Table of Contents

- 1 Introduction to Oracle NetSuite Accounting Software

- 2 Understanding Order to Cash (O2C) and Procure to Pay (P2P) in NetSuite

- 2.1 What is the Order to Cash (O2C) Process?

- 2.2 What is the Procure to Pay (P2P) Process?

- 3 Bookkeeping from Order to Cash (O2C) on NetSuite

- 4 Step-by-Step Bookkeeping from Procure to Pay (P2P) on NetSuite

- 5 NetSuite Accounting Software Pricing: What to Expect

- 5.1 Cost of NetSuite Accounting Software

- 5.2 NetSuite Pricing Plans for Small and Large Businesses

- 5.3 Ways to Optimize NetSuite Costs

- 6 Why Choose Accounts Junction for NetSuite Accounting Services?

- 6.1 1. Expertise in NetSuite Accounting

- 6.2 2. Automation and Efficiency

- 6.3 3. Regulatory Compliance

- 6.4 4. Comprehensive Financial Services

- 6.5 5. Industry-Specific Solutions

- 6.5.1 Conclusion

- 6.5.2 FAQs

Complete bookkeeping from order to cash and procure to pay on netsuite accounting software

Introduction to Oracle NetSuite Accounting Software

Oracle NetSuite Accounting Software is a complete cloud-based financial solution for businesses of any size. As an ERP system, it combines key business functions like accounting, inventory, order management, and procurement into one platform. In this blog, we will cover the features and benefits of Oracle NetSuite accounting software, highlighting how it automates financial workflows like Order to Cash (O2C) and Procure to Pay (P2P) for an improved user experience.

Understanding Order to Cash (O2C) and Procure to Pay (P2P) in NetSuite

The Order to Cash (O2C) and procure to pay (P2P) processes are essential for managing revenue, expenses, and vendor relations in any business. Oracle NetSuite accounting software streamlines these processes, allowing companies to manage their financials with greater accuracy and efficiency.

What is the Order to Cash (O2C) Process?

The Order to Cash (O2C) process includes all steps from receiving a customer order to receiving payment for the goods or services. Businesses must manage this cycle effectively to ensure smooth revenue flow. The O2C process includes order management, invoicing, payment collection, and cash application. Oracle NetSuite accounting software integrates all these functions, reducing manual errors and increasing operational efficiency.

What is the Procure to Pay (P2P) Process?

The Procure to pay (P2P) process involves acquiring goods or services from vendors and processing payments for them. This process typically includes generating purchase orders, receiving goods, matching invoices with purchase orders, and processing payments. NetSuite's automation helps businesses streamline the P2P workflow, ensuring timely vendor payments and minimizing procurement and payment discrepancies.

Bookkeeping from Order to Cash (O2C) on NetSuite

- Managing Sales Orders and Invoices: The process begins when a customer places an order. In NetSuite, you can automatically generate sales orders and transform them into invoices. By linking sales orders with customer data, NetSuite reduces the chances of errors in order fulfillment and invoicing.

- Payment Processing and Cash Application: After sending the invoice, NetSuite automates payment collection by supporting methods like credit cards, bank transfers, and checks. As payments are received, the system matches payments to the respective invoices and updates the general ledger in real time.

- Automating Revenue Recognition in NetSuite: NetSuite accounting software automates the process of revenue recognition, ensuring compliance with accounting standards such as ASC 606. The software automatically recognizes revenue when goods are shipped or services are provided, removing the need for manual adjustments and reducing errors.

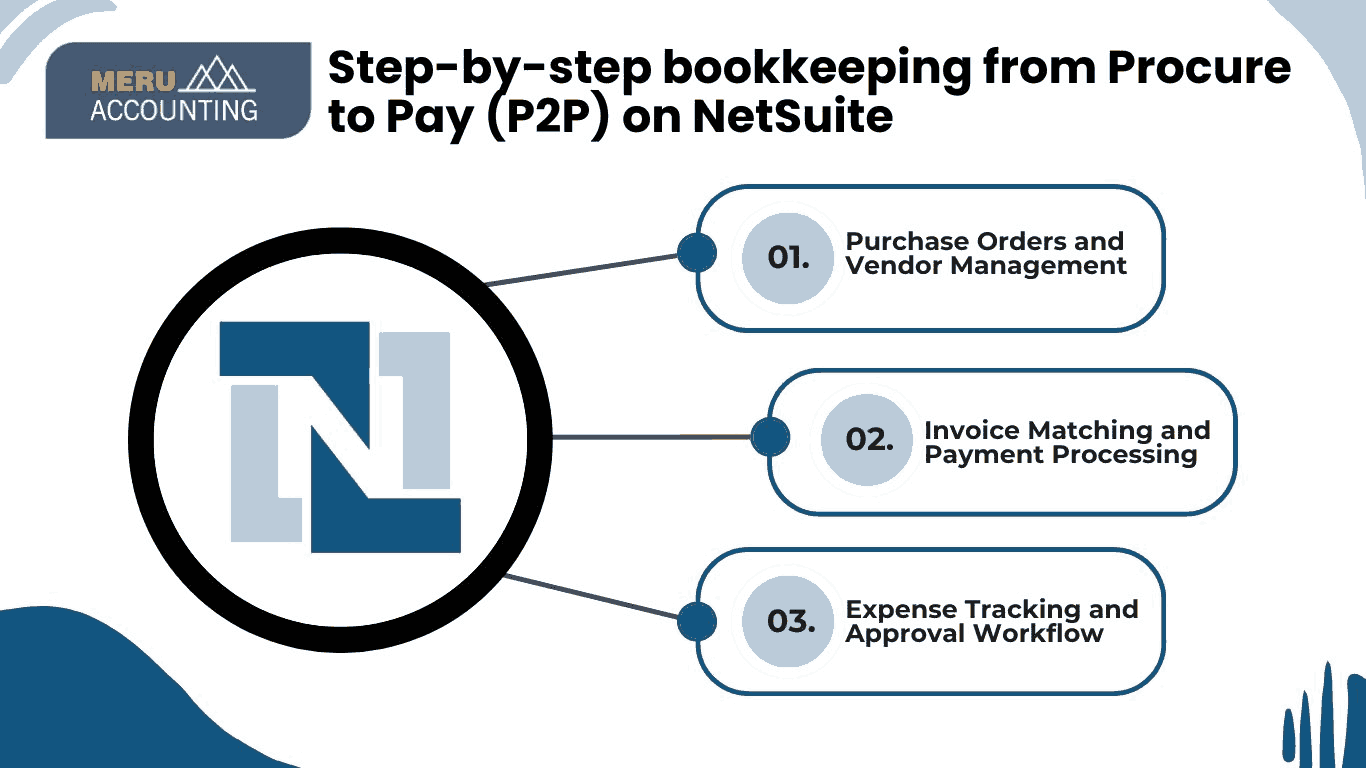

Step-by-Step Bookkeeping from Procure to Pay (P2P) on NetSuite

- Purchase Orders and Vendor Management: NetSuite enables businesses to create and manage purchase orders (POs) directly within the system. The platform tracks vendor performance and relationships, helping businesses keep accurate records of vendor transactions and purchases.

- Invoice Matching and Payment Processing: Once the goods or services are delivered, NetSuite matches the vendor’s invoice to the original purchase order and receives the document. This automation reduces the manual work of matching invoices and ensures that vendors are paid accurately and on time.

- Expense Tracking and Approval Workflows: NetSuite’s P2P process includes tracking business expenses and managing approval workflows. Companies can set approval systems to ensure only authorized individuals approve purchases and payments, enhancing financial controls and reducing fraud risk.

NetSuite Accounting Software Pricing: What to Expect

Oracle NetSuite accounting software is a powerful enterprise resource planning (ERP) solution, and its pricing reflects its wide-ranging functionalities. Businesses considering NetSuite should understand the factors influencing its cost, including business size, operational complexity, and required modules.

Cost of NetSuite Accounting Software

The cost of NetSuite varies significantly depending on factors such as business needs, the number of users, required modules, and customization. Businesses generally pay an annual subscription fee, which includes:

- Base License Fee: Starts at $999 per month

- Per User Fee: Starts at $99 per user per month

Apart from the subscription cost, companies may also incur:

- Implementation Costs: These vary based on customization needs and complexity.

- Training Costs: Companies may need to invest in staff training.

- Ongoing Support: Businesses can opt for support contracts with NetSuite solution providers, which can be either fixed-fee or time-and-material-based contracts【12】.

NetSuite Pricing Plans for Small and Large Businesses

NetSuite offers different pricing structures to cater to small, mid-sized, and large businesses:

- Small Businesses: Can start with a basic financial management package, keeping costs relatively low.

- Large Enterprises: Require additional features like multi-currency support, advanced reporting, and integrations, increasing costs.

Ways to Optimize NetSuite Costs

Businesses can reduce NetSuite costs through various strategies:

- Choose a Long-Term Contract: Opting for multi-year contracts (up to 5 years) helps lock in rates and avoid frequent price increases.

- Buy Essential Modules First: Additional modules can be added later to control initial costs.

- Time the Purchase Right: NetSuite offers better deals at the end of a quarter or financial year to meet sales targets【12】.

Why Choose Accounts Junction for NetSuite Accounting Services?

1. Expertise in NetSuite Accounting

- Accounts Junction specializes in NetSuite accounting, ensuring smooth financial management for businesses.

- Our professionals are well-versed in NetSuite’s functionalities, including bank feeds, online banking, invoicing, and integration with other business systems.

2. Automation and Efficiency

- We utilize NetSuite’s automation features to streamline accounting tasks.

- Automated invoicing, electronic receipt management, and real-time financial tracking improve operational efficiency.

3. Regulatory Compliance

- Accounts Junction ensures compliance with US accounting regulations, tax laws, and financial reporting standards.

- Our team keeps up with changes in financial regulations, reducing the risk of non-compliance.

4. Comprehensive Financial Services

- Services include bookkeeping, financial reporting, payroll management, and tax filing.

- We provide detailed financial insights to help businesses make informed decisions.

5. Industry-Specific Solutions

- We cater to various industries, such as hospitality, trucking, law firms, and education.

- Customized accounting solutions help businesses handle industry-specific financial challenges.

Conclusion

Oracle NetSuite Accounting Software is a comprehensive, cloud-based ERP solution that offers businesses an integrated platform to manage critical financial processes. With its powerful features, such as automated billing, financial consolidation, inventory management, and revenue recognition, NetSuite significantly enhances operational efficiency and financial accuracy.

Automating key workflows like Order to Cash (O2C) and Procure to Pay (P2P) in NetSuite is a great innovation for businesses of all sizes. By streamlining these processes, businesses can reduce manual errors, improve cash flow management, and ensure faster decision-making. NetSuite offers a complete financial management solution, from sales orders and invoices to automated payment processing and vendor management.

FAQs

1. What are the main features of Oracle NetSuite Accounting Software?

Ans: Oracle NetSuite accounting software includes automated billing, financial consolidation, revenue recognition, inventory management, and advanced reporting to streamline financial workflows.

2. How much does NetSuite Accounting Software cost?

Ans: The cost of NetSuite depends on factors like business size, required modules, and customization needs. It's typically a subscription-based pricing model with additional fees for add-ons.

3. Is Oracle NetSuite suitable for small businesses?

Ans: Yes, Oracle NetSuite is scalable with flexible pricing, making it perfect for small businesses that need advanced accounting features without complexity.

4. How does NetSuite automate financial workflows?

Ans: NetSuite automates financial processes like order management, invoicing, revenue recognition, and expense tracking, reducing manual efforts and errors.

5. Can I integrate NetSuite with other business systems?

Ans: Yes, NetSuite integrates with CRM, HR software, and e-commerce platforms for a unified business solution.