A Complete Guide to Using QuickBooks for Uber Drivers: Features, Benefits, and Tips

Managing finances as an Uber driver can be time-consuming and stressful. You deal with daily expenses, ride income, and tax season all at once. QuickBooks makes this process simpler. This guide explains how using QuickBooks for Uber drivers can help with bookkeeping, save time, and keep you ready for taxes. It also highlights the role of tax accountants who understand rideshare income and can help drivers reduce tax bills through deductions for fuel, maintenance, insurance, and more.

Introduction to QuickBooks

QuickBooks is a trusted accounting software built for small and solo businesses. It helps with daily finance tasks like expense tracking, mileage logging, invoicing, and tax estimates. For Uber drivers, this means spending less time managing spreadsheets and more time focusing on rides. The software is cloud-based, so you can access it from your phone or computer anytime.

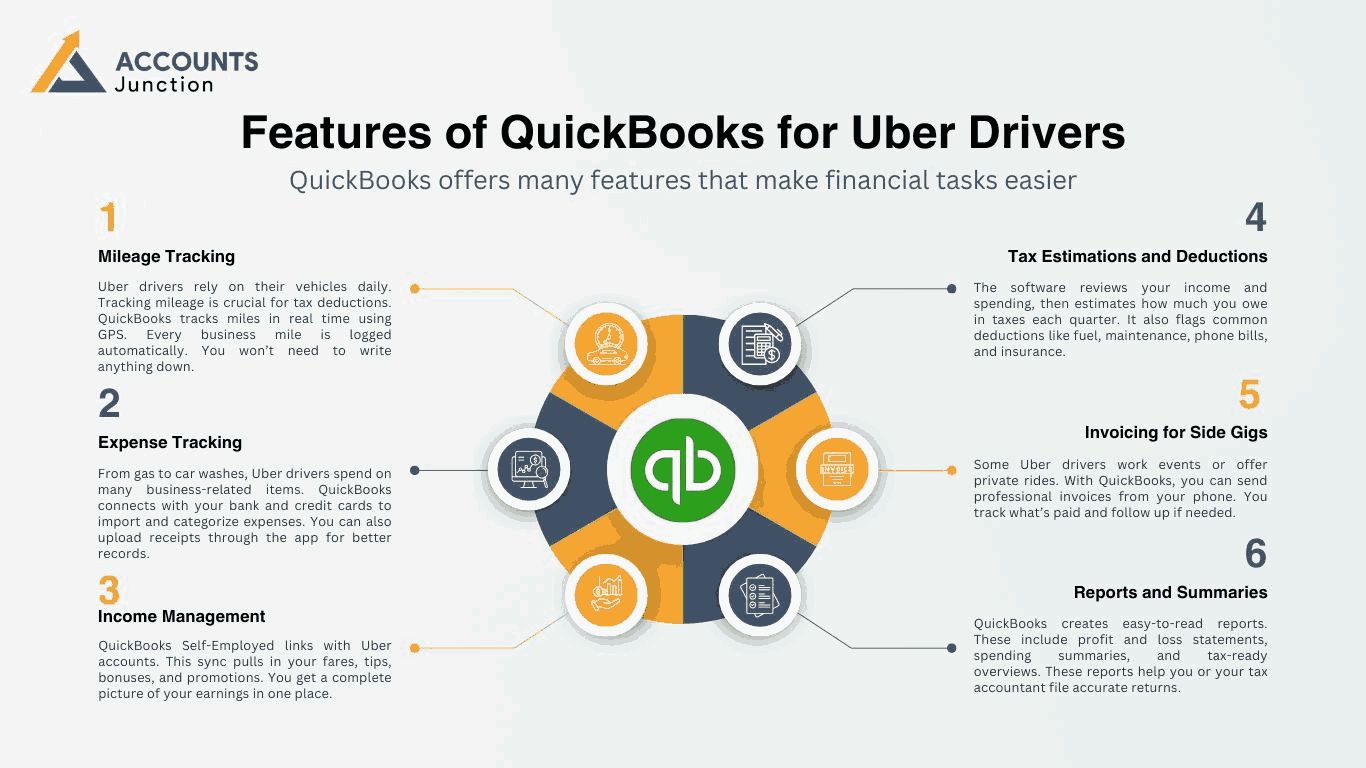

Features of QuickBooks for Uber Drivers

QuickBooks offers many features that make financial tasks easier:

Mileage Tracking

- Uber drivers rely on their vehicles daily. Tracking mileage is crucial for tax deductions. QuickBooks tracks miles in real time using GPS. Every business mile is logged automatically. You won’t need to write anything down.

Expense Tracking

- From gas to car washes, Uber drivers spend on many business-related items. QuickBooks connects with your bank and credit cards to import and categorize expenses. You can also upload receipts through the app for better records.

Income Management

- QuickBooks Self-Employed links with Uber accounts. This sync pulls in your fares, tips, bonuses, and promotions. You get a complete picture of your earnings in one place.

Tax Estimations and Deductions

- The software reviews your income and spending, then estimates how much you owe in taxes each quarter. It also flags common deductions like fuel, maintenance, phone bills, and insurance.

Invoicing for Side Gigs

- Some Uber drivers work events or offer private rides. With QuickBooks, you can send professional invoices from your phone. You track what’s paid and follow up if needed.

Reports and Summaries

- QuickBooks creates easy-to-read reports. These include profit and loss statements, spending summaries, and tax-ready overviews. These reports help you or your tax accountant file accurate returns.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Benefits of Using QuickBooks

Saves Time

- QuickBooks automates routine finance tasks. No need to enter mileage or expenses by hand. That gives you more time to focus on driving.

Improves Accuracy

- Manual entry can lead to errors. Automatic syncing, mileage tracking, and categorization keep your records clean and reliable.

Clear Financial Picture

- QuickBooks gives insight into where your money goes. It shows you profits, spending trends, and what you owe in taxes.

Tax Season is Easier

- With all records stored and sorted, tax filing becomes faster. You avoid last-minute scrambling and reduce the chance of audits.

Grows with Your Business

- If you add more side gigs or start working for multiple platforms, QuickBooks scales up. You can manage all earnings and expenses under one account.

Tips for Getting Started

Choose QuickBooks Self-Employed

- This plan is made for solo drivers and gig workers. It includes the right tools like mileage tracking and tax estimates.

Connect Your Accounts

- Link your Uber account and bank cards to QuickBooks. This ensures income and expenses are always updated.

Set Expense Rules

- You can create rules to label expenses. For example, tag gas costs as "Fuel." This keeps your categories consistent.

Track Miles Daily

- Use the mobile app to track miles in real time. Mark each trip as business or personal with one tap.

Check Reports Monthly

- Review your spending and earnings at least once a month. This helps you plan better and avoid surprises.

Keep Receipts

- QuickBooks lets you scan and store receipts. This gives added proof in case of audits.

Sync with Other Apps

- You can connect QuickBooks to apps like Google Calendar or another mileage tracker for extra accuracy.

Choosing Between QuickBooks Plans

QuickBooks offers different plans, but Uber drivers usually need one of these:

QuickBooks Self-Employed

- Best for independent drivers

- Includes mileage tracking, expense imports, and quarterly tax estimates

- Offers TurboTax integration for easy tax filing

QuickBooks Online (Simple Start or Essentials)

- Suitable if you run a small fleet or hire other drivers

- Includes invoicing, reports, and payroll options

Most solo Uber drivers find QuickBooks Self-Employed enough. But if your work expands, you can upgrade easily.

Role of a Tax Accountant for Uber Drivers

Even with QuickBooks, some Uber drivers prefer to work with tax pros. These accountants know what to look for in rideshare records. They can:

- Spot missing deductions

- Review QuickBooks reports for accuracy

- Help file quarterly and annual taxes

- Advise on business structure (like switching to an LLC)

If you work long hours and want to avoid tax stress, hiring a tax accountant is a smart move.

Common Mistakes Uber Drivers Make Without QuickBooks

Not Tracking Miles

- Many drivers forget to log trips, losing out on big tax deductions. QuickBooks automates this.

Mixing Personal and Business Expenses

- Using one account for both can cause confusion. QuickBooks helps sort expenses into the right category.

Filing Taxes Late

- Without regular tracking, it’s easy to fall behind. QuickBooks sends reminders and keeps tax info ready.

Forgetting Receipts

- Receipts are proof. Without them, you may not be able to claim certain deductions. QuickBooks stores receipts digitally.

Estimating Taxes Wrong

- Guessing taxes often leads to underpaying or overpaying. QuickBooks calculates taxes based on real numbers.

QuickBooks Add-ons That Help Uber Drivers

TurboTax Integration

- QuickBooks Self-Employed pairs with TurboTax. This lets you send your tax data straight into the tax prep software. It saves time and reduces errors.

QuickBooks Payments

- If you invoice clients for private rides, QuickBooks Payments lets them pay you by card. Funds go straight to your account.

QuickBooks Time

- For drivers juggling rideshare with delivery or part-time work, QuickBooks Time tracks hours. This keeps all income in one view.

How to Use QuickBooks with Other Gig Platforms

Many Uber drivers also work for Lyft, DoorDash, or Instacart. QuickBooks can track all earnings and expenses in one place. You simply link other gig platforms or bank accounts used for those jobs. Set rules to tag income from each source. Use the same mileage tracker to log trips for all platforms.

How to Prepare for Tax Season with QuickBooks

Start by reviewing your reports each quarter. Fix any miscategorized expenses. Use the app to export your tax summary or share it with your accountant. Save time by keeping all receipts scanned and matched to each expense. QuickBooks also tells you when quarterly taxes are due, so you stay compliant and avoid penalties.

FAQs

1. What is QuickBooks, and why is it useful for Uber drivers?

- QuickBooks is accounting software that tracks your miles, expenses, and income. It helps you stay organized, manage taxes, and save time.

2. Can QuickBooks automatically track my mileage?

- Yes. QuickBooks uses GPS to log every business mile. You can review and classify trips in the app.

3. Does QuickBooks help with quarterly tax payments?

- It does. The software estimates your taxes each quarter and reminds you when payments are due.

4. What kinds of expenses does QuickBooks track?

- It tracks fuel, maintenance, insurance, tolls, phone bills, and more. You can add custom categories too.

5. Is QuickBooks worth it if I have side gigs beyond Uber?

- Yes. You can invoice clients, track income, and log extra miles for private driving jobs.

6. Do I still need a tax accountant if I use QuickBooks?

- QuickBooks simplifies taxes, but a rideshare tax pro can help find extra deductions and file returns correctly.

7. Can QuickBooks work if I use multiple gig apps?

- Yes. You can link each account or related bank card. QuickBooks will track all income and expenses.

8. What’s the difference between QuickBooks Self-Employed and QuickBooks Online?

- Self-Employed is simpler and ideal for solo drivers. QuickBooks Online offers more tools for managing teams, payroll, or larger operations.

9. Can QuickBooks track toll expenses and parking fees?

- Yes. You can tag these manually or let the system import them from your card statement.

Conclusion

QuickBooks helps Uber drivers take control of their finances. It automates key tasks like mileage and expense tracking, keeps income records updated, and simplifies tax prep. When used with help from a tax accountant, it reduces stress and saves money.

Partnering with a firm like Accounts Junction adds more value. Their tax professionals know rideshare rules and can use QuickBooks data to ensure full compliance. Whether you’re just starting or have years of experience, QuickBooks and expert guidance can keep your finances clear and focused.

Uber drivers who use QuickBooks stay ready for taxes, keep better records, and make smarter money decisions. With the right setup, you can save time, reduce errors, and focus on growing your business.