Table of Contents

- 1 What is Outsourcing Tax Return Preparation?

- 2 Why Businesses and Individuals Choose to Outsource

- 3 The Role of CPAs in Tax Return Preparation & Planning

- 4 Benefits of Outsourcing Tax Return Preparation to Expert CPAs

- 5 Why Our CPA Experts Are the Best Choice for Outsourced Tax Services

- 5.1 Conclusion

- 5.2 FAQs

- 5.3 1. What is outsourcing tax return preparation?

Outsourcing Tax Return Preparation & Planning by Expert CPAs

What is Outsourcing Tax Return Preparation?

Outsourcing tax return preparation is the process where businesses and individuals hire external tax professionals, such as CPAs, to handle their tax filing and planning. This service allows taxpayers to ensure accuracy, stay compliant with tax regulations, and save time. Instead of managing complex tax calculations and staying updated with changing tax laws, outsourcing provides access to experienced CPAs who specialize in tax return preparation and planning.

Tax return preparation involves multiple steps, including gathering financial records, calculating deductions, and ensuring compliance with federal and state tax laws. CPAs have the expertise to manage tax codes, ensuring that returns are filed correctly and on time. Many businesses and individuals prefer outsourcing tax return preparation because it minimizes risks and maximizes financial efficiency.

Why Businesses and Individuals Choose to Outsource

Many businesses and individuals prefer outsourcing tax return preparation because it offers several advantages, including:

- Time-Saving: Tax preparation is time-consuming and requires attention to detail. Outsourcing tax return preparation allows individuals and businesses to focus on their core operations without the stress of handling complex tax filings.

- Accuracy & Compliance: CPAs stay updated with the latest tax laws and regulations, ensuring tax returns are accurate and compliant. Mistakes in tax returns can lead to penalties and audits, but experienced CPAs help avoid such issues.

- Cost-Effective: Hiring an in-house tax team can be expensive. Outsourcing tax return preparation reduces costs by eliminating the need for salaries, benefits, and training for an internal tax department.

- Reduced Stress: Handling taxes alone can be overwhelming, especially during the busy tax season. CPAs simplify the process and provide expert guidance, making tax filing stress-free.

- Minimized Risk of Errors: Tax errors can result in fines, audits, and financial losses. Professional CPAs ensure accurate calculations and thorough documentation, reducing the risk of costly mistakes.

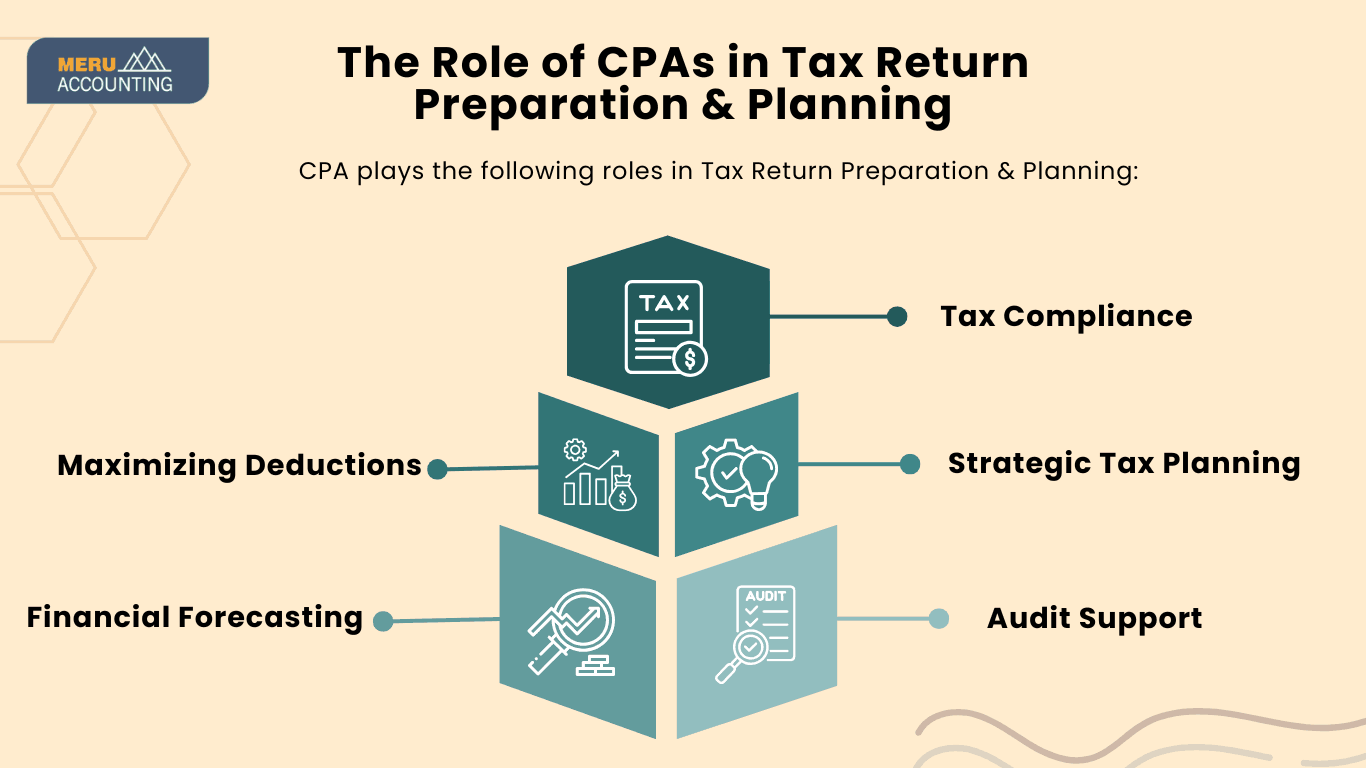

The Role of CPAs in Tax Return Preparation & Planning

CPAs play a crucial role in tax return preparation and planning. They provide expert guidance and ensure tax efficiency. Their role includes:

- Tax Compliance: CPAs ensure that all tax returns meet legal requirements and deadlines, helping clients avoid penalties. They stay informed about new tax laws and updates to maintain compliance.

-

Strategic Tax Planning: They analyze financial records and suggest strategies to reduce tax liabilities. Proactive tax planning helps businesses and individuals take advantage of deductions and credits.

-

Audit Support: If an audit arises, CPAs assist in documentation and responses. Having a professional tax expert available ensures a smoother audit process.

-

Maximizing Deductions: CPAs identify eligible deductions and credits to reduce tax burdens. They help taxpayers claim all available benefits, leading to significant savings.

-

Financial Forecasting: They help businesses plan future taxes and financial decisions, ensuring financial stability and growth.

Benefits of Outsourcing Tax Return Preparation to Expert CPAs

Outsourcing tax return preparation to expert CPAs provides numerous advantages, such as:

-

Access to Experienced Tax Professionals: Hiring CPAs means working with professionals who have extensive tax knowledge and experience.

-

Reduced Tax Liabilities: CPAs help businesses and individuals identify tax-saving opportunities and deductions, leading to reduced tax liabilities.

-

Faster Tax Filing: With expert CPAs handling tax preparation, tax returns are filed faster and without delays, preventing last-minute rushes.

-

Enhanced Security & Confidentiality: Professional tax firms use secure software to protect sensitive financial data, ensuring confidentiality and compliance.

-

Cost Savings: Outsourcing tax return preparation eliminates the need to hire full-time in-house tax professionals, reducing operational costs.

-

Tax Strategies Tailored to Your Needs: Every individual and business has unique tax situations. CPAs offer customized tax strategies to minimize liabilities and maximize returns.

-

Scalability for Growing Businesses: As businesses grow, tax requirements become more complex. Outsourcing ensures scalability and continued compliance with changing tax regulations.

Why Our CPA Experts Are the Best Choice for Outsourced Tax Services

Outsourcing tax return preparation to Accounts Junction offers businesses and individuals a perfect and efficient way to manage tax compliance. Our CPA experts provide top-level services, ensuring accuracy, efficiency, and cost-effectiveness.

- Certified and Experienced CPAs: Our team consists of highly trained professionals with years of experience in tax preparation, planning, and compliance across multiple jurisdictions.

- Customized Tax Strategies: We offer customized tax solutions to optimize deductions, minimize liabilities, and ensure tax efficiency for businesses and individuals.

- Advanced Tax Software: Utilizing innovative tax software, we simplify tax filing processes, ensuring accuracy and adherence to compliance standards.

- Transparent Pricing: With a competitive and clear pricing structure, we ensure there are no hidden costs, giving clients complete financial clarity.

- Global Expertise: We specialize in handling tax return preparation for clients across various industries and locations, ensuring compliance with international tax regulations.

Conclusion

Outsourcing tax return preparation is a strategic decision that ensures accuracy, compliance, and financial efficiency for businesses and individuals. By utilizing the expertise of CPAs, taxpayers can minimize risks, maximize deductions, and streamline their tax filing processes. Accounts Junction provides top-level outsourced tax services with certified professionals, advanced technology, and a client-focused approach.

Whether you need tax planning, compliance assistance, or audit support, our experts are here to help. Partner with us for a perfect, cost-effective, and secure tax preparation experience, allowing you to focus on your core business while we handle your tax needs with precision and expertise.

FAQs

1. What is outsourcing tax return preparation?

Ans: Outsourcing tax return preparation involves hiring external tax professionals, such as CPAs, to handle tax filing, ensuring accuracy and compliance

2. Why should businesses and individuals outsource tax preparation?

Ans: It saves time, ensures compliance, reduces costs, minimizes stress, and lowers the risk of errors in tax filings.

3. How do CPAs help with tax return preparation and planning?

Ans: CPAs ensure compliance, maximize deductions, provide audit support, and help with strategic tax planning to minimize liabilities.

4. What are the benefits of outsourcing tax return preparation?

Ans: Benefits include expert guidance, reduced tax liabilities, faster filing, enhanced security, cost savings, and customized tax strategies.

5. How does outsourcing tax preparation improve accuracy?

Ans: CPAs stay updated with tax laws, use advanced tax software, and conduct thorough reviews to ensure error-free tax filings.

6. Is outsourcing tax preparation cost-effective?

Ans: Yes, it eliminates the need for an in-house tax team, reducing salaries, training costs, and operational expenses.

7. Why choose Accounts Junction for outsourced tax services?

Ans: Accounts Junction offers certified CPAs, tailored tax strategies, secure technology, transparent pricing, and 24/7 expert support.

8. Can outsourcing tax preparation help with business growth?

Ans: Yes, it ensures scalable solutions, ongoing compliance, and strategic tax planning as businesses expand.