How do I enter daily sales in QuickBooks for a restaurant?

Accurate financial management is vital for a successful restaurant, and QuickBooks for a restaurant can make this process easier. QuickBooks for a restaurant streamlines accounting tasks. This makes it an essential tool. From tracking daily sales to managing expenses and payroll, QuickBooks provides a comprehensive solution for restaurant owners. With the right setup, restaurant bookkeeping becomes more efficient, ensuring financial stability and compliance with tax regulations.

We'll cover key financial aspects for restaurants in this blog. First, we'll show how QuickBooks streamlines management. Then, we'll provide a step-by-step guide on entering daily sales. We'll also discuss common bookkeeping mistakes and the benefits of professional restaurant bookkeeping services. If you're looking for expert assistance, Accounts Junction offers tailored restaurant QuickBooks solutions to meet your needs.

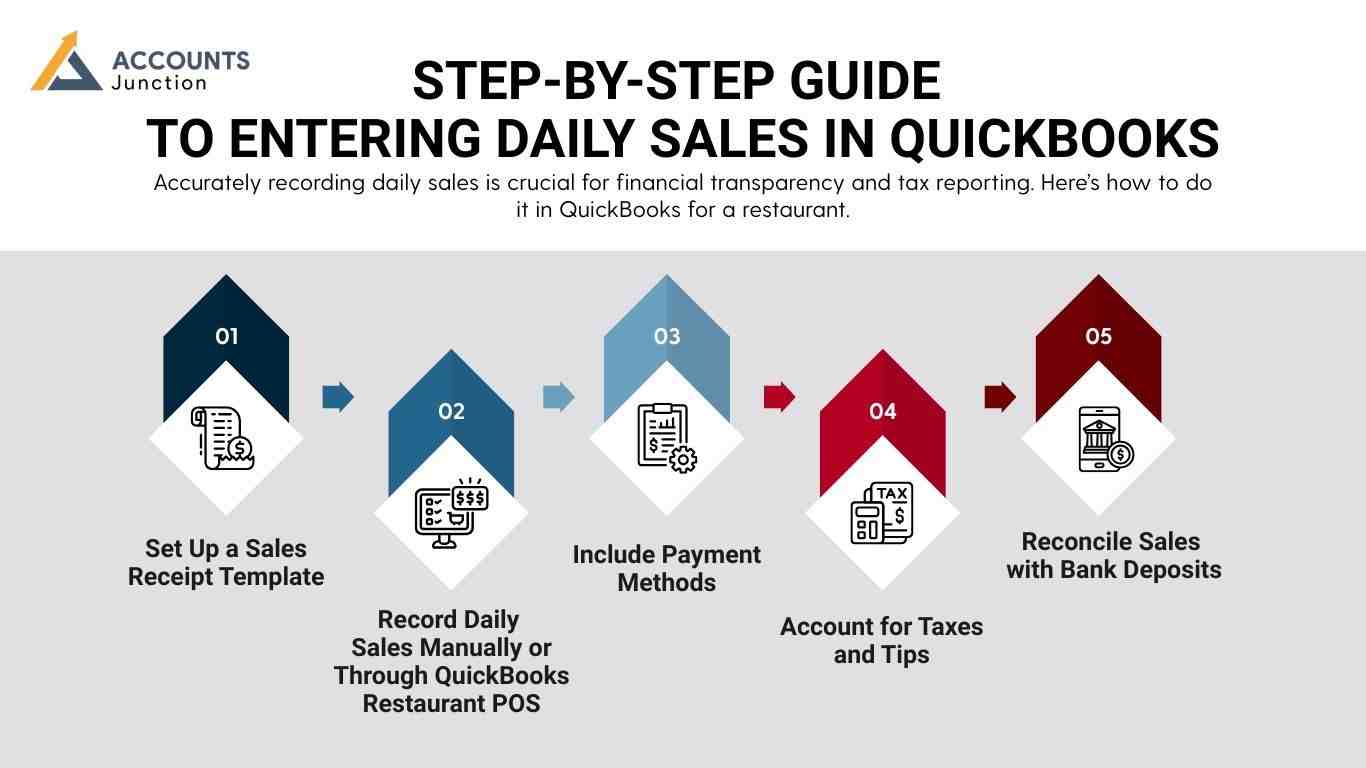

Step-by-Step Guide to Entering Daily Sales in QuickBooks

Accurately recording daily sales is crucial for financial transparency and tax reporting. Here’s how to do it in QuickBooks for a restaurant:

-

Set Up a Sales Receipt Template

- Open QuickBooks Online for restaurants and navigate to the Sales section.

- Customize a sales receipt template to match your restaurant’s revenue streams (e.g., food, beverages, taxes, tips).

- Record Daily Sales Manually or Through QuickBooks Restaurant POS

- If using a POS system, integrate it with QuickBooks for a restaurant to transfer sales data automatically.

- If entering manually, create a new sales receipt and enter the total sales for each revenue category.

- Include Payment Methods

- Record cash, credit card, and third-party payments separately.

- This ensures accurate reconciliation with bank statements.

- Account for Taxes and Tips

- Ensure sales tax and gratuities are correctly categorized under liabilities.

- QuickBooks for a restaurant allows for easy tracking of taxes and tips.

- Reconcile Sales with Bank Deposits

- Regularly compare sales recorded in QuickBooks for a restaurant with actual bank deposits.

- Use bank reconciliation features in QuickBooks for a restaurant to detect discrepancies.

Features of QuickBooks Online for Restaurants

1. Real-Time Financial Tracking

- Provides an up-to-date view of income, expenses, and cash flow.

- Automatically syncs bank transactions for accurate reporting.

2. Sales and Revenue Management

- Integrates with Point-of-Sale (POS) systems like Square, Toast, and Clover.

- Categorizes daily restaurant sales, including food, beverages, and service charges.

3. Expense and Cost Tracking

- Tracks operational costs such as rent, utilities, and supplies.

- Automates expense categorization for better financial insights.

4. Inventory Management

- Monitors ingredient stock levels to prevent shortages and over-purchasing.

- Helps manage the cost of goods sold (COGS) to maintain profitability.

5. Payroll and Employee Management

- Calculates wages, taxes, and tips for employees.

- Integrates with payroll services to automate salary payments.

Benefits of Using QuickBooks Online for Restaurants

1. Improved Financial Accuracy

- Reduces manual errors in financial tracking and reporting.

- Ensures tax and compliance accuracy.

2. Time-Saving Automation

- Automates repetitive tasks such as invoicing, payroll, and bank reconciliations.

- Allows restaurant owners to focus on operations rather than bookkeeping.

3. Better Cash Flow Management

- Provides real-time insights into cash flow to manage expenses effectively.

- Helps in forecasting revenue and budgeting for future costs.

4. Increased Profitability

- Helps track food costs and reduce waste through efficient inventory management.

- Identifies high-margin menu items to optimize pricing strategies.

5. Easy Collaboration with Accountants and Bookkeepers

- Allows accountants and restaurant owners to access financial data remotely.

- Facilitates seamless tax filing and compliance management.

Common Restaurant Bookkeeping Mistakes and How to Avoid Them

1. Not Tracking Daily Sales Properly

- Mistake: Failing to record daily sales accurately from the POS system.

- Solution: Reconcile POS reports with bank deposits daily and categorize sales correctly.

2. Ignoring Cash Flow Management

- Mistake: Not monitoring cash flow, leading to liquidity issues.

- Solution: Maintain a cash flow forecast and monitor inflows and outflows regularly.

3. Mixing Personal and Business Finances

- Mistake: Using personal accounts for business transactions makes record-keeping difficult.

- Solution: Open a dedicated business bank account and use separate credit cards for restaurant expenses.

4. Poor Inventory Management

- Mistake: Not tracking ingredient usage, leading to food waste and loss of profit.

- Solution: Use inventory management software to track stock levels and calculate the cost of goods sold (COGS).

5. Mismanaging Payroll and Tips

- Mistake: Failing to record wages, overtime, and tips correctly, leading to tax penalties.

- Solution: Use payroll software that tracks hours, tax deductions, and tip reporting compliance.

6. Not Reconciling Bank Statements Regularly

- Mistake: Overlooking bank reconciliations, leading to undetected fraud or errors.

- Solution: Reconcile bank and credit card statements at least monthly to identify discrepancies.

Benefits of Professional Restaurant Bookkeeping Services

1. Accurate Financial Records

- Ensures all sales, expenses, and financial transactions are recorded correctly.

- Reduces errors and discrepancies in bookkeeping.

2. Improved Cash Flow Management

- Helps track income and expenses to maintain healthy cash flow.

- Prevents overspending and ensures sufficient funds for operations.

3. Time-Saving Automation

- Frees up restaurant owners from manual bookkeeping tasks.

- Allows more time to focus on business operations and customer service.

4. Compliance with Tax Regulations

- Ensures accurate tax calculations, including sales tax, payroll tax, and corporate tax.

- Reduces the risk of tax penalties due to errors or late filings.

5. Better Inventory and Cost Control

- Tracks ingredient costs and food waste to reduce unnecessary expenses.

- Helps manage the cost of goods sold (COGS) for better profit margins.

Integrating POS Systems with QuickBooks

Many restaurant owners may ask if POS integration is needed. Manual entry can work, but linking your POS to QuickBooks can save a lot of time. Systems like Toast, Square, or Clover can send sales, tips, and taxes straight to QuickBooks. This may cut mistakes and make daily reports easier. Even small errors in data entry can cause bigger problems. Integration may also show busy hours, popular menu items, and trends that can help set prices. Restaurants that use POS integration often find bookkeeping smoother and simpler.

Subpoints:

- Real-Time Data Flow: Sales from each shift are recorded instantly.

- Fewer Manual Errors: Less chance of missing cash or card payments.

- Better Reports: QuickBooks can make clear reports from POS data.

Tips for Maintaining Accurate Daily Sales Records

Even when using QuickBooks for a restaurant, it’s important to check your data daily. Keeping daily sales records correct can help avoid cash shortages, tax issues, or staff confusion. Owners can set up a routine to capture every sale. Small habits, like checking receipts at the end of the day, may make a big difference.

Subpoints:

- End-of-Day Checks: Compare POS totals with bank deposits.

- Separate Each Sale: Record food, drinks, and service charges clearly.

- Record Tips Separately: Helps manage payroll and taxes correctly.

- Back Up Regularly: Protect against lost data from software or device errors.

Understanding Reports and Analytics in QuickBooks for Restaurants

QuickBooks for a restaurant does more than store numbers; it provides insights to guide smart business choices. Reports may highlight profitable menu items, track labor costs, and help predict future income. Checking these analytics often may help with stock, prices, and staff planning.

Subpoints:

- Profit & Loss Reports: Show money coming in and going out.

- Sales by Item: See which menu items make the most money.

- Cash Flow Forecast: Spot low cash periods early.

- Expense Patterns: Find costs that often go up and cut waste.

Efficient financial management is essential for restaurant success, and QuickBooks for a restaurant provides the necessary tools to streamline accounting. From recording daily sales to managing payroll and tax compliance, QuickBooks simplifies financial tracking.

Avoiding common bookkeeping mistakes and leveraging professional restaurant bookkeeping services can improve business efficiency. Restaurant owners need accurate financial reports. They also require tax compliance and strategic business insights. Partnering with experts like Accounts Junction ensures they receive all of these.

We track daily sales, expenses, payroll, tips, and food costs. POS systems like Square, Toast, and Clover link to QuickBooks for automatic records. We manage bills and customer payments to avoid mistakes and keep accounts clear. We also give simple reports to help make smart business choices. With our help, restaurants stay compliant, save time, and focus on growth.

FAQs

1. What is QuickBooks for restaurants?

- QuickBooks for restaurants is accounting software to track sales, costs, and taxes. It may make money records simple.

2. Why track daily sales in QuickBooks?

- Tracking daily sales keeps records correct and taxes easier. It may also show revenue patterns.

3. Can QuickBooks link to my POS system?

- Yes, it can link to POS systems like Square, Toast, and Clover. This may save time and reduce mistakes.

4. How do I record cash payments in QuickBooks?

- Enter cash payments in sales receipts or via POS. Daily entry may match bank deposits.

5. Should tips be included in daily sales?

- Tips should be tracked separately under liabilities. This may make payroll taxes easier.

6. How often should I reconcile bank statements?

- Do it at least once a month, or weekly for more accuracy. It may catch mistakes early.

7. Can QuickBooks track restaurant inventory?

- Yes, it can track stock and cost of goods sold. This may cut waste and control spending.

8. Is professional bookkeeping needed for restaurants?

- It may keep records right, follow tax rules, and save time. Many owners find it helpful.

9. How does QuickBooks handle sales tax?

- QuickBooks can calculate and sort sales tax automatically. This may make filing simpler.

10. Can I enter sales manually without a POS system?

- Yes, using sales receipts is possible. Accurate entry is key to avoid errors.

11. How do I categorize revenue in QuickBooks?

- Use separate categories for food, drinks, tips, and taxes. This may make profit easier to see.

12. What bookkeeping mistakes should I avoid?

- Mixing personal accounts, ignoring cash flow, and wrong tip records are common. Avoiding these may save trouble.

13. How can QuickBooks help cash flow?

- It tracks money in and out and may forecast future needs. This may prevent cash shortages.

14. Can QuickBooks make payroll reports?

- Yes, it can calculate wages, tips, and overtime. This may make taxes easier to manage.

15. Which reports should I check often?

- Profit & loss, sales by item, cash flow, and cost trends are key. They may guide better decisions.

16. Can I customize sales receipt templates?

- Yes, QuickBooks allows templates for menu items and sales. This may make the records clear.

17. How does QuickBooks reduce mistakes?

- Automation reduces repeated entry errors. POS link may cut human mistakes more.

18. Can QuickBooks track multiple payment types?

- Yes, it can separate cash, card, and online payments. This may make bank reconciliation simple.

19. How often should inventory be updated?

- Daily or weekly updates work best. This may stop shortages and waste.

20. Can QuickBooks guide menu pricing?

- Yes, it may show profits by item. Restaurants may find high-margin dishes easily.