Table of Contents

- 1 What Are Virtual CFO Services?

- 2 The Role of a CFO in Business Growth

- 3 In-House CFO vs. Virtual CFO Services

- 3.1 1. Cost

- 3.2 2. Expertise & Experience

- 3.3 3. Flexibility & Scalability

- 3.4 4. Availability & Accessibility

- 3.5 5. Technology & Tools

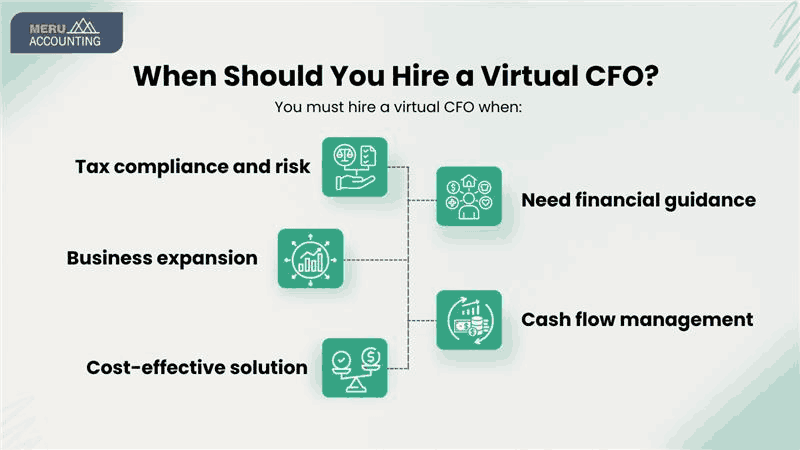

- 4 When Should You Hire a Virtual CFO?

- 5 How to Select the Best Virtual CFO Services for Your Business

- 6 Why Choose Our Virtual CFO Services?

- 6.1 Conclusion

- 6.2 FAQs

In-house vs Virtual CFO Services - Which Is Better?

What Are Virtual CFO Services?

Virtual CFO services provide businesses with financial leadership remotely. Instead of hiring a full-time, in-house CFO, companies can hire virtual CFO services to manage their financial operations without the added cost of an in-house employee. These services are flexible and scalable, making them ideal for growing businesses.

A virtual CFO handles tasks such as:

- Financial planning and forecasting

- Budgeting and cost management

- Cash flow optimization

- Tax compliance and reporting

- Risk management

- Growth strategies and financial decision-making

With the rise of technology, businesses can now access the best virtual CFO services online, allowing them to benefit from expert financial guidance without the need for a physical office presence.

The Role of a CFO in Business Growth

A Chief Financial Officer (CFO) plays a vital role in managing a company's financial health and driving business growth. They oversee financial planning, budgeting, risk management, and strategic decision-making. Having a CFO ensures that businesses can make informed financial decisions, improve cash flow, and comply with regulatory requirements.

For many businesses, especially startups and small to mid-sized companies, hiring a full-time in-house CFO may not be feasible due to high costs. This is where Virtual CFO services become essential for optimizing financial management and driving business growth.They offer the same level of financial expertise but at a fraction of the cost.

In-House CFO vs. Virtual CFO Services

When choosing between an in-house CFO and virtual CFO services, businesses must consider their needs, budget, and long-term goals. Here is a comparison:

1. Cost

- In-house CFO: Hiring an in-house CFO requires a full-time salary, benefits, office space, and other expenses, which can be costly.

- Virtual CFO Services: More affordable, as businesses only pay for the services they need on an hourly, monthly, or project basis.

2. Expertise & Experience

- In-house CFO: Limited to the experience of the individual hired.

- Virtual CFO Services: Offers access to a team of experts with diverse industry knowledge.

3. Flexibility & Scalability

- In-house CFO: Fixed salary regardless of workload.

- Virtual CFO Services: Flexible pricing and scalable services depending on business growth.

4. Availability & Accessibility

- In-house CFO: Available on-site but may be constrained by office hours.

- Virtual CFO Services: Available remotely with global expertise and on-demand access.

5. Technology & Tools

- In-house CFO: May rely on traditional accounting tools and systems.

- Virtual CFO Services: Utilizes cloud-based accounting software and the latest financial technologies.

When Should You Hire a Virtual CFO?

Hiring a virtual CFO can be a smart move for businesses that need financial expertise without the cost of a full-time CFO. Here are key situations when you should consider it.

- Need financial guidance: Small businesses often require expert financial advice but may not have the budget for a full-time CFO. A virtual CFO offers strategic insights at a lower cost.

- Cash flow management: Effective cash flow management is essential for business stability. A virtual CFO helps with budgeting, forecasting, and maintaining liquidity.

- Tax compliance and risk: Tax regulations can be complex, and financial risks can impact business growth. A virtual CFO ensures compliance and minimizes risks.

- Business expansion: Expanding a business requires financial planning and strategic advice. A virtual CFO helps in scaling operations efficiently.

- Cost-effective solution: A virtual CFO provides flexible financial services without the long-term commitment of hiring a full-time CFO.

How to Select the Best Virtual CFO Services for Your Business

Selecting the best virtual CFO services requires careful consideration of factors such as:

- Experience & Industry Knowledge: Ensure the virtual CFO has experience in your industry.

- Service Offerings: Look for comprehensive services, including financial planning, budgeting, and tax compliance.

- Technology & Tools: Check if they use modern accounting software for seamless financial management.

- Flexibility & Pricing: Choose a service that offers scalable solutions based on your business needs.

- Reputation & Reviews: Read testimonials and case studies to evaluate the quality of service.

By considering these factors, businesses can find the best virtual CFO services that align with their financial goals and operational needs.

Why Choose Our Virtual CFO Services?

At Accounts Junction, we provide Virtual CFO services designed to help businesses enhance financial management and achieve long-term success. Our team of experienced financial professionals offers tailored solutions that align with your business goals, ensuring efficiency and profitability.

- Strategic Financial Planning and Analysis: Our Virtual CFOs provide strategic financial planning and in-depth analysis to help businesses make informed decisions. We analyze financial data, identify growth opportunities, and develop actionable strategies to optimize financial performance.

- Cash Flow Management and Budgeting: Effective cash flow management and budgeting are crucial for business sustainability. We help track cash inflows and outflows, forecast future financial needs, and implement budgeting strategies to maintain a healthy financial position.

- Tax Compliance and Risk Assessment: Staying compliant with tax regulations can be complex, but our Virtual CFOs ensure accurate tax planning and risk assessment. We assist businesses in minimizing tax liabilities, adhering to local and international tax laws, and mitigating financial risks.

- Customized Solutions for Startups and Growing Businesses: Every business has unique financial needs, and our Virtual CFO services offer customized solutions for startups and growing enterprises. We provide financial guidance tailored to your industry, helping businesses scale efficiently.

- Cloud-Based Financial Reporting and Forecasting: With advanced cloud-based financial tools, we provide real-time reporting and forecasting to improve decision-making. Our technology-driven approach ensures transparency, accessibility, and accurate financial insights for better financial control.

- Cost-Effective Alternative to an In-House CFO: Hiring an in-house CFO can be expensive, but our Virtual CFO services provide the same level of expertise at a fraction of the cost. We help businesses optimize financial operations, improve profitability, and drive sustainable growth.

Conclusion

By choosing virtual CFO services, businesses can enjoy financial expertise without the burden of hiring a full-time CFO. Whether you need strategic planning, budgeting, or tax compliance support, virtual CFO services can help you achieve financial success efficiently and affordably. With Accounts Junction, you gain access to top-tier financial expertise, allowing you to focus on core business operations while we handle your financial strategies with precision.

FAQs

1. What industries benefit from virtual CFO services?

Ans: Businesses in industries such as technology, healthcare, retail, real estate, and e-commerce can benefit from virtual CFO services for financial planning and strategic growth.

2. How much do virtual CFO services cost?

Ans: The cost varies depending on the level of service required. Businesses can opt for hourly, monthly, or customized pricing plans.

3. Can a virtual CFO replace an in-house CFO?

Ans: Yes, for small to mid-sized businesses, virtual CFO services can effectively replace an in-house CFO, offering expert financial guidance at a lower cost.

4. How do I hire a virtual CFO?

Ans: To hire a virtual CFO services and research providers, check their experience, service offerings, and client reviews, and schedule a consultation to discuss your business needs.

5. What makes your virtual CFO services the best?

Ans: We offer the best virtual CFO services by providing tailored financial solutions, industry expertise, cloud-based financial tools, and cost-effective pricing.

6. How can Accounts Junction’s Virtual CFO services help my business grow?

Ans: Accounts Junction provides strategic financial planning, cash flow management, and budgeting to enhance profitability and support business expansion.

7. Are Accounts Junction’s Virtual CFO services cost-effective compared to hiring an in-house CFO?

Ans: Yes, our Virtual CFO services offer expert financial management at a fraction of the cost of a full-time CFO, ensuring affordability and efficiency.