Major difference between Accounts payable and accounts receivables

What Are Accounts Payables and Accounts Receivables?

Accounts payables and accounts receivables are critical aspects of a business’s financial structure. Accounts payable (AP) are short-term debts a company owes to suppliers or vendors. These debts arise from goods and services received but not yet paid for. Accounts receivable (AR) is the money customers owe to the business. This happens after they receive goods or services on credit.

Managing accounts receivable and payable effectively is crucial for ensuring a stable cash flow. Poor AP management can lead to supplier penalties and damaged relationships. It may also cause cash flow issues. Similarly, inefficient AR management can lead to delayed collections, increased bad debt, and financial instability.

Main Differences Between Accounts Payable and Accounts Receivable

|

Feature |

Accounts Payable (AP) |

Accounts Receivable (AR) |

|

Definition |

Money a business owes to suppliers |

Money owed to a business by customers |

|

Recorded As |

A liability on the balance sheet |

An asset on the balance sheet |

|

Cash Flow Impact |

Outflow of cash when payments are made |

The inflow of cash when payments are received |

|

Management Responsibility |

Accounts payable department |

Accounts receivable department |

|

Business Impact |

Ensuring timely payments to avoid penalties |

Ensuring timely collections to maintain liquidity |

Understanding the difference between accounts payable and accounts receivable helps businesses maintain a strong financial foundation. Since AP involves outgoing payments and AR deals with incoming revenue, managing both efficiently is vital for business success.

How to Manage Accounts Receivable and Payable Effectively

To optimize accounts receivable and payable management, businesses should adopt best practices that ensure efficiency and accuracy.

Best Practices for Managing Accounts Payable:

- Automate Invoice Processing: Using accounts payable and accounts receivable software reduces errors and streamlines operations.

- Schedule Payments Strategically: Avoid late fees and take advantage of early payment discounts.

- Maintain Clear Supplier Communication: Strong relationships with vendors lead to better terms and reliability.

- Reconcile Accounts Regularly: Ensuring accurate records prevents discrepancies and financial losses.

- Monitor Cash Flow: Keeping track of AP ensures the business can meet financial obligations without liquidity issues.

Best Practices for Managing Accounts Receivable:

- Issue Invoices Promptly: The sooner an invoice is sent, the quicker the payment process begins.

- Offer Flexible Payment Options: Customers are more likely to pay on time when given multiple payment options.

- Follow Up on Overdue Payments: Regular reminders reduce the risk of bad debt.

- Use Automation Tools: Accounts payable and accounts receivable software simplifies tracking and collection efforts.

- Assess Customer Creditworthiness: Extending credit only to reliable clients minimizes financial risk.

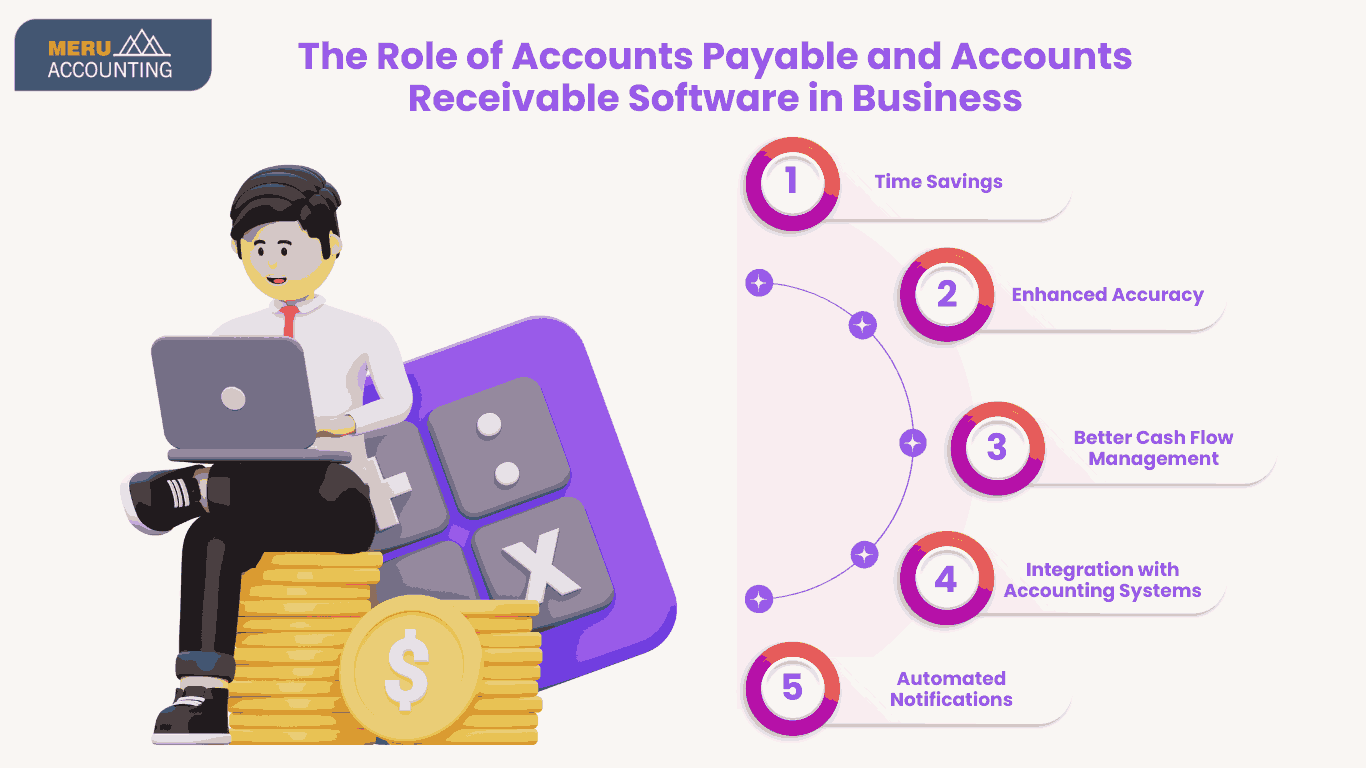

The Role of Accounts Payable and Accounts Receivable Software in Business

Modern businesses rely on accounts payable and accounts receivable software to automate and manage their financial transactions efficiently. The advantages of using such software include:

- Time Savings: Automated processing reduces manual work and minimizes errors. Businesses no longer need to rely on time-consuming manual data entry, which can lead to inefficiencies and inaccuracies.

- Enhanced Accuracy: Digital tracking prevents missed payments and incorrect entries. Manual errors, such as duplicate payments or incorrect invoice entries, can cause financial losses and reporting discrepancies.

- Better Cash Flow Management: Real-time financial insights allow businesses to forecast cash flow more effectively. With a clear overview of both accounts receivable and payable, businesses can make informed decisions about spending, investments, and future financial planning.

- Integration with Accounting Systems: Synchronization with financial software ensures seamless bookkeeping. Accounts payable and accounts receivable software can be integrated with enterprise resource planning (ERP) systems and accounting software like QuickBooks, Xero, or Odoo, allowing businesses to maintain a unified financial management system.

- Automated Notifications: Businesses can set up alerts for due dates, preventing missed payments or collections. Automated reminders help companies stay on top of outstanding invoices, ensuring that they receive payments from customers on time.

Companies that implement accounts payable and accounts receivable software improve their financial operations and gain a competitive edge in the market.

Why Should Businesses Consider Accounts Junction for Professional AP and AR Management Services?

Handling accounts receivable and payable can be complex, and many businesses prefer outsourcing these tasks to experts. Accounts Junction is a leading service provider specializing in accounts payable and accounts receivable management, offering businesses:

- Expert Financial Guidance: Skilled professionals ensure compliance and accuracy. Managing accounts payable and accounts receivables requires financial expertise to ensure compliance with tax regulations and industry standards.

- Cost Savings: By outsourcing accounts receivable and payable processes, businesses can significantly reduce administrative costs associated with hiring, training, and maintaining an in-house AP and AR team. Accounts Junction streamlines the process, eliminating inefficiencies and preventing costly financial errors.

- Improved Efficiency: Timely processing of invoices, payments, and collections ensures that businesses maintain steady cash flow. Accounts Junction ensures that all transactions are recorded promptly, minimizing delays and improving financial accuracy.

- Advanced Automation Tools: With the latest accounts payable and accounts receivable software, Accounts Junction provides businesses with advanced automation tools that help track invoices, send automated reminders, and generate financial reports.

- Tailored Solutions: Every business has unique financial needs, and Accounts Junction offers customized AP and AR strategies based on industry requirements, company size, and financial goals.

By utilizing Accounts Junction’s expertise, businesses can achieve better financial stability and optimize their AP and AR management.

Conclusion

Effectively managing accounts payable and accounts receivables is essential for business success. Ensuring timely payments and collections prevents financial strain and supports long-term growth. By adopting best practices and using accounts payable and accounts receivable software, businesses can automate processes and improve efficiency.

Outsourcing AP and AR management to professionals like Accounts Junction gives your business expert guidance. It also improves cash flow management and provides access to advanced financial tools. Businesses need efficient AP and AR practices to succeed. Managing supplier payments and customer receivables helps them stay competitive.

FAQs

Q1: What happens if accounts payable are not managed properly?

A: Poor AP management can lead to late fees, damaged supplier relationships, and cash flow problems. Using accounts payable and accounts receivable software helps prevent these issues.

Q2: How can businesses improve their accounts receivable process?

A: Companies can improve AR by sending invoices on time, offering various payment options, and using automation for follow-ups. Implementing accounts receivable and payable best practices also ensures timely collections.

Q3: What are the key benefits of accounts payable and accounts receivable software?

A: Accounts payable and accounts receivable software improves efficiency, reduces errors, ensures timely payments, and enhances financial reporting.

Q4: Why is it important to maintain a balance between accounts payable and accounts receivable?

A: Maintaining balance helps businesses manage cash flow effectively, ensuring they have enough liquidity for operations while meeting financial obligations.

Q5: How can Accounts Junction help businesses with AP and AR management?

A: Accounts Junction offers expert solutions, automation tools, and compliance support to optimize accounts payable and accounts receivable processes efficiently.

By understanding the significance of accounts payable and accounts receivable, utilizing modern software solutions, and seeking professional financial management, businesses can ensure smooth financial operations and sustainable growth.