Table of Contents

- 1 What Are Accounts Receivable?

- 2 Use of Accounts Receivable in Business Cash Flow

- 2.1 How Does AR Affect Cash Flow?

- 3 Why Effective Receivable Management is Crucial

- 4 Key Strategies for Efficient Accounts Receivable Management

- 5 How Receivable Management Services Can Optimize Cash Flow

- 6 Streamline Your Accounts Receivable Process with Accounts Junction

- 6.1 Conclusion

- 6.2 FAQs

What is the importance of managing accounts receivable?

What Are Accounts Receivable?

Accounts receivable are the outstanding payments a business is owed for goods or services delivered on credit. It is recorded as a current asset and helps maintain cash flow and financial stability. Effective accounts receivable management ensures that businesses receive payments on time, reducing financial risks and enhancing overall operational efficiency.

Use of Accounts Receivable in Business Cash Flow

Accounts Receivable (AR) refers to the money a business is entitled to receive. It comes from goods or services already provided but not yet paid for. It’s like a short-term loan, allowing customers to pay later instead of immediately.

How Does AR Affect Cash Flow?

- Brings Money into the Business: When customers pay their dues, the business receives cash. This helps cover expenses like salaries, rent, and inventory purchases.

- Delays in Payments Can Cause Problems: If customers take too long to pay, the business may struggle to cover its bills. This can impact daily operations.

- Needs Proper Management: Businesses should follow up on overdue payments and offer discounts for early payments. Setting clear payment terms helps keep cash flowing smoothly.

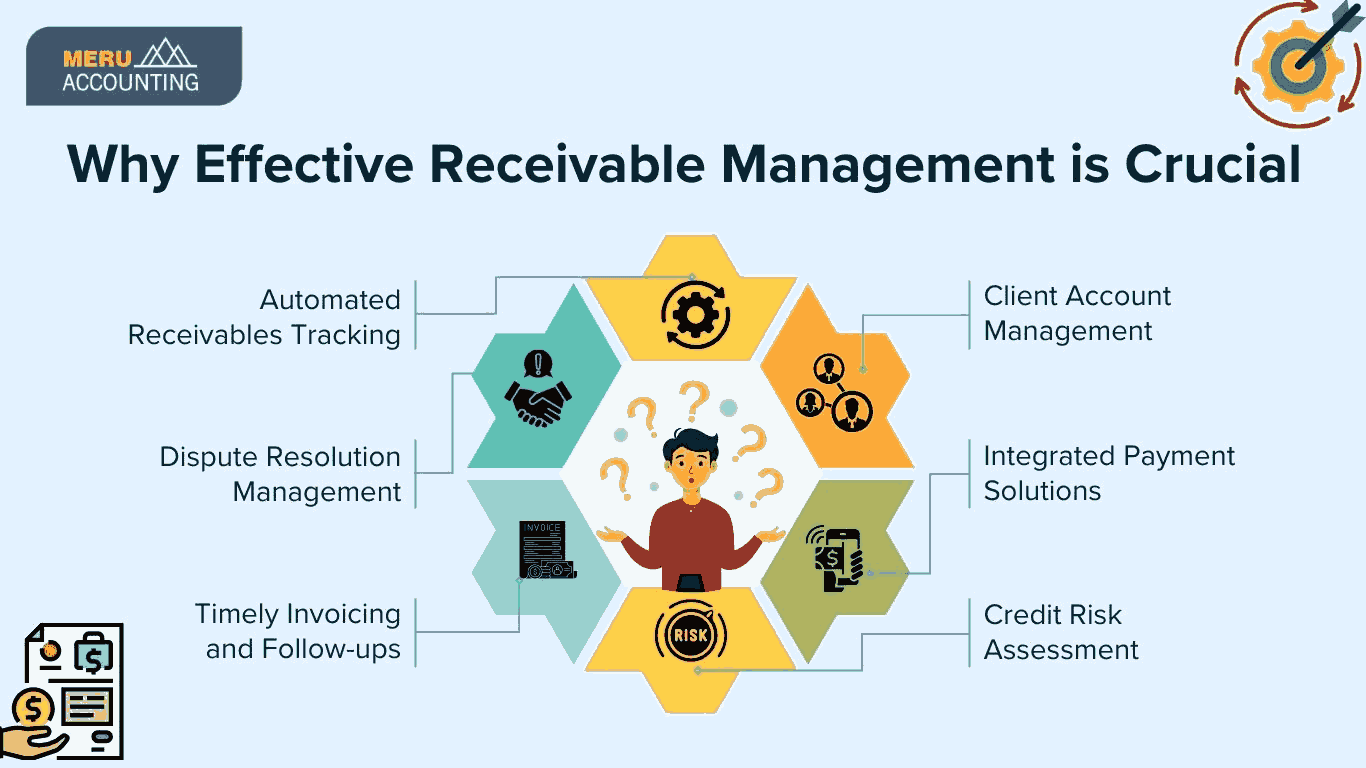

Why Effective Receivable Management is Crucial

- Client Account Management: Provide tailored management of client accounts, ensuring smooth communication and efficient resolution of any billing issues. This approach helps maintain positive client relationships and ensures that any concerns are addressed on time, enhancing overall satisfaction.

- Integrated Payment Solutions: Offer seamless integration with various payment gateways to facilitate easier and quicker payment processing. This integration streamlines transactions, allowing clients to make payments quickly and efficiently, improving cash flow and reducing administrative overhead.

- Credit Risk Assessment: Evaluate the financial stability of clients before offering credit terms. This helps assess and manage credit risks effectively. This helps manage credit risk by identifying potential issues early. It ensures credit is granted only to reliable clients, reducing the risk of defaults and financial loss.

- Timely Invoicing and Follow-ups: Ensure accurate and timely invoicing, along with systematic payment reminders. This reduces delays, encourages prompt payments, and avoids overdue balances.

- Dispute Resolution Management: Set up a structured process for quickly addressing and resolving invoice disputes. Efficient resolution helps maintain good client relationships and prevents payment delays.

- Automated Receivables Tracking: Use automated systems to track outstanding invoices and aging reports. This allows proactive follow-up and better management of overdue accounts.

In short, accounts receivable is important because it represents future cash for the business. Managing it well ensures a healthy cash flow and prevents financial troubles.

Key Strategies for Efficient Accounts Receivable Management

- Clear Credit Policies: Establishing clear terms and conditions for credit sales ensures customers understand payment expectations.

- Timely Invoicing: Sending invoices promptly improves the likelihood of receiving payments on time.

- Automated Payment Reminders: Using receivable management services to send reminders helps prevent overdue payments.

- Offering Multiple Payment Options: Providing various payment methods enhances customer convenience and speeds up collections.

- Regular Account Reconciliation: Consistently reviewing accounts receivable ensures accuracy and identifies potential issues early.

- Effective Credit Risk Assessment: Conducting thorough credit checks helps identify high-risk customers. This prevents potential bad debts.

- Incentives for Early Payments: Offering discounts or incentives to customers who pay early can encourage prompt payment. This can help improve cash flow.

How Receivable Management Services Can Optimize Cash Flow

Receivable management services help businesses handle unpaid invoices efficiently. They make sure customers pay on time, reducing the risk of cash shortages. These services use technology and smart strategies to:

- Send Payment Reminders: Automatically notify customers about upcoming or overdue payments.

- Track Overdue Accounts: Keep an eye on late payments and take action to collect them.

- Save Time & Effort: Reduce the workload of employees by automating invoice tracking.

- Increase Payments Received: Improve the chances of getting paid on time.

- Maintain Good Customer Relationships: Use professional communication to follow up on payments without damaging relationships.

Receivable management services help businesses focus on growth. They also ensure a steady cash flow for smooth operations.

Streamline Your Accounts Receivable Process with Accounts Junction

Accounts Junction offers specialized receivable management services to help businesses maintain a steady cash flow. Our solutions include automated invoicing, payment tracking, and customized credit policies. With our expertise, you can minimize outstanding debts and enhance financial efficiency.

Our Key Services Include:

- Automated Invoicing: Reduce manual effort and ensure timely billing to clients.

- Real-Time Payment Tracking: Monitor payments efficiently and get instant updates on outstanding invoices.

- Customized Credit Policies: Set up effective credit policies to minimize risks and improve cash flow.

- Proactive Collection Strategies: Implement structured follow-ups and automated reminders to reduce overdue payments.

- Detailed Reporting & Analysis: Gain insights into your receivables to make informed financial decisions.

- Client Account Management: Provide tailored management of client accounts, ensuring smooth communication and efficient resolution of any billing issues.

- Integrated Payment Solutions: Offer seamless integration with various payment gateways to facilitate easier and quicker payment processing.

- Credit Risk Assessment: Assess and manage credit risks effectively by evaluating the financial stability of clients before extending credit terms.

With Accounts Junction, businesses can experience reduced collection times, improved cash liquidity, and better financial planning.

Conclusion

Effective accounts receivable management is essential for maintaining a strong financial foundation in any business. By ensuring timely payments, businesses can improve cash flow, reduce bad debts, and enhance overall operational efficiency. Implementing structured credit policies, automating invoicing, and utilizing receivable management services can significantly optimize cash collection processes. Accounts Junction offers expert solutions to streamline receivables and minimize financial risks. This helps businesses focus on long-term growth. Prioritizing receivable management today leads to a financially stable and thriving business tomorrow.

FAQs

1. What happens if accounts receivable are not managed properly?

Ans: If accounts receivable are not managed well, businesses may face cash flow issues and increased bad debts. This can make it difficult to cover operational expenses and affect overall financial health.

2. How can businesses encourage customers to pay on time?

Ans: Businesses can offer early payment discounts and set clear payment terms. They can also send automated reminders and use receivable management services to ensure timely collections.

3. What is the ideal accounts receivable turnover ratio?

Ans: A high turnover ratio indicates efficient collection processes. Generally, a ratio between 5 and 12 is considered healthy, but this can vary by industry.

4. Can receivable management services help small businesses?

Ans: Yes, receivable management services help small businesses by automating invoicing, tracking overdue payments, and improving cash flow without requiring extensive internal resources.

5. How often should businesses review their accounts receivable?

Ans: Businesses should review their accounts receivable regularly, at least weekly or monthly. This helps track outstanding payments, identify issues, and take necessary actions for smooth cash flow.