank accounts in Xero to fetch live data.

Enable automatic feeds to reduce manual entries.

Step 7: Review Reports

Run reports like profit and loss and balance sheet.

Make sure both match your old Myob records accurately.

Tips for a Smooth Myob to Xero Conversion

Follow these practical tips for a clean and easy switch.

1. Pick the Right Time

Choose the end of a month for simple closing.

It helps you start Xero with clean financial data.

2. Keep Backups Safe

Always save both Myob and Xero copies for security.

Backups prevent data loss during or after migration.

3. Move Step by Step

Transfer one data type at a time, not all together.

It helps you test and fix small issues before moving ahead.

4. Verify Tax Codes

Ensure that tax codes match between both platforms.

This avoids wrong reports and tax calculation errors.

5. Test After Import

Always compare trial balances before going live.

Testing ensures your accounting data is fully accurate.

Common Problems While You Convert Myob to Xero

Being aware of common issues helps you prepare better.

1. CSV Format Errors

Sometimes file formats differ from Xero’s template.

Review columns and fix alignment before importing again.

2. Missing Transactions

Some transactions may not export properly from Myob.

Always recheck all exported files to avoid missing data.

3. Wrong Balances

Opening balances may differ after migration.

Cross-check reports and correct them inside Xero.

4. Tax Code Issues

Myob and Xero use different tax formats.

Map and match them carefully to avoid wrong entries.

5. Payroll Data Errors

Payroll needs special attention during migration.

Recheck leave, pay items, and staff details after import.

After the Migration Process

After moving data from Myob to Xero, follow these next steps.

1. Reconcile All Accounts

Ensure that all bank accounts match correctly.

Check balances and verify every transaction entry.

2. Run Comparison Reports

Run key reports in both systems for accuracy.

Look for small mismatches and fix them early.

3. Add Team Members

Set up users in Xero and assign clear roles.

Limit access based on employee responsibilities.

4. Link Add-ons

Integrate useful tools like Dext or Hubdoc with Xero.

They simplify invoice uploads and data management.

5. Provide Team Training

Train your team to understand how Xero works.

Teach them to use bank feeds and create reports.

Benefits After You Convert Myob to Xero

Once your move is done, you’ll notice real improvements fast.

1. Faster Bookkeeping

Tasks like data entry and reconciliations take less time.

You can focus more on customers and business growth.

2. Real-Time Financial View

Xero shows live cash flow and updated records anytime.

You can make better and quicker financial decisions.

3. Simple Collaboration

Multiple users can work together from any location.

This helps your team stay updated and work efficiently.

4. Online Invoicing

Send and track invoices directly through Xero easily.

Clients can pay faster, improving your cash flow.

5. Safe Cloud Storage

All records are stored safely on the cloud.

You never lose data and can restore it anytime.

6. Clear Business Insights

Xero’s smart reports help you track business progress.

You can plan better for profits and cost control.

Moving from Myob to Xero is a smart step toward simple, modern, and accurate accounting. The process may seem complex at first, but with proper planning, clean data, and expert help, it becomes smooth and safe.

Working with Accounts Junction ensures your migration happens without data loss or confusion. Our skilled team makes sure every report, invoice, and balance matches correctly. With Accounts Junction, the entire process becomes easy and stress-free, helping your business start using Xero quickly with full accuracy and confidence. You also receive expert guidance, ongoing support, and complete financial clarity from day one.

FAQs

1. How long does it take to convert Myob to Xero?

- It takes 3–5 days based on the data size. Larger files may take a few more days.

2. Can I convert Myob to Xero myself?

- Yes, but experts make the process smooth and safe. DIY may lead to missing or wrong entries.

3. What data can move during conversion?

- You can move accounts, bills, invoices, and contacts. Some data may need manual review after import.

4. Is payroll data included in conversion?

- Some tools move payroll, others need manual entry. Always check employee and leave records after migration.

5. Will my Myob data remain safe?

- Yes, always back up before you start conversion. Keep copies of all important reports and files.

6. Do I need to stop work while migrating?

- No, you can still use Myob until Xero is ready. Plan a short downtime before switching fully.

7. Why should I move from Myob to Xero?

- Xero is cloud-based, fast, and easy to use. It offers real-time data and smart automation tools.

8. Can I move only part of my data?

- Yes, you can move selected accounts or dates. Partial transfer is useful for testing or training.

9. What is the best time for conversion?

- The best time is month-end or year-end. It keeps financial records clean and clear.

10. How do I check if my data moved correctly?

- Compare reports from both systems for accuracy. Look at trial balance and bank reconciliation reports.

11. Can I use old Myob data after conversion?

- Yes, you can keep Myob for record purposes. It helps to access past reports if needed.

12. Does Xero support all currencies like Myob?

- Yes, Xero supports multiple currencies for business use. Set exchange rates before importing foreign transactions.

13. Can I import attachments from Myob to Xero?

- Most tools do not move attachments directly. You can reattach files manually in Xero later.

14. What happens to Myob tax codes?

- You need to map them to Xero tax codes. This keeps your tax reports accurate after migration.

15. Can I move inventory items to Xero?

- Yes, inventory lists can be exported from Myob. Import them to Xero with correct item details.

16. What if I find errors after migration?

- You can edit or re-import the data in Xero. Fixing errors early ensures clean accounting records.

17. Is Xero better than Myob for small firms?

- Yes, Xero suits small and medium-sized businesses. It’s simple, fast, and cloud-ready with great support.

18. How much does the Myob to Xero conversion cost?

- Cost depends on file size and services chosen. Professional help may cost more, but it saves time.

19. What if my Myob version is old?

- You can still export data and upgrade the format. Professionals can help adjust files for Xero import.

20. Can I move multi-company data to Xero?

- Yes, but you must create an Xero account per company. Each company’s data moves separately and cleanly.

21. How secure is Xero after conversion?

- Xero uses strong encryption and cloud protection tools. Your financial data remains safe and private always.

22. Do I need training to use Xero?

- Basic training helps you use Xero efficiently. Learn about bank feeds, reports, and invoices.

23. What should I check before migration?

- Check all reconciliations, balances, and active accounts. Fix errors before exporting to avoid problems later.

24. Can Meru Accounting help with support later?

- Yes, Meru Accounting offers full post-migration support. They ensure your data and reports stay accurate.

25. What if I need reports from Myob later?

- You can access your Myob backup anytime. Keep copies of key reports for record-keeping.