Table of Contents

- 1 Overview of Income Tax in Singapore

- 2 Who Needs to File Income Tax in Singapore?

- 3 Types of Income Tax Filings in Singapore

- 4 Step-by-Step Guide to E-Filing Income Tax in Singapore

- 5 Registering for E-Filing with IRAS Singapore

- 6 How to Prepare Your Tax Documents

- 7 Submitting Your Tax Returns via IRAS E-Filing

- 8 Why Choose Accounts Junction for Filing Income Tax in Singapore?

- 8.1 Conclusion

- 8.2 FAQs

How to file income tax in Singapore

Overview of Income Tax in Singapore

Singapore operates on a territorial tax system, meaning that individuals and businesses are taxed only on income earned within Singapore. The tax rates vary based on income brackets for individuals and corporate profits for businesses. To file income tax in Singapore, taxpayers must report all relevant earnings and apply any eligible deductions. The e-filing IRAS Singapore portal simplifies this process, ensuring efficient and paperless tax submission.

A key concept in taxation is estimated chargeable income, which refers to the projected taxable income of a business. Companies must declare their estimated chargeable income in Singapore to the Inland Revenue Authority of Singapore (IRAS) within three months of the financial year-end.

Filing income tax in Singapore is a crucial responsibility for individuals and businesses. With the e-filing IRAS Singapore system, taxpayers can efficiently submit their income tax returns while ensuring compliance with the country's regulations. Understanding estimated chargeable income in Singapore is essential for accurate tax assessment and filing. In this blog, we will cover everything you need to know about how to file income tax in Singapore efficiently.

Who Needs to File Income Tax in Singapore?

Both individuals and companies must file income tax in Singapore if they meet certain criteria:

- Individuals: Anyone earning more than SGD 22,000 annually must file taxes through e-filing IRAS Singapore portal.

- Companies: All registered companies must submit their estimated chargeable income in Singapore and corporate tax returns.

- Self-Employed/Freelancers: Individuals earning income outside of employment contracts must report their earnings.

IRAS provides e-filing services to streamline the tax submission process for all taxpayers.

Types of Income Tax Filings in Singapore

When you file income tax in Singapore, you need to know the different tax filing types:

- Personal Income Tax: Individuals report their employment or self-employed earnings.

- Corporate Income Tax: Businesses declare their estimated chargeable income in Singapore and final tax obligations.

- Withholding Tax: Applied to foreign companies or individuals earning income from Singapore sources.

- Goods and Services Tax (GST): Required for businesses with annual revenue exceeding SGD 1 million.

For all these tax types, e-filing IRAS Singapore is the preferred method of submission.

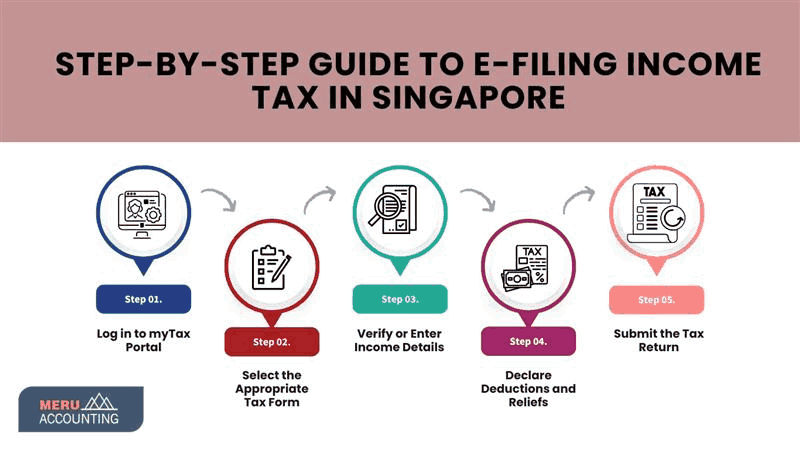

Step-by-Step Guide to E-Filing Income Tax in Singapore

The process to file income tax in Singapore is straightforward when using e-filing IRAS Singapore portal:

- Log in to myTax Portal: Access the IRAS platform using your SingPass or CorpPass.

- Select the Appropriate Tax Form: Choose the relevant tax filing option.

- Verify or Enter Income Details: Ensure all earnings are accurately reported.

- Declare Deductions and Reliefs: Reduce taxable income by claiming eligible deductions.

- Submit the Tax Return: Complete the process and keep a copy for reference.

Corporate taxpayers must also report their estimated chargeable income in Singapore within three months after the financial year ends.

Registering for E-Filing with IRAS Singapore

To access e-filing IRAS Singapore, you need to register:

- Individuals: Use your SingPass to access the system.

- Businesses: Companies must activate their CorpPass accounts for tax filing.

- Foreigners: Non-residents can register for an IRAS Unique Account (IUA) to file income tax in Singapore.

After registration, you can seamlessly manage tax obligations, including declaring estimated chargeable income in Singapore.

How to Prepare Your Tax Documents

Before using e-filing IRAS Singapore, gather the following documents:

- Form IR8A from your employer (for salaried individuals)

- Income records for self-employed individuals

- Financial statements for businesses declaring estimated chargeable income in Singapore

- Deduction receipts for eligible claims

Organizing these documents ensures a smooth process when you file income tax in Singapore.

Submitting Your Tax Returns via IRAS E-Filing

When using e-filing IRAS Singapore, follow these steps:

- Access myTax Portal: Log in with your credentials.

- Fill Out the Tax Form: Enter income details and tax reliefs.

- Verify the Information: Double-check accuracy before submission.

- Submit Before the Deadline: Ensure you file on time to avoid penalties.

- Receive the Notice of Assessment (NOA): IRAS will confirm your tax obligations after processing.

For corporate taxpayers, estimated chargeable income in Singapore must be declared within the stipulated time frame.

Why Choose Accounts Junction for Filing Income Tax in Singapore?

Accounts Junction provides expert assistance to help businesses and individuals file income tax in Singapore efficiently. With expertise in e-filing IRAS Singapore, our services include:

- Accurate Tax Preparation: Ensuring compliance with Singapore’s tax regulations.

- Timely Submission: Avoid penalties by meeting deadlines for tax filing and estimated chargeable income declaration.

- Personalized Guidance: Expert tax consultation tailored to your financial needs.

- Seamless Integration: Assistance with myTax Portal and IRAS registration.

Choosing Accounts Junction ensures that you file your taxes correctly and optimize tax benefits.

Conclusion

Filing income tax in Singapore is a crucial responsibility for individuals and businesses, ensuring compliance with the Inland Revenue Authority of Singapore (IRAS). E-filing through IRAS Singapore makes the process easier and reduces errors and delays. Staying informed about estimated chargeable income in Singapore and tax filing types is key to meeting regulations.

Taxpayers can easily file taxes by following the guide, from registering for e-filing with IRAS Singapore to submitting returns online. Proper tax document preparation, understanding deductions, and adhering to deadlines are key factors in filing income tax smoothly.

For businesses and individuals looking for expert guidance, Accounts Junction offers professional tax filing services, ensuring accuracy, compliance, and optimized tax planning. Whether you're new to filing or need help with complex taxes, professional support saves time and avoids costly mistakes.

FAQs

1. Who needs to file income tax in Singapore?

Anyone earning over SGD 22,000 annually, businesses with taxable income, and companies declaring estimated chargeable income in Singapore must file income tax.

2. What is e-filing IRAS Singapore?

It is the online tax submission system provided by IRAS, allowing individuals and businesses to submit tax returns digitally.

3. When is the deadline for filing income tax in Singapore?

For individuals, the deadline is April 18 for e-filing IRAS Singapore. For businesses, estimated chargeable income must be submitted within three months of the financial year-end.

4. What happens if I miss the tax filing deadline?

Submitting late may lead to fines and added interest charges. It is essential to file income tax in Singapore on time.

5. Can I amend my tax return after submission?

Yes, amendments can be made via e-filing IRAS Singapore before IRAS finalizes your tax assessment.