Things You Cannot Ignore in Monthly Bookkeeping Checklist.

While maintaining the bookkeeping for any business, you need to ensure that all necessary aspects are done properly related to it. One of the crucial aspects of an efficient bookkeeping system is to make a proper bookkeeping checklist on a monthly basis.

This will give a better understanding of the financial transactions happening regularly. Dividing the bookkeeping tasks on a monthly basis can bring simplicity and consistency in it. Many businesses have experienced consistency in bookkeeping by making proper checklist on a monthly basis.

If you are struggling with bookkeeping, accounting, or proper cash flow management then you need to get important bookkeeping checklist done monthly. Although there are many activities in bookkeeping, this guide will provide important bookkeeping activities.

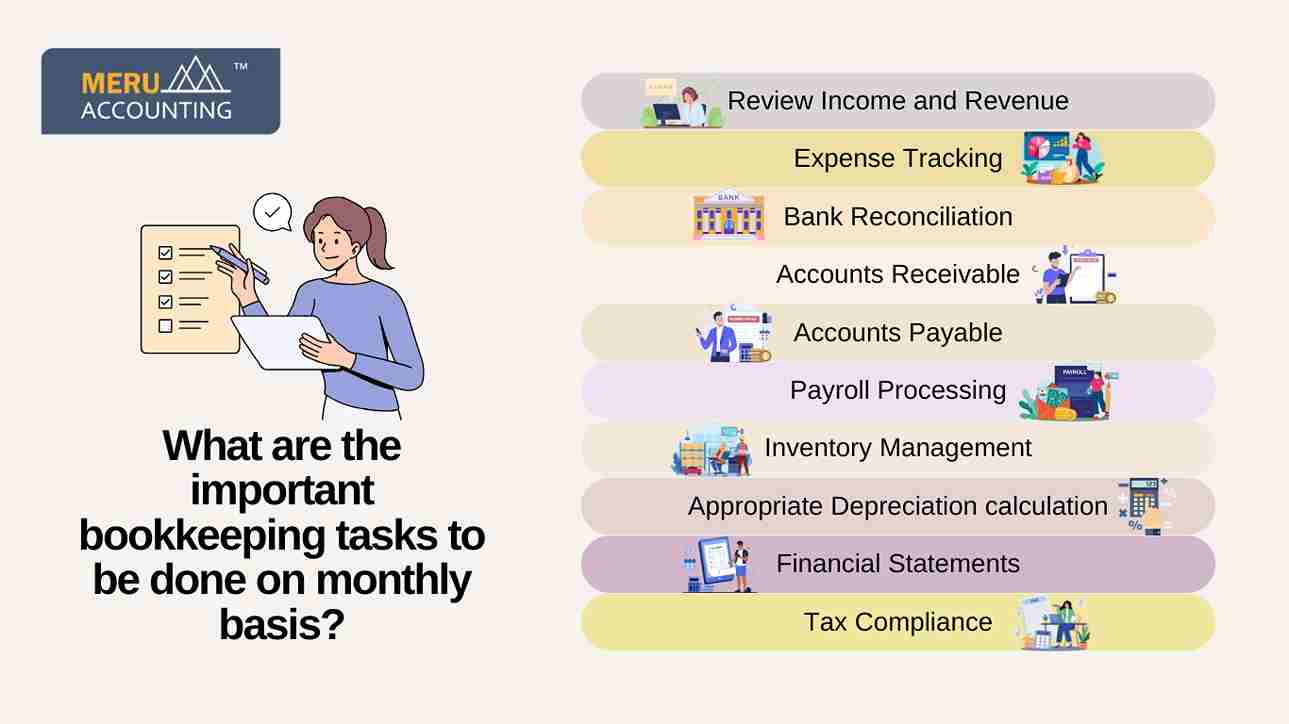

What are the important bookkeeping tasks to be done on monthly basis?

Doing some important tasks of bookkeeping on monthly basis can be very helpful for businesses.

Here are the main things you can’t ignore in the monthly bookkeeping checklist:

Review Income and Revenue

Verify that all sources of income and revenue have been recorded accurately. Confirm that sales, fees, and other income items match with supporting documentation.

Expense Tracking

Check and categorize all expenses, including bills, receipts, and credit card transactions. Ensure that expenses are correctly allocated to the appropriate accounts.

Bank Reconciliation

Reconcile your bank and credit card statements with your accounting records. Any missing transactions or mistakes can be easily detected. This will bring better accuracy in the bookkeeping.

Accounts Receivable

Review all the outstanding customer invoices and follow up on overdue payments. Consider sending reminders or making collection calls as necessary.

Accounts Payable:

Verify that all supplier invoices are accounted for and scheduled for payment. Check for any past-due bills and plan to settle them.

Payroll Processing:

If applicable, ensure accurate payroll processing, including employee salaries, taxes, and benefits. Verify that all payroll taxes are properly calculated and paid.

Inventory Management

Update your inventory records to reflect current stock levels. Monitor inventory turnover and assess the need for restocking or liquidating items.

Appropriate Depreciation calculation

Record and calculate depreciation and amortization expenses for fixed assets and intangible assets. Ensure its compliance with accounting standards.

Financial Statements

Prepare or review key financial statements, including the income statement (profit and loss), balance sheet, and cash flow statement. Analyze financial performance and identify trends.

Tax Compliance:

Prepare any required tax reports and filings, such as sales tax, payroll tax, and income tax. All tax obligations must be ensured before-hand as per guidelines.

It is essential to maintain organized financial records, backup documentation, and a clear filing system to streamline the monthly bookkeeping process. Regularly updating your bookkeeping software or spreadsheets can also simplify these bookkeeping tasks. Staying organized and consistent with your monthly bookkeeping routine is crucial for the long-term financial success of your business.

If you are looking to outsource bookkeeping services to experts then Accounts Junction is a better choice. Accounts Junction provides quality bookkeeping services for businesses. They have experts who can make proper bookkeeping checklists on a monthly basis. This will ensure that all your important bookkeeping tasks are done properly to bring consistency. Accounts Junction is a proficient bookkeeping service-providing company around the world.