Table of Contents

- 1 Introduction to Real Estate Accounting and Its Importance

- 2 Key Components of Real Estate Bookkeeping for Investors

- 3 How Real Estate Accounting Services Improve Financial Management

- 4 Tax Benefits and Compliance Through Real Estate Accounting

- 5 How Accurate Real Estate Bookkeeping Boosts ROI

- 6 Why Choose Accounts Junction for Real Estate Accounting Services?

- 6.1 Conclusion

- 6.2 FAQs

What Impact Can Real Estate Accounting Services Have on Your ROI?

Introduction to Real Estate Accounting and Its Importance

Real estate accounting is crucial for investors and businesses in the property sector. Effective real estate accounting involves systematically recording and analyzing financial transactions related to property activities, considering industry-specific principles and complex tax regulations. In its absence, stakeholders may face financial misstatements and missed opportunities, highlighting the importance of specialized services for optimizing financial strategies and maximizing returns.

Real estate accounting services significantly improve financial management by offering expertise in industry-specific accounting and tax laws, ensuring accuracy and compliance. Outsourcing these tasks saves time and resources, allowing investors to focus on core activities. Professionals provide organized financial data, generate insightful reports for better decision-making, and offer strategic financial planning guidance.

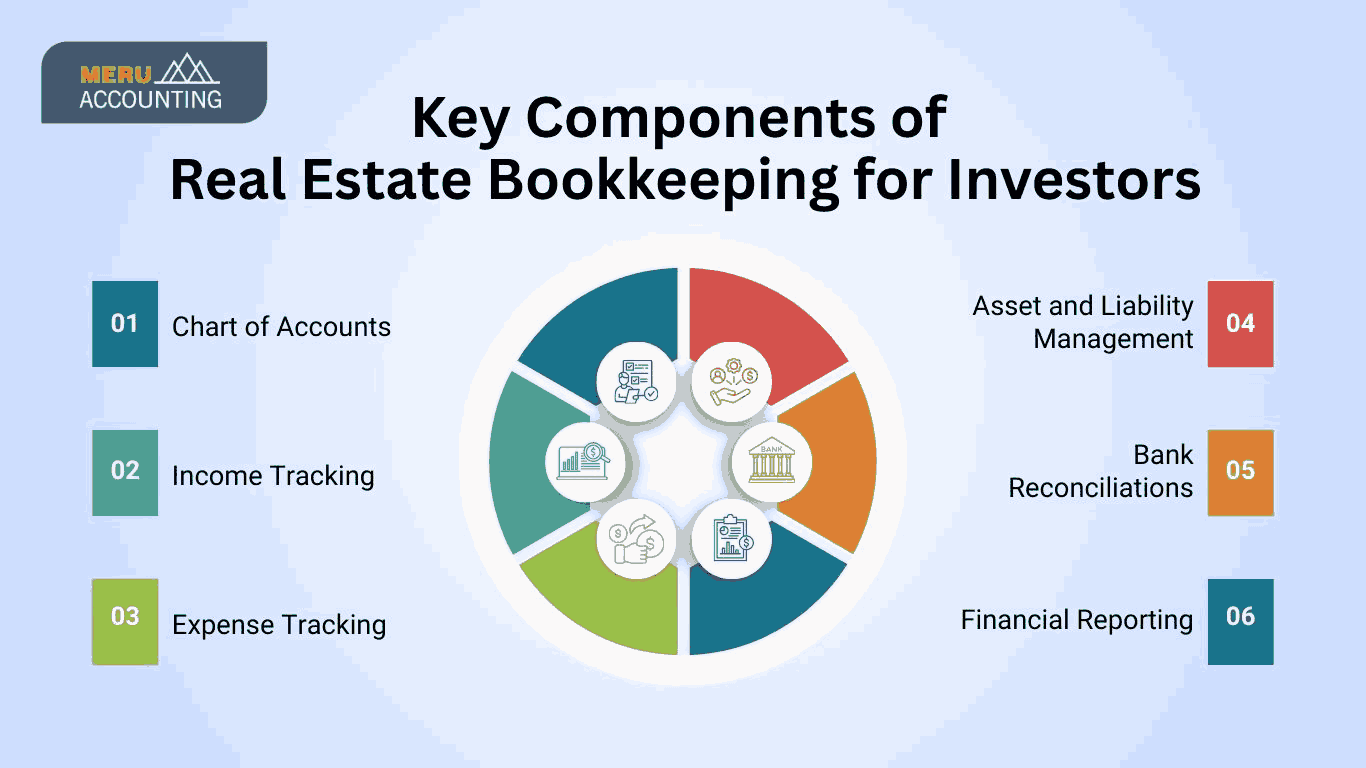

Key Components of Real Estate Bookkeeping for Investors

Careful bookkeeping is essential for real estate investors. It provides organized records for tracking performance and informed decisions. Several key components for effective real estate bookkeeping are:

- Chart of Accounts: Provides a categorized list of financial accounts specific to real estate.

- Income Tracking: Accurately records all income sources, primarily rental income.

- Expense Tracking: Diligently records all property-related expenses for tax and analysis.

- Asset and Liability Management: Tracks property costs, improvements, depreciation, and liabilities.

- Bank Reconciliations: Regularly compares bank statements with internal records for accuracy.

- Financial Reporting: Generates key reports like income statements and balance sheets for performance overview.

Essential bookkeeping tasks include organized accounts, income/expense tracking, asset management, reconciliations, and reporting.

How Real Estate Accounting Services Improve Financial Management

Engaging professional real estate accounting services brings expertise and efficiency to financial management. These services ensure accuracy, save time, and provide valuable insights for better financial outcomes. Here's how:

- Expertise and Accuracy: Professionals with industry knowledge minimize errors and ensure compliant financial records.

- Time Savings and Efficiency: Outsourcing frees up time for core activities like property management and acquisition.

- Improved Organization: Organized systems for managing financial data ensure accessibility for analysis and reporting.

- Enhanced Financial Reporting: Comprehensive reports provide a clear picture of financial performance for informed decisions.

- Strategic Financial Planning: Accountants offer guidance on budgeting and forecasting for future investment strategies.

- Cash Flow Management: Effective tracking ensures sufficient liquidity for expenses and opportunities.

- Risk Reduction: Accurate record-keeping and compliance reduce the risk of financial issues and penalties.

Professional services offer expertise, save time, improve organization, provide insights, and reduce risks.

Tax Benefits and Compliance Through Real Estate Accounting

Real estate businesses can gain a lot of tax benefits with professional accounting and bookkeeping. A professional support by your side can help you manage tax complexities, ensuring compliance, and identifying tax benefits to maximize ROI.

- Tax Compliance: Ensures adherence to tax rules, minimizing penalties.

- Depreciation Optimization: Maximizes tax savings through depreciation.

- Expense Deductions: Claims eligible property expenses to reduce taxable income.

- Capital Gains Tax Planning: Strategies to minimize capital gains tax when selling.

- Passive Activity Loss Rules: Navigating rules for deducting rental property losses.

- Tax Credits and Incentives: Identifying and claiming available credits.

Expert accounting ensures tax compliance and helps identify strategies to maximize tax benefits.

How Accurate Real Estate Bookkeeping Boosts ROI

Accurate bookkeeping provides a clear view of financial performance, enabling informed decisions that improve ROI.

- Informed Pricing Strategies: Accurate data for profitable rental rates.

- Effective Cost Management: Identifying areas for cost reduction.

- Strategic Investment Decisions: Data-driven choices for acquisitions and renovations.

- Improved Tenant Retention: Understanding costs for tenant satisfaction.

- Negotiating Power: Using accurate records for better deals.

- Performance Benchmarking: Comparing performance for improvement.

- Attracting Investors and Lenders: Essential for securing financing.

Accurate bookkeeping enables informed decisions that optimize income, control expenses, and increase overall ROI. In short, focusing on accuracy can boost overall ROI of your real estate business.

Why Choose Accounts Junction for Real Estate Accounting Services?

Accounts Junction specializes in the real estate and construction industry. We have been an ideal partner for managing real estate finances. We primarily focus on delivering accuracy and ROI. It makes us an ideal partner for managing real estate finances.

Conclusion

Effectively managing the financial aspects of real estate investments is crucial for success. From ensuring careful bookkeeping and navigating complex tax regulations to providing strategic financial insights that directly boost ROI, the benefits are significant. With professional expertise, investors can optimize their financial performance, minimize risks, and ultimately achieve their investment goals.

FAQs

1. What is the difference between bookkeeping and accounting in real estate?

Bookkeeping is the day-to-day process of recording financial transactions. Accounting involves analyzing, interpreting, and summarizing financial data to create reports and make informed decisions.

2. Why is specialized accounting important for real estate investors?

Real estate has unique accounting principles and tax laws that differ from other industries. Specialized real estate accounting ensures compliance and helps investors maximize tax benefits and understand their property's financial performance accurately.

3. What are some common tax deductions for real estate investors? Common deductions include mortgage interest, property taxes, insurance, repairs and maintenance, depreciation, and property management fees.

4. How can real estate accounting services help with tax planning? Accountants can help identify tax-saving opportunities, optimize depreciation schedules, plan for capital gains taxes, and ensure compliance with complex tax regulations.

5. What should I look for when choosing real estate accounting services?

Look for a provider with specialized real estate expertise and a comprehensive suite of services. Also, ensure they have a commitment to accuracy and offer a personalized approach.

6. How can Accounts Junction help me with my real estate accounting needs?

Accounts Junction offers specialized real estate accounting services, including bookkeeping, tax planning, and financial reporting, tailored to the unique needs of real estate investors and businesses.

7. What are the benefits of outsourcing real estate accounting?

Outsourcing saves time, reduces errors, ensures compliance, and provides access to specialized expertise. Ultimately outsourcing helps to improve financial management and ROI.