Table of Contents

- 1 What is Tax Preparation Outsourcing?

- 2 Why Businesses Choose to Outsource Tax Preparation

- 3 Signs Your Business Should Consider Outsourcing Tax Preparation

- 4 Key Benefits of Tax Preparation Outsourcing

- 5 How to Choose the Right Partner to Outsource Tax Preparation:

- 6 Why Choose Our Tax Preparation Outsourcing Services?

- 6.1 Conclusion

- 6.2 FAQs

Is tax preparation outsourcing right for my business?

What is Tax Preparation Outsourcing?

Tax preparation outsourcing is the process of hiring external professionals to handle tax-related tasks instead of managing them in-house. Businesses of all sizes outsource tax preparation to reduce the burden of tax compliance, ensure accuracy, and save time. With ever-changing tax laws, outsourcing helps companies stay updated while focusing on their core business operations.

Why Businesses Choose to Outsource Tax Preparation

Many businesses opt to outsource tax preparation because it provides access to experienced tax professionals without needing an in-house accounting team. Here are some common reasons why companies prefer outsourcing:

- Cost Savings: Hiring a full-time accountant or tax professional can be expensive. Outsourcing allows businesses to access expert services at a fraction of the cost.

- Expertise and Accuracy: Tax professionals stay updated with the latest tax regulations, ensuring accurate filings and minimizing errors.

- Time Efficiency: Preparing taxes in-house can be time-consuming. Outsourcing frees up time for business owners to focus on growth and strategy.

- Compliance and Risk Management: Tax laws are complex and ever-changing. Professional tax preparers ensure compliance, reducing the risk of audits and penalties.

- Scalability: Businesses with seasonal fluctuations in revenue or tax requirements can scale their outsourced tax preparation services up or down as needed.

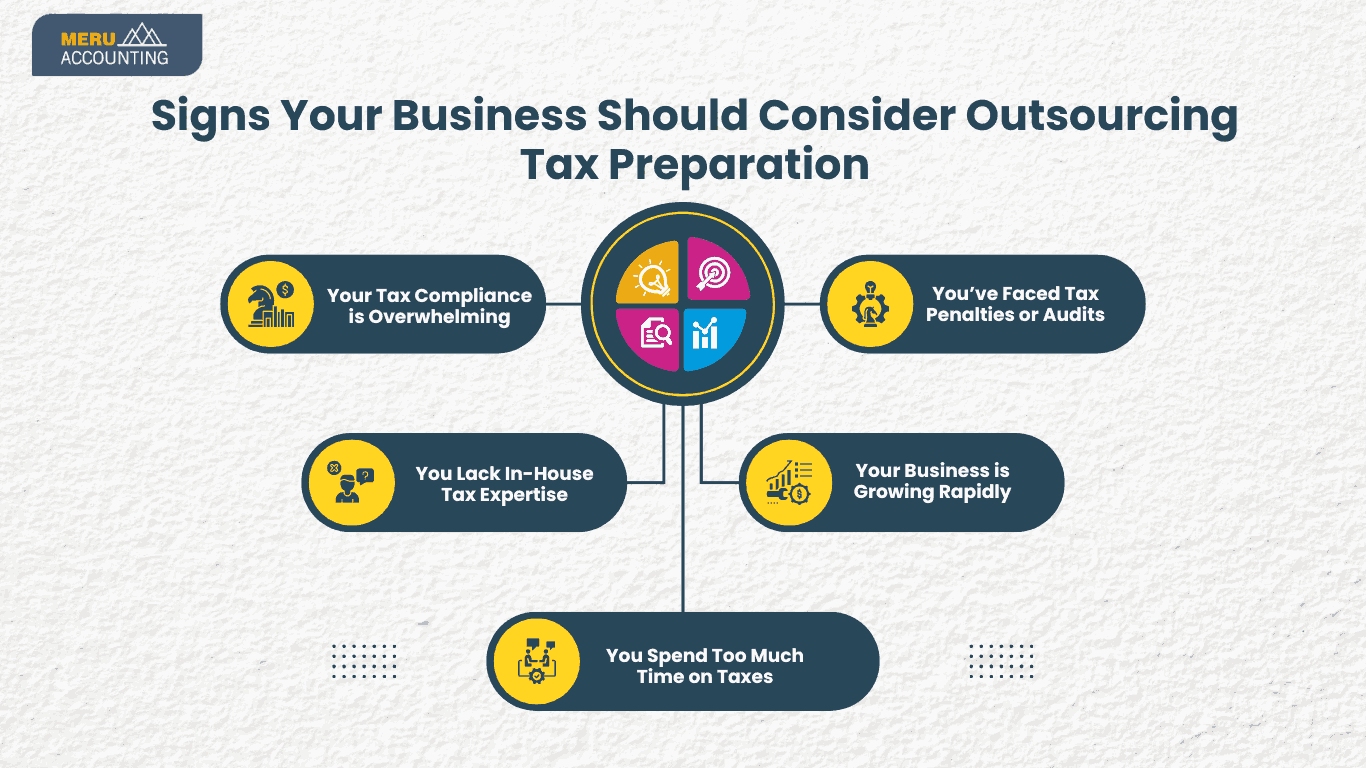

Signs Your Business Should Consider Outsourcing Tax Preparation

If you are unsure whether tax preparation outsourcing is the right choice, here are some signs that indicate your business might benefit from it:

1. Your Tax Compliance is Overwhelming: Managing tax filings, deductions, and compliance requirements can be stressful, especially for small business owners. If you find tax season overwhelming, outsourcing can relieve this burden.

2. You Spend Too Much Time on Taxes: Time spent on tax preparation takes away from business growth activities. If tax tasks consume valuable hours, outsourcing can help you refocus on your core business.

3. You Lack In-House Tax Expertise: Hiring an in-house tax expert can be expensive. If your business lacks the necessary expertise, outsourcing ensures that professionals handle your tax needs accurately.

4. You’ve Faced Tax Penalties or Audits: Mistakes in tax filings can lead to penalties or audits. If you’ve faced these issues in the past, outsourcing ensures that experienced professionals prepare your taxes correctly.

5. Your Business is Growing Rapidly: As your business expands, tax requirements become more complex. Outsourcing allows you to scale tax preparation services without the hassle of hiring and training new staff.

Key Benefits of Tax Preparation Outsourcing

Outsourcing tax preparation offers several benefits that make it a smart choice for businesses:

1. Cost Efficiency: Outsourcing eliminates the need for hiring, training, and retaining an in-house tax team. Businesses only pay for the services they need, reducing overall costs.

2. Improved Accuracy and Compliance: Tax professionals stay updated with the latest tax laws, reducing the chances of errors and ensuring compliance with regulations.

3. Time Savings: By outsourcing, business owners and employees can focus on core activities instead of spending time on tax-related tasks.

4. Access to Advanced Tools and Technology: Professional tax preparation firms use advanced tax software and tools, ensuring efficient and accurate tax filings.

5. Data Security and Confidentiality: Reputable outsourcing providers follow strict security protocols to protect your financial data from breaches and unauthorized access.

6. Scalability and Flexibility: Outsourcing services can be customized to meet your business’s specific tax needs, whether you need assistance during tax season or year-round support.

How to Choose the Right Partner to Outsource Tax Preparation:

Selecting the right outsourcing partner is crucial for ensuring efficiency and accuracy. Here are some factors to consider:

1. Experience and Expertise: Choose a provider with experience in tax preparation outsourcing and expertise in handling businesses of your industry.

2. Certifications and Compliance: Ensure the provider follows regulatory guidelines and employs certified tax professionals (such as CPAs or EAs).

3. Technology and Security Measures: Check if the firm uses advanced tax software and has strong data security protocols in place.

4. Transparent Pricing: Avoid hidden charges by selecting a provider that offers clear and competitive pricing.

5. Customer Support and Communication: A responsive and knowledgeable support team ensures a smooth outsourcing experience.

Why Choose Our Tax Preparation Outsourcing Services?

At Accounts Junction, we specialize in providing top-level tax preparation outsourcing services tailored to your business needs.:

- Experienced Tax Professionals: Our team consists of certified tax experts with extensive knowledge of tax laws and compliance.

- Cost-Effective Solutions: We offer competitive pricing with flexible plans to suit businesses of all sizes.

- Advanced Technology: We use innovative tax software to ensure accurate and efficient tax preparation.

- Confidentiality and Security: Your financial data is protected with strict security protocols and confidentiality measures.

- Customized Services: We provide personalized tax solutions based on your unique business needs.

- Reliable Support: Our dedicated team is available to answer your tax-related queries and provide ongoing assistance.

Conclusion

Tax preparation outsourcing is a smart decision for businesses looking to save time, reduce costs, and ensure compliance. Whether you struggle with tax complexities, face frequent tax penalties, or want to streamline tax processes, outsourcing can help. Choosing the right tax preparation outsourcing partner ensures accurate tax filings and peace of mind, allowing you to focus on business growth. Accounts Junction offers expert tax preparation outsourcing services, ensuring accuracy, compliance, and cost efficiency. With a team of skilled professionals, we help businesses streamline their tax processes and avoid penalties.

FAQs

1. What types of businesses benefit from tax preparation outsourcing?

Ans: Businesses of all sizes, including startups, small businesses, and large corporations, can benefit from outsourcing tax preparation.

2. Is outsourcing tax preparation secure?

Ans: Yes, reputable providers implement strong security measures to protect financial data and ensure confidentiality.

3. How much does it cost to outsource tax preparation?

Ans: Costs vary based on the complexity of tax filings and services required. Most providers offer flexible pricing plans.

4. Can I outsource tax preparation if I already have an accountant?

Ans: Yes, businesses can outsource specific tax tasks while keeping an in-house accountant for other financial duties.

5. Will outsourcing tax preparation help reduce tax errors?

Ans: Yes, outsourcing to experienced professionals minimizes the risk of errors and ensures compliance with tax regulations.