Table of Contents

- 1 Accounting for Traders

- 2 Comprehending Trading Accounting

- 3 How to Use Trading Accounting Effectively?

- 3.1 1. Keep Correct Trade Records

- 3.2 2. Monitor Gains, Both Realized and Unrealized

- 3.3 3. Determine the Cost Basis

- 3.4 4. Make Use of Accounting Software

- 3.5 5. Account reconciliation Frequently

- 3.6 6. Recognize the Tax Repercussions

- 3.7 7. Get financial statements ready

- 3.8 8. Get Expert Assistance

- 3.9 Conclusion:

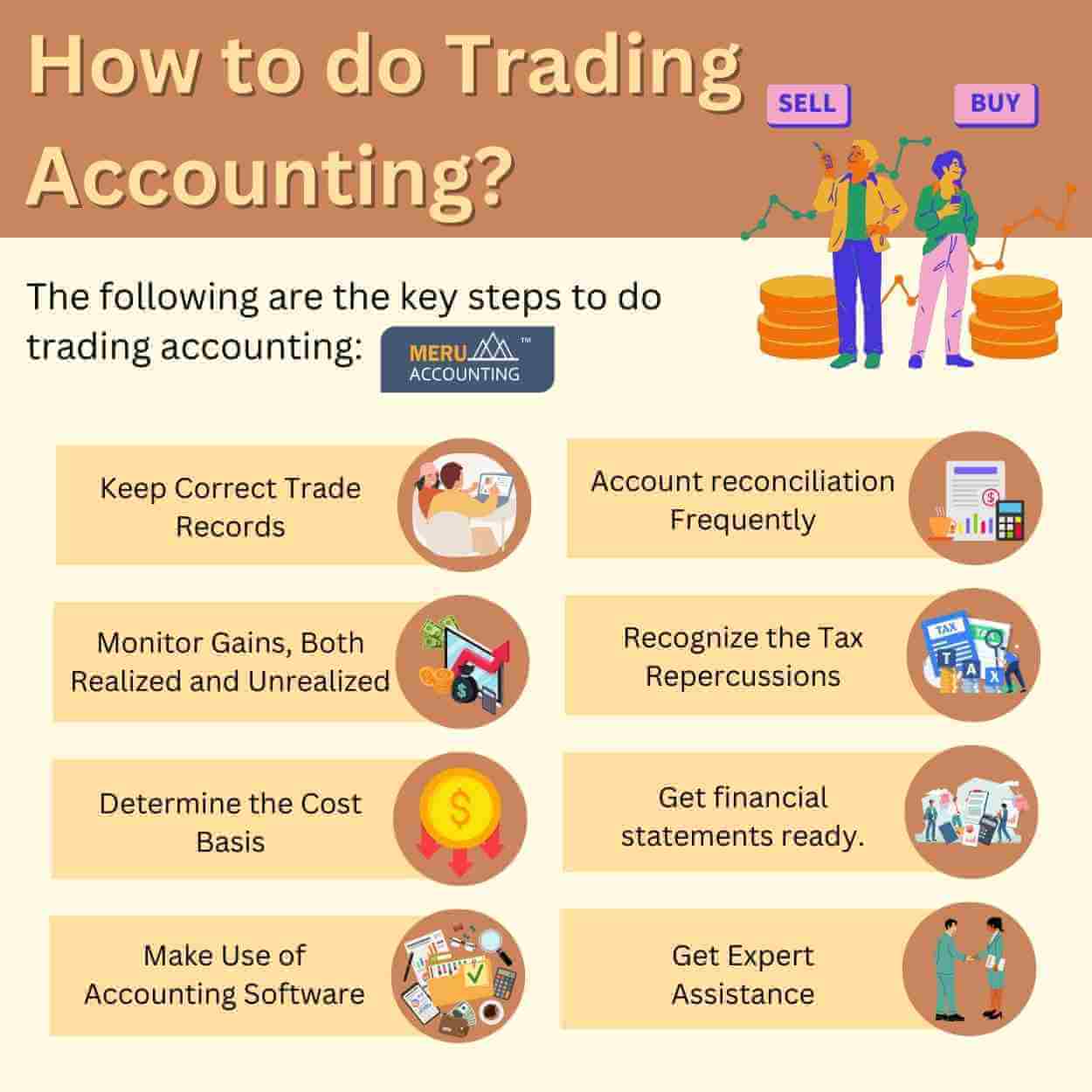

How to do trading accounting?

Accounting for Traders

For traders to maintain financial accuracy, adhere to rules, and make well-informed investment decisions, effective trading accounting is crucial. We will walk you through the principles of trade accounting services in this blog, making sure you have a firm grasp of how to handle your financial records. Important topics like keeping thorough records of buy and sell orders, classifying costs and earnings, and monitoring all trading transactions will be covered.

We'll also go over how crucial it is to use specialized accounting software in order to automate calculations and produce thorough reports. Reconciling your accounts on a regular basis to find inconsistencies and guarantee correctness is another aspect of proper accounting for traders. Traders can improve overall trading strategy, maximize tax reporting, and obtain important insights into their financial performance by being proficient in these procedures.

Accounting for traders involves specific practices that differ from general accounting. This blog will provide a comprehensive guide on how to do accounting for traders effectively, using trade accounting services to streamline your financial management.

Comprehending Trading Accounting

- Trade Accounting Services' Significance

- Services for trade accounting are essential for traders to keep an eye on their financial activity. These services assist traders in ensuring tax law compliance, computing earnings and losses, and maintaining accurate records of their purchase and sell operations. Traders can retain financial clarity and concentrate on their core business by utilizing professional accounting services.

- Crucial Elements of Trader Accounting

- Accounting for traders has special requirements, including keeping an account of individual transactions, figuring out realized and unrealized gains, and handling tax consequences. Trading accounting necessitates close attention to detail and a thorough understanding of financial markets, unlike normal business accounting.

How to Use Trading Accounting Effectively?

1. Keep Correct Trade Records

It is essential to maintain thorough records of all trade activity. For every trade, note the date, kind of security, amount, cost, and transaction fees. For the purpose of computing gains and losses as well as tax filing, accurate records are crucial

2. Monitor Gains, Both Realized and Unrealized

Separate realized gains from unrealized gains. Unrealized gains are paper profits on open positions, whereas realized gains happen when a position is closed. When evaluating the overall performance of a portfolio and its tax consequences, both are crucial.

3. Determine the Cost Basis

Ascertain the asset's initial tax value, or the cost basis, for every transaction. The purchase price plus any related transaction charges make up the cost basis. An accurate cost computation basis is vital for accurately reporting capital gains.

4. Make Use of Accounting Software

Make use of accounting software designed specifically for traders. These solutions can produce the required financial reports, compute gains and losses, and automate transaction tracking. Software programs can eliminate errors and drastically cut down on manual labor.

5. Account reconciliation Frequently

Making sure that your records and brokerage statements match is ensured by regular account reconciliation. By identifying differences early on, reconciliation enables you to swiftly rectify any difficulties.

6. Recognize the Tax Repercussions

There are particular tax ramifications for trading activity. The tax rates on short-term trades, those held for less than a year are greater than those on long-term trades. Recognize the rules governing taxes and think about seeking advice from a tax expert to guarantee compliance.

7. Get financial statements ready

Make regular financial statements, such as income and balance sheets. These records give you a quick overview of your financial situation and support you in making wise trading choices.

8. Get Expert Assistance

Take into account using expert trade accounting services. Proficient accountants with a focus on trading may provide significant perspectives, guarantee precise documentation, and assist you in managing complex tax regulations.

For traders, efficient accounting is essential to both financial success and regulatory compliance. Traders can simplify their financial management by employing specialist tools, keeping precise records, and being aware of tax ramifications. Using expert trade accounting services can improve efficiency and accuracy even further, freeing traders to concentrate on their primary business.

Conclusion:

We at Accounts Junction provide thorough trade accounting services that are customized to meet the particular requirements of traders. Accurate financial management and adherence to tax laws are guaranteed by our experience in trader accounting. Get in touch with us right now to find out how we can help you get financial clarity and improve your trading accounting procedures.