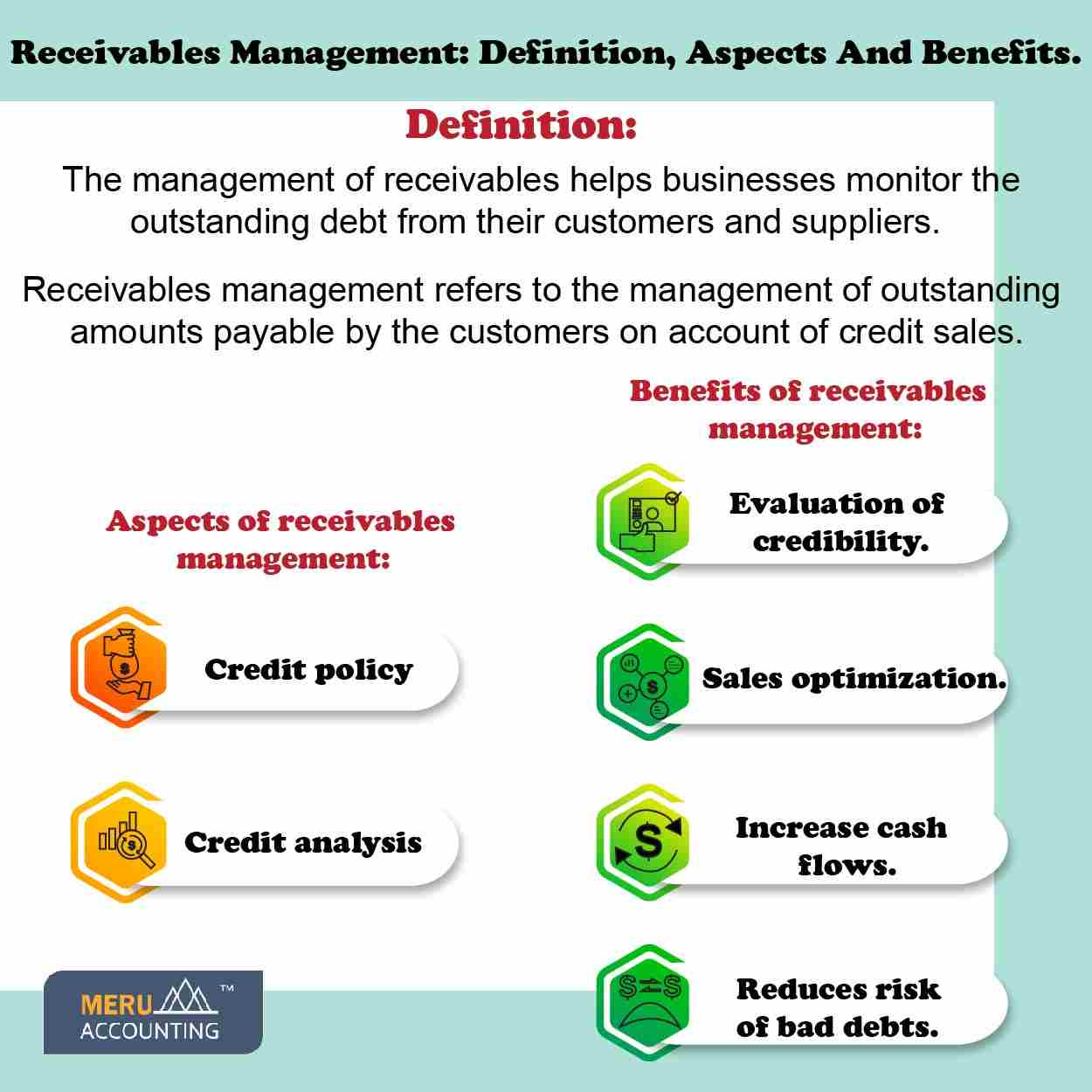

Receivables Management: Definition, Aspects And Benefits

The management of receivables helps businesses monitor the outstanding debt from their customers and suppliers. Finance professionals and the accounting department use receivables management to improve cash flow, grow sales, and increase business profits.

Understanding the basics of receivables management will help you increase the cash flow of your business by formulating a better credit policy.

Receivables Management: Meaning

Receivables management refers to the management of outstanding amounts payable by the customers on account of credit sales. When a business sells its products or services on credit, accounts receivable are created. For instance, a company sells goods worth $60,000 on March

1, 2022 with a credit period of 30 days. On March 1, 2022, accounts receivable worth $60,000 are created.

Now if the customer pays $20,000 on March 20 2023, the accounts receivable get reduced by $20,000 with the remaining balance of $40,000. Similarly, on subsequent credit sales, the overall balance of the account receivable increases. And, the payments from the customers reduce the account receivable.

Effective management of the accounts receivables helps the business to improve the cashflows, reduces the risk of bad debts, and maintains a good relationship with customers.

Aspects of receivables management

The following are the stages of credit analysis;

- Collection of information regarding credit history.

- Determining the accuracy of the collected information.

- Acceptance or rejection of the credit application.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Benefits of Receivable Management

Evaluation of the customer credibility:

- It assesses the borrowing limit of the customer and their repaying capacity.

- It evaluates the customer by credit rating and reduces the risk of bad debts.

- Sales optimization: Management of receivables helps the firm to optimize sales and increase sales volume.

- Businesses can attract potential customers by providing different credit facilities.

- Receivables management helps to gain information about the credit policies of the business.

- Increase cash flows: It helps to know the collection cycle of the accounts receivables. It speeds up the collection process of the outstanding amount from the customers by reviewing the credit policies.

- Reduces risk of bad debts: It helps to set reminders for the customer about due payments. It boosts the timely collection of payment by levying interest charges on delayed payments. It leads to follow-up procedures to reduce the risk of bad debt.