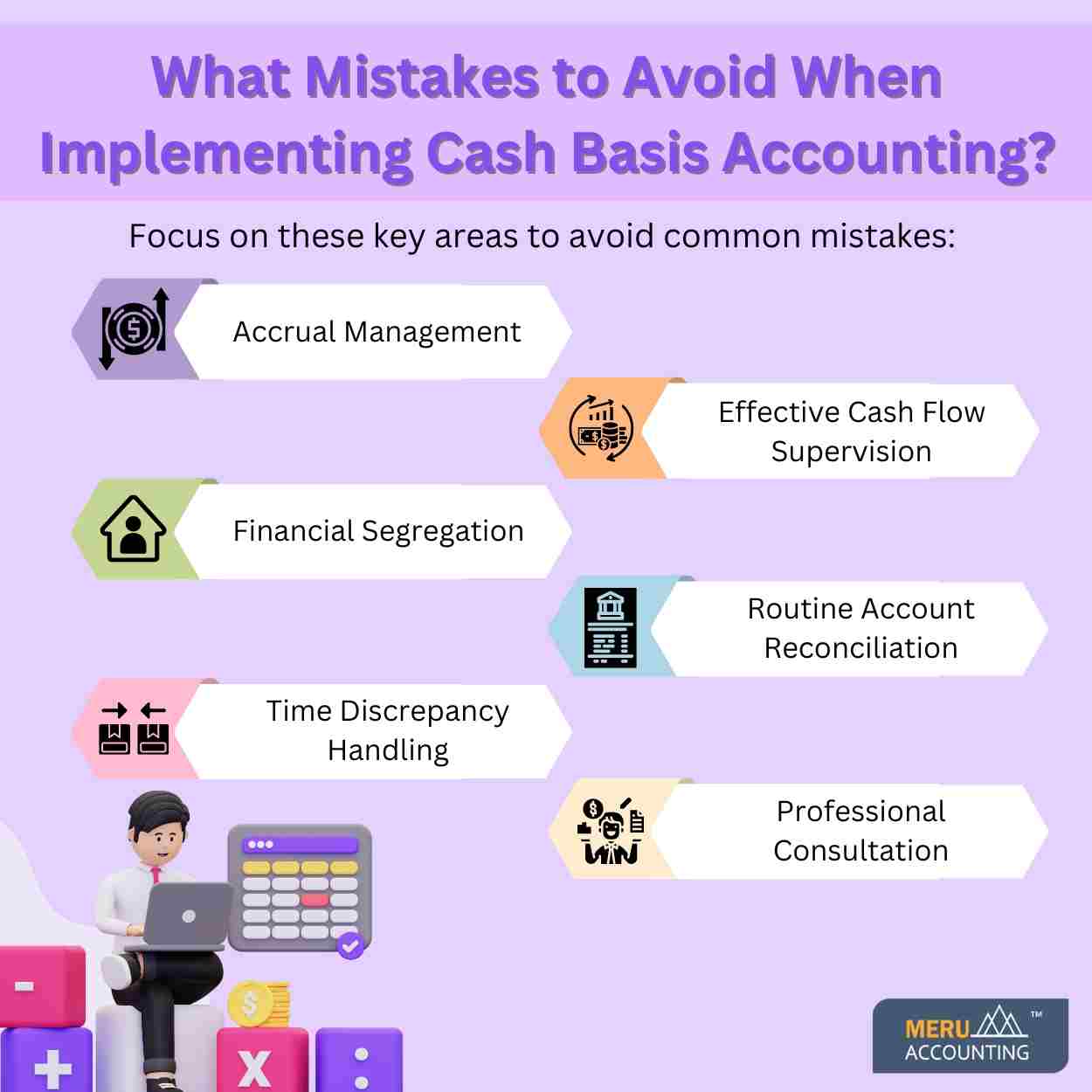

What Mistakes to Avoid When Implementing Cash Basis Accounting?

Cash basis accounting is a straightforward method that tracks financial transactions based on when cash exchanges hands, making it a popular choice for small businesses and startups. While it offers simplicity and ease of use, there are some pitfalls to watch out for when implementing this accounting method.

The mistakes that one should avoid while implementing cash basis accounting are:

Ignoring Accruals

In cash accounting, income and expenses are logged only upon cash receipt or payment, respectively, contrasting with accrual accounting's timing of recognition. Yet, this approach risks neglecting accrued transactions, potentially skewing financial reports. Ensure precise tracking and acknowledgment of accrued income and expenses to uphold the accuracy of cash-based accounting records.

Failing to Separate Personal and Business Finances

Maintaining separate accounts for personal and business finances is essential in cash accounting methods like cash-based accounting. Blending these transactions can create confusion in financial records and tax filings. To ensure accuracy, establish dedicated bank accounts and credit cards for your business transactions. This practice streamlines accounting processes and facilitates precise reporting in cash-based accounting systems.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Overlooking Timing Differences

Cash accounting can create timing discrepancies with income and expenses, unlike accrual accounting. For instance, revenue from a service received in December might not be recognized until January in cash basis accounting. Similarly, expenses paid in December might not be recorded until January. Neglecting these differences can distort financial reports, potentially misleading stakeholders.

Neglecting Cash Flow Management

Cash basis accounting offers insights into cash inflows and outflows but may not fully depict your business's financial status. Monitoring cash flow is vital for liquidity assessment, expense management, and growth planning. Relying solely on cash-based accounting overlooks this critical aspect. Integrate cash flow forecasts and budgeting with cash accounting to ensure informed financial decisions.

Forgetting to Reconcile Accounts Regularly

Regular reconciliation is essential in cash accounting to ensure alignment between your financial records and actual bank balances. Failure to reconcile accounts frequently can result in discrepancies, risky accuracy of financial statements, and impeding timely error correction. To uphold the integrity of your cash-based accounting, prioritize scheduling routine reconciliations. This practice unveils errors or inconsistencies that may otherwise go unnoticed, safeguarding the accuracy and reliability of your financial records.

Not Consulting with an Accountant or Tax Professional

While cash-based accounting offers simplicity, consulting an accountant or tax experts remains cautious, particularly for complicated transactions or tax matters. Their expertise aids in navigating regulations, ensuring tax law compliance, and offering invaluable insights. This guidance not only saves time and money but also mitigates potential future challenges.

Conclusion

At Accounts Junction, we understand the importance of seamless accounting practices. Our dedicated team ensures that you avoid these mistakes and effectively implement cash-based accounting. With our expertise, you can confidently manage your finances, knowing that potential errors are mitigated and compliance is maintained. Partner with Accounts Junction today to streamline your cash accounting processes and optimize your financial management.